Technological advancements have paved the way for banks and financial institutions to broaden their services globally. However, despite ongoing efforts to tackle disparities in access, systemic biases persist, including those related to race, gender, income disparities, and unequal lending practices, contributing to financial inequality.

Prioritising financial inclusion is crucial for fostering global economic growth and AI plays a significant role in achieving this objective.

AI is enhancing financial inclusion by providing financial education and minimising fraud in transactions, empowering previously underserved populations.

The Impact of Financial Inclusion

Impact on Individuals

It is transformative for poverty reduction, empowering marginalised populations to save and invest, providing a tangible path out of poverty. Additionally, access to insurance and savings accounts enhances personal resilience, helping individuals navigate financial risks associated with unforeseen events like health crises, natural disasters, and economic downturns. Financial inclusion is the first step towards social equity.

Impact on the Economy

It fuels economic growth by supporting small businesses and entrepreneurs, fostering innovation, job creation, and overall development. Beyond individual empowerment, it plays a crucial role in addressing global challenges, particularly by facilitating climate action in communities most affected by climate change.

Many market participants recognise the profound impact that financial inclusion can have on the economy and are collectively taking action.

Here are some examples of how they are leveraging AI to promote financial inclusion.

Click here to download ‘Bridging Gaps: AI’s Role in Financial Inclusion’ as a PDF

It’s been barely one year since we entered the Generative AI Age. On November 30, 2022, OpenAI launched ChatGPT, with no fanfare or promotion. Since then, Generative AI has become arguably the most talked-about tech topic, both in terms of opportunities it may bring and risks that it may carry.

The landslide success of ChatGPT and other Generative AI applications with consumers and businesses has put a renewed and strengthened focus on the potential risks associated with the technology – and how best to regulate and manage these. Government bodies and agencies have created voluntary guidelines for the use of AI for a number of years now (the Singapore Framework, for example, was launched in 2019).

There is no active legislation on the development and use of AI yet. Crucially, however, a number of such initiatives are currently on their way through legislative processes globally.

EU’s Landmark AI Act: A Step Towards Global AI Regulation

The European Union’s “Artificial Intelligence Act” is a leading example. The European Commission (EC) started examining AI legislation in 2020 with a focus on

- Protecting consumers

- Safeguarding fundamental rights, and

- Avoiding unlawful discrimination or bias

The EC published an initial legislative proposal in 2021, and the European Parliament adopted a revised version as their official position on AI in June 2023, moving the legislation process to its final phase.

This proposed EU AI Act takes a risk management approach to regulating AI. Organisations looking to employ AI must take note: an internal risk management approach to deploying AI would essentially be mandated by the Act. It is likely that other legislative initiatives will follow a similar approach, making the AI Act a potential role model for global legislations (following the trail blazed by the General Data Protection Regulation). The “G7 Hiroshima AI Process”, established at the G7 summit in Japan in May 2023, is a key example of international discussion and collaboration on the topic (with a focus on Generative AI).

Risk Classification and Regulations in the EU AI Act

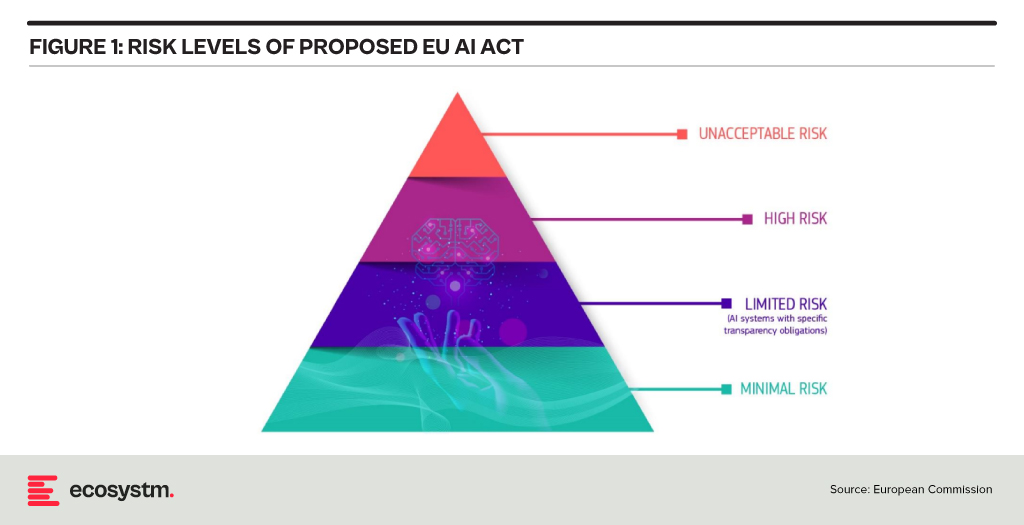

At the heart of the AI Act is a system to assess the risk level of AI technology, classify the technology (or its use case), and prescribe appropriate regulations to each risk class.

For each of these four risk levels, the AI Act proposes a set of rules and regulations. Evidently, the regulatory focus is on High-Risk AI systems.

