The UN’s global stocktake synthesis report underscores the need for significant efforts to meet the ambitious goals of the Paris Agreement to keep the global warming limit to 1.5ºC, compared to pre-industrial levels. Achieving this requires collective action from governments, organisations, and individuals.

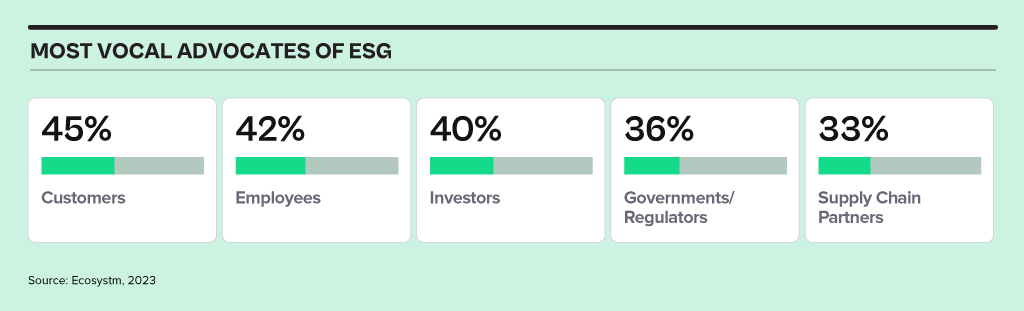

While regulators focus on mandates, organisations today are being influenced more by individual responsibility for positive impact. Customers and employees are leading ESG actions – another fast-emerging voice driving ESG initiatives are value chain partners looking to build sustainable supply chains.

Ecosystm research reveals that only 27% of organisations worldwide currently view ESG as a strategic imperative, yet we anticipate rapid change in the landscape.

Click below to find out what Ecosystm analysts Gerald Mackenzie, Kaushik Ghatak, Peter Carr and Sash Mukherjee consider the top 5 ESG trends that will shape organisations’ sustainability roadmaps in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 ESG Trends in 2024’ as a PDF.

#1 Organisations Will Evolve ESG Strategies from Compliance to Customer & Brand Value

Many of the organisations that we talk to have framed their ESG strategy and roadmaps primarily in relation to compliance and regulatory standards that they need to meet, e.g. in relation to emissions reporting and reduction, or in verifying that their supply chains are free from Modern Slavery.

However, organisations that are more mature in their journeys have realised that ESG is quickly becoming a strategic differentiator and compliance is only the start of their sustainability journey.

Customers, employees, and investors are increasingly selective about the brands they want to associate with and expect them to have a purpose and values that are aligned with their own.

#2 Sustainability Will Remain a Stepping-Stone to Full ESG

Heading into 2024, the corporate continues to navigate the nuances between Sustainability and Environmental, Social, and Governance (ESG) initiatives. Sustainability, focused on environmental stewardship, is a common starting point for corporate responsibility, offering measurable goals for a solid foundation.

Yet, the transition to comprehensive ESG, which includes broader social and governance issues alongside environmental concerns, demands broader scope and deeper capabilities, shifting from quantitative to qualitative measures. The trend of merging sustainability with ESG risks is blurring distinct objectives, potentially complicating reporting and compliance, and causing confusion in the market. Nevertheless, this conflation ultimately paves the way for more integrated, holistic corporate strategies.

By aligning sustainability efforts with wider ESG goals, companies will develop more comprehensive solutions that address the entire spectrum of corporate responsibility.

#3 ESG Consulting Will Grow – Till Industry Templates Take Over

At the end of 2022, LinkedIn buzzed with announcements of Chief Sustainability Officer appointments. However, the Global Sustainability Barometer Study reveals that only around one-third of global organisations have a dedicated sustainability lead. What changed?

Organisations have recognised that ESG is intricate, requiring a comprehensive focus and a capable team, not just a sustainability leader.

Each organisation’s path to sustainability is unique, shaped by factors like size, industry, location, stakeholders, culture, and values. Successfully integrating ESG requires a nuanced understanding of an organisation’s barriers, opportunities, and risks, making it challenging to navigate the sustainability journey alone. This is complicated by the absence of clear government/industry mandates and guidelines that frame best practices.

