Verint has announced the intention to acquire Conversocial, a US-based social media management system provider for USD 50 million to integrate social messaging capabilities across Verint’s cloud platform. The deal is expected to be closed in Verint’s third quarter subject to customary closing conditions and regulatory clearances.

Verint has been expanding their digital engagement capabilities through acquisitions. In June, Verint expanded their Workforce Management (WFM) offerings to include AI-driven insights for better hiring decisions through the acquisition of HireIQ. To extend Verint’s omnichannel cloud Voice of the Customer (VoC) portfolio, Verint acquired Foresee. Verint is also building IVA capabilities and recently launched a low code version of their IVA solution to make it easier for brands to build the solution without the need for technical knowledge.

The Need to Enhance Digital Engagement

Using self-service and messaging as the first point of connection to engage with a brand is growing rapidly. It accelerated during the pandemic, and it is common now for individuals to engage with their financial institution, airlines, retail and others through social media. Now that customers are demanding it, brands are lifting their game and engaging with customers on the platform of their choices. This acquisition will allow Verint to deepen their digital engagement with customers across Marketing, Contact Centres and digital functions – it follows the pulse of today’s customers.

Digital discussions are accelerating and having a platform that can orchestrate as well as understand all the data from each digital and social messaging channel is important. Verint is taking the data discussion seriously and earlier this year they launched Engagement Data Management Solution (EDM). The ‘’data’’ piece is huge and cuts across functions – from back-office communications to gathering data across all channels and touchpoints. However, where this is going wrong for some enterprises is that all the data they collect sits in multiple repositories; in some instances the data has not been analysed for years! Managing the multiple social experiences, including data management and insights from these multiple sources, will be key to delivering proactive customer experience.

The data discussion is particularly significant for a vendor such as Verint – they are well known for their speech analytics and compliance management capabilities. These are all critical to managing multiple channels of conversation. They help agents to be accurate, efficient, and compliant; allow organisations to use asynchronous channels and social messaging and digital channels; immediately rectified errors through monitoring the data on the channels and so on. More importantly, they allow organisations to pick up points from conversations that can be passed on to Marketing to gauge the effectiveness of the messaging and campaigns. Organisations can ‘’identify and fix” problems by truly listening to customers.

Why Conversocial

If we look at the Conversocial customer stories, we realise how relevant their offerings are to industry requirements. They offer brands the ability to engage through an automated channel and chatbots. Whirlpool appears to have benefited by integrating channels to deliver better customer care as well as communicating with field engineers through WhatsApp. Another customer, Freshly – a meals delivery company – saw a spike in incoming queries at the start of the pandemic. They were able to use automation to ease of the load and say that 50% of the conversations were handled in-channel through automation without the need for human agent intervention. They were also able to use Facebook Messenger as a preferred contact channel and decreased their cost-per-contact.

This acquisition demonstrates how Verint is taking the digital and the data discussion seriously. CX Vendors that do not move fast in building end-to-end digital capabilities will find it hard to compete in a highly competitive CX market.

Five9, a cloud-based contact centre solutions provider announced the acquisition of intelligent virtual agent (IVA) platform provider, Inference Solutions for about USD 172 million. Five9 and Inference Solutions have been partnering for the last couple of years, with Five9 being a reseller for Inference Solutions’ IVA platform. The acquisition is expected to provide a boost to Five9’s AI portfolio, automate contact centre agent activities and provide AI-based omnichannel self-service solutions.