Contrasting Approaches: EU AI Act vs. UK’s Pro-Innovation Regulatory Approach

The AI Act has received its share of criticism, and somewhat different approaches are being considered, notably in the UK. One set of criticism revolves around the lack of clarity and vagueness of concepts (particularly around person-related data and systems). Another set of criticism revolves around the strong focus on the protection of rights and individuals and highlights the potential negative economic impact for EU organisations looking to leverage AI, and for EU tech companies developing AI systems.

A white paper by the UK government published in March 2023, perhaps tellingly, named “A pro-innovation approach to AI regulation” emphasises on a “pragmatic, proportionate regulatory approach … to provide a clear, pro-innovation regulatory environment”, The paper talks about an approach aiming to balance the protection of individuals with economic advancements for the UK on its way to become an “AI superpower”.

Further aspects of the EU AI Act are currently being critically discussed. For example, the current text exempts all open-source AI components not part of a medium or higher risk system from regulation but lacks definition and considerations for proliferation.

Adopting AI Risk Management in Organisations: The Singapore Approach

Regardless of how exactly AI regulations will turn out around the world, organisations must start today to adopt AI risk management practices. There is an added complexity: while the EU AI Act does clearly identify high-risk AI systems and example use cases, the realisation of regulatory practices must be tackled with an industry-focused approach.

The approach taken by the Monetary Authority of Singapore (MAS) is a primary example of an industry-focused approach to AI risk management. The Veritas Consortium, led by MAS, is a public-private-tech partnership consortium aiming to guide the financial services sector on the responsible use of AI. As there is no AI legislation in Singapore to date, the consortium currently builds on Singapore’s aforementioned “Model Artificial Intelligence Governance Framework”. Additional initiatives are already underway to focus specifically on Generative AI for financial services, and to build a globally aligned framework.

To Comply with Upcoming AI Regulations, Risk Management is the Path Forward

As AI regulation initiatives move from voluntary recommendation to legislation globally, a risk management approach is at the core of all of them. Adding risk management capabilities for AI is the path forward for organisations looking to deploy AI-enhanced solutions and applications. As that task can be daunting, an industry consortium approach can help circumnavigate challenges and align on implementation and realisation strategies for AI risk management across the industry. Until AI legislations are in place, such industry consortia can chart the way for their industry – organisations should seek to participate now to gain a head start with AI.

After the resounding success of the inaugural event last year, Ecosystm is once again partnering with Elevandi and the State Secretariat for International Finance SIF as a knowledge partner for the Point Zero Forum 2023. In this Ecosystm Insights, our guest author Jaskaran Bhalla, Content Lead, Elevandi talks about the Point Zero Forum 2023 and how it is all set to explore digital assets, sustainability, and AI in an ever-evolving Financial Services landscape.

The Point Zero Forum is returning for its second edition between 26 to 28 June 2023 in Zurich, Switzerland. The inaugural Forum held in June 2022 attracted over 1,000 leaders and featured more than 200 esteemed speakers from Europe, Asia Pacific, the USA, and MENA. The Forum represents a collaboration between the Swiss State Secretariat for International Finance (SIF) and Elevandi and is organised in cooperation with the BIS Innovation Hub, the Monetary Authority of Singapore (MAS), and the Swiss National Bank.

As we gear up for this year’s Point Zero Forum, let’s take a moment to reflect on some of the pivotal developments that have shaped the Financial Services industry since the previous Forum and also moulded the three key themes that will take centre stage this year: Sustainability, Artificial Intelligence (AI), and Digital Assets.

COP27, the rise of blended finance and the groundbreaking Net-Zero Public Data Utility

In November 2022, the Government of the Arab Republic of Egypt hosted the 27th session of the Conference of the Parties of the UNFCCC (COP27), with a view to accelerate the transition to a low-carbon future. In the build-up to COP27, Ravi Menon, the Managing Director of the MAS spoke at the inaugural Transition Finance towards Net-Zero conference and shared with the audience that the world is currently not on a trajectory to achieve net-zero emissions by 2050. And according to the UN Emissions Gap report 2021, based on the current policies in place, the world is 55% short of the emissions reduction target for 2030. He also elaborated on the significant role that blended finance can play in tackling climate change, a theme that widely resonated with the global leaders at COP27. To enable easy and transparent reporting on climate commitments, the Climate Data Steering Committee (CDSC) outlined the next steps on its recommended plans for the Net-Zero Data Public Utility (NZDPU) at COP 27. NZDPU aims to aid efforts to transition to a net-zero economy by addressing data gaps, inconsistencies, and barriers to information that slow climate action.

The Point Zero Forum 2023 will deep-dive into the data, technologies, and capital and risk management solutions that can accelerate the fair transition towards a low-carbon future.

Panel Discussion Highlight: The opening panel discussion, “Data for Net-Zero: Views from the Climate Data Steering Committee,” scheduled for 26 June, will feature members of the CDSC, which include the Financial Conduct Authority, the MAS, Glasgow Financial Alliance for Net Zero (GFANZ), and the Swiss State Secretariat for International Finance. The panel will discuss the role of new technologies and collaborative platforms in promoting greater accessibility of transition data and innovative business models.

