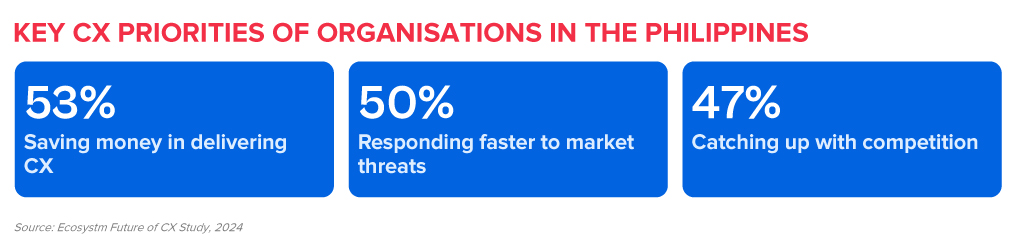

The Philippines, renowned as a global contact centre hub, is experiencing heightened pressure on the global stage, leading to intensified competition within the country. Smaller BPOs are driving larger players to innovate, requiring a stronger focus on empowering customer experience (CX) teams, and enhancing employee experience (EX) in organisations in the Philippines.

As the Philippines expands its global footprint, organisations must embrace progressive approaches to outpace rivals in the CX sector.

These priorities can be achieved through a robust data strategy that empowers CX teams and contact centres to glean actionable insights.

Here are 5 ways organisations in the Philippines can achieve their CX objectives.

Download ‘Securing the CX Edge: 5 Strategies for Organisations in the Philippines’ as a PDF.

#1 Modernise Voice and Omnichannel Orchestration

Ensuring that all channels are connected and integrated at the core is critical in delivering omnichannel experiences. Organisations must ensure that the conversation can be continued seamlessly irrespective of the channel the customer chooses, without losing the context.

Voice must be integrated within the omnichannel strategy. Even with the rise of digital and self-service, voice remains crucial, especially for understanding complex inquiries and providing an alternative when customers face persistent challenges on other channels.

Transition from a siloed view of channels to a unified and integrated approach.

#2 Empower CX Teams with Actionable Customer Data

An Intelligent Data Hub aggregates, integrates, and organises customer data across multiple data sources and channels and eliminates the siloed approach to collecting and analysing customer data.

Drive accurate and proactive conversations with your customers through a unified customer data platform.

- Unifies user history across channels into a single customer view.

- Enables the delivery of an omnichannel experience.

- Identifies behavioural trends by understanding patterns to personalise interactions.

- Spots real-time customer issues across channels.

- Uncovers compliance gaps and missed sales opportunities from unstructured data.

- Looks at customer journeys to proactively address their needs.

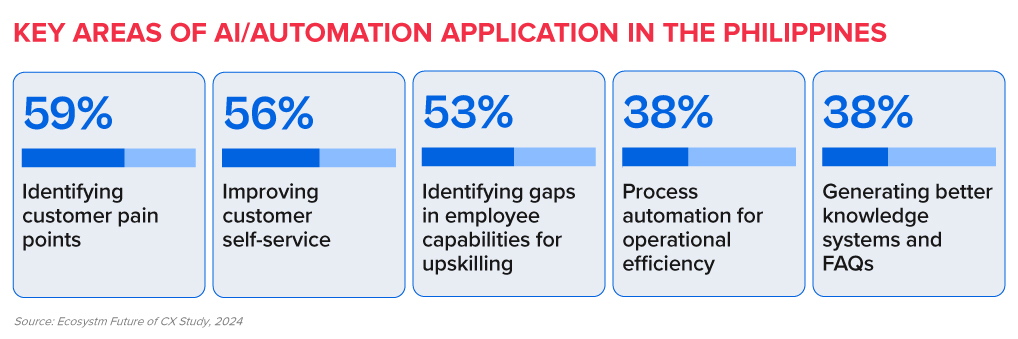

#3 Transform CX & EX with AI/Automation

AI and automation should be the cornerstone of an organisation’s CX efforts to positively impact both customers and employees.

Evaluate all aspects of AI/automation to enhance both customer and employee experience.

- Predictive AI algorithms analyse customer data to forecast trends and optimise resource allocation.

- AI-driven identity validation reduces fraud risk.

- Agent Assist Solutions offer real-time insights to agents, enhancing service delivery and efficiency.

