Oracle is clearly prioritising a rapid expansion across the globe. The company is in a race to catch up with the big 3 (AWS, Google, and Microsoft), and recognises that many of their customers are eager to migrate to the cloud, and they have other options. Their strategy appears to be to rely on third-party co-location providers for most of their data centres, and build a single availability zone per region, at least to start.

Oracle Cloud Rollout Ramps Up

Let us consider the following:

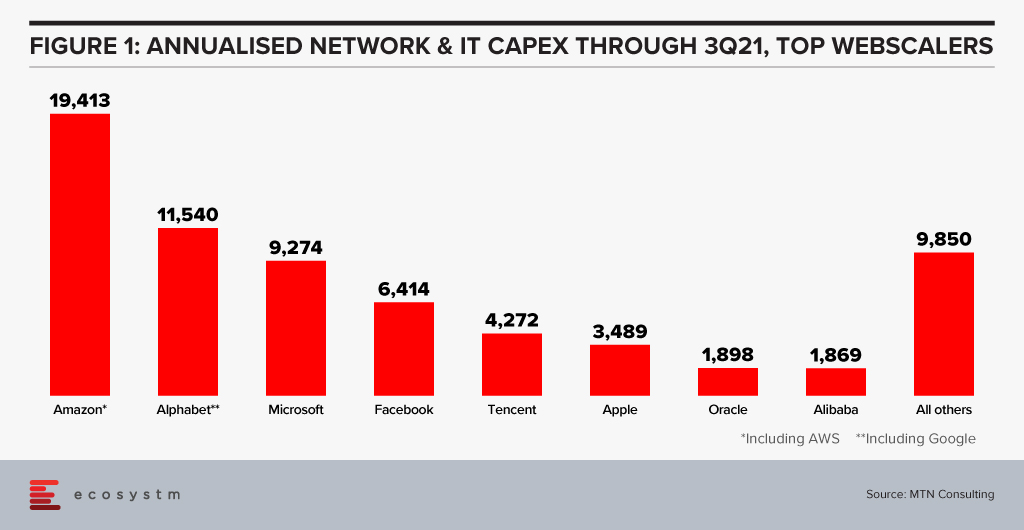

- Oracle’s network spending level puts it in the range of other webscalers. Focusing only on the Network and IT portion of their CapEx, Oracle has now passed Alibaba. Oracle is also ahead of both IBM and Baidu, which are included in the “All others” category in Figure 1.

- The coverage of the Oracle Cloud Infrastructure (OCI) is impressive. It has 36 regions today (some dedicated for government use), with a plan to reach 44 by year-end 2022. That compares to 27 overall for AWS, 65 for Azure, 29 for GCP; regional competitors Tencent and Huawei have 27 regions each, and Alibaba 25 regions. The downside is that Oracle has only one availability zone in most of its regions, while the Big 3 usually have 2 or 3 per region. Oracle needs to build out its local resiliency rapidly over the next year or two or risk losing business to the big 3, especially to AWS; but the company knows this and is budgeting CapEx aggressively to address the problem.

- Oracle’s initial reliance on leased facilities may be an interim step. The rapid growth of AWS, Azure, and GCP in the late 2010s was a surprise and Oracle started to see serious risks of losing customers to these cloud platforms. Building out their own cloud base on new data centres would have taken years and cost them business. So, Oracle did the smart thing and leaped into the cloud as fast as possible with the resources and time available. The company has scaled their OCI operations at an impressive rate. It expects capital expenditures to double YoY for the fiscal year ending May 2022, as it increases “data centre capacities and geographic locations to meet current and expected customer demand” for OCI.

- Finally, Oracle has invested heavily in designing the servers to be installed in its data centres (even if most of them are leased). Oracle was an early investor in Ampere Computing, which makes Arm-based processors, sidestepping the Intel ecosystem. In May 2021, Oracle rolled out its first Arm-based compute offering, OCI Ampere A1 Compute, based on the Ampere Altra processor. Oracle says this allows OCI customers to run “cloud-native and general-purpose workloads on Arm-based instances with significant price-performance benefits.” Microsoft and Tencent also deploy the Ampere Altra in some locations.

Reaching Global Scale

Once Oracle decided to launch into the cloud, its goal was to both grow revenues and also protect its legacy base from slipping away to the Big 3, which already had a growing global footprint. Oracle chose to quickly build cloud regions in its key markets, with the understanding that it would have to fill out individual regions as time passed. This is not that different from the big 3, in fact, but Oracle started its buildout much later. It also has lesser availability zones per region.

Oracle has not ignored this disparity. It recognises that reliability is key for its clients in trusting OCI. For example, the company emphasises that:

- Each Oracle Cloud region contains at least three fault domains, which are “groupings of hardware that form logical data centers for high availability and resilience to hardware and network failures.” Fault domains allow a customer to distribute instances so “the instances are not on the same physical hardware within a single availability domain.”

- OCI has a network of 70 “FastConnect” partners which offer dedicated connectivity to OCI regions and services (comparable to AWS DirectConnect)

- OCI and Microsoft Azure have a partnership allowing “joint customers” to run workloads across the two clouds, providing low latency, cross-cloud interconnect between OCI and Azure in eight specific regions. Customers can migrate existing applications or develop cloud native applications using a mix of OCI and Azure.

- Oracle allows customers to deploy OCI completely within their own data centers, with Dedicated Region and Exadata Cloud@Customer, deploy cloud services locally with public cloud-based management, or deploy cloud services remotely on the edge with Roving Edge Infrastructure.

- Further, Oracle clearly tries to differentiate around its Arm-based Ampere processors. Reliability is not necessarily the focus, though. The main focus is contrasting Ampere with the x86 ecosystem around overall price-performance, with highlights on power efficiency, scalability and ease of development.

Ultimately the market will decide whether Oracle’s approach makes it truly competitive with the big 3. The company continues to announce some big wins, including with Deutsche Bank, FedEx, NEC, Toyota, and Zoom. The latter is probably the company’s biggest cloud win given Zoom’s rise to prominence amidst the pandemic. Not surprisingly, Oracle’s recent Singapore cloud region launch was hosted by Zoom.

Conclusion

Over the long run, the webscale market is getting more concentrated in the hands of a few players; some companies tracked as webscalers, such as HPE and SAP, will fall by the wayside as they can’t keep up with the infrastructure spending requirements of being a top player. Oracle is aiming to remain in the race, however. CEO Larry Ellison addressed this in an earnings call, arguing the global cloud market is not just the “big 3” (AWS, Azure, and GCP), but is a “big 4” due in part to Oracle’s database strengths. Ellison also argued that the OCI is “much better for security, for performance, for reliability” and cost: “we’re cheaper.” The market will ultimately decide these things, but Oracle is off to a strong start. Its asset light approach to network buildout, and limited depth within regions, clearly have downfalls. But the company has a deep roster of long-term customers across many regions, and it is moving fast to secure their business as they migrate operations to the cloud.

Last week AWS announced their plans to invest USD 5.3 billion to launch new data centres in New Zealand’s Auckland region by 2024. Apart from New Zealand, AWS has recently added new regions in Beijing, Hong Kong, Mumbai, Ningxia, Seoul, Singapore, Sydney and Tokyo; and are set to expand into Indonesia, Israel, UAE and Spain.

In a bid to deliver secure and low latency data centre capabilities, the infrastructure hub will comprise three Availability Zones (AZ) and will be owned and operated by the local AWS entity in New Zealand. The new region will enable local businesses and government entities to run workloads and store data using their local data residency preferences.

It is estimated that the new cloud region will create nearly 1,000 jobs over the next 15 years. They will continue to train and upskill the local developers, students and next-gen leaders through the AWS re/Start, AWS Academy, and AWS Educate programs. To support the launch and build new businesses, the AWS Activate program will provide web-based trainings, cloud computing credits, and business mentorship.

New Zealand is becoming attractive to cloud and data centre providers. Last year, Microsoft had also announced their Azure data centre investments and skill development programs in New Zealand. To support the future of cloud services and to fulfil the progressive data centre demands, Datagrid and Meridian Energy partnered to build the country’s first hyperscale data centre, last year. Similarly, CDC Data Centres have plans to develop two new hyperscale data centres in Auckland.

An Opportunity for New Zealand to Punch Above its Weight as the New Data Economy Hub

“The flurry of data centre related activity in New Zealand is not just a reflection of the local opportunity given that the overall IT Market size of a sub-5 million population will always be modest, even if disproportionate. Trust, governance, transparency are hallmarks of the data centre business. Consider this – New Zealand ranks #1 on Ease of Doing Business rankings globally and #1 on the Corruptions Perception Index – not as a one-off but consistently over the years.

Layered on this is a highly innovative business environment, a cluster of high-quality data science skills and an immense appetite to overcome the tyranny of distance through a strong digital economy. New Zealand has the opportunity to become a Data Economy hub as geographic proximity will become less relevant in the new digital economy paradigm.

New Zealand is strategically located between Latin America and Asia, so could act as a data hub for both regions, leveraging undersea cables. The recently initiated and signed Digital Economy Partnership Agreement between Singapore and New Zealand – with Chile as the 3rd country – is a testimony to New Zealand’s ambitions to be at the core of a digital and data economy. The DEPA is a template other countries are likely to sign up to and should enhance New Zealand’s ability to be a trusted custodian of data.

Given the country’s excellent data governance practices, access to clean energy, conducive climate for data centres, plenty of land and an exceptional innovation mindset, this is an opportunity for global businesses to leverage New Zealand as a Data Economy hub.“

New Zealand’s Data Centre Market is Becoming Attractive

“The hyperscale cloud organisations investing in New Zealand-based data centres is both a great opportunity and a significant challenge for both local data centre providers and the local digital industry. With AWS and Microsoft making significant investments in the Auckland region the new facilities, will improve access to the extensive facilities provided by Azure and AWS with reduced latency.

To date, there have not been significant barriers for most non-government organisations to access any of the hyperscalers, with latency of trans-Tasman already reasonably low. However, large organisations, particularly government departments, concerned about data sovereignty are going to welcome this announcement.

With fibre to the premise available in significant parts of New Zealand, with cost-effective 1GB+ symmetrical services available, and hyperscalers on-shore, the pressure to grow New Zealand’s constrained skilled workforce can only increase. Skills development has to be a top priority for the country to take advantage of this infrastructure. While immigration can address part of the challenge, increasing the number of skilled citizens is really needed. It is good to see the commitment that AWS is making with the availability of training options. Now we need to encourage people to take advantage of these options!“

Top Cloud Providers Continue to Drive Data Centre Investment

“Capital investments in data centres have soared in recent quarters. For the webscale sector, spending on data centres and related network technology account for over 40% of total CapEx. The webscale sector’s big cloud providers have accounted for much of the recent CapEx surge. AWS, Google, and Microsoft have been building larger facilities, expanding existing campuses and clusters, and broadening their cloud region footprint into smaller markets. These three account for just under 60% of global webscale tech CapEx over the last four quarters. The facilities these webscale players are building can be immense.