The launch of ChatGPT by OpenAI and its record for the fastest 100M monthly active users

The launch of ChatGPT by OpenAI on 30 November, 2022 led to widespread adoption by users globally – eventually setting the record for the fastest-growing, active users, hitting 100M monthly active users by Feb 2023. While on one hand users rushed to share enormous efficiency gains achieved by the use of ChatGPT, on the other hand ChatGPT soon became a disruptive tool to spread fake news.

The Point Zero Forum 2023 will deep-dive into Generative AI’s potential for enhancing efficiency, improving risk management, and providing better customer experience in the Financial Services industry, while highlighting the need for ensuring fair, ethical, accountable, and transparent use of these technologies.

Panel Discussion Highlight: The session “Breaking New Ground with Generative AI: Project MindForge”, scheduled for 27 June, will feature global leaders from NVIDIA, the MAS, Citigroup and Bloomberg. The panel will discuss the opportunities of Generative AI for the Financial Services sector.

MiCA regulation gets adopted by the EU lawmakers and sets a precedent for digital asset regulations

More than 2.5 years after it was first proposed, the EU Markets in Crypto-Assets (MiCA) regulation was approved in April 2023 by EU Parliament. While there is still work to be done to implement MiCA and measure its success, and to answer open questions around regulation for out-of-scope assets (like DeFI and NFTs), the digital assets industry is keenly observing whether MiCA could serve as a template for global crypto regulation. In May 2023, the International Organization Of Securities Commissions (IOSCO), the global standard setter for securities markets, also joined the global discussion on digital asset regulation by issuing for consultation detailed recommendations to jurisdictions across the globe as to how to regulate crypto assets.

The Point Zero Forum 2023 will do a stocktake on key global regulatory frameworks, market infrastructure, and use cases for the widespread adoption of digital assets, asset tokenisation, and distributed ledger technology.

Panel Discussion Highlight: The sessions “State of Global Digital Asset Regulation: Navigating Opportunities in an Evolving Landscape” and “Interoperability and Regulatory Compliance: Building the Future of Digital Asset Infrastructure”, scheduled on 26 and 27 June respectively, will feature global leaders from both public sector (such as the MAS, Bank of Italy, Bank of Thailand, U.S. Commodity Futures Trading Commission, EU Parliament) and private sector organisations (such as JP Morgan, Sygnum, SBI Digital Assets, Chainalysis, GBBC, SIX Digital Exchange). The discussions will centre around digital asset regulations and key considerations in the rapidly evolving world of digital assets.

Register here at https://www.pointzeroforum.com/registration. Receive 10% off the Industry Pass by entering the code ‘JB10’ at check out. (Policymakers, regulators, think tanks, and academics receive complimentary access/ Founders of tech companies (incorporated for less than 3 years) can apply for a discounted Founder’s Pass)

Innovation and collaboration are the cornerstones of FinTech success stories. Successful FinTechs have identified market gaps and designed innovative solutions to address these gaps. They have also built an ecosystem of partners – such as other FinTechs, large corporates and financial services organisations – to deliver better customer experiences, create process efficiencies and make compliance easier.

As FinTechs have become mainstream over the years the innovations and the collaborations continue to make technology and business headlines.

Here are some recent trends:

- The Growth of Cross-border Finance. Globalisation and the rise of eCommerce have created a truly global marketplace – and financial agencies such as the MAS and those in the EU are responding to the need.

- Transparency through Smart Contracts. As businesses and platforms scale applications and capabilities through global partnerships, there is a need for trusted, transparent transactions. Symbiont‘s partnership with Swift and BNB Chain‘s tie-up with Google Cloud are some recent examples.

- Evolution of Digital Payments. Digital payments have come a long way from the early days of online banking services and is now set to move beyond digital wallets such as the Open Finance Association and EU initiatives to interlink domestic CBDCs.

- Banks Continue to Innovate. They are responding to market demands and focus on providing their customers with easy, secure, and enhanced experiences. NAB is working on digital identity to reduce fraud, while Standard Chartered Bank is collaborating with Bukalapak to introduce new digital services.

- The Emergence of Embedded Finance. In the future, we will see more instances of embedded financial services within consumer products and services that allows seamless financial transactions throughout customer journeys. LG Electronics‘ new NFT offering is a clear instance.

Read below to find out more.

Download The Future of Finance: FinTech Innovations & Collaborations as a PDF

Innovation is at the core of Singapore’s ethos. The country has perfected the art of ‘structured innovation’ where pilots and proof of concepts are introduced and the successful ones scaled up by recalibrating technology, delivery systems, legislation, and business models. The country has adopted a similar approach to achieving its sustainability goals.

