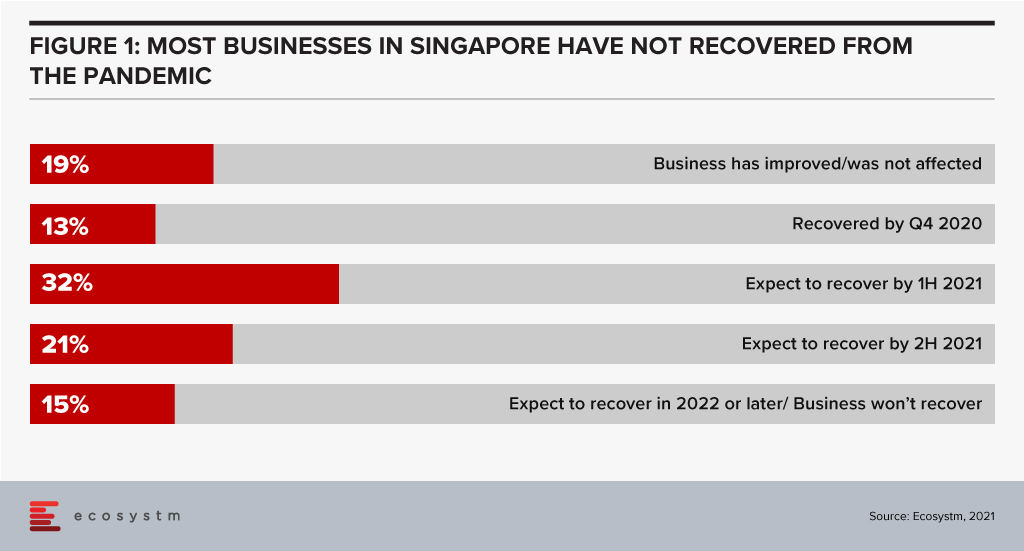

The past twelve months have been tough. Most businesses in Singapore (68%) still haven’t seen revenue recover to pre-pandemic levels. Many budgets are down and you are likely to have a long list of spending options that might help you grow revenue and pull your business out of the pandemic-induced slump. Even if your business is doing well, the pressure on budgets is real.

Increasing your CX Spend

Despite the pressure on budgets Ecosystm data makes a strong case to not cut your customer experience (CX) spend! Businesses in Singapore that are cutting their CX spend are less likely to return to growth, more likely to be competing on price (hence cutting margins), not focused on their digital and omnichannel customers, and have lower levels of innovation. Funnily enough, these are also the businesses with complex, legacy systems which need more focus to provide an improved CX! To be quite frank, businesses in Singapore who are cutting CX spend are setting themselves up for failure. With other businesses increasing CX spend, the gap between the customer experiences will grow to a point where customers will leave and it will be hard to catch up.

Prioritising your CX Spend

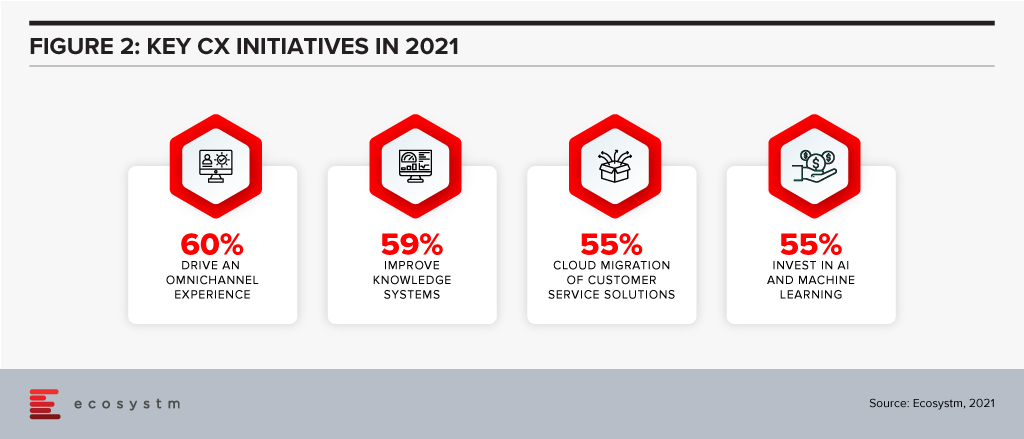

So now that you have secured your CX spend, where will you get the biggest bang for your buck? Let’s look at where businesses in Singapore are focusing their CX initiatives in 2021.

Offering an omnichannel experience. Your customers expect more than just a great digital experience – they want the right experience at the right touchpoint. The CX leaders in Singapore (who, unsurprisingly are often the market leaders) are already offering great omnichannel experiences, so this is quickly becoming about catching up – and not about getting ahead. Providing a consistent, personalised, and optimised experience across your digital touchpoints needs to be a top priority for your business today. If you are not offering conversational commerce solutions, start that strategy as soon as possible – you need to be where your customers are today. Extending this to physical channels and broader ecosystem partners should also be on your agenda.