#4 Sustainability Tech Will Finally Gain Traction

Many organisations initiate sustainability journeys with promises and general strategies. While the role of technology in accelerating goals is recognised, alignment has been lacking. In 2024 sustainability tech will gain traction.

Environmental Tech. Improved sensors and analytics will enhance monitoring of air and water quality, carbon footprint, biodiversity, and climate patterns.

Carbon-Neutral Transportation. Advancements in electric and hydrogen vehicles, batteries, and clean mobility infrastructure will persist.

Circular Economy. Innovations like reverse logistics and product lifecycle tracking will help reduce waste and extend product/material life.

Smart Grids and Renewable Energy. Smart grid tech and new solutions for renewable energy integration will improve energy distribution.

#5 Cleantech Innovation Will See Increased Funding

Cleantech is the innovation that is driving our adaptation to climate change. We expect that investments into, and the pace of innovation and adoption of Cleantech will accelerate into 2024.

As companies commit to their net-zero targets, the need to operationalise the technologies required to fuel this transition becomes all the more urgent. BloombergNEF reported that for Europe alone, nearly USD 220 billion was invested in Cleantech in 2022.

But to meet net-zero ambitions, annual investments in Cleantech will need to triple over the rest of this decade and quadruple in the next.

2023 has been an eventful year. In May, the WHO announced that the pandemic was no longer a global public health emergency. However, other influencers in 2023 will continue to impact the market, well into 2024 and beyond.

Global Conflicts. The Russian invasion of Ukraine persisted; the Israeli-Palestinian conflict escalated into war; African nations continued to see armed conflicts and political crises; there has been significant population displacement.

Banking Crisis. American regional banks collapsed – Silicon Valley Bank and First Republic Bank collapses ranking as the third and second-largest banking collapses in US history; Credit Suisse was acquired by UBS in Switzerland.

Climate Emergency. The UN’s synthesis report found that there’s still a chance to limit global temperature increases by 1.5°C; Loss and Damage conversations continued without a significant impact.

Power of AI. The interest in generative AI models heated up; tech vendors incorporated foundational models in their enterprise offerings – Microsoft Copilot was launched; awareness of AI risks strengthened calls for Ethical/Responsible AI.

Click below to find out what Ecosystm analysts Achim Granzen, Darian Bird, Peter Carr, Sash Mukherjee and Tim Sheedy consider the top 5 tech market forces that will impact organisations in 2024.

Click here to download ‘Ecosystm Predicts: Tech Market Dynamics 2024’ as a PDF

#1 State-sponsored Attacks Will Alter the Nature Of Security Threats

It is becoming clearer that the post-Cold-War era is over, and we are transitioning to a multi-polar world. In this new age, malevolent governments will become increasingly emboldened to carry out cyber and physical attacks without the concern of sanction.

Unlike most malicious actors driven by profit today, state adversaries will be motivated to maximise disruption.

Rather than encrypting valuable data with ransomware, wiper malware will be deployed. State-sponsored attacks against critical infrastructure, such as transportation, energy, and undersea cables will be designed to inflict irreversible damage. The recent 23andme breach is an example of how ethnically directed attacks could be designed to sow fear and distrust. Additionally, even the threat of spyware and phishing will cause some activists, journalists, and politicians to self-censor.

#2 AI Legislation Breaches Will Occur, But Will Go Unpunished

With US President Biden’s recently published “Executive order on Safe, Secure and Trustworthy AI” and the European Union’s “AI Act” set for adoption by the European Parliament in mid-2024, codified and enforceable AI legislation is on the verge of becoming reality. However, oversight structures with powers to enforce the rules are currently not in place for either initiative and will take time to build out.

In 2024, the first instances of AI legislation violations will surface – potentially revealed by whistleblowers or significant public AI failures – but no legal action will be taken yet.

#3 AI Will Increase Net-New Carbon Emissions

In an age focused on reducing carbon and greenhouse gas emissions, AI is contributing to the opposite. Organisations often fail to track these emissions under the broader “Scope 3” category. Researchers at the University of Massachusetts, Amherst, found that training a single AI model can emit over 283T of carbon dioxide, equal to emissions from 62.6 gasoline-powered vehicles in a year.

Organisations rely on cloud providers for carbon emission reduction (Amazon targets net-zero by 2040, and Microsoft and Google aim for 2030, with the trajectory influencing global climate change); yet transparency on AI greenhouse gas emissions is limited. Diverse routes to net-zero will determine the level of greenhouse gas emissions.

Some argue that AI can help in better mapping a path to net-zero, but there is concern about whether the damage caused in the process will outweigh the benefits.

#4 ESG Will Transform into GSE to Become the Future of GRC

Previously viewed as a standalone concept, ESG will be increasingly recognised as integral to Governance, Risk, and Compliance (GRC) practices. The ‘E’ in ESG, representing environmental concerns, is becoming synonymous with compliance due to growing environmental regulations. The ‘S’, or social aspect, is merging with risk management, addressing contemporary issues such as ethical supply chains, workplace equity, and modern slavery, which traditional GRC models often overlook. Governance continues to be a crucial component.

The key to organisational adoption and transformation will be understanding that ESG is not an isolated function but is intricately linked with existing GRC capabilities.

This will present opportunities for GRC and Risk Management providers to adapt their current solutions, already deployed within organisations, to enhance ESG effectiveness. This strategy promises mutual benefits, improving compliance and risk management while simultaneously advancing ESG initiatives.

#5 Productivity Will Dominate Workforce Conversations

The skills discussions have shifted significantly over 2023. At the start of the year, HR leaders were still dealing with the ‘productivity conundrum’ – balancing employee flexibility and productivity in a hybrid work setting. There were also concerns about skills shortage, particularly in IT, as organisations prioritised tech-driven transformation and innovation.

Now, the focus is on assessing the pros and cons (mainly ROI) of providing employees with advanced productivity tools. For example, early studies on Microsoft Copilot showed that 70% of users experienced increased productivity. Discussions, including Narayana Murthy’s remarks on 70-hour work weeks, have re-ignited conversations about employee well-being and the impact of technology in enabling employees to achieve more in less time.

Against the backdrop of skills shortages and the need for better employee experience to retain talent, organisations are increasingly adopting/upgrading their productivity tools – starting with their Sales & Marketing functions.

After the resounding success of the inaugural event last year, Ecosystm is once again partnering with Elevandi and the State Secretariat for International Finance SIF as a knowledge partner for the Point Zero Forum 2023. In this Ecosystm Insights, our guest author Jaskaran Bhalla, Content Lead, Elevandi talks about the Point Zero Forum 2023 and how it is all set to explore digital assets, sustainability, and AI in an ever-evolving Financial Services landscape.

The Point Zero Forum is returning for its second edition between 26 to 28 June 2023 in Zurich, Switzerland. The inaugural Forum held in June 2022 attracted over 1,000 leaders and featured more than 200 esteemed speakers from Europe, Asia Pacific, the USA, and MENA. The Forum represents a collaboration between the Swiss State Secretariat for International Finance (SIF) and Elevandi and is organised in cooperation with the BIS Innovation Hub, the Monetary Authority of Singapore (MAS), and the Swiss National Bank.

As we gear up for this year’s Point Zero Forum, let’s take a moment to reflect on some of the pivotal developments that have shaped the Financial Services industry since the previous Forum and also moulded the three key themes that will take centre stage this year: Sustainability, Artificial Intelligence (AI), and Digital Assets.

COP27, the rise of blended finance and the groundbreaking Net-Zero Public Data Utility

In November 2022, the Government of the Arab Republic of Egypt hosted the 27th session of the Conference of the Parties of the UNFCCC (COP27), with a view to accelerate the transition to a low-carbon future. In the build-up to COP27, Ravi Menon, the Managing Director of the MAS spoke at the inaugural Transition Finance towards Net-Zero conference and shared with the audience that the world is currently not on a trajectory to achieve net-zero emissions by 2050. And according to the UN Emissions Gap report 2021, based on the current policies in place, the world is 55% short of the emissions reduction target for 2030. He also elaborated on the significant role that blended finance can play in tackling climate change, a theme that widely resonated with the global leaders at COP27. To enable easy and transparent reporting on climate commitments, the Climate Data Steering Committee (CDSC) outlined the next steps on its recommended plans for the Net-Zero Data Public Utility (NZDPU) at COP 27. NZDPU aims to aid efforts to transition to a net-zero economy by addressing data gaps, inconsistencies, and barriers to information that slow climate action.

The Point Zero Forum 2023 will deep-dive into the data, technologies, and capital and risk management solutions that can accelerate the fair transition towards a low-carbon future.

Panel Discussion Highlight: The opening panel discussion, “Data for Net-Zero: Views from the Climate Data Steering Committee,” scheduled for 26 June, will feature members of the CDSC, which include the Financial Conduct Authority, the MAS, Glasgow Financial Alliance for Net Zero (GFANZ), and the Swiss State Secretariat for International Finance. The panel will discuss the role of new technologies and collaborative platforms in promoting greater accessibility of transition data and innovative business models.

The launch of ChatGPT by OpenAI and its record for the fastest 100M monthly active users

The launch of ChatGPT by OpenAI on 30 November, 2022 led to widespread adoption by users globally – eventually setting the record for the fastest-growing, active users, hitting 100M monthly active users by Feb 2023. While on one hand users rushed to share enormous efficiency gains achieved by the use of ChatGPT, on the other hand ChatGPT soon became a disruptive tool to spread fake news.

The Point Zero Forum 2023 will deep-dive into Generative AI’s potential for enhancing efficiency, improving risk management, and providing better customer experience in the Financial Services industry, while highlighting the need for ensuring fair, ethical, accountable, and transparent use of these technologies.

Panel Discussion Highlight: The session “Breaking New Ground with Generative AI: Project MindForge”, scheduled for 27 June, will feature global leaders from NVIDIA, the MAS, Citigroup and Bloomberg. The panel will discuss the opportunities of Generative AI for the Financial Services sector.

MiCA regulation gets adopted by the EU lawmakers and sets a precedent for digital asset regulations

More than 2.5 years after it was first proposed, the EU Markets in Crypto-Assets (MiCA) regulation was approved in April 2023 by EU Parliament. While there is still work to be done to implement MiCA and measure its success, and to answer open questions around regulation for out-of-scope assets (like DeFI and NFTs), the digital assets industry is keenly observing whether MiCA could serve as a template for global crypto regulation. In May 2023, the International Organization Of Securities Commissions (IOSCO), the global standard setter for securities markets, also joined the global discussion on digital asset regulation by issuing for consultation detailed recommendations to jurisdictions across the globe as to how to regulate crypto assets.

The Point Zero Forum 2023 will do a stocktake on key global regulatory frameworks, market infrastructure, and use cases for the widespread adoption of digital assets, asset tokenisation, and distributed ledger technology.

Panel Discussion Highlight: The sessions “State of Global Digital Asset Regulation: Navigating Opportunities in an Evolving Landscape” and “Interoperability and Regulatory Compliance: Building the Future of Digital Asset Infrastructure”, scheduled on 26 and 27 June respectively, will feature global leaders from both public sector (such as the MAS, Bank of Italy, Bank of Thailand, U.S. Commodity Futures Trading Commission, EU Parliament) and private sector organisations (such as JP Morgan, Sygnum, SBI Digital Assets, Chainalysis, GBBC, SIX Digital Exchange). The discussions will centre around digital asset regulations and key considerations in the rapidly evolving world of digital assets.

Register here at https://www.pointzeroforum.com/registration. Receive 10% off the Industry Pass by entering the code ‘JB10’ at check out. (Policymakers, regulators, think tanks, and academics receive complimentary access/ Founders of tech companies (incorporated for less than 3 years) can apply for a discounted Founder’s Pass)

Ecosystm supported by their partner EY, conducted an invitation-only Executive ThinkTank at the Point Zero Forum in Zurich. A select group of regulators, investors, technology providers, and senior leaders from financial institutions from across the globe came together to share their insights and experiences on the practicability, regulatory support, and implications of sustainable finance portfolios.