The Singapore Green Plan 2030 outlines the strategies to become a sustainable nation. It is driven by five ministries: Education, National Development, Sustainability and the Environment, Trade and Industry, and Transport, and includes five key pillars: City in Nature, Sustainable Living, Energy Reset, Green Economy, and Resilient Future. We will see a slew of new programs and initiatives in green finance, sustainability, solar energy, electric vehicles (EVs), and innovation, in the next couple of years.

Singapore’s Intentions of Becoming a Green Finance Leader

Singapore is serious about becoming a world leader in green finance. The Green Bonds Programme Office was set up last year, to work with statutory boards to develop a framework along with industry and investor stakeholders. We have seen a number of sustainable finance initiatives last year, such as the National Environment Agency (NEA) collaborating with DBS to raise USD 1.23 billion from its first green bond issuance. The proceeds will fund new and ongoing sustainable waste management initiatives. Temasek collaborated with HSBC for a USD 110 million debt financing platform for sustainable projects and Sembcorp issued sustainability bonds worth USD 490 million.

Building an Ecosystm of Sustainable Organisations

Sustainability has to be a collective goal that will require governments to work with enterprises, investors and consumers. To ensure that enterprises are focusing on Sustainability, governments have to keep in mind what drives these initiatives and the challenges organisations face in achieving their goals.

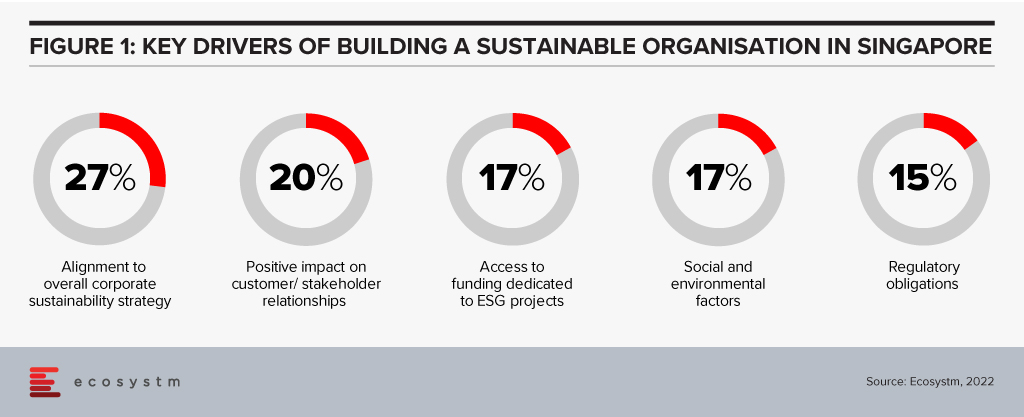

There are several reasons driving organisations in Singapore to adopt sustainability goals and ESG responsibilities (Figure 1)

It is equally important to address organisations’ challenges in building sustainability in their business processes. Last week, the Institute of Banking and Finance (IBF) and the Monetary Authority of Singapore (MAS) set out 12 Sustainable Finance Technical Skills and Competencies (SF TSCs) required by people in various roles in sustainable finance. This addresses the growing demand for sustainable finance talent in Singapore; and covers knowledge areas such as climate change policy developments, natural capital, green taxonomies, carbon markets and decarbonisation strategies. There are Financial Services related competencies as well, such as sustainability risk management, sustainability reporting, sustainable investment management, and sustainable insurance and reinsurance solutions. The SF TSCs are part of the IBF Skills Framework for Financial Services.

Sustainable Resources Initiatives

Singapore is not only focused on Sustainable Finance. If we look at NEA’s Green Bonds, there are specific criteria that projects must satisfy in order to qualify, including a focus on sustainable waste management.

Last week the Government announced that the National Research Fund (NRF) will allocate around USD 160 million to drive new initiatives in water, reuse and recycling technologies, as part of the Research, Innovation and Enterprise 2025 plan (RIE2025). Part of the fund will be allocated to the Closing the Resource Loop (CTRL) initiative, administered by the NEA that will fund sustainable resource recovery solutions.

Singapore faces severe resource constraints, and water security is not a new challenge for the country. The NRF funding will also be used partially for R&D in 3 water technology focus areas: desalination and water reuse; used water treatment; and waste reduction and resource recovery.

The Government is Leading the Way

The Government’s concerted efforts to make the Singapore Green Plan 2030 a success is seeing corporate participation in the vision. In February, Shell started supplying sustainable aviation fuel (SAF) to customers such as SIA Engineering Company and the Singapore Air Force in Singapore. Shell has also upgraded their Singapore facility to blend SAF at multiple, key locations. Last week, Atlas announced their commitment to Web 3.0 technologies and “tech for good”. They aim to increase their green energy use to 75% by 2022; 90% by 2023; and 100% by 2024. ESG consciousness is percolating down from the Government.

The success of Singapore’s Sustainability strategies will depend on innovation, the Government’s ongoing commitment, and the support provided to enterprises, investors, and consumers. The Singapore Government is poised to lead from the front in building a Sustainable Ecosystem.

It is estimated that nearly 1.7 billion adults remain unbanked globally. Besides the unbanked there are large sections of the world that are underbanked or underserved because of geographical, educational and gender divides. And then there are the entrepreneurs and small and medium enterprises that find it harder to secure funds.