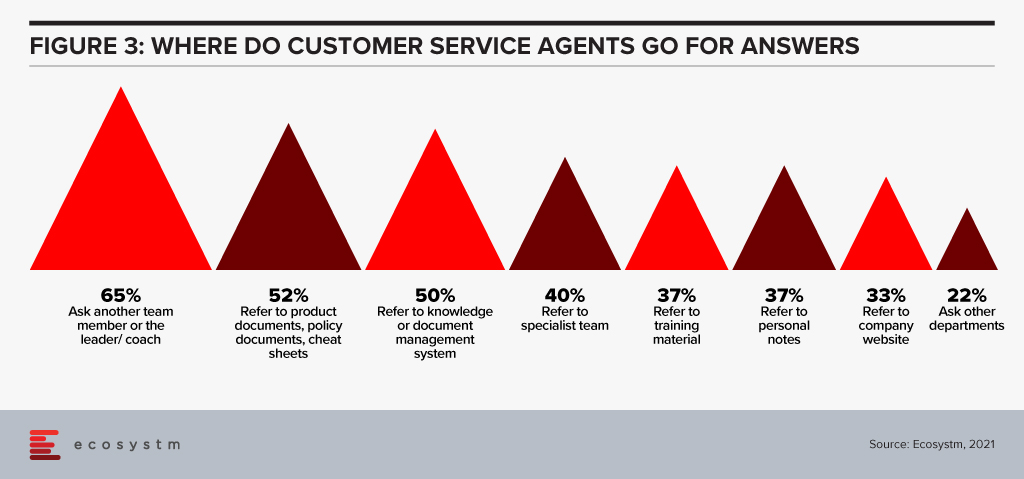

Improving knowledge systems. Your knowledge systems don’t do what they say on the box. They don’t provide answers to questions – for employees or customers. In fact, if your customer service agents get asked a question they don’t know the answer to, their number one source for answers is actually their colleagues or team leaders – NOT the knowledge management system! Start investing in systems – or ideally a single system – that help your employees get better, faster answers to questions. Make sure that the system is providing the same answers to both your employees and your customers across all touchpoints – physical and digital.

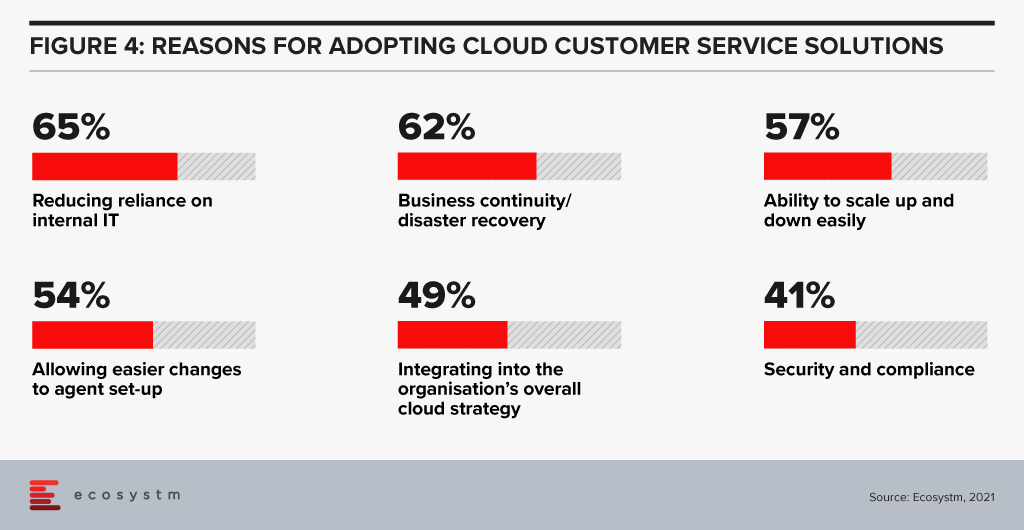

Migrating customer service platforms to the cloud. Over half the businesses in Singapore that we assessed have this as a top CX priority. Cloud solutions offer faster time to value, lower management costs, give access to more regular improvements and often provide the ability to easily integrate with partners who offer product extensions and customisations. This trend will continue in 2021 and 2022 as more businesses realise that their legacy customer service or contact centre platform is inhibiting their ability to innovate their customer experience. These systems also help businesses to stay compliant and reduce the reliance on internal IT – which has traditionally struggled to keep up with the fast-changing nature of the contact centre and customer service teams.

Investing in AI and machine learning. Many businesses are using AI to provide the personalised and optimised customer experiences they aspire to. AI and machine learning are allowing businesses to create personalised offers, offer a next-best action and automate services. Advanced banks in Singapore can create interest rate offers for each individual customer based on their credit profile and history. 46% of businesses in Singapore are already using AI to offer recommendations for customer service agents, 44% to optimise or test messaging and campaigns and 43% to provide faster, more accurate access to information and knowledge. 18 months ago, AI was a business differentiator – allowing your business to create a stand-out CX. Today AI is quickly becoming a standard practice – the battle now is around using AI to create personalised and optimised experiences.

A great customer experience will be the most important factor in lifting your business to pre-pandemic growth levels and helping your business remain competitive in today’s tough business conditions. When it comes to CX, there is no such thing as “saving your way to growth”.

Your opportunity to drive greater business success lies in your ability to better win, serve and retain your customers. Refresh your customer strategy and capability today to make 2021 an exceptional year for your business.

SAS announced that it has acquired Boemska, a provider of low-code development tools and analytics workload management software. The small, privately held company is UK-based with an R&D centre in Serbia. The acquisition will be integrated into SAS Viya, its cloud-native platform, which includes containerised analytics and machine learning offerings. Terms of the deal have not been disclosed.

A SAS silver partner, Boemska has wins in Health, Finance, and Travel. Most of its reference clients are based in Europe in addition to a small number in the US and South Africa. Boemska has two primary software offerings – Enterprise Session Monitor (ESM) and AppFactory. Additionally, it delivers cloud migration, performance diagnostics, and application development services.

Boemska Capabilities

Boemska ESM provides visibility into performance and cost management of analytics workloads. The product enables self-service root cause analysis for developers, monitoring and batch schedule optimisation for administrators, and departmental cost allocation of cloud resources. ESM manages SAS, R, and Python workloads and is compatible with workload management platforms from the likes of IBM and BMC. Boemska shipped an updated version of ESM in 2020 to improve the UI and ensure support for SAS Viya. At the time, it announced that its development team had doubled in the preceding 12 months, suggesting a trajectory of growth.