- GenAI integration automates post-call activities, allowing agents to focus on high-value tasks.

#4 Augment Existing Systems for Success

Many organisations face challenges in fully modernising legacy systems and reducing reliance on multiple tech providers.

CX transformation while managing multiple disparate systems will require a platform that integrates desired capabilities for holistic CX and EX experiences.

A unified platform streamlines application management, ensuring cohesion, unified KPIs, enhanced security, simplified maintenance, and single sign-on for agents. This approach offers consistent experiences across channels and early issue detection, eliminating the need to navigate multiple applications or projects.

Capabilities that a platform should have:

- Programmable APIs to deliver messages across preferred social and messaging channels.

- Modernisation of outdated IVRs with self-service automation.

- Transformation of static mobile apps into engaging experience tools.

- Fraud prevention across channels through immediate phone number verification APIs.

#5 Focus on Proactive CX

In the new CX economy, organisations must meet customers on their terms, proactively engaging them before they initiate interactions. This requires a re-evaluation of all aspects of CX delivery.

- Redefine the Contact Centre. Transforming it into an “Intelligent” Data Hub providing unified and connected experiences; leveraging intelligent APIs to proactively manage customer interactions seamlessly across journeys.

- Reimagine the Agent’s Role. Empowering agents to be AI-powered brand ambassadors, with access to prior and real-time interactions, instant decision-making abilities, and data-led knowledge bases.

- Redesign the Channel and Brand Experience. Ensuring consistent omnichannel experiences through unified and coherent data; using programmable APIs to personalise conversations and discern customer preferences for real-time or asynchronous messaging; integrating innovative technologies like video to enrich the channel experience.

Technological innovation is dramatically changing how organisations interact with modern consumers in the rapidly evolving banking, financial services, and insurance (BFSI) industry. The growing dependence on digital communication tools and platforms lies at the core of this transformation. These tools have become vital for BFSI organisations to meet the dynamic needs of today’s customers, enabling agile, responsive Sales & Support teams that can use real-time data to sustain customer engagement, ensure data security, comply with regulations, and streamline operations.

Customer Engagement Challenges in BFSI Organisations

Security Concerns. Customers in the BFSI industry are increasingly concerned about the security of their financial transactions and Personal Identifiable Information (PII). With the rise of cyber threats, customers expect robust security measures to protect their accounts and sensitive information. BFSI organisations need to continually invest in cybersecurity infrastructure and technologies to reassure customers and maintain their trust.

Customer Expectations. In the competitive landscape of the BFSI industry, customer retention and attraction are critical to sustaining profitability. Organisations must prioritise an agile approach that adapts swiftly to market changes. Central to this strategy is the delivery of personalised experiences aligned with individual preferences and needs, driven by advancements in digitalisation. To achieve this, BFSI organisations have to increase investments in AI-driven solutions to gain deep insights into customer behaviour, enabling them to accurately anticipate and meet evolving needs.

Regulatory Compliance. The industry operates in a highly regulated environment with strict compliance requirements imposed by various regulatory bodies. Ensuring compliance with constantly evolving regulations such as GDPR, PSD2, Dodd-Frank, etc., poses a significant challenge for organisations. To complicate the landscape further, institutions with cross-border operations need to consider the laws in different countries. Compliance efforts often result in additional operational complexities and costs, which can impact the overall customer experience if not managed effectively.

Digital Transformation. Rapid technological advancements and changing customer preferences are driving BFSI organisations to undergo digital transformation initiatives. However, legacy systems and processes hinder their ability to innovate and adapt to digital trends quickly. Transitioning to modern, agile architectures while ensuring uninterrupted services and minimal disruption to customers is a complex undertaking for many BFSI organisations.

Customer Education and Communication. Financial products and services can be complex, and customers often require guidance to make informed decisions. Sales & Support teams in BFSI organisations struggle to effectively educate their customers about the features, benefits, and risks associated with various products. Clear and transparent communication regarding fees, terms, and conditions is essential for building trust and maintaining customer satisfaction. Balancing regulatory requirements with the need for transparent communication can be challenging.