The largest webscalers – Google, AWS, Facebook and Microsoft – clearly prefer to design and operate their own facilities. Each of them spends heavily on both external procurement and internal design for the technology that goes into their data centres. Custom silicon and the highest speed, most advanced optical interconnect solutions are key. As utility costs are a huge element of running a data centre, webscalers also seek out the lowest cost (and, increasingly, greenest) power solutions, often investing in new power sources directly. Webscalers aim to deploy facilities which are on the bleeding edge of technology.

An important part of the growth in cloud adoption is the construction of infrastructure closer to the end-user. AWS’s investment in New Zealand will benefit their positioning and should help deliver more responsive and resilient services to New Zealand’s enterprise market.“

The emergence of COVID-19 last year caused a rapid shift towards work and study from home, and a pickup in eCommerce and social media usage. Tech companies running large data centre-based “webscale” networks have eagerly exploited these changes. Already flush with cash, the webscalers invested aggressively in expanding their networks, in an effort to blanket the globe with rapid, responsive connectivity. Capital investments have soared. For the webscale sector, spending on data centres and related network technology accounts for over 40% of the total CapEx.

Here are the 3 key emerging trends in the data centre market:

#1 Top cloud providers drive webscale investment but are not alone

The webscale sector’s big cloud providers have accounted for much of the recent CapEx surge. AWS, Google, and Microsoft have been building larger facilities, expanding existing campuses and clusters, and broadening their cloud region footprint into smaller markets. These three account for just under 60% of global webscale tech CapEx over the last four quarters. Alibaba and Tencent have been reinforcing their footprints in China and expanding overseas, usually with partners. Numerous smaller cloud providers – notably Oracle and IBM – are also expanding their cloud services offerings and coverage.

Facebook and Apple, while they don’t provide cloud services, also continue to invest aggressively in networks to support large volumes of customer traffic. If we look at Facebook, the reason becomes clear: as of early 2021, they needed to support 65 billion WhatsApp messages per day, over 2 billion minutes of voice and video calls per day, and on a monthly basis their Messenger platform carries 81 billion messages.

The facilities these webscale players are building can be immense. For instance, Microsoft was scheduled to start construction this month on two new data centres in Des Moines Iowa, each of which costs over USD 1 billion and measures over 167 thousand square metres. And Microsoft is not alone in building these large facilities.

#2 Building it all alone is not an option for even the biggest players

The largest webscalers – Google, AWS, Facebook and Microsoft – clearly prefer to design and operate their own facilities. Each of them spends heavily on both external procurement and internal design for the technology that goes into their data centres. Custom silicon and the highest speed, most advanced optical interconnect solutions are key. As utility costs are a huge element of running a data centre, webscalers also seek out the lowest cost (and, increasingly, greenest) power solutions, often investing in new power sources directly. Webscalers aim to deploy facilities that are on the bleeding edge of technology. Nonetheless, in order to reach the far corners of the earth, they have to also rely on other providers’ network infrastructure. Most importantly, this means renting out space in data centres owned by carrier-neutral network operators (CNNOs) in which to install their gear.

The Big 4 webscalers do this as little as possible. For many smaller webscalers though, piggybacking on other networks is the norm. Of course, they want some of their own data centres – usually the largest ones closest to their main concentrations of customers and traffic generators. But leasing space – and functionalities like cloud on-ramps – in third-party facilities helps enormously with time to market.

Oracle is a case in point. They have expanded their cloud services business dramatically in the last few years and attracted some marquee names to their client list, including Zoom, FedEx and Cisco. To ramp up, Oracle reported a rise in CapEx, growing to USD 2.1 billion in the 12 months ended June 2021, which represents a 31% increase from the previous year. However, when compared to Microsoft’s spending this appears modest. Microsoft reported having spent USD 20.6 billion in the 12 months ended June 2021 – a 33% increase over the previous year – to help drive the growth of their Azure cloud service.

One reason behind Oracle’s more modest spending is how heavily the company has relied on colocation partners for their cloud buildouts. Oracle partners with Equinix, Digital Realty, and other providers of neutral data centre space to speed their cloud time to market. Oracle rents space in 29 Digital Realty locations, for instance, and while Equinix doesn’t quantify its partnership with Oracle, Oracle’s cloud regions across the globe access the Oracle Cloud Infrastructure (OCI) via the Equinix Cloud Exchange Fabric. Oracle also works with telecom providers; their Dubai cloud region, launched in October 2020, is hosted out of an Etisalat owned data centre.