There are several ongoing initiatives by policy organisations, governments, corporates and FinTechs that aim to fulfil the goal of creating an inclusive world.

This Ecosystm Snapshot looks at some recent examples from central banks such as MAS, RBI, BSP Philippines, the Royal Monetary Authority of Bhutan; financial services providers such as Mastercard and Citi; and FinTechs such as Microchip Payments and Sempo.

To download this VendorSphere as a PDF for easier sharing, please click here.

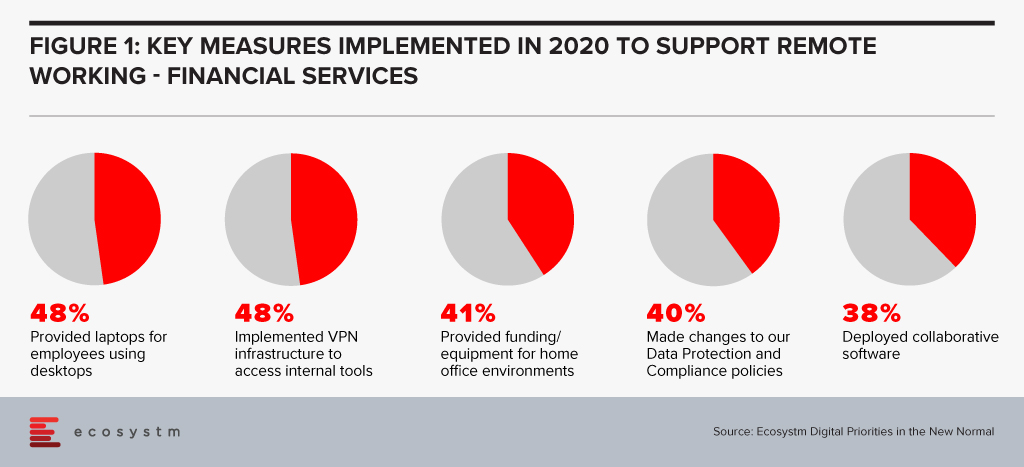

Financial services institutions made a fast switch to remote working when the pandemic forced widespread lockdowns across the globe. The adoption of remote working was nascent in the industry, and there was a need for a fast pivot by both the organisations and employees (Figure 1).

However, this has also exposed the industry to technology-related risks. Ecosystm Principal Advisor, Gerald Mackenzie says, “The move to a more virtualised working environment has been a trend taking shape for many years and like so many trends, it needed an impetus to make it a norm; in this case COVID-19.”

“Many, if not most, financial institutions have been shifting to more cloud-based and modularised Banking-as-a-Service (BaaS) models and these trends will only accelerate as we need to manage risks inherent in conducting financial services via remote working environments. For example, critical capabilities such as Advisor to Client communications need to be verifiable and auditable whether they are happening inside or outside of the office and I predict regulators will be pushing financial institutions to ensure these standards become the norm rather than the exception.”

Singapore Addresses Risk in the Financial Industry

To manage and mitigate risks that could emerge from the extensive remote working adoptions by FIs, The Monetary Authority of Singapore (MAS) and The Association of Banks in Singapore (ABS) jointly released a paper titled Risk Management and Operational Resilience in a Remote Working Environment. This is also in line with the previous collaboration between MAS and ABS in May 2020 to establish the Return to Onsite Operations Taskforce (ROOT). ROOT sought to strengthen and implement safe management and operational resilience measures as well as endorsement of industry best practices.

The paper seeks to create awareness amongst financial institutions on key remote working risks in the domains of technology, operations, security, fraud, staff misconduct, legal and regulatory risks. MAS encourages them to take pre-emptive measures to adopt good practices on managing risks.

Mackenzie adds, “Of course, some of the issues are difficult to solve. For example, staff accessing client data from their homes creates inherent vulnerabilities and the ways to ensure staff have suitable ‘in-home’ working environments to effectively manage these risks can be challenging and expensive. There are great opportunities for innovators to adapt solutions to solve these problems in what will undoubtedly be a growing investment area for many Financial Institutions.” The paper also examines various controls on the people and culture leveraging examples drawn from the experiences of ABS member banks to address evolving risks. For instance, FIs can implement security controls on staff infrastructure including their personal devices, verify in-person meetings against original documents, timely response strategies for recovery teams, legal risks and more.

To keep pace with the changing trends in technology deployment, risk management, and cybersecurity, MAS has been regularly working and engaging with experts to introduce guidelines, principles and best practices for financial institutions. In February, MAS issued a consultation paper proposing revisions to enhance the current requirements for enterprise risk management, investment risk management and public disclosure practices for insurers. Similarly, in January, MAS issued risk management best practice and standards to guide financial institutions in managing technology risk and maintain IT and cyber resilience.

Get insights on the technology areas in the Financial services industry that will see continued investments, as organisations get into the recovery phase.