5 Ways to Empower Sales & Support Teams in BFSI

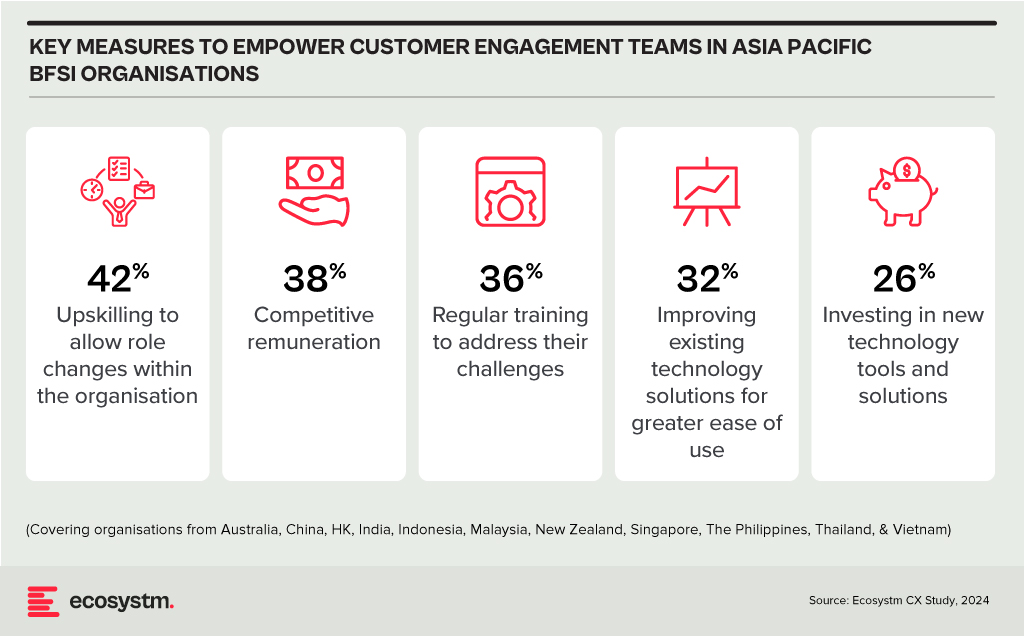

BFSI organisations in Asia Pacific often overlook technology enablement for the empowerment of their Sales & Support and other customer engagement teams. Key measures to empower these teams include upskilling for role flexibility and offering competitive remuneration for better employee retention.

Organisations should prioritise upgrading Sales & Support tools and solutions to address the team’s key pain points.

#1 Boost Customer Engagement with Omnichannel Support

BFSI organisations need to work on a suite of API-driven solutions to create a comprehensive omnichannel presence. This enables engagement with customers via their preferred channels, such as SMS, email, voice, chat, or video. Such flexibility enhances customer satisfaction and loyalty by ensuring personalised and convenient interactions. This includes capabilities such as the ability to deploy messaging and voice services to dispatch timely account activity alerts, secure transactions with two-factor authentication, and deliver customised financial advice through chatbots or direct communications.

#2 Streamline Customer Service with AI and Virtual Assistants

Integrating AI and virtual assistants allows BFSI companies to automate standard inquiries and transactions, freeing Sales & Support teams to tackle more sophisticated customer needs. These AI tools can interpret and process natural language, facilitating conversational interactions with automated services. This boosts efficiency and shortens response times, elevating the customer engagement experience. Also, consistently integrating these virtual assistants across various channels ensures a uniform customer experience – and brand image.

#3 Enhance Security Measures and Compliance Standards

Adhering to stringent security and compliance requirements is essential for BFSI organisations. A secure platform complies with critical global and country-level standards and regulations. The voice and video communication services must include comprehensive encryption, protecting all customer interactions. There is also a need to have a suite of tools for monitoring and auditing communications to meet compliance requirements, allowing BFSI organisations to protect sensitive data while providing secure communication options.

#4 Leverage Insights for Personalised Customer Interactions

BFSI organisations must focus on aggregating, harmonising, and scrutinising customer interactions across various channels. This holistic view of customer behaviour allows for more targeted and personalised services, enhancing customer engagement and loyalty. By leveraging insights into customers’ interaction histories, preferences, and financial objectives, companies can customise their outreach and recommendations, improving upselling, cross-selling, and retention strategies.