AppFactory is a low-code development platform for data scientists and data engineers using SAS, which generates JavaScript for front-end developers along with data transport, authentication, and exception handling. SAS emphasises the portability of apps that can be created and run on mobile and IoT devices. Examples provided include machine learning and event alerts in healthcare wearables, video-based defect identification in Manufacturing, and drone-based asset monitoring in Utilities. Boemska states that its low-code offering seeks to bridge the “last mile of analytics” by putting insights into the hands of decision-makers.

SAS Focuses on Cloud-Native Analytics and AI

SAS launched Viya 4.0 in mid-2020, a major step in its vision to become a provider of cloud-native analytics and machine learning solutions. The platform includes offerings, such as Visual Analytics, Visual Statistics, Visual Machine Learning, and Visual Data Science packaged in containers and orchestrated by Kubernetes. Microsoft Azure has become its preferred cloud partner, assisting in developing SAS Cloud, hosted from data centres in the US, Brazil, Australia, and newly launched facilities in Germany and the UK. Viya managed services are also available from Azure regions. AWS and Google Cloud are expected to make the leap to Viya 4.0 from version 3.5 soon. As part of its cloud-native strategy, SAS now offers three tiers for software updates – bi-annual, monthly, or immediately after release.

Ecosystm Comment

The major overhaul of SAS Viya is part of the vendor’s USD 1B investment into AI over three years from 2019-2021. The platform includes a heavy emphasis on NLP, machine learning, and computer vision. The integration of Boemska’s low-code development offering into Viya will allow SAS clients to extract greater value from AI by quickly embedding it in mobile and enterprise applications. The converging trends of citizen developers and data literacy suggest SAS has selected the right path for the future.

Download Ecosystm Predicts: The Top 5 AI & Automation Trends for 2021

Download Ecosystm’s complimentary report detailing the top 5 AI trends in 2021 and what innovations they bring to the table that IT leaders should monitor. Create your free account to access all the Ecosystm Predictions for 2021, and many other reports, on the Ecosystm platform

Artificial Intelligence (AI) is becoming embedded in financial services across consumer interactions and core business processes, including the use of chatbots and natural language processing (NLP) for KYC/AML risk assessment.

But what does AI mean for financial regulators? They are also consuming increasing amounts of data and are now using AI to gain new insights and inform policy decisions.

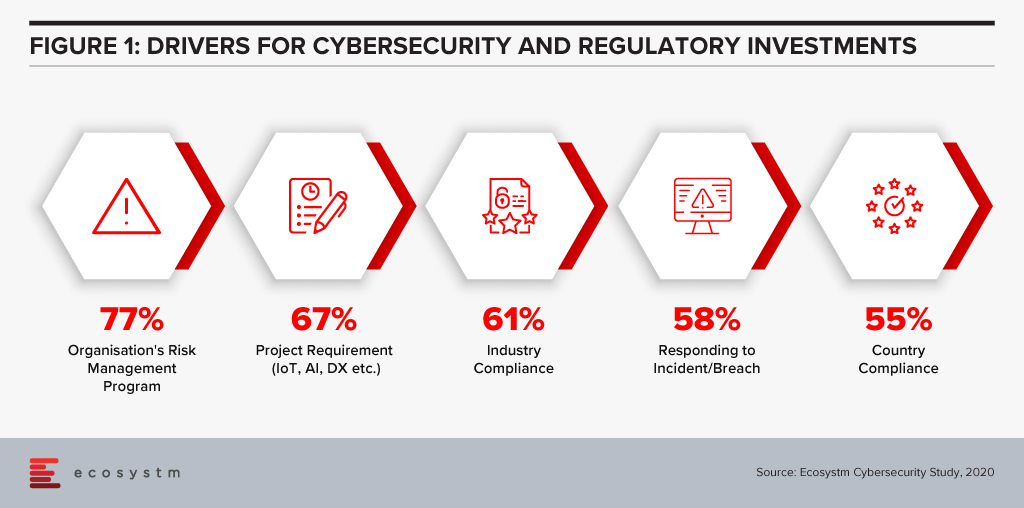

The efficiencies that AI offers can be harnessed in support of compliance within both financial regulation (RegTech) and financial supervision (SupTech). Authorities and regulated institutions have both turned to AI to help them manage the increased regulatory requirements that were put in place after the 2008 financial crisis. Ecosystm research finds that compliance is key to financial institutions (Figure 1).

SupTech is maturing with more robust safeguards and frameworks, enabling the necessary advancements in technology implementation for AI and Machine Learning (ML) to be used for regulatory supervision. The Bank of England and the UK Financial Conduct Authority surveyed the industry in March 2019 to understand how and where AI and ML are being used, and their results indicated 80% of survey respondents were using ML. The most common application of SupTech is ML techniques, and more specifically NLP to create more efficient and effective supervisory processes.

Let us focus on the use of NLP, specifically on how it has been used by banking authorities for policy decision making during the COVID-19 crisis. AI has the potential to read and comprehend significant details from text. NLP, which is an important subset of AI, can be seen to have supported operations to stay updated with the compliance and regulatory policy shifts during this challenging period.

Use of NLP in Policy Making During COVID-19

The Financial Stability Board (FSB) coordinates at the international level, the work of national financial authorities and international standard-setting bodies in order to develop and promote the implementation of effective regulatory, supervisory and other financial sector policies. A recent FSB report delivered to G20 Finance Ministers and Central Bank Governors for their virtual meeting in October 2020 highlighted a number of AI use cases in national institutions.

We illustrate several use cases from their October report to show how NLP has been deployed specifically for the COVID-19 situation. These cases demonstrate AI aiding supervisory team in banks and in automating information extraction from regulatory documents using NLP.

De Nederlandsche Bank (DNB)

The DNB is developing an interactive reporting dashboard to provide insight for supervisors on COVID-19 related risks. The dashboard that is in development, enables supervisors to have different data views as needed (e.g. over time, by bank). Planned SupTech improvements include incorporating public COVID-19 information and/or analysing comment fields with text analysis.