Artificial Intelligence (AI) is becoming embedded in financial services across consumer interactions and core business processes, including the use of chatbots and natural language processing (NLP) for KYC/AML risk assessment.

But what does AI mean for financial regulators? They are also consuming increasing amounts of data and are now using AI to gain new insights and inform policy decisions.

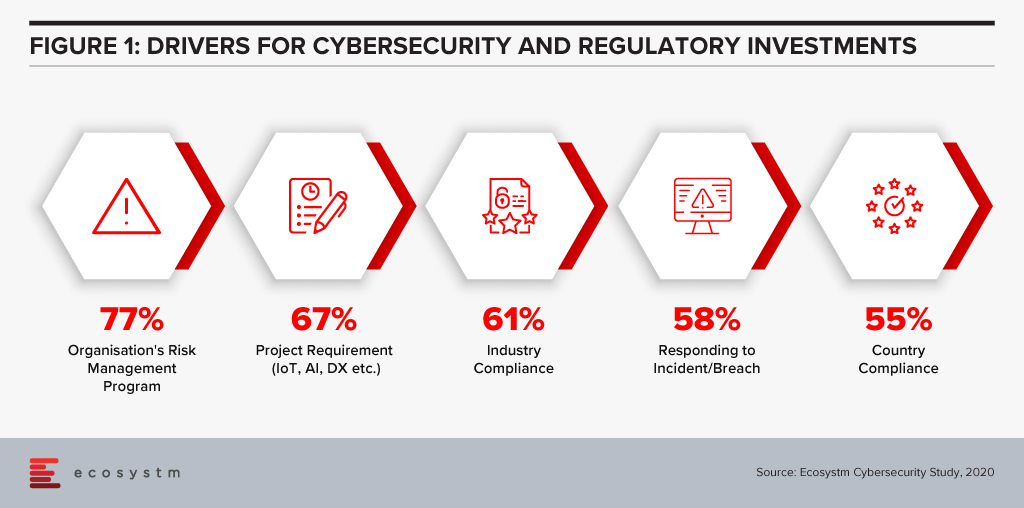

The efficiencies that AI offers can be harnessed in support of compliance within both financial regulation (RegTech) and financial supervision (SupTech). Authorities and regulated institutions have both turned to AI to help them manage the increased regulatory requirements that were put in place after the 2008 financial crisis. Ecosystm research finds that compliance is key to financial institutions (Figure 1).

SupTech is maturing with more robust safeguards and frameworks, enabling the necessary advancements in technology implementation for AI and Machine Learning (ML) to be used for regulatory supervision. The Bank of England and the UK Financial Conduct Authority surveyed the industry in March 2019 to understand how and where AI and ML are being used, and their results indicated 80% of survey respondents were using ML. The most common application of SupTech is ML techniques, and more specifically NLP to create more efficient and effective supervisory processes.

Let us focus on the use of NLP, specifically on how it has been used by banking authorities for policy decision making during the COVID-19 crisis. AI has the potential to read and comprehend significant details from text. NLP, which is an important subset of AI, can be seen to have supported operations to stay updated with the compliance and regulatory policy shifts during this challenging period.

Use of NLP in Policy Making During COVID-19

The Financial Stability Board (FSB) coordinates at the international level, the work of national financial authorities and international standard-setting bodies in order to develop and promote the implementation of effective regulatory, supervisory and other financial sector policies. A recent FSB report delivered to G20 Finance Ministers and Central Bank Governors for their virtual meeting in October 2020 highlighted a number of AI use cases in national institutions.

We illustrate several use cases from their October report to show how NLP has been deployed specifically for the COVID-19 situation. These cases demonstrate AI aiding supervisory team in banks and in automating information extraction from regulatory documents using NLP.

De Nederlandsche Bank (DNB)

The DNB is developing an interactive reporting dashboard to provide insight for supervisors on COVID-19 related risks. The dashboard that is in development, enables supervisors to have different data views as needed (e.g. over time, by bank). Planned SupTech improvements include incorporating public COVID-19 information and/or analysing comment fields with text analysis.

Monetary Authority of Singapore (MAS)

MAS deployed automation tools using NLP to gather international news and stay abreast of COVID-19 related developments. MAS also used NLP to analyse consumer feedback on COVID-19 issues, and monitor vulnerabilities in the different customer and product segments. MAS also collected weekly data from regulated institutions to track the take-up of credit relief measures as the pandemic unfolded. Data aggregation and transformation were automated and visualised for monitoring.

US Federal Reserve Bank Board of Governors

One of the Federal Reserve Banks in the US is currently working on a project to develop an NLP tool used to analyse public websites of supervised regulated institutions to identify information on “work with your customer” programs, in response to the COVID-19 crisis.

Bank of England

The Bank developed a Policy Response Tracker using web scraping (targeted at the English versions of each authority/government website) and NLP for the extraction of key words, topics and actions taken in each jurisdiction. The tracker pulls information daily from the official COVID-19 response pages then runs it through specific criteria (e.g. user-defined keywords, metrics and risks) to sift and present a summary of the information to supervisors.

Market Implications

Even with its enhanced efficiencies, NLP in SupTech is still an aid to decision making and cannot replace the need for human judgement. NLP in policy decision is performing clearly defined information gathering tasks with greater efficiency and speed. But NLP cannot change the quality of the data provided, so data selection and choice are still critical to effective policy making.

For authorities, the use of SupTech could improve oversight, surveillance, and analytical capabilities. These efficiency gains and possible improvement in quality arising from automation of previously manual processes could be consideration for adoption.

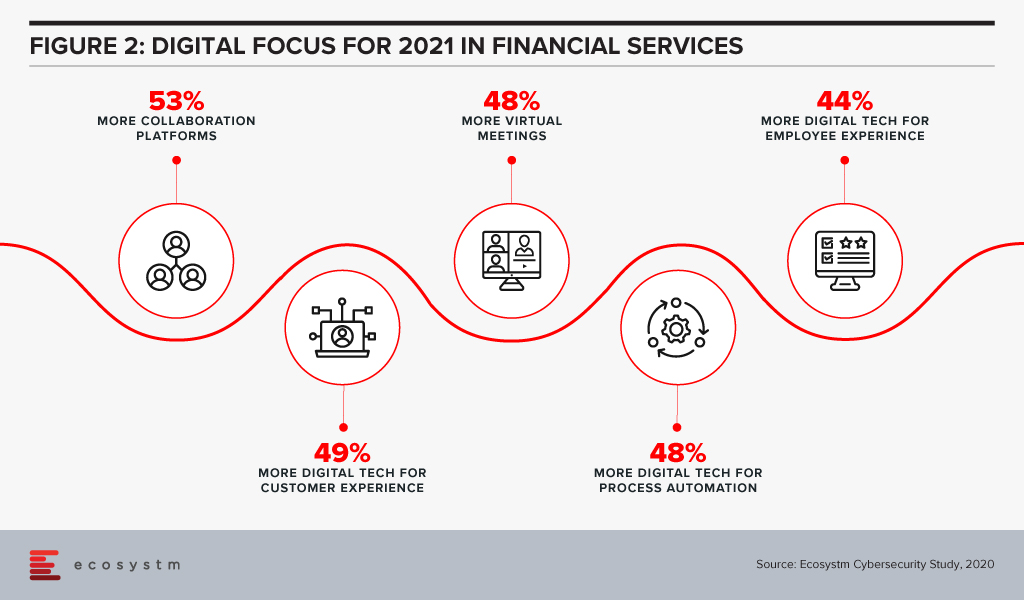

Attention will be paid in 2021 to focusing on automation of processes using AI (Figure 2).

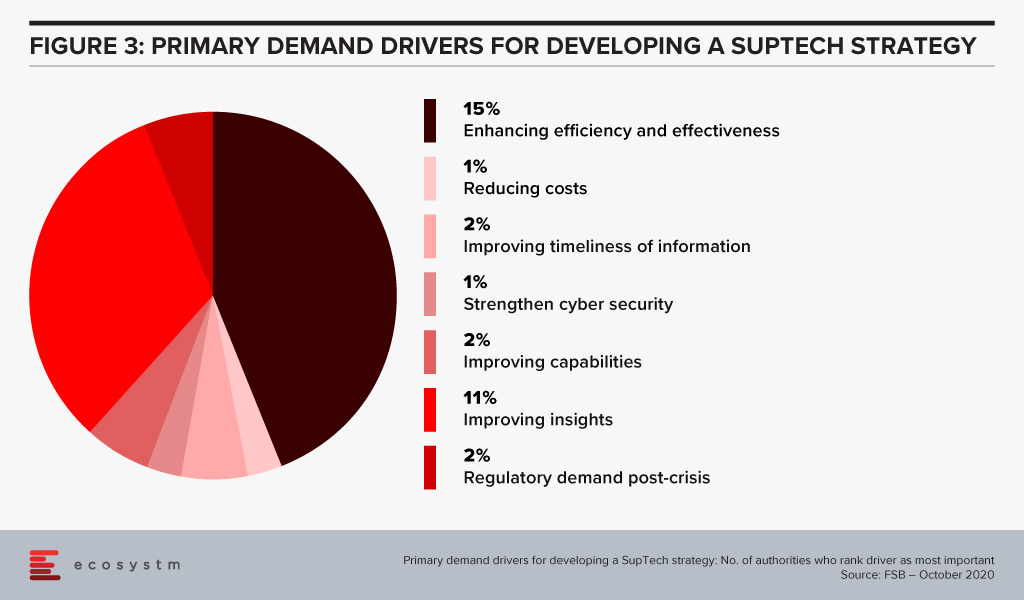

Based on a survey done by the FSB of its members (Figure 3), the majority of their respondents had a SupTech innovation or data strategy in place, with the use of such strategies growing significantly since 2016.