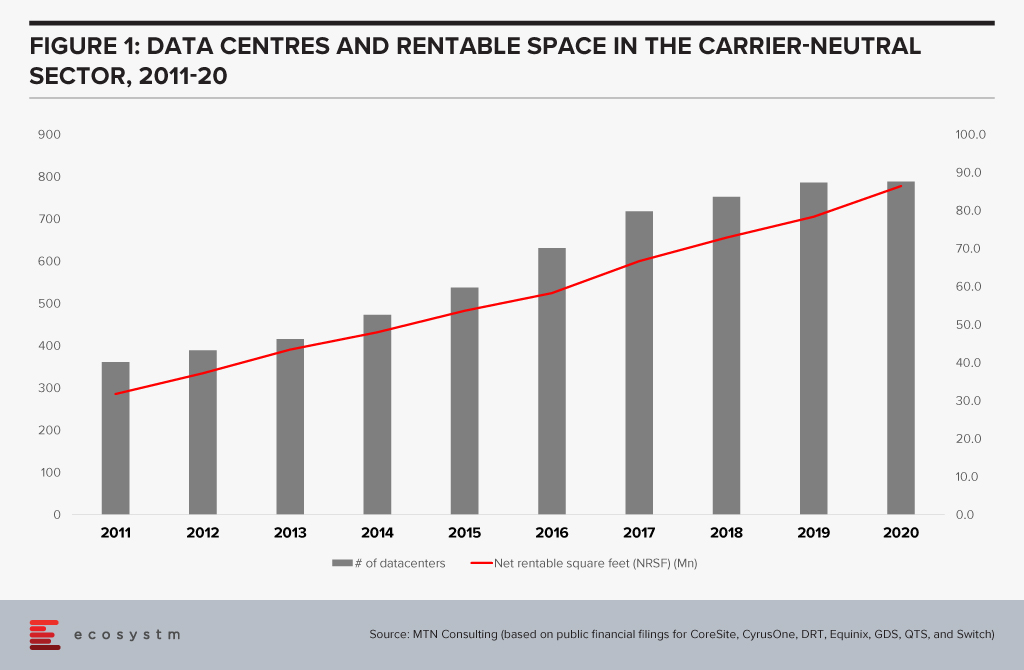

#3 Carrier-neutral data centre investment is surging in concert with webscale/cloud growth

As the webscale sector has raced to expand over the last 2 years, companies that specialise in carrier-neutral data centres have benefited. Industry sources estimate that as much as 50% or more of the cloud sector’s total data centre footprint is actually in these third-party data centres. That is unlikely to change, especially as some CNNOs are explicitly aiming to build out their networks in areas where webscalers have less incentive to devote resources. It’s not just about the webscalers’ need for space; the need for highly responsive, low latency networks is also key, and interconnection closer to the end-user is a driver.

Looking at the biggest publicly traded carrier-neutral providers in the data centre sector shows that their capacity has expanded significantly in the last few years (Figure 1)

By my estimation, for the first 6 months of 2021, CapEx reported publicly for these CNNOs increased 18% against 1H20, to an estimated USD 4.1 Billion. Beyond the big public names, private equity investment is blossoming in the data centre market, in part aimed at capturing some of the demand growth generated by webscalers. Examples include Blackstone’s acquisition of QTS Realty Trust, Goldman Sachs setting up a data centre-focused venture called Global Compute Infrastructure; and Macquarie Capital’s strategic partnership with Prime Data Centers.

Some of this new investment target core facilities in the usual high-traffic clusters, but some also target smaller country markets (e.g. STT’s new Bangkok-based data centre), and the network edge (e.g. EdgeConneX, a portfolio company of private equity fund EQT Infrastructure).

EdgeConneX is a good example of the flexibility required by the market. They build smaller size facilities and deploy infrastructure closer to the edge of the network, including a PoP in Boston’s Prudential Tower. The company offers data centre solutions “ranging from 40kW to 40MW or more.” They have built over 40 data centres in recent years, including both edge data centres and a number of regional and hyperscale facilities across North America, Europe, and South America. Notably, EdgeConneX recently created a joint venture with India’s property group Adani – AdaniConneX – which looks to leverage India’s status of being the current hotspot for carrier-neutral data centre investment.

As enterprises across many vertical markets continue to adopt cloud services, and their requirements grow more stringent, the investment climate for new data centre capacity is likely to remain strong. Webscale providers will provide much of this capacity, but carrier-neutral specialists have an important role to play.

“Cloud is universal – everything is going to be on the cloud soon! If you are not moving to the cloud, you are going extinct! AWS, Microsoft and Google are going to rule the world!” This has been the hyped narrative for some time now. But watch out New World – the Old World is fighting back!

Traditional vendors like HP Enterprise, Cisco, and Oracle are all deploying strategies to remain relevant in the new world. For these vendors – especially for HPE and Cisco that come from a predominantly hardware background – the future is hybrid. They picture a world in which the data centre – either on-prem or in a co-located facility – thrives on, in tandem with the cloud. This is a reasonably good bet. For most large enterprises with a huge repository of applications and data sitting in the data centre, migrating everything to the cloud is a nightmare – fraught with risk and very expensive.

Ecosystm research shows that 32% of organisations have deployed containerisation – and this percentage will only grow. The ability for firms to toggle between data centre bare metal based applications and completely on-the-cloud ones is becoming more manageable by the day. This enormous flexibility allows a firm that has large compute needs to keep some stable workloads in a data centre, whether on-prem or co-located, while simultaneously using cloud-based workloads, optimising spends and performance.

Here is a glimpse into the strategies of three key vendors.

HPE’s ‘as-a-service’ Messaging is Spot on

Two years ago, Antonio Neri boldly went where no HPE CEO had gone before, promising that HPE’s entire portfolio would be available ‘as-a-service’ within 3 years. At the recently concluded HPE Discover event, there were a flurry of announcements to showcase that GreenLake is indeed on its way to meet that ambitious goal in 2022.

HPE’s recent announcements show customers that GreenLake is an end-to-end solution for managing their IT infrastructure moving forward. It ticks all the boxes: providing flexibility and scalability; the advantage of using both data centre and cloud; and high manageability and security with a full suite of applications.