Monetary Authority of Singapore (MAS)

MAS deployed automation tools using NLP to gather international news and stay abreast of COVID-19 related developments. MAS also used NLP to analyse consumer feedback on COVID-19 issues, and monitor vulnerabilities in the different customer and product segments. MAS also collected weekly data from regulated institutions to track the take-up of credit relief measures as the pandemic unfolded. Data aggregation and transformation were automated and visualised for monitoring.

US Federal Reserve Bank Board of Governors

One of the Federal Reserve Banks in the US is currently working on a project to develop an NLP tool used to analyse public websites of supervised regulated institutions to identify information on “work with your customer” programs, in response to the COVID-19 crisis.

Bank of England

The Bank developed a Policy Response Tracker using web scraping (targeted at the English versions of each authority/government website) and NLP for the extraction of key words, topics and actions taken in each jurisdiction. The tracker pulls information daily from the official COVID-19 response pages then runs it through specific criteria (e.g. user-defined keywords, metrics and risks) to sift and present a summary of the information to supervisors.

Market Implications

Even with its enhanced efficiencies, NLP in SupTech is still an aid to decision making and cannot replace the need for human judgement. NLP in policy decision is performing clearly defined information gathering tasks with greater efficiency and speed. But NLP cannot change the quality of the data provided, so data selection and choice are still critical to effective policy making.

For authorities, the use of SupTech could improve oversight, surveillance, and analytical capabilities. These efficiency gains and possible improvement in quality arising from automation of previously manual processes could be consideration for adoption.

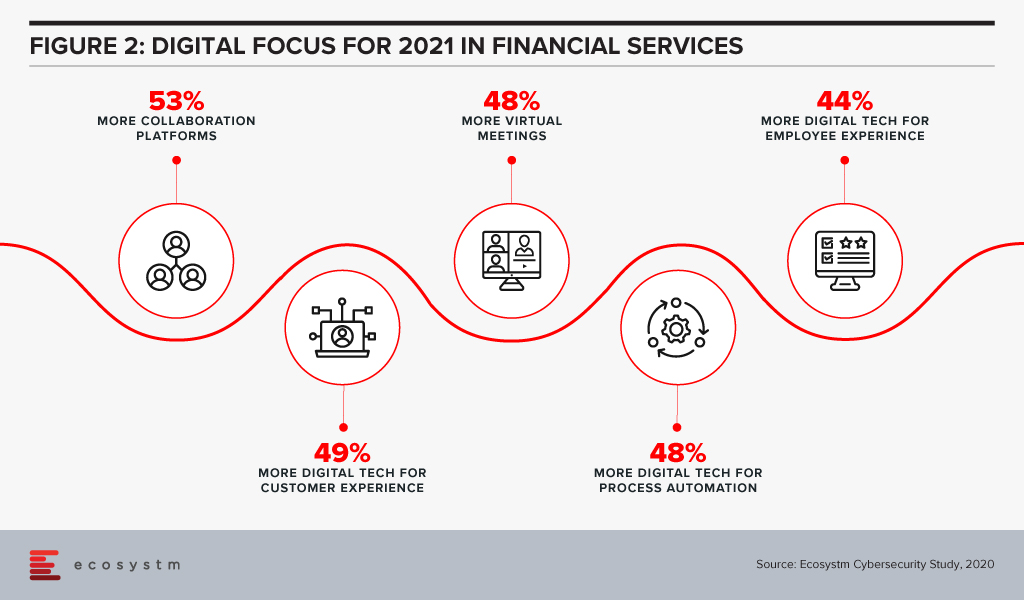

Attention will be paid in 2021 to focusing on automation of processes using AI (Figure 2).

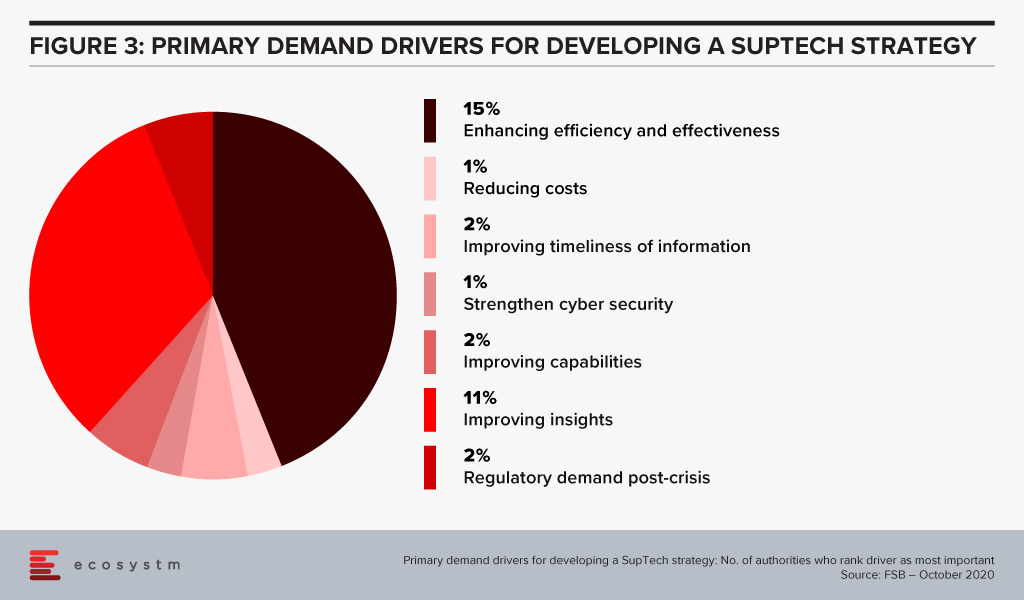

Based on a survey done by the FSB of its members (Figure 3), the majority of their respondents had a SupTech innovation or data strategy in place, with the use of such strategies growing significantly since 2016.

Summary

For more mainstream adoption, data standards and use of effective governance frameworks will be important. As seen from the FSB survey, SupTech applications are now used in reporting, data management and virtual assistance. But institutions still send the transaction data history in different reporting formats which results in a slower process of data analysing and data gathering. AI, using NLP, can help with this by streamlining data collection and data analytics. While time and cost savings are obvious benefits, the ability to identify key information (the proverbial needle in the haystack) can be a significant efficiency advantage.

Singapore FinTech Festival 2020: Infrastructure Summit

For more insights, attend the Singapore FinTech Festival 2020: Infrastructure Summit which will cover topics tied to creating infrastructure for a digital economy; and RegTech and SupTech policies to drive innovation and efficiencies in a co-Covid-19 world.

Five9, a cloud-based contact centre solutions provider announced the acquisition of intelligent virtual agent (IVA) platform provider, Inference Solutions for about USD 172 million. Five9 and Inference Solutions have been partnering for the last couple of years, with Five9 being a reseller for Inference Solutions’ IVA platform. The acquisition is expected to provide a boost to Five9’s AI portfolio, automate contact centre agent activities and provide AI-based omnichannel self-service solutions.

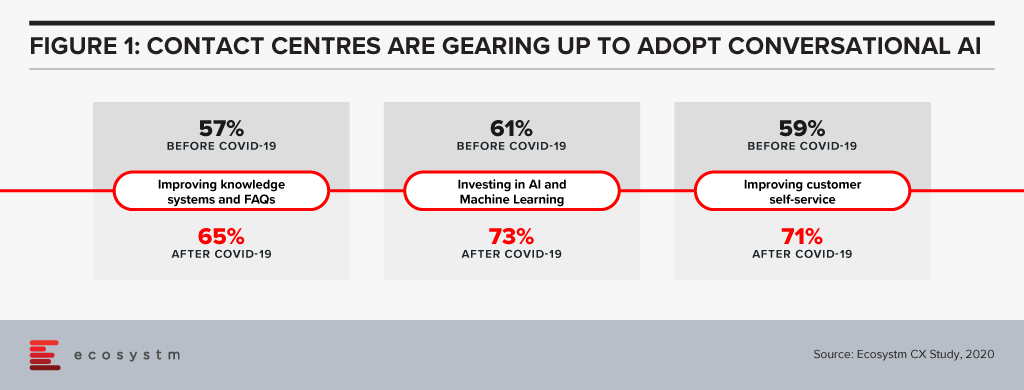

The need to drive greater automation in the contact centre is high on the agenda, and this acquisition demonstrates how important AI and automation is to contact centre modernisation. The old-fashioned ways of long wait times, being passed on through different menus on the IVR and being asked to repeat yourself through the older speech recognition engines is starting to not only frustrate customers but will become obsolete. Based on Ecosystm’s research, close to 60% of contact centres globally stated that investing in machine learning and AI is a top customer experience priority in the next 12 months.

Inference has come a long way since its inception at Telstra Labs

Inference Solutions (founded in 2005) was spun out of Telstra Labs. It has since expanded to the US and developed a suite of solutions in the IVA segment. They have a good partnership strategy with the leading telecom providers globally as well as the UC/contact centre vendors. Inference Solutions uses resellers such as service providers, UC, and contact centre software providers – and these include AT&T, Cisco (Broadsoft), Momentum Telecom, Nextiva, 8×8 and many others. The Inference Studio solution will see a new release in the next few months where the solution will come pre-built with the ability for the contact centre team to pre-load the contact centre conversations. These can be conversations that have been going on for 6 months or longer. The Studio solution will then be able to analyse and understand the underlying intent of the conversation, match the intent so that it can be used to auto train the bots accurately. That process of matching the intent and training is expensive and if you can automate some elements of that, it will bring the cost of the deployment down. Its solution integrates into NLP engines from Google, AWS, and IBM. In Australia they continue to work on patents in close partnerships with Melbourne University and RMIT. Throughout its journey, Inference has built a good base of customers in the US, UK, and Australia.

Five9 to accelerate on its vision of AI and Cloud

Contact centre modernisation is high on the agenda for many organisations and this will lead them to build AI and automation at the core of their customer strategies. The discussion spans across the CEO, Digital and Innovation, and the Contact Centre teams.

Five9 had acquired Whendu, an iPaaS platform provider empowering businesses and developers with no-code, visual application workflow tool, optimised for contact centres in November 2019, and Virtual Observer, an innovative provider of cloud-based workforce optimisation, also known as Workforce Engagement Management (WEM) in February of this year.

The pandemic has resulted in increased engagement of contact centres with customers. Companies are gradually looking for ways to automate tasks, deliver better communication, speech and text recognition, decipher languages, and implement solutions mimicking humans. As a solution to these challenges, IVAs are being viewed as efficient and effective digital workers for a modern contact centre. IVAs represent increased throughput, more accurate results, and better-informed agents.

Successful use cases have shown that conversational AI can reduce calls and repetitive queries by 70-90%. IVRs with monolithic, complicated menus will start becoming unpopular and force contact centres to embark on a modernisation and automation strategy. If we evaluate the shift in priorities after COVID-19, we see that organisations are ramping up their self-service capabilities and their adopt of AI and machine learning (Figure 1).

The acquisition will give Five9 a foothold in the Asia Pacific region with an initial focus on the Australia market. The Australia market is by far the most advanced cloud contact centre market in the Asia Pacific. Five9 gains a team of staff that will help them fuel the contact centre modernisation discussion across the Asia Pacific. As the region has a complex market, the need to work with local carriers and partners will be critical for further expansion. Five9 has made an important acquisition in building in IVA capability into its CCaaS solution.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated

The Retail industry has had to do a sharp re-think of its digital roadmap and transformation journey – Ecosystm research shows that about 75% of retail organisations had to start, accelerate, or re-focus their digital transformation initiatives. However, that will not be enough as organisations move beyond survival to recovery – and future successes. While retailers will focus on the shift in customer expectations, a mere focus on customer experience will not be enough in 2021. Ecosystm Principal Advisors, Alan Hesketh and Alea Fairchild present the top 5 Ecosystm predictions for Retail & eCommerce in 2021.