Here are some of the key takeaways from the ThinkTank.

- The Barriers to a Sustainable Future. The first step towards a sustainable future is recognising the challenges organisations face when pursuing Net Zero targets. Often, Net Zero targets are looked upon as additional costs.

- Overcoming the Challenges. It is important to connect Net Zero back to business goals, given that there might be sudden shifts in regulations and because of the emergence of environment-conscious consumers.

- A Sustainable Future Requires a Collaborative Approach. Global governments, regulators, Financial Services institutions, other enterprises, and technology providers need to collaborate on building a sustainable future.

- A Time for Simplification. Clear mandates on reporting climate aspects similar to how financial aspects are reported, will result in greater adoption of sustainability and ESG measures.

- The Role of Digital Architecture. The path to a Net Zero, decarbonised world will be technology-led.

Read below to find out more.

Download Risks and Opportunities of Net Zero Commitments and Decarbonisation Pathways as a PDF

A partner event of our annual flagship Singapore FinTech Festival, Point Zero Forum represents a unique collaboration between Elevandi (an entity set up by MAS), and the Swiss Secretariat for International Finance (SIF), organised in cooperation with the BIS Innovation Hub, Monetary Authority of Singapore, and Swiss National Bank. The inaugural Forum will be graced by Singapore’s Deputy Prime Minister, Heng Swee Keat, Switzerland’s Federal Councillor and the Head of the Federal Department of Finance, Ueli Maurer, as well as leading CEOs (UBS, Julius Baer, Six Group); and innovative founders (FTX Group, wefox). The Forum will serve as the starting point for engaging investors and policymakers with innovators to advance the future of financial services (FOFS).

This invite-only forum aims to bring together investors, influencers, thinkers and decision-makers from the public and private sector to exchange ideas, share knowledge, develop a network, with the purpose of:

- Developing new ideas to advance the FOFS – decentralised finance and Web 3.0, embedded finance and sustainable finance.

- Driving investment activity by bringing together leading founders with VCs, private banking clients, family offices and PE houses

- Dissecting regulatory considerations related to each FOFS development by bringing together public and private sector leaders

Three days of in-depth plenary sessions, deep-dive private roundtables and workshops, and exclusive sessions will focus on significant new market opportunities built on Web 3.0 architecture (June 22) – Tokenisation (June 23) and Sustainable Finance (June 23).

Ecosystm ThinkTank: Risks and Opportunities of Net Zero Committments and Decarbonisation Pathways is a closed door and confidential dialogue for a very limited number of hand-selected participants.

ESG is increasingly becoming an area of focus and Net Zero Commitments have taken centre stage across all industries. With the ‘Net Zero Intent’ gaining traction, questions around practicability, regulatory support and implications sustainable finance portfolios remain unanswered.

This ThinkTank will aim to find answers and solutions to further foster Net Zero commitments and to build practical decarbonisation pathways. Topics to address will include:

- What are the decarbonising pathways for lending, underwriting or other products? And what are the best practices in eliminate ‘Net Zero Laggards’ from financial portfolios?

- What support is needed from policymakers to support Net Zero execution?

- How do governments and financial institutions engage with high emitters that are key pillars to the economy?

The 2021 United Nations Climate Change Conference (COP26, that was held in Glasgow in 2021, highlighted the need to mobilise public and private sector finance to support global net-zero emissions targets and to protect communities and habitats.

Sustainable Finance and Green Bonds present opportunities for lenders, investors, and borrowers. It allows borrowers to obtain funding at decreased and competitive costs. And as investor demands continue to rise, Government institutions have expressed keen interest in issuing green bonds to support ecologically beneficial initiatives.

Here are some recent global announcements.

- France announces the issuance of USD 4 billion green bond sale.

- Germany raises USD 4 billion in green bonds to finance green expenditures and investments.

- Singapore sets a roadmap for its first sovereign green bond with the Singapore Green Bond Framework.

- Austria launches its first green bond.

- The UK launches an inquiry into the role of the financial sector in the country’s net zero transition.

Download Building a Climate Resilient Future with Sustainable Finance as a PDF