Examples are the partnership with Azure Stack HCI, to add to earlier ones with leading vendors like SAP, Citrix, and VMware. HPE is building a platform that provides customers with the comfort that they can adopt GreenLake and pretty much have access to any application they may choose to implement – offering full coverage from the Edge to the Cloud. It is extremely interesting that GreenLake allows the option of switching on and switching off processor cores as needed, and the customer pays based on usage. This is surely a first for the industry!

Another example is Lighthouse, which allows the customer to rapidly configure, and provision workloads based on dynamic needs. While all the hyperscalers provide similar services when the workload is on the cloud, Lighthouse allows the same flexibility and speed for cloud services which can be run in the data centre, on-prem, co-located, or even at the Edge.

A third example was the announcement of Project Aurora which will add an additional security layer from validating the input data all the way to verifying the workload at the start and then as it is running. It appears to use an AI/ML system that checks for unexpected behaviours to detect any kind of malware.

It makes good sense for HPE to push GreenLake and move to offering ‘everything-as-a-service’. As one of the incumbent enterprise hardware business leaders, this is a good response rather than to watch one’s business continue to shrink YoY. GreenLake is HPE’s way of futureproofing themselves and making sure they stay relevant in the new cloud world.

Cisco Secures the Hybrid Workplace

Cisco has been active launching Cisco Plus earlier this year, as their bridge to the as-a-service model with a network-as-a-service (NaaS) offering. Somewhat like GreenLake, Cisco Plus offers flexible consumption for compute, storage, and networking. They are committed to offering most of their portfolio as-a-service over time.

Cisco has shown some resilience in terms of revenue but has still been struggling to grow. After a steady growth since 2017, the revenues dropped by 7% in 2020 almost as a direct impact of COVID-19. The post-pandemic world has the potential of being a bigger threat for Cisco. Many estimates show the number of people working from home is likely to go up dramatically and Cisco’s key networking offering could rapidly become redundant. However, at Ecosystm we believe that the hybrid work model will be predominant.

Cisco is also betting on a hybrid world. No matter where one works from, there are networking needs. Cisco’s focus, therefore, is on security – this will be on the mind of virtually any enterprise as it chalks out its future strategy. With a hybrid environment, making everything secure becomes more complex while continuing to be vital. Cisco has a heavy emphasis on Secure Access Service Edge (SASE) – the idea that the security envelope now has to be a flexible form that has a presence everywhere that the enterprise needs to be. This will make a lot of sense to most enterprises as they tread the hybrid path.

Cisco will offer a portfolio of tools to make it increasingly easier for customers to use multi-cloud, multi-vendor environments, offering the best of both worlds.

Oracle Incentivises Cloud Migration

Oracle has a different approach because they are trying to solve a different problem. They are competing with the hyperscalers, while fully acknowledging a hybrid world. However, as a company with less legacy in hardware, it makes sense for them to focus on migrating to cloud rather than on hybridisation. Oracle has just announced that they will subsidise existing customers who add cloud workloads with them, by providing discounts on the existing licensing fees that the customer is paying Oracle. This discount appears to be around 25% to 33%. In essence, this means that if a customer spends about USD 100k with Oracle on licensing and decides to start moving workloads to the Oracle Cloud worth somewhere between USD 300-400k, they can potentially write off the entire license fees they are currently paying!

Conclusion

There is a strong effort from every vendor right now to retain and consolidate their customer share and build a vision that convinces the customer that they are the way to go. For the traditional hardware players that vision is of a hybrid world – attractive to today’s large enterprise. For the likes of AWS, Microsoft, Google, and Oracle it is all about moving the customer to their cloud. The assumption of course is that moving someone to your cloud will lead to more of your apps being used by the customer. For the hardware vendors like Cisco and HPE, it is all about moving the customer to their own platforms which empower hybridisation. In all cases, a necessary component is to offer ‘everything-as-a-service’ upending the traditional models of selling.

In my opinion, with time the IaaS portion of the cloud is likely to gradually devolve into something like a utility. There will be a lot of upheavals and market disruption before we get there, but eventually, software and other services are likely to stand separate from the infrastructure provider. All the vendors are therefore depending on capturing the customer at the platform-as-a-service (PaaS) level, but even this is likely to get commoditised over time. Eventually, the winners will be disparate providers of the best applications for different functions. Meanwhile, we are in for an extremely interesting ride as we see all the vendors jockeying for space!

BHP – the multinational mining giant – has signed agreements with AWS and Microsoft Azure as their long-term cloud providers to support their digital transformation journey. This move is expected to accelerate BHP’s cloud journey, helping them deploy and scale their digital operations to the workforce quickly while reducing the need for on-premises infrastructure.

Ecosystm research has consistently shown that many large organisations are using the learnings from how the COVID-19 pandemic impacted their business to re-evaluate their Digital Transformation strategy – leveraging next generation cloud, machine learning and data analytics capabilities.

BHP’s Dual Cloud Strategy

BHP is set to use AWS’s analytics, machine learning, storage and compute platform to deploy digital services and improve operational performance. They will also launch an AWS Cloud Academy Program to train and upskill their employees on AWS cloud skills – joining other Australian companies supporting their digital workforce by forming cloud guilds such as National Australia Bank, Telstra and Kmart Group.

Meanwhile, BHP will use Microsoft’s Azure cloud platform to host their global applications portfolio including SAP S/4 HANA environment. This is expected to enable BHP to reduce their reliance on regional data centres and leverage Microsoft’s cloud environment, licenses and SAP applications. The deal extends their existing relationship with Microsoft where BHP is using Office 365, Dynamics 365 and HoloLens 2 platforms to support their productivity and remote operations.