This is a summary of the predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Retail & eCommerce Trends for 2021

- There Will Only be Omnichannel Retailers

The value of an omnichannel offer in Retail has become much clearer during the COVID-19 pandemic. Retailers that do not have the ability to deliver using the channel customers prefer will find it hard to compete. As the physical channel becomes less important new revenue opportunities will open up for businesses operating in adjacent market sectors – companies such as food and grocery wholesalers will increasingly sell direct to consumers, leveraging their existing online and distribution capabilities.

Most customers transact on mobile device – either a mobile phone or tablet. New capabilities will remove some of the barriers to using these mobile devices. For one, technologies such as Progressive Web Apps (PWA) and Accelerated Mobile Pages (AMP) will provide a better customer experience on mobile platforms than existing websites, while delivering a user experience at par or better than mobile apps. Also, as retailers become AI-enabled, machine learning engines will provide purchase recommendations through smartwatches or in-home, voice-enabled, smart devices.

- COVID-19 Will Continue to be an Influence Forcing Radical Shifts

In driving the economic recovery in 2021, we will see ‘glocal’ consumption – emphasis on local retailers and global players taking local actions to win the hearts and minds of local consumers. There will be significant actions within local communities to drive consumers to support local retailers. Location-based services (LBS) will be used extensively as consumers on the high street carry more LBS-enabled devices than ever before. Bluetooth beacon technology and proximity marketing will drive these efforts. Consumers will have to opt-in for this to work, so privacy and relationship management are also important to consider.

But people still want to “physically” browse, and design aesthetics of a store are still part of the attraction. In the next 18 months, the concept of virtual stores that are digital twins will take off, particularly in the holiday and Spring clearance sales. Innovators like Matterport can help local retailers gain a more global audience with a digital twin with a limited technological investment. At a minimum, Shopify or other intermediaries will be necessary for a digital shop window.

- The Industry will See Artificial Intelligence in Everything

AI will increase its impact on Retail with an uptake in two key areas.

- Customer interactions. Retail AI will use customer data to deliver much richer and targeted experiences. This may include the ability to get to a ‘segment of one’. Tools will include chatbots that are more functional and support for voice-based commerce using mobile and in-home edge devices. Also, in-store recognition of customers will become easier through enhanced device or facial recognition. Markets where privacy is less respected will lead in this area – other markets will also innovate to achieve the same outcomes without compromising privacy but will lag in their delivery. This mismatch of capability may allow early adopters to enter other geographic markets with competitive offers while meeting the privacy requirements of these markets.

- Supply chain and pricing capabilities. AI-based machine learning engines using both internal and increased sources of external data will replace traditional math-based forecasting and replenishment models. These engines will enable the identification of unexpected and unusual demand influencing factors, particularly from new sources of external data. Modelling of price elasticity using machine learning will be able to handle more complex models. Retailers using this capability will be in a better position to optimise their customer offers based on their pricing strategies. Supply chains will be re-engineered so products with high demand volatility are manufactured close to markets, and the procurement of products with stable demands will be cost-based.

- Distribution Woes Will Continue

Third party delivery platforms such as Wish and RoseGal are recruiting additional international non-Asian suppliers to expand their portfolios. Amazon and AliExpress are leaders here, but there are many niche eCommerce platforms taking up the slack due to the uneven distribution patterns from the ongoing economic situation. Expect to see a number of new entrants taking up niche spaces in the second half of 2021, sponsored by major retail product brands, to give Amazon a run for their money on a more local basis.

As the USPS continues to be under strain, delivery companies like FedEx in the US who partner with the USPS are already suffering from the USPS’s operational slowdown, in both their customer reputation and delivery speed. In 2021, COVID-19 – and workers’ unions – will continue to impact distribution activities. Increased spending in warehouse automation and new retail footprints such as dark stores will be seen to make up for worker shortfalls.

- China’s Retail Models Will Expand into Other Markets

China’s online businesses operate in a large domestic market that is comparatively free of international competitors. Given the scale of the domestic market, these online companies have been able to grow to become substantial businesses using advanced technologies. All the Chinese tech giants – among them Alibaba, ByteDance, DiDi Chuxing, and Tencent – are expanding internationally.

China’s rapidly recovering economy puts those businesses in a strong position to fund a competitive expansion into international markets using their domestic base, particularly with their Government’s promotion of the country’s tech sector. It is harder to impose restrictions on software-based businesses, unlike the approach that we have witnessed the US Government take for hardware companies such as Huawei – placing constraints on mobile phone components and operating systems.

These tech giants also have significant experience in a Big Data environment that provides little privacy protection, as well as leading-edge AI capabilities. While they will not be able to operate with the same freedom in global markets, and there will be other large challenges in translating Chinese experience to other markets – these tech players will be able to compete very effectively with incumbent global companies. Chinese companies also continue to raise capital from US stock exchanges with The Economist reporting Chinese listings have raised close to USD 17 billion since January 2020.

Organisations are on a fast track to digitalisation. The Ecosystm Digital Priorities in the New Normal study finds that 60% of organisations anticipate increased use of digital technologies for process automation, even after the COVID-19 restrictions are lifted. One of the key challenges that these organisations will face is the lack of internal digital skills – especially in emerging technologies. One of the success metrics of any technology adoption is employee uptake. Without the necessary skills or understanding of the benefits of emerging technology, employees will largely shy away from digital offerings, even the ones that will make their work more efficient and their lives easier.