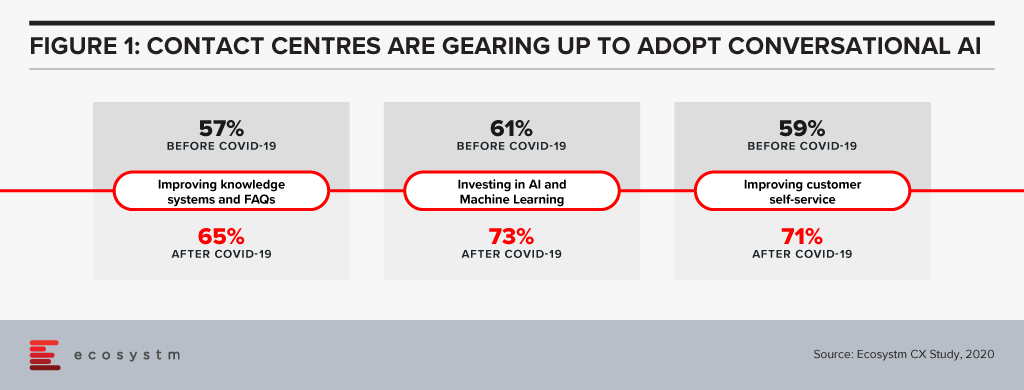

The need to drive greater automation in the contact centre is high on the agenda, and this acquisition demonstrates how important AI and automation is to contact centre modernisation. The old-fashioned ways of long wait times, being passed on through different menus on the IVR and being asked to repeat yourself through the older speech recognition engines is starting to not only frustrate customers but will become obsolete. Based on Ecosystm’s research, close to 60% of contact centres globally stated that investing in machine learning and AI is a top customer experience priority in the next 12 months.

Inference has come a long way since its inception at Telstra Labs

Inference Solutions (founded in 2005) was spun out of Telstra Labs. It has since expanded to the US and developed a suite of solutions in the IVA segment. They have a good partnership strategy with the leading telecom providers globally as well as the UC/contact centre vendors. Inference Solutions uses resellers such as service providers, UC, and contact centre software providers – and these include AT&T, Cisco (Broadsoft), Momentum Telecom, Nextiva, 8×8 and many others. The Inference Studio solution will see a new release in the next few months where the solution will come pre-built with the ability for the contact centre team to pre-load the contact centre conversations. These can be conversations that have been going on for 6 months or longer. The Studio solution will then be able to analyse and understand the underlying intent of the conversation, match the intent so that it can be used to auto train the bots accurately. That process of matching the intent and training is expensive and if you can automate some elements of that, it will bring the cost of the deployment down. Its solution integrates into NLP engines from Google, AWS, and IBM. In Australia they continue to work on patents in close partnerships with Melbourne University and RMIT. Throughout its journey, Inference has built a good base of customers in the US, UK, and Australia.

Five9 to accelerate on its vision of AI and Cloud

Contact centre modernisation is high on the agenda for many organisations and this will lead them to build AI and automation at the core of their customer strategies. The discussion spans across the CEO, Digital and Innovation, and the Contact Centre teams.

Five9 had acquired Whendu, an iPaaS platform provider empowering businesses and developers with no-code, visual application workflow tool, optimised for contact centres in November 2019, and Virtual Observer, an innovative provider of cloud-based workforce optimisation, also known as Workforce Engagement Management (WEM) in February of this year.

The pandemic has resulted in increased engagement of contact centres with customers. Companies are gradually looking for ways to automate tasks, deliver better communication, speech and text recognition, decipher languages, and implement solutions mimicking humans. As a solution to these challenges, IVAs are being viewed as efficient and effective digital workers for a modern contact centre. IVAs represent increased throughput, more accurate results, and better-informed agents.

Successful use cases have shown that conversational AI can reduce calls and repetitive queries by 70-90%. IVRs with monolithic, complicated menus will start becoming unpopular and force contact centres to embark on a modernisation and automation strategy. If we evaluate the shift in priorities after COVID-19, we see that organisations are ramping up their self-service capabilities and their adopt of AI and machine learning (Figure 1).

The acquisition will give Five9 a foothold in the Asia Pacific region with an initial focus on the Australia market. The Australia market is by far the most advanced cloud contact centre market in the Asia Pacific. Five9 gains a team of staff that will help them fuel the contact centre modernisation discussion across the Asia Pacific. As the region has a complex market, the need to work with local carriers and partners will be critical for further expansion. Five9 has made an important acquisition in building in IVA capability into its CCaaS solution.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated