Last week Microsoft announced the acquisition of Nuance for an estimated USD 19.7 billion. This is Microsoft’s second largest acquisition ever, after they acquired LinkedIn in 2016. Nuance is an established name in the Healthcare industry and is said to have a presence in 10,000 healthcare organisations globally. Apart from Healthcare, Nuance has strong capabilities in Conversational AI and speech solutions to support other industries. This acquisition is in line with Microsoft’s go-to-market roadmap and strategies.

Microsoft’s Healthcare Focus

Microsoft announced their Healthcare Cloud last year and this acquisition will bolster their Healthcare offerings and market presence. Nuance’s product portfolio includes clinical speech recognition SaaS offerings – Dragon Ambient eXperience, Dragon Medical One and PowerScribe One for radiology reporting – on Microsoft Azure. The acquisition builds on already existing integrations and partnerships that were in place over the years.

“Microsoft Cloud for Healthcare offers its solution capabilities to healthcare providers using a ‘modular’ approach. Given how diverse healthcare providers are in their technology maturity and appetite for change, the more diverse the ‘modules’, the greater the opportunities for Microsoft. This partnership with Nuance also brings to the table established relationships with EHR vendors, which will be useful for Microsoft globally.

The Healthcare industry continues to struggle as the world negotiates the challenges of mass vaccination. But on the upside, the ongoing Healthcare crisis has given remote care a much-needed shot in the arm. Clinicians today will be more open to documentation and transcription services for process automation and compliance. The acquisition of Nuance’s Healthcare capabilities will definitely boost Microsoft’s market presence in provider organisations.

However, Healthcare is not the only industry that Microsoft and Nuance are focused on. The Microsoft Cloud for Retail that was launched earlier this year aims to offer integrated and intelligent capabilities to retailers and brands to improve their end-to-end customer journey. Nuance has omnichannel customer engagement solutions that can be leveraged in Retail and other industries. As Microsoft continues to verticalise their offerings, they will consider more acquisitions that will complement their value proposition.“

Microsoft’s Focus on Conversational AI

Microsoft already has several speech recognition offerings, speech to text services, and chatbots; and they continue to invest in the Conversational AI space. They have created an open-source template for creating virtual assistants to help Bot Framework developers. In February, Microsoft announced their industry specific cloud offerings for Financial services, Manufacturing, and Non-Profit, and also introduced a series of AI and natural language features in Microsoft Outlook, Microsoft Teams, Microsoft Office Lens and Microsoft Office mobile to deliver interactive, voice forward assistive experiences.

“There is no slowing down in this space and the acquisition clearly demonstrates the vision that Microsoft is building with Nuance – a vendor that has made speech recognition, text to speech, conversational AI the foundation of the company. This is a brilliant move by Microsoft in the Conversational AI space and a win-win for both companies.

This move could also mark further inroads for Microsoft into the contact centre space. With Teams now being integrated into contact centre technologies, working with large customers using speech and conversational AI, Dynamics 365 could herald the start of more acquisitions for Microsoft to bolster a wider customer engagement vision.

The Conversational AI war is heating up and various other cloud vendors such as Google and AWS are starting to get aggressive and have made investments in recent years to enhance their Conversational AI capabilities. Google Dialogflow has been seeing rapid uptake and they now have deep partnerships with Genesys, Avaya, Cisco and other contact centre players. Microsoft coming into the game and acquiring a company with years of history and IP in the speech space, demonstrates how the cloud battle and the war between Google, Microsoft and AWS is heating up in the Conversational AI. All of a sudden you have Microsoft as a powerhouse in this game.”

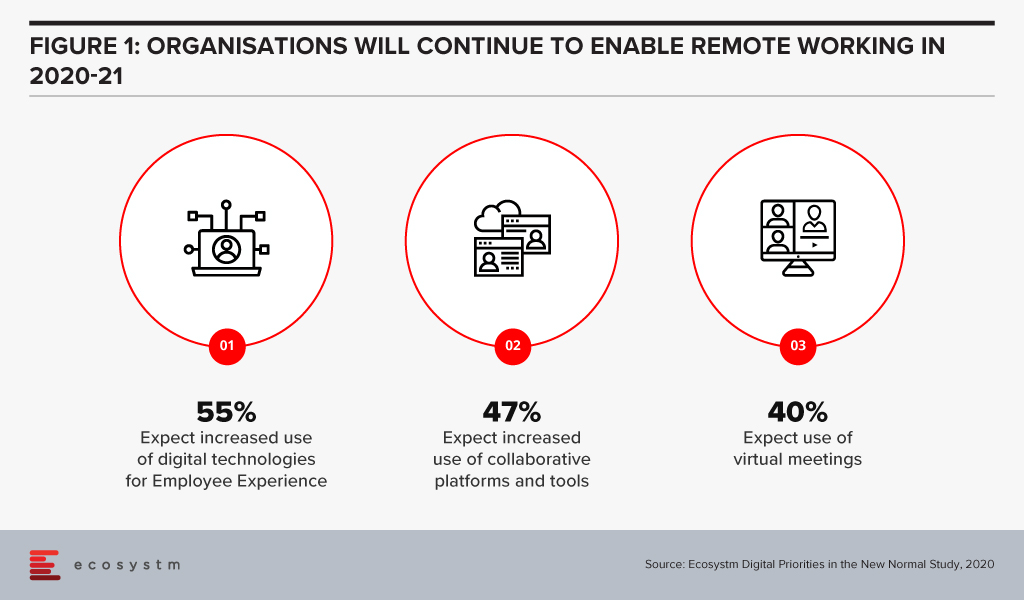

The Future of Work is here, now. Organisations were faced with unprecedented challenges of coping with the work-from-home model, when COVID-19 hit earlier this year. Many organisations managed the pivot very successfully, but all organisations were impacted in some way. Various trends have emerged over the last few months, that are likely to persist long after the immediate COVID-19 measures are removed by countries. In the Ecosystm Digital Priorities in the New Normal study, we find that organisations will continue to cater for remote employees (Figure 1) and keep a firm eye on employee experience (EX).

August has seen these clear trends in the Future of Work

#1 Tech companies leading from the front in embracing the Future of Work

As the pandemic continued to spread across the globe, various companies adopted the work from home model at a scale never seen before. While it is still unclear how the work model will look like, many companies continue to extend their remote working policies for the remaining year, and some are even thinking of making it a permanent move.

Tech companies appear to be the most proactive in extending remote working. Google, Microsoft, and AWS have all extended their work from home model till the end of the year or till the middle of next year. Earlier in the month Facebook extended its work from home program until mid-2021 and are also giving employees USD 1,000 to equip their home offices. This appears to be a long-term policy, with the company announcing in May that in the next 5-10 years, they expect 50% of their employees to be remote. Similarly, Salesforce and Uber also announced that they would be extending remote working till the mid-next year, and are providing funding for employees to set up the right work environment.

In Australia, Atlassian has made work from home a permanent option for their employees. They will continue to operate their physical offices but have given employees the option to choose where they want to work from.

Some organisations have gone beyond announcing these measures. Slack has talked about how they are evolving their corporate culture. For example, they have evolved their hiring policies and most new roles are open to remote candidates. Going forward, they are evaluating a more asynchronous work environment where employees can work the hours that make sense for them. In their communique, they are open about the fluid nature of the work environment and the challenges that employees and organisations might face as their shift their work models.

Organisations will have to evaluate multiple factors before coming up with the right model that suits their corporate culture and nature of work, but it appears that tech companies are showing the industry how it can be done.

#2 Tech companies evolve their capabilities to enable the Future of Work

Right from the start of the crisis, we have seen organisations make technology-led pivots. Technology providers are responding – and fast – to the changing environment and are evolving their capabilities to help their customers embrace the digital Future of Work.

Many of these responses have included strengthening their ecosystems and collaborating with other technology providers. Wipro and Intel announced a collaboration between Wipro’s LIVE Workspace digital workspace solution and the Intel vPro platform to enable remote IT support and solution. The solution provides enhanced protection and security against firmware-level attacks. Slack and Atlassian strengthened their alliance with app integrations and an account ‘passport’ in a joint go-to-market move, to reduce the time spent logging into separate services and products. This will enable both vendors to focus on their strengths in remote working tools and provide seamless services to their customers.

Tech companies have also announced product enhancements and new capabilities. CBTS has evolved their cloud-based unified communications, collaboration and networking solutions, with an AI-powered Secure Remote Collaboration solution, powered by Cisco Webex. With seamless integration of Cisco Webex software, Cisco Security software, and endpoints that combine high-definition cameras, microphones, and speakers, with automatic noise reduction, the solution now offers features such real-time transcription, closed captioning, and recording for post-meeting transcripts.

Communication and Collaboration tools have been in the limelight since the start of the crisis with providers such as Zoom, Microsoft Teams and Slack introducing new features throughout. In August Microsoft enhanced the capabilities of Teams and introduced a range of new features to the Teams Business Communications System. It now offers the option to host calls of up to 20,000 participants with a limit to 1,000 for interactive meetings, after which the call automatically shifts to a “view only” mode. With the possibility of remote working becoming a reality even after the crisis is over, Microsoft is looking to make Teams relevant for a range of meeting needs – from one-on-one meetings up to large events and conferences. In the near future, the solution will also allow organisations to add corporate branding, starting with branded meeting lobbies, followed by branded meeting experiences.

While many of these solutions are aimed at large enterprises, tech providers are also aware that they are now receiving a lot of business from small and medium enterprises (SMEs), struggling to make changes to their technology environment with limited resources. Juniper has expanded their WiFi 6 access points to include 4 new access points aimed at outdoor environments, SMEs, retail sites, K-12 schools, medical clinics and even the individual remote worker. While WiFi 6 is designed for high-density public or private environments, it is also designed for IoT deployments and in workplaces that use videoconferencing and other applications that require high bandwidth.

#3 The Future of Work is driving up hardware sales

Ecosystm research shows that at the start of the crisis, 76% of organisations increased investments in hardware – including PCs, devices, headsets, and conferencing units – and 67% of organisations expect their hardware spending to go up in 2020-21. Remote working remains a reality across enterprises. Despite the huge increase in demand, it became difficult for hardware providers to fulfil orders initially, with a disrupted supply chain, store closures and a rapid shift to eCommerce channels. This quarter has seen a steady rise in hardware sales, as providers overcome some of their initial challenges.

Apart from enterprise sales, there has been a surge in the consumer demand for PCs and devices. While remote working is a key contributor, online education and entertainment are mostly prompting homebound people to invest more in hardware. Even accessories such as joysticks are in short supply – a trend that seems to have been accelerated by the Microsoft Flight Simulator launch earlier this month.

The demand for both iPad and Mac saw double-digit growth in this quarter. Around half of the customers purchasing these devices were new to the product. Apple sees the rise in demand from remote workers and students. Lenovo reported a 31% increase in Q1 net profits with demand surges in China, Europe, the Middle East and Africa.

#4 The impact on Real Estate is beginning to show

The demand for prime real estate has been hit by remote working and organisations not renewing leases or downsizing – both because most employees are working remotely and because of operational cost optimisation during the crisis. This is going to have a longer-term impact on the market, as organisations re-evaluate their need for physical office space. Some organisations will reduce office space, and many will re-design their offices to cater to virtual interactions (Figure 1). While now, Ecosystm research shows that only 16% of enterprises are expecting a reduction of commercial space, this might well change over the months to come. Organisations might even feel the need to have multiple offices in suburbs to make it convenient for their hybrid workers to commute to work on the days they have to. Amazon is offering employees additional choices for smaller offices outside the city of Seattle.

But the Future of Work and the rise of a distributed workforce is beginning to show an initial impact on the real estate industry. Last week saw Pinterest cancel a large office lease at a building to be constructed near its headquarters in San Francisco. The company felt that it might not be the right time to go ahead with the deal, as they are re-evaluating where employees would like to work from in the future. Even the termination fees of USD 89.5 million did not discourage them. They will continue to maintain their existing work premises but do not see feel that it is the right time to make additional real estate investments, as they re-evaluate where employees would like to work from in the future.

There is a need for organisations to prepare themselves for the Future of Work – now! Ecosystm has launched a new 360o Future of Work practice, leveraging real-time market data from our platform combined with insights from our industry practitioners and experienced analysts, to guide organisations as they shift and define their new workplace strategies.

As organisations aim to maintain operations during the ongoing crisis, there has been an exponential increase in employees working from home and relying on the Workplace of the Future technologies. 41% of organisations in an ongoing Ecosystm study on the Digital Priorities in the New Normal cited making remote working possible as a key organisational measure introduced to combat current workplace challenges.

Ecosystm Principal Advisor, Audrey William says, “During the COVID-19 pandemic, people have become reliant on voice, video and collaboration tools and even when things go back to normal in the coming months, the blended way of work will be the norm. There has been a surge of video and collaboration technologies. The need to have good communication and collaboration tools whether at home or in the office has become a basic expectation especially when working from home. It has become non-negotiable.”