Organisations are realising the value of making their workforce future ready.

DBS Instilling Company-Wide Digital Culture

Far-sighted companies are collaborating with technology vendors and professional training providers to promote tech awareness and education to futureproof their workforce. DBS Bank in Singapore has collaborated with AWS to train and upskill 3,000 employees – including the leadership team – with AI and machine learning skills through gamification in a DBS x AWS DeepRacer League.

The AWS DeepRacer Leagues have been previously organised in several parts of the world, but the DBS x AWS DeepRacer will be the first to be organised at this scale. The league will enable DBS employees to get their hands-on AI and machine learning tutorials online. They will then have the opportunity to test out their new skills in programming a 3D racing simulator and iteratively fine-tune their models and compete with each other. The learning program is entirely cloud-based and aims to ingrain digital skills in the workforce.

DBS has won several accolades for their digital transformation and innovation initiatives, and they continue to experiment with emerging technologies. In 2019, DBS digitalised and simplified end-to-end credit processing, setting the foundation for advanced credit risk management using data analytics and machine learning. They have also deployed an AI-powered engine for self-service digital options to its retail banking customers. Taking their employees along with them on this journey is a wise move.

Ecosystm Principal Advisor, Ravi Bhogaraju says, “With the increasing use of automation, AI and machine learning, the nature of work and businesses is transforming rapidly. This is creating opportunities for processes to be automated and increasing the use of AI and Deep Learning into the business processes of the organisation. Industry value chains are transforming – AI and machine learning is adding automation, analytics and predictive intelligence to the portfolio. The recent news of DBS and AWS partnering to upskill the bank’s workforce underscores the value of creating a future ready workforce.”

“Such upskilling efforts add industry-specific context to make them more effective. BCG refers to this as ‘Human + AI’. A recent study from BCG and MIT shows that 18% of companies in the world that are pioneering AI are making money with it. Those companies focus 80% of their AI initiatives on effectiveness and growth, taking better decisions – not replacing humans with AI to save costs.”

Government Focus on Digital Skills Upgrade

This week, Singapore also saw another initiative to bridge digital skills gaps – this time from the public sector. In 2018, the Government launched its Smart Nation Scholarship program to attract and nurture talent, and later involve them in various departments to drive Singapore’s Smart Nation initiatives. The most recent Smart Nation Scholarship program 2020 attracted 723 applicants (17% more than the previous year). This is a slightly different approach, aimed at attracting digital native employees and mentoring them for digital leadership. After completing their studies, the 15 scholarship recipients are set to join public sector agencies such as Cyber Security Agency of Singapore (CSA), Government Technology Agency (GovTech), and Infocomm Media Development Authority (IMDA), to give the younger generation an opportunity to co-create the country’s Smart Nation vision.

Bhagaraju says, “Both private and government institutions are working to enhance workforce skills, improve marketability and making the workforce future ready. Industry 4.0 and the digital revolution have created the need to address the skill gaps that have arisen. Government programs such as the Skills Future program in Singapore, Malaysia’s HRD upskilling program, and the EU-28 European Digital initiative are all making a sustained effort to promote lifelong learning and acquisition/upgrading of skills for their respective citizens with quite successful results, that will have long-term impacts.”

Two things happened recently that 99% of the ICT world would normally miss. After all microprocessor and chip interconnect technology is quite the geek area where we generally don’t venture into. So why would I want to bring this to your attention?

We are excited about the innovation that analytics, machine learning (ML) and all things real time processing will bring to our lives and the way we run our business. The data center, be it on an enterprise premise or truly on a cloud service provider’s infrastructure is being pressured to provide compute, memory, input/output (I/O) and storage requirements to take advantage of the hardware engineers would call ‘accelerators’. In its most simple form, an accelerator microprocessor does the specialty work for ML and analytics algorithms while the main microprocessor is trying to hold everything else together to ensure that all of the silicon parts are in sync. If we have a ML accelerator that is too fast with its answers, it will sit and wait for everyone else as its outcomes squeezed down a narrow, slow pipe or interconnect – in other words, the servers that are in the data center are not optimized for these workloads. The connection between the accelerators and the main components becomes the slowest and weakest link…. So now back to the news of the day.

A new high speed CPU-to-device interconnect standard, the Common Express Link (CXL) 1.0 was announced by Intel and a consortium of leading technology companies (Huawei and Cisco in the network infrastructure space, HPE and Dell EMC in the server hardware market, and Alibaba, Facebook, Google and Microsoft for the cloud services provider markets). CXL joins a crowded field of other standards already in the server link market including CAPI, NVLINK, GEN-Z and CCIX. CXL is being positioned to improve the performance of the links between FPGA and GPUs, the most common accelerators to be involved in ML-like workloads.

Of course there were some names that were absent from the launch – Arm, AMD, Nvidia, IBM, Amazon and Baidu. Each of them are members of the other standards bodies and probably are playing the waiting game.

Now let’s pause for a moment and look at the other announcement that happened at the same time. Nvidia and Mellanox announced that the two companies had reached a definitive agreement under which Nvidia will acquire Mellanox for $6.9 billion. Nvidia puts the acquisition reasons as “The data and compute intensity of modern workloads in AI, scientific computing and data analytics is growing exponentially and has put enormous performance demands on hyperscale and enterprise datacenters. While computing demand is surging, CPU performance advances are slowing as Moore’s law has ended. This has led to the adoption of accelerated computing with Nvidia GPUs and Mellanox’s intelligent networking solutions.”

So to me it seems that despite Intel working on CXL for four years, it looks like they might have been outbid by Nvidia for Mellanox. Mellanox has been around for 20 years and was the major supplier of Infiniband, a high speed interconnect that is common in high performance workloads and very well accepted by the HPC industry. (Note: Intel was also one of the founders of the Infiniband Trade Association, IBTA, before they opted to refocus on the PCI bus). With the growing need for fast links between the accelerators and the microprocessors, it would seem like Mellanox persistence had paid off and now has the market coming to it. One can’t help but think that as soon as Intel knew that Nvidia was getting Mellanox, it pushed forward with the CXL announcement – rumors that have had no response from any of the parties.