Ecosystm principal Advisor, Alan Hesketh says, “This dual sourcing is likely to achieve cost benefits for BHP from a competitive negotiation stand-point, and positions BHP well to negotiate further improvements in the future. With their scale, BHP has negotiating power that most cloud service customers cannot achieve – although an effective competitive process is likely to offer tech buyers some improvements in pricing.”

Can this Strategy Work for You?

Hesketh thinks that the split between Microsoft for Operations and AWS for Analytics will provide some interesting challenges for BHP. “It is likely that high volumes of data will need to be moved between the two platforms, particularly from Operations to Analytics and AI. The trend is to run time-critical analytics directly from the operational systems using the power of in-memory databases and the scalable cloud platform.”

“As BHP states, using the cloud reduces the need to put hardware on-premises, and allows the faster deployment of digital innovations from these cloud platforms. While achieving technical and cost improvements in their Operations and Analytics domains, it may compromise the user experience (UX). The UX delivered by the two clouds is quite different – so delivering an integrated experience is likely to require an additional layer that is capable of delivering a consistent UX. BHP already has a strong network infrastructure in place, so they are likely to achieve this within their existing platforms. If there is a need to build this UX layer, it is likely to reduce the speed of deployment that BHP is targeting with the dual cloud procurement approach.”

Many businesses that have previously preferred a single cloud vendor will find that they will increasingly evaluate multiple cloud environments, in the future. The adoption of modern development environments and architectures such as containers, microservices, open-source, and DevOps will help them run their applications and processes on the most suitable cloud option.

While this strategy may well work for BHP, Hesketh adds, “Tech buyers considering a hybrid approach to cloud deployment need to have robust enterprise and technology architectures in place to make sure the users get the experience they need to support their roles.”

Last week Microsoft announced the acquisition of Nuance for an estimated USD 19.7 billion. This is Microsoft’s second largest acquisition ever, after they acquired LinkedIn in 2016. Nuance is an established name in the Healthcare industry and is said to have a presence in 10,000 healthcare organisations globally. Apart from Healthcare, Nuance has strong capabilities in Conversational AI and speech solutions to support other industries. This acquisition is in line with Microsoft’s go-to-market roadmap and strategies.

Microsoft’s Healthcare Focus

Microsoft announced their Healthcare Cloud last year and this acquisition will bolster their Healthcare offerings and market presence. Nuance’s product portfolio includes clinical speech recognition SaaS offerings – Dragon Ambient eXperience, Dragon Medical One and PowerScribe One for radiology reporting – on Microsoft Azure. The acquisition builds on already existing integrations and partnerships that were in place over the years.

“Microsoft Cloud for Healthcare offers its solution capabilities to healthcare providers using a ‘modular’ approach. Given how diverse healthcare providers are in their technology maturity and appetite for change, the more diverse the ‘modules’, the greater the opportunities for Microsoft. This partnership with Nuance also brings to the table established relationships with EHR vendors, which will be useful for Microsoft globally.

The Healthcare industry continues to struggle as the world negotiates the challenges of mass vaccination. But on the upside, the ongoing Healthcare crisis has given remote care a much-needed shot in the arm. Clinicians today will be more open to documentation and transcription services for process automation and compliance. The acquisition of Nuance’s Healthcare capabilities will definitely boost Microsoft’s market presence in provider organisations.

However, Healthcare is not the only industry that Microsoft and Nuance are focused on. The Microsoft Cloud for Retail that was launched earlier this year aims to offer integrated and intelligent capabilities to retailers and brands to improve their end-to-end customer journey. Nuance has omnichannel customer engagement solutions that can be leveraged in Retail and other industries. As Microsoft continues to verticalise their offerings, they will consider more acquisitions that will complement their value proposition.“

Microsoft’s Focus on Conversational AI

Microsoft already has several speech recognition offerings, speech to text services, and chatbots; and they continue to invest in the Conversational AI space. They have created an open-source template for creating virtual assistants to help Bot Framework developers. In February, Microsoft announced their industry specific cloud offerings for Financial services, Manufacturing, and Non-Profit, and also introduced a series of AI and natural language features in Microsoft Outlook, Microsoft Teams, Microsoft Office Lens and Microsoft Office mobile to deliver interactive, voice forward assistive experiences.

“There is no slowing down in this space and the acquisition clearly demonstrates the vision that Microsoft is building with Nuance – a vendor that has made speech recognition, text to speech, conversational AI the foundation of the company. This is a brilliant move by Microsoft in the Conversational AI space and a win-win for both companies.

This move could also mark further inroads for Microsoft into the contact centre space. With Teams now being integrated into contact centre technologies, working with large customers using speech and conversational AI, Dynamics 365 could herald the start of more acquisitions for Microsoft to bolster a wider customer engagement vision.

The Conversational AI war is heating up and various other cloud vendors such as Google and AWS are starting to get aggressive and have made investments in recent years to enhance their Conversational AI capabilities. Google Dialogflow has been seeing rapid uptake and they now have deep partnerships with Genesys, Avaya, Cisco and other contact centre players. Microsoft coming into the game and acquiring a company with years of history and IP in the speech space, demonstrates how the cloud battle and the war between Google, Microsoft and AWS is heating up in the Conversational AI. All of a sudden you have Microsoft as a powerhouse in this game.”