Summary

For more mainstream adoption, data standards and use of effective governance frameworks will be important. As seen from the FSB survey, SupTech applications are now used in reporting, data management and virtual assistance. But institutions still send the transaction data history in different reporting formats which results in a slower process of data analysing and data gathering. AI, using NLP, can help with this by streamlining data collection and data analytics. While time and cost savings are obvious benefits, the ability to identify key information (the proverbial needle in the haystack) can be a significant efficiency advantage.

Singapore FinTech Festival 2020: Infrastructure Summit

For more insights, attend the Singapore FinTech Festival 2020: Infrastructure Summit which will cover topics tied to creating infrastructure for a digital economy; and RegTech and SupTech policies to drive innovation and efficiencies in a co-Covid-19 world.

Singapore is committed to empower its small and medium enterprises (SMEs) to make better financial decisions and avail of seamless trade and financial transactions across the larger global economy. In June, the Digital Economic Partnership Agreement (DEPA) was signed between New Zealand, Singapore and Chile. The initiative includes facilitating end-to-end digital trade – by creating digital identities, allowing paperless trade and developing Fintech solutions – and ensuring a trusted cross-border data flow. To learn more about the DEPA agreement, register for the “Re-image the Digital Economy” webinar on the 29th July at 10am SGT.

This follows the announcement that was made last year by the Monetary Authority of Singapore (MAS) and Infocomm Media Development Authority (IMDA); of the successful completion of phase 1 of the proof-of-concept (POC) for its Business sans Borders (BSB). BSB is meant to be a “meta-hub” connecting several SME-centric platforms (starting within the Philippines, India and Singapore) giving SMEs seamless access to a larger ecosystem of buyers, sellers, logistics service providers, financing, and digital solution providers; and allowing them to be part of the larger global marketplace. The PoC involved a collaboration with private sector partners such as GlobalLinker, Mastercard, PwC, SAP and Yellow Pages.

AMTD Aligns with the BSB Objective

Hongkong-based investment banking firm AMTD Group leads a consortium that includes Xiaomi Finance, Singapore’s SP Group, and Funding Societies, that is a contender for one of Singapore’s digital wholesale banking licenses. While announcing their bid, they had clearly stated that they aimed to focus on SMEs in the region and globally. They continue to focus on SMEs by strengthening their partner ecosystem.

Last week AMTD announced a partnership with GlobalLinker making them the preferred financial services partner on the GlobalLinker’s SME-focused platform. AMTD intends to make available their entire ecosystem to SMEs including their virtual bank in Hong Kong, Airstar and their potential digital wholesale bank consortium in Singapore (which is to be called Singa Bank). In line with Singapore’s BSB objective, the partnership will see GlobalLinker join AMTD’s network which includes Fintech companies, regional banks and enterprises – SpiderNet. SpiderNet is a cross-sector ecosystem which is continuously expanding to connect and collaborate with shareholders, government bodies, industry associations, and clients. GlobalLinker’s AI-powered SME networking platform fosters SME digitalisation and helps members and customers connect with each other and use digital solutions. AMTD will be part of this network and bring the breadth of their partner ecosystem onto GlobalLinker’s platform.

Ecosystm Principal Advisor, Dheeraj Chowdhry says, “This marks the deepening of the trend of convergence between the established industry players and the Fintechs. The inefficiency of the obsession to ‘build’ and the associated resource and cost effort has perhaps been recognised on both sides and hence the path of coexistence and synergy seems more pragmatic. Fintechs are not competing but, in fact, complementing industry players by accelerating customer adoption of new digital formats for the entire landscape.”

AMTD Continues to Strengthen Partner Ecosystem

Last week also saw AMTD announce a collaboration with Singapore’s CIMB Bank and Funding Societies, to explore opportunities to create a wide range of banking and capital market services to aid SMEs with a one-stop solution for cross-regional and financial products.

Such partnerships by AMTD provides a glimpse of the group’s strong focus on Singapore. In April this year, AFIN and AMTD partnered to establish the USD 36 million AMTD ASEAN-Solidarity Fund. In May, AMTD, MAS, and Singapore FinTech Association (SFA) announced the launch of a USD 4.3 million MAS-SFA-AMTD FinTech Solidarity Grant to support Singapore-based FinTech firms.

AMTD remains committed to evolving their capabilities and ecosystem to empower the SME market in Singapore and the region. AMTD Digital announced their intention of acquiring a controlling stake in PolicyPal, Singapore’s InsureTech pioneer, and CapBridge Financial, a leading private capital platform for investing in growth companies globally. They have also expressed their intentions to acquire a controlling stake in FOMO Pay, a Singapore-based QR code and digital payment solution provider.

“AMTD’s early cognizance of the need for a strong ecosystem has led the organisation to their foray into partnerships and stakes in PolicyPal, FOMO Pay and now GlobalLinker. This strengthens AMTD’s commitment to the Fintech space including stakes in AirStar Digital Bank in Hong Kong and the Digital Bank application in Singapore,” says Chowdhry. “The Fintechs in AMTD’s stable will be part of the ‘AMTD web’ associated companies cutting across geographies and accelerate the ‘Business sans Borders’ objective of MAS and IMDA.”