William also notes, “We are living in an ‘Experience Economy’ – if the user experience around voice, video and collaboration is poor, customers will find a platform that gives them the experience they like. To get that equation right is not easy and there is a lot of R&D, partnerships and user experience design involved.”

AWS and Slack Partnership

Amid a rapid increase in remote working requirements, AWS and Slack announced a multi-year partnership to collaborate on solutions to enable the Workplace of the Future. This will give Slack users the ability to manage their AWS resources within Slack, as well as replace Slack’s voice and video call features with AWS’s Amazon Chime. And AWS will be using Slack for their internal communication and collaboration.

Slack already uses AWS cloud infrastructure to support enterprise customers and have committed to spend USD 50 million a year over five years with AWS. However, the extended partnership is promising a new breed of solutions for the future workforce.

Slack and AWS are also planning to tightly integrate key features such as: AWS Key Management Service with Slack Enterprise Key Management (EKM) for better security and encryption; AWS Chatbot to push AWS Virtual machines notifications to Slack users; and AWS AppFlow to secure data flow between Slack, AWS S3 Storage and AWS Redshift data warehouse.

The Competitive Landscape

The partnership between AWS and Slack has enabled Slack to scale and compete with more tools in its arsenal. The enterprise communication and collaboration market is heating up with announcements such as Zoom ramping up its infrastructure on Oracle Cloud. The other major cloud platform players already have their own collaboration offerings, with Microsoft Teams and Google Meet. The AWS-Slack announcement is another example of industry players looking to improve their offerings through partnership agreements. Slack is already integrated with a number of Microsoft services such as OneDrive, Outlook and SharePoint and there was talk of being integrated with Microsoft Teams earlier this year. Similarly, Slack has also integrated some GSuite tools on its platform.

“There is a battle going on now in the voice, video and collaboration space and there are many players that offer rich enterprise grade capabilities in this space. AWS is already Slack’s “preferred” cloud infrastructure provider, and the two companies have a common rival in Microsoft, competing with its Azure and Teams products, respectively,” says William.

The Single Platform Approach

The competition in the video, voice and collaboration market in becoming increasingly intense and the ability to make it easy for users across all functions on one common platform is the ideal situation. This explains why we have seen vendors in recent months adding greater capabilities to their offerings. For instance, Zoom added Zoom phone functionality to expand its offerings to users. Avaya released Spaces – an integrated cloud meeting and team collaboration solution with chat, voice, video, online meetings, and content sharing capabilities. The market also has Cisco as an established presence, providing video and voice solutions to many large organisations.

Organisations want an all-in-one platform for voice, video and collaboration if possible as it makes it easier for management. Microsoft Teams is a single platform for enterprise communications and collaboration. William says, “Teams has seen steady uptake since its launch and for many IT managers the ability to capture all feedback, issues/logs on one platform is important. Other vendors are pushing the one vendor platform option heavily; for example, 8×8 has been able to secure wins in the market because of the one vendor platform push.”

“As the competition heats up, we can expect more acquisitions and partnerships in the communications and collaboration space, in an effort to provide all functions on a single platform,” says William. “However, irrespective of what IT Teams want, we are still seeing organisations use different platforms from multiple vendors. This is a clear indication that in the end there is only one benefit that organisations seek – quality of experience.”

The COVID-19 pandemic has highlighted the importance of the telecommunications industry which has now become the backbone of the new normal, both in a social and business sense. The last few months have seen a number of changes including more video usage, location of traffic and time of traffic. Network usage is on the rise and telecom carriers are prioritising on the resilience of their networks and the quality of services offered to their customers.

What goes up must come down

According to Speedtest, global mobile and broadband speeds have suffered as a result of the increase in traffic with speeds dropping in March 2020 for mobile to 30.47 Mbps (from 31.62 Mbps in February) and fixed broadband to 74.64 Mbps (from 75.41 Mbps in February). In Southeast Asia, only Singapore and Vietnam averaged mobile speeds of 54.37 Mbps and 33.97 Mbps respectively, exceeding the global average speeds. As for fixed broadband, Singapore ranked highest globally achieving 197.26 Mbps while Thailand and Malaysia clocked 149.95 Mbps and 79.86 Mbps respectively, trumping the global average speeds.