Microsoft introduced a second Vertical Cloud offering, last week – this time turning the focus on Retail, after having launched Microsoft Cloud for Healthcare in October 2020.

The Microsoft Cloud for Retail aims to offer integrated and intelligent capabilities to retailers and brands to improve their end-to-end customer journey. It brings industry-specific capabilities to the Microsoft suite including Microsoft Azure, Microsoft Power Platform, Microsoft 365, and Microsoft Dynamics 365 – and is aimed at the growing need for “intelligent retail’. Microsoft’s partner ecosystem will also be involved in the new platform to address challenges in the sector and future proof the retail evolution.

In The Top 5 Retail & eCommerce Trends for 2021, Ecosystm notes that while retailers will focus on the shift in customer expectations, a mere focus on customer experience will not be enough this year. From the customer experience angle, they will strongly focus on omnichannel, catering to ‘glocal’ consumption, using location-based services, and improving both their onsite and online customer experience. They will also have to work on their supply chain and pricing capabilities, as distribution woes continue. These trends are seeing a deeper need for transformational technologies and leading cloud providers are introducing solutions targeted at the industry. Google has introduced its cloud retail solutions aiming to help retailers get more from data. Similarly, AWS has cloud offerings for the retail industry leveraging its retail domain experience and cloud deployment services.

Ecosystm Comments

“Global cloud vendors continue to “move up the stack” to provide more of the technology landscape for organisations. The focus of these tech giants is on adding unique value to customers by tailoring the combination of the different cloud services they can provide to specific industries. Providing the full-stack will mean higher customer retention rates – as the implementation time should be lower than traditional on-premises implementations. Microsoft has a diverse range of capabilities. Having a software company and implementation partner that can deliver the full stack of technology and business processes should improve the time to value for organisations.

But I see three key difficulties in implementing systems such as these:

- People adapting effectively to use the new processes

- Migrating enough high-quality data to leverage the new capabilities

- Integrating the new capabilities into an organisation’s existing landscape.

This is why it is likely that initial use will come from Microsoft’s existing Retail customers as they expand the range of services they use. New adopters of these Microsoft solutions will find that much of the complexity and cost of implementing a new business solution will remain.

However, these value-added cloud services open access to smaller organisations. If Microsoft is able to work with their partners to simplify the implementation of these capabilities, it will allow smaller organisations to access these complex capabilities affordably.“

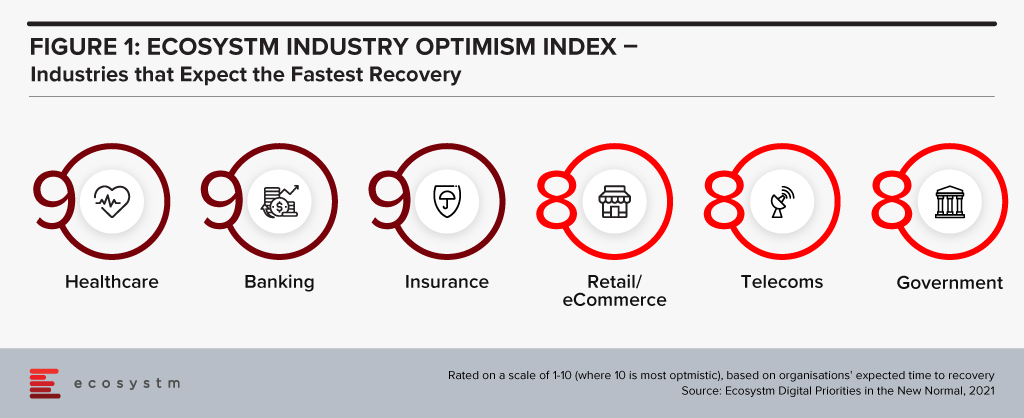

“The Ecosystm Digital Priorities in the New Normal Study aims to determine how optimistic industries are about successfully negotiating these uncertain times (Figure 1). The industries that are rated the most optimistic fall into two clear categories. In the first category, there are industries, such as Healthcare that had to transform urgently – mostly in an unplanned manner. This has led to a greater appetite for change and optimism in these industries. Then there are industries, such as Retail, that had some time to re-focus their technology roadmap when the crisis hit. These industries have a strong customer focus and had started their digital journeys before the pandemic.

Microsoft’s industry focus appears to be spot-on. Their first two vertical clouds target enterprises that have had to – and will continue to – pivot. The ‘modular’ approach taken in the Microsoft Cloud for Healthcare offering allows providers to choose the right capability for their organisation – whether it is workflow automation, patient engagement through virtual health, collaboration within care teams or better clinical and operational insights. As healthcare organisations across the world negotiate the challenges of mass vaccination, they may well find themselves leveraging these industry-specific capabilities as they revamp their workflows, processes, and data use.”

Get to know the right research, insights and technologies for you to be one step ahead in this new world of retail in our top 5 retail trends for 2021 that represent the most significant shifts in 2021

SAS announced that it has acquired Boemska, a provider of low-code development tools and analytics workload management software. The small, privately held company is UK-based with an R&D centre in Serbia. The acquisition will be integrated into SAS Viya, its cloud-native platform, which includes containerised analytics and machine learning offerings. Terms of the deal have not been disclosed.

A SAS silver partner, Boemska has wins in Health, Finance, and Travel. Most of its reference clients are based in Europe in addition to a small number in the US and South Africa. Boemska has two primary software offerings – Enterprise Session Monitor (ESM) and AppFactory. Additionally, it delivers cloud migration, performance diagnostics, and application development services.