Advice for Tech Suppliers:

The two announcements are great for any vendor who is entering the AI, intense computing world using graphics and floating point arithmetic functions. We know that more digital-oriented solutions are asking for analytics based outcomes so there will be a growing demand for broader commoditized server platforms to support them. Tech suppliers should avoid backing or picking one of either the CXL or Infiniband at the moment until we see how the CXL standard evolves and how nVidia integrates Mellanox.

Advice for Tech Users:

These two announcements reflect innovation that is generally so far away from the end user, that it can go unnoticed. However, think about how USB (Universal Serial Bus) has changed the way we connect devices to our laptops, servers and other mobile devices. The same will true for this connection as more and more data is both read and outcomes generated by the ‘accelerators’ for the way we drive our cars, digitize our factories, run our hospitals, and search the Internet. Innovation in this space just got a shot in the arm from these two announcements.

Is IIoT Edge Computing solution a real Internet of Things (IoT) trend for 2019?

As large hardware manufacturers like Cisco, HPE, Dell and more are building specific, robust and secure infrastructure for the edge, it is believed that there will be a lot of money flowing in the IIoT Edge computing world.

The Development and implementation of Edge-Machine Learning solutions is a complex process and requires a combination of rich industry experience, knowledge of automation (PLCs, SCADAS, HMIs), electrical & mechanical engineering along with unique Edge Computing distributed system. This is used by Data Scientists to develop Machine Learning algorithms which can be utilised by IIoT applications in the manufacturing industry.

For organisations looking to implement these solutions, it is always a good idea to know more on adoption and ask for the continuation of a pilot project for more than a year.

Below are the top 5 things that one should follow to accelerate implementation of IIoT edge computing solutions in the Manufacturing industry –

1) Get help to find the needle in the haystack

With the fragmented ecosystem of IIoT vendors and companies talking about the Industrial Internet or Industry 4.0, the challenge that always appears in front of the customers is to ask for free pilots from the manufacturers.

It is not just finding the needle (IIoT best or cheaper solution) in the haystack (ecosystem), it is how this needle matches with your business and technology strategies.

I know, I am selling myself, but my recommendation to you is to get advice from independent IIoT experts.

2) Avoid OT Vendor Lock-In: We need machine data availability

Powerful Edge Analytics-Machine Learning applications require data exchange with the Programmable Logic Controllers (PLCs) of the manufacturers. By looking at the specifications we may think that it will be an easy task to extract the data from PLCs going through different ways or manufacturer’s help-guides. However, the problem is vendor lock-ins, most of the top PLC manufacturer’s do not allow “easy” data access and extraction methods neither to the customers nor to any third parties.

It is not a question of protocols, it is a question of vendor lock-in and data availability.

Customers must seek and claim for open-source solutions to avoid vendor lock-in during the long run. The open source can better lead to the path of innovation in their manufacturing plants.

3) Edge Computing and Machine Learning: The last frontier to break between IT/OT

In my article “IT and OT, Friends or Foes in the Industrial Internet of Things?” I was optimistic about the quick convergence of Information Technology (IT) and Operations Technology (OT), I was wrong. If you visit and inspect a manufacturing plant floor, you will see how much progress is still to be made.

Edge Analytics is a key component in the integration of IT & OT and requires a knowledge of both to make it work. The lack of skills & knowledge in the IT and OT fields impact the business & operations and creates a dilemma on which department should lead the Edge Analytics projects.

Manufacturing companies need a role with authority (Chief IIoT Officer or CIIoT) and resources to lead the IT/OT convergence strategy.

4) Do not stop by the dilemma of Edge: To Cloud or NOT to Cloud

When I wrote in 2016 “Do not let the fog hide the clouds in the Internet of Things”, the hype around Edge Computing and Machine Learning started. There was a confusion about fog computing and edge computing and how this layer will impact the IoT architecture, especially cloud workloads.

Today, many cloud vendors offer IoT platforms and tools that combine the Cloud and the Edge application development, machine learning and analytics at the edge, governance, and end to end security. On the OT side, companies like Siemens have launched MindSphere, an open cloud-based IoT operating system based on the SAP HANA cloud platform.

Manufacturers should continue to deploy and develop Edge Computing – Machine Learning applications to monitor the health of their machines or to improve their asset maintenance or to monitor the quality control of their plant floor processes and shouldn’t stop because of the fear of the integration of their platform with the Public or Hybrid Cloud environment.

Edge Computing solutions help manufacturers to improve their competitiveness without the Clouds but make sure your Edge IIoT solution is ready for easy integration with the Clouds.

5) Connected Machines is the only way for new Business Models

Security is another major obstacle for the adoption of IIoT in the manufacturing industry. Manufacturers have been reluctant to open their manufacturing facilities to the Internet because of the risks of cyber-attacks.

In a fast-moving era where platforms and services require products and machines connected, every manufacturing factory should be able to tap into machine data remotely and make it available for Machine vendors. This requires every Edge Computing / Machine Learning system to be built with the capability to share data remotely via open and secure protocols/standards like MTConnect and OPC-UA.

Having machines connected is the first step to make machines smarter, to build smarter factories and to flourish new business models as Remote Equipment Monitoring.

Key Takeaway

The benefits of using Edge Computing / Machine Learning solutions are very attractive to the manufacturers because it offers minimal latency, conserve network bandwidth, improve operations reliability, offers quick decision-making ability, gather data, and process the collected data to gain insights. The ROI in such IIoT solutions is very attractive.

To get these benefits and to grace IIoT journey, manufacturers have to step-up and accept to receive tangible and innovative business value.