#5 Increase Operational Efficiency with Cloud-Based Solutions

Cloud-based communication solutions offer BFSI organisations the scalability and flexibility needed to respond swiftly to market shifts and customer demands. This adaptability is vital for fostering growth in a dynamic industry. A customisable solution supports organisations in refining their operations, from automating workflows to integrating CRM systems, enabling Sales & Support teams to operate more smoothly and effectively. Cloud technology helps reduce operational expenses, elevate service quality, and spur innovation.

Digital communication and collaboration tools have the power to revolutionise BFSI, enhancing engagement, security, and efficiency. Through APIs, AI, and cloud, organisations can meet evolving market needs, driving growth and innovation. Embracing these solutions ensures competitiveness and agility in a changing landscape.

In good times and in bad, a great customer experience (CX) differentiates your company from your competitors and creates happy customers who turn into brand advocates. While some organisations in Asia Pacific are just starting out on their CX journey, many have made deep investments. But in the fast-paced world of digital, physical and omnichannel experience improvement, if you stand still, you fall behind.

We interviewed CX leaders across the region, and here are the top 5 top actions that they are taking to stay ahead of the curve.

#1 Better Governance of Customer Data

Most businesses accelerate their CX journeys by collecting and analysing data. They copy data from one channel to another, share data across touchpoints, create data silos to better understand data, and attempt to create a single view of the customer. Without effective governance, every time create copies of customer data are created, moved, and shared with partners, it increases the attack surface of the business. And there is nothing worse than telling customers that their data was accessed, stolen or compromised – and that they need to get a new credit card, driver’s license or passport.

To govern customer data effectively, it is essential to collaborate with different stakeholders, such as legal, risk, IT, and CX leaders – data owners, consumers, and managers, analytics leaders, data owners, and data managers – in the strategy discussions.

#2 Creating Human Experiences

To create a human-centric experience, it is important to understand what humans want. However, given that each brand has different values, the expectations of customers may not always be consistent.

Much of the investment in CX by Asian companies over the past five years have been focused on making transactions easy and effective – but ultimately it is the emotional attachment which brings customers back repeatedly. In creating human experiences, brands create a brand voice that is authentic, relatable, empathetic and is consistent across all channels.

Humanising the experience and brand requires:

- Hyperpersonalisation of customer interactions. By efforts such as using names, understanding location requirements, remembering past purchases, and providing tailored recommendations based on their expectations, businesses can make customers feel valued and understood. Understanding the weather, knowing whether the customer’s favourite team won or lost on the weekend, mentioning an important birthday, etc. can all drive real, human experiences – with or without an actual human involved in the process!

- Transparency. Honesty and transparency can go a long way in building trust with customers. Businesses should be open about their processes, pricing, and policies. Organisations should be transparent about mistakes and what they are doing to fix the problem.

#3 Building Co-creation Opportunities

Co-creation is a collaborative approach where organisations involve their customers in the development and improvement of products, services, and experiences. This process can foster innovation, enhance customer satisfaction, and contribute to long-term business success. Co-creation can increase customer satisfaction and loyalty, drive innovation, enhance brand reputation, boost market relevance, and reduce risks and costs.

Strategies for co-creation include:

- Creating open innovation platforms where customers can submit ideas, feedback, and suggestions

- Organising workshops or focus groups that bring together customers, designers, and developers to brainstorm and generate new ideas

- Running contests or crowdsourcing initiatives to engage customers in problem-solving and idea generation

- Establishing feedback loops and engaging customers in the iterative development process

- Partnering with customers or external stakeholders, such as suppliers or distributors, to co-create new products or services

#4 Collecting Data – But Telling Stories

Organisations use storytelling as a powerful CX tool to connect with their customers, convey their brand values, and build trust.

Here are some ways organisations share stories with their customers:

- Brand storytelling. Creating narratives around their brand that showcase their mission, vision, and values

- Customer testimonials and case studies. Sharing real-life experiences of satisfied customers to showcase the value of a product or service

- Content marketing. Creating engaging content in the form of blog posts, articles, videos, podcasts, and more to educate, entertain, and inform their customers

- Social media. Posting photos, videos, or updates that showcase the brand’s personality, to strengthen relationships with the audience

- Packaging and in-store experiences. Creative packaging and well-designed in-store experiences to tell a brand story and create memorable customer interactions

- Corporate social responsibility (CSR) initiatives. Helping customers understand the values the organisation stands for and build trust

#5 Finally – Not Telling Just Positive Stories!