Boemska Capabilities

Boemska ESM provides visibility into performance and cost management of analytics workloads. The product enables self-service root cause analysis for developers, monitoring and batch schedule optimisation for administrators, and departmental cost allocation of cloud resources. ESM manages SAS, R, and Python workloads and is compatible with workload management platforms from the likes of IBM and BMC. Boemska shipped an updated version of ESM in 2020 to improve the UI and ensure support for SAS Viya. At the time, it announced that its development team had doubled in the preceding 12 months, suggesting a trajectory of growth.

AppFactory is a low-code development platform for data scientists and data engineers using SAS, which generates JavaScript for front-end developers along with data transport, authentication, and exception handling. SAS emphasises the portability of apps that can be created and run on mobile and IoT devices. Examples provided include machine learning and event alerts in healthcare wearables, video-based defect identification in Manufacturing, and drone-based asset monitoring in Utilities. Boemska states that its low-code offering seeks to bridge the “last mile of analytics” by putting insights into the hands of decision-makers.

SAS Focuses on Cloud-Native Analytics and AI

SAS launched Viya 4.0 in mid-2020, a major step in its vision to become a provider of cloud-native analytics and machine learning solutions. The platform includes offerings, such as Visual Analytics, Visual Statistics, Visual Machine Learning, and Visual Data Science packaged in containers and orchestrated by Kubernetes. Microsoft Azure has become its preferred cloud partner, assisting in developing SAS Cloud, hosted from data centres in the US, Brazil, Australia, and newly launched facilities in Germany and the UK. Viya managed services are also available from Azure regions. AWS and Google Cloud are expected to make the leap to Viya 4.0 from version 3.5 soon. As part of its cloud-native strategy, SAS now offers three tiers for software updates – bi-annual, monthly, or immediately after release.

Ecosystm Comment

The major overhaul of SAS Viya is part of the vendor’s USD 1B investment into AI over three years from 2019-2021. The platform includes a heavy emphasis on NLP, machine learning, and computer vision. The integration of Boemska’s low-code development offering into Viya will allow SAS clients to extract greater value from AI by quickly embedding it in mobile and enterprise applications. The converging trends of citizen developers and data literacy suggest SAS has selected the right path for the future.

Download Ecosystm Predicts: The Top 5 AI & Automation Trends for 2021

Download Ecosystm’s complimentary report detailing the top 5 AI trends in 2021 and what innovations they bring to the table that IT leaders should monitor. Create your free account to access all the Ecosystm Predictions for 2021, and many other reports, on the Ecosystm platform

Nutanix has emerged as a leading hyper converged infrastructure (HCI) provider and is partnering with public cloud infrastructure providers to bring greater value to its customers. Last week saw the partnership between Microsoft and Nutanix, aimed to evolve the hybrid offerings of both providers. As part of this collaboration, both companies will focus on extending Nutanix hybrid cloud infrastructure to Azure. The collaboration will include the development of Nutanix-ready nodes on Azure to support Nutanix Clusters and services. The benefits expected include improved cost, security, and efficiency. Clients will also be able to deploy Azure instances from Nutanix interface for a consistent experience across their cloud environment. The solution is aimed to eliminate re-tooling, re-architecting processes and other technical challenges of maintaining a hybrid environment.

Ecosystm Principal Advisor, Darian Bird says, “The announcement of Nutanix Clusters on Azure is another piece of the hybrid puzzle that will allow Nutanix clients to extend their private cloud environments into public infrastructure. Organisations want the control associated with a private cloud but with the flexibility to scale up and down in the public cloud. Key to hybrid cloud is an additional layer that enables applications to be shifted from one cloud to another, either to prevent lock-in or to choose the best environment depending on the circumstances.”

The deal will also broaden the sales and support experience for Microsoft and Nutanix. “Nutanix has emphasised licence portability as a key characteristic of its hybrid cloud strategy. Microsoft clients will be able to use Azure credits to pay for Nutanix software, while those already with Nutanix licences will be able to port those over to Clusters on Azure. Simplified cloud procurement will be critical for IT departments looking to optimise cloud expenditure across multiple providers.”

Bird adds, “Organisations will now be able to manage servers, containers, and data services on Nutanix HCI, on prem or in the cloud through a single control pane with Azure Arc. Microsoft has realised that producing a true hybrid cloud system requires it to manage as many types of infrastructure as possible, whether they come from niche partners or major competitors. IT departments want the choice of supplier without adding complexity to their systems.”

Nutanix Strengthening its Partner Ecosystem

“The partnership with Microsoft Azure comes only a month after Nutanix announced the general availability of Clusters on AWS. Considering Nutanix’s close connection to Google, it seems likely that it will also launch on the search giant’s cloud before long,” says Bird.

Last year, Nutanix partnered with HPE for the general availability of HPE’s integrated hybrid cloud as a service offering, HPE GreenLake for Nutanix, and the HPE ProLiant DX solution.

Earlier in the month, Nutanix launched its global partner multi-cloud program – Elevate – to bring Nutanix’s global partner ecosystem under one integrated architecture managed through consistent tools, resources and platforms, to accelerate their clients’ multi-product, multicloud roadmap in their transformation journeys.

“Nutanix has made great strides in its shift from hardware vendor to HCI provider and it’s now focused on delivering tools that enable the shift to cloud. These recent moves will help Nutanix catch up to VMware and become a viable alternative in a hybrid cloud environment,” says Bird.