Southeast Asian carriers increase network efficiency and quality

Singapore. The country’s ICT regulator, Infocomm Media Development Authority (IMDA), reported an increase in internet usage and its intentions to support telecom carriers in boosting network capacity to ensure essential services run smoothly. Priority will be given to high traffic and residential areas where a larger proportion of the population are working from home. The Ministry of Communications and Information (MCI) reported that Singapore has at least 30 percent buffer in network capacity even during peak periods. Major TV operators Mediacorp, Singtel and Starhub have made more content available for free during this period. This may further impact network speeds as customers are consuming more content over wifi (on mobile apps) or over the fibre networks.

Thailand. Part of the country’s public assistance measures during the pandemic, include offering about 30 million mobile subscribers 10GB free data. The National Broadcasting and Telecommunications Commission (NBTC) will also upgrade the speeds of fixed broadband to at least 100 Mbps which is expected to benefit 1.2 million household subscribers. Leading operator Advanced Info Service (AIS) recently announced that it has deployed 5G networks at hospitals to boost network capacity and speeds, and is deploying robots for telemedicine to empower the healthcare system to fight COVID-19.

Malaysia. Maxis and Telekom Malaysia (TM) reported a surge in traffic since the movement control order (MCO) was implemented by the Government on the 18th March 2020. The MCO is expected to run at least until 28th April 2020. TM cited a 30 percent increase in usage attributed to the increase in traffic for streaming, online games and teleconferencing. Leading operators Maxis, Digi, Celcom and U Mobile have offered 1GB free data during the MCO period as part of the Government’s stimulus package. Maxis, TM, Digi and Celcom have also committed significant manpower to ensure that the networks are operating efficiently and to ensure customer support. Leading TV operator Astro has made all movie, news and cartoon networks available to all its customers until the 28th April 2020.

Social distancing fillip for video conferencing

The rise of social distancing has made us all seek new ways to connect, mainly through video chat. Video conferencing traffic is on the rise as it is the next best thing to face-to-face meetings. Microsoft Teams and Zoom have been big benefactors. The American Economic Institute (AEI) notes that Zoom hit some 200 million users daily from a daily average 10 million. Microsoft Teams added some 12 million registrations to a total of 44 million.

Many predict that the home working trend will continue in the recovery stage and beyond, due to improvements in the telecommunications infrastructure and impending rollout of 5G. It is also predicted that the commercial property sector is likely to suffer due to this trend. This period also highlights the critical importance of cybersecurity with increasing occurrences of hacking and fraud. Zoom is being forced to reinforce their privacy and security measures, as an example.

COVID-19 has changed the way we web

On the social front, many are also using video conferencing to communicate with friends and family. Operators relaxing and offering additional data has undoubtedly contributed to the increase in this usage too. Now that many are homebound, network traffic in residential areas are higher than ever. In the past, peak hours of traffic at homes were at night – this has changed with adults and children homebound. Adults are using video conferencing and more voice calls; while children are using elearning, playing games or streaming videos. The European Commission had asked Netflix and other streaming platforms to reduce streaming quality to standard definition (SD). Netflix has assured that it has the capability to manage levels of streaming quality in accordance with the networks quality requirement of individual countries.

Online gaming and video streaming have emerged as winners and have seen an increase in consumption in these times as they provide for entertainment for millions stuck at home. There is tremendous opportunity for both telecom operators and content providers to increase their number of services in this area. Netflix, YouTube, Microsoft Xbox and PlayStation are among the winners in this sector. YouTube provides for a primary news source and commentary on the epidemic for many. Netflix’s stocks are near an all-time high at present.

eCommerce boost for essentials goods and services

The eCommerce sector should see a major improvement in Southeast Asia as physical channels to market have reduced. Emerging economies such as Malaysia and Thailand should see an improvement in services and embrace eCommerce like their mature counterparts. Statista reports that the average Malaysian eCommerce shopper spent just US$159 and Thailand just US$100 on online consumer goods purchases in 2018, considerably lower than the global average of US$634. There is huge opportunity to provide for basic necessities such as online grocery, food and delivery of goods. As a consequence, contactless payment and the transport and logistics sector will be forced to adapt their business operations to ride this wave successfully. As eCommerce transactions diversify and increase in emerging markets, it will give telecom providers an opportunity to keep engaging with platform players.