Many companies focus on telling the good stories: “Here’s what happens when you use our products”; “Our customers are super-successful” and; “Don’t just take it from us, listen to what our customers say.”

But memorable stories are created with contrast – like telling the story of what happened when someone didn’t use the product or service. Successful brands don’t want to just leave the audience with a vision of what could be possible, but also what will be likely if they don’t invest. Advertisers have understood this for years, but customers don’t just hear stories through advertisements – they hear it through social media, word of mouth, traditional media, and from sales and account executives.

Over the last 2 years, the primary focus for Retail & eCommerce organisations has been on creating the right customer experience and digital engagements – mainly to survive.

In 2022 the focus will be on creating market differentiation. This will extend to business strategies and process optimisation. The Retail & eCommerce industry will explore ways to leverage data to empower multiple roles across the organisation and engage with customers irrespective of where they are on their customer journeys.

Read on to find out what Ecosystm Analysts Alan Hesketh, Niloy Mukherjee and Tim Sheedy think will be the leading trends in the Retail & eCommerce industry in 2022.

In this Insight, guest author Anupam Verma talks about how a smart combination of technologies such as IoT, edge computing and AI/machine learning can be a game changer for the Financial Services industry. “With the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.”

The number of IoT devices have now crossed the population of planet earth. The buzz around the Internet of Things (IoT) refuses to go down and many believe that with 5G rollouts and edge computing, the adoption will rise exponentially in the next 5 years.

The IoT is described as the network of physical objects (“things”) embedded with sensors and software to connect and exchange data with other devices over the internet. Edge computing allows IoT devices to process data near the source of generation and consumption. This could be in the device itself (e.g. sensors), or close to the device in a small data centre. Typically, edge computing is advantageous for mission-critical applications which require near real-time decision making and low latency. Other benefits include improved data security by avoiding the risk of interception of data in transfer channels, less network traffic and lower cost. Edge computing provides an alternative to sending data to a centralised cloud.

In the 5G era, a smart combination of technologies such as IoT, edge computing and AI/machine learning will be a game changer. Multiple uses cases from self-driving vehicles to remote monitoring and maintenance of machinery are being discussed. How do we see IoT and the Edge transforming Financial Services?

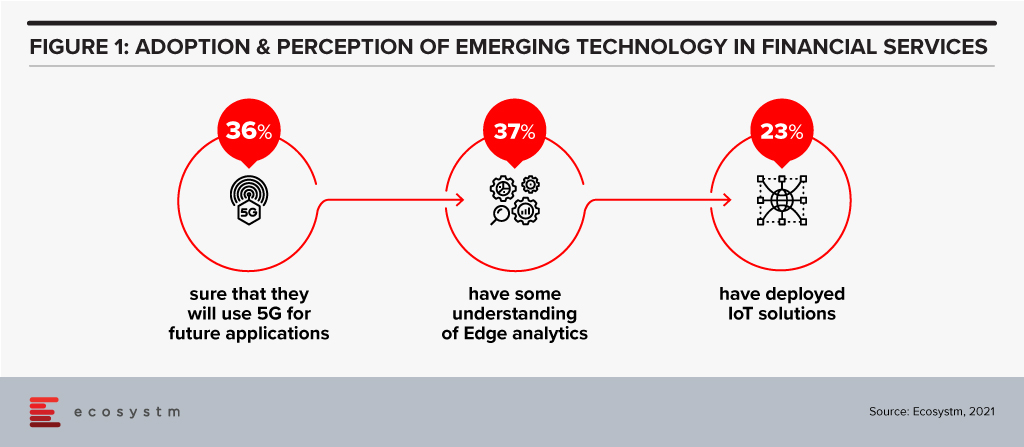

Before we go into how these technologies can transforming the industry, let us look at current levels of perception and adoption (Figure 1).

There is definitely a need for greater awareness of the capabilities and limitations of these emerging technologies in the Financial Services.

Transformation of Financial Services

The BFSI sector is increasingly moving away from selling a product to creating a seamless customer journey. Financial transactions, whether it is payment, transfer of money, or a loan can be invisible, and Edge computing will augment the customer experience. This cannot be achieved without having real-time data and analytics to create an updated 360-degree profile of the customer at all times. This data could come from multiple IoT devices, channels and partners that can interface and interact with the customer. A lot of use cases around personalisation would not be possible without edge computing. The Edge here would mean faster processing and smoother experience leading to customer delight and a higher trust quotient.