Telecom carriers are likely to suffer financial losses due to the scale of the disruption COVID-19 has brought about. However, there are some positives takeaways from this period. The increase of network traffic and the changing patterns have driven carriers to better understand network traffic management. The sharp consumer and business onboarding as far as applications and digital services are concerned, has given the digital economy and 5G use cases a shot in the arm. This is likely to spur innovation in services including communications, eCommerce, payments, logistics and healthcare among others.

As far back as in 2018, Tencent had set its eyes on the business customer, starting a Cloud and Smart Industries business group (CSIG). Since then it has not lost focus on what businesses need and has continued to evolve its offerings. Late last year, Tencent Meeting , a video-conferencing app for its enterprise business was launched. This was a savvy move, as it came right after Zoom was blocked from the China market forcing local users to search for in-country alternatives.

Tencent’s Go-to-Market Strategy

Talking about Tencent’s go-to-market strategy, Ecosystm Principal Advisor, Niloy Mukherjee says, “The current leader in the video-conferencing space, Zoom is not available in China so that market alone can sustain an offering like Tencent Meeting. With the popularity of WeChat, Tencent has a huge opportunity to combine conferencing on the desktop and the mobile and I see that as an advantage for Tencent when compared to other players in the market.”

In another savvy move, as enterprises grapple with remote employees and video-conferencing solution grow in importance, Tencent rolled out its video-conferencing solution for the global market. VooV Meeting, the global version of the domestic app Tencent Meeting, was launched in over 100 countries including the larger Asia Pacific markets such as Malaysia, Hong Kong, Singapore and Japan.

Mukherjee says, “At this particular moment in time, the COVID-19 crisis has suddenly brought video-conferencing front and centre. While people are now resorting to it out of compulsion, they are likely to discover that this is a great way to work. As bandwidths and connectivity improve across countries, video-conferencing emerges as a really viable solution. Organisations will soon realise that this technology can help save tremendous amounts of travel and facility rental costs. So, usage is likely to grow exponentially – and it is not a bad time at all for Tencent to enter this market.”

The Video-Conferencing Market is Heating up

The video-conferencing market continues to grow and providers such as Zoom, Microsoft, Google, and Slack have made many of their offerings free. In the current milieu industries such as healthcare, education and professional services are using unprecedented video collaboration tools, both internally and for customer interactions.

Zoom is gaining global popularity with stock prices rising 28% in the last month in an otherwise under-performing global market. Zoom continues to evolve user-friendly features such as the virtual background, forcing other conferencing providers such as Microsoft to emulate them. Microsoft Teams has also seen a steep rise in popularity, with the company reporting over 50% rise in chat volume in the last month.

Ecosystm Principal Advisor, Audrey William says, “Expanding the capabilities beyond video will be critical for a larger market share. Zoom is now expanding its offering to include calling capabilities with Zoom phone. Beyond video, collaboration platforms are growing in importance and Microsoft Teams, as an example, has made the platform feature-rich across voice, video and collaboration capabilities. Users will want features that will make chat, video, voice and collaboration sessions rich and intuitive. If the experience is not good, they will find another platform to use. It will all come down to user experience!”

Tencent is by no means the only tech organisation from China that is eyeing the global market. Recently, Alibaba launched a free international collaboration platform based on their productivity app Dingtalk for medical professionals to share information and advice on prevention and treatment of COVID-19. In a boost to Tencent however, the United Nations (UN) announced that they will be using VooV Meeting to host their online conversations, especially for their initiatives to mark their 75th anniversary – UN75. Not only will the UN use Tencent’s video-conferencing capabilities, they will also leverage other Tencent offerings such as WeChat Work, and Tencent AI SI.

William thinks that the market might be crowded and Tencent will face some challenges. “Tencent’s challenge is that it is entering an established market. To make a mark, it will have to continue to innovate on features, focus on platform security and ensure that the experience is seamless. Tencent announced in January that the solution can support 300 attendees simultaneously. To sustain this and make a bigger push internationally, it will need to work with local partners to help take this product to market.”

“With all the options around, people will not use VooV Meeting just because it is free – they will if they find the features to be unique and the experience brilliant.”

Mukherjee adds, “Tencent is one of the most admired companies in China – it is a top pick for most graduates as their preferred employer and is seen as a better company to work for than other big players in China. This is a reflection of its strong corporate culture and continuing success. Tencent has, so far, had a good track record of competing with the likes of Alibaba and I believe that they will move quickly to muscle in and take a leadership space in the global video-conferencing market.”