With IoT, customers can bank anywhere anytime using connected devices like wearables (smartwatches, fitness trackers etc). People can access account details, contextual offers at their current location or make payments without even needing a smartphone.

Use Cases of IoT & Edge in Financial Services

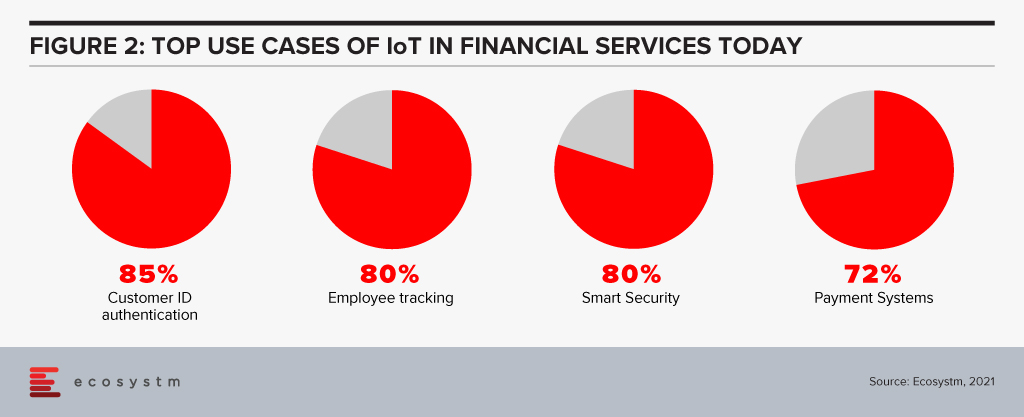

IT and Digital Leaders in Financial Services are aware of the benefits of IoT and there are some use cases that most of them think will help transform Financial Services (Figure 2).

However, there are many more potential use cases. Here are some use cases whose volume will only grow every day to fuel incessant data generation, consumption and processing at the Edge.

- Smart Homes. IoT devices like Alexa/Google Home have capabilities to become “bank in a speaker” with edge computing.

- In-Sync Omnichannels. IoT devices can be synced with other banking channels. A customer may start a transaction on an IoT device and complete it in a branch. Facial recognition can be used to identify the customer after he/she walks in and synced IoT devices will ensure that the transaction is completed without any steps repeated (zero re-work) thereby enhancing customer satisfaction.

- Virtual Relationship Managers. In a digital branch, the customer may use Virtual Reality (VR) headsets to engage with virtual relationship managers and relevant experts. Gamification using VR can be amazingly effective in the area of financial literacy and financial planning.

- Home and Auto Purchase. VR may also find use in home and auto purchase processes with financing built into it. The entire customer journey will have a much smoother experience with edge computing.

- Auto and Health Insurance. Companies can use IoT (device installed in the vehicle) plus edge computing to monitor and improve driving behaviour, eventually rewarding safety with lower premiums. The growth in electric mobility will continue to provide the basis for auto insurance. Companies can use wearables to monitor crucial health parameters and exercising habits. The creation of real-time dynamic rewards around it can change behaviour towards a healthier lifestyle. Awareness, longevity, rising costs and pandemic will only fuel this sector’s growth.

- Payments. Device to device contactless payment protocol is picking up and IoT and edge computing can create next-gen revolution in payments. Your EV could have an embedded wallet and pay for its parking and toll.

- Branch/ATM. IoT sensors and CCTV footage from branches/ATMs can be utilised in real-time to improve branch productivity as well as customer engagement, at the same time enhancing security. It could also help in other situations like low cash levels in ATMs and malfunctions. Sending live video streams for video analytics to the cloud can be expensive. By processing data within the device or on-premises, the Edge can help lower costs and reduce latency.

- Trading in Securities. Another area where response time matters is algorithmic trading. Edge computing will help to quickly process and analyse a large amount of data streaming real-time from multiple feeds and react appropriately.

- Trade Finance. Real-time tracking of goods may add a different dimension to the risk, pricing and transparency of supply chains.

Cloud vs Edge

The decision to use cloud or edge will depend on multiple considerations. At the same time, all the data from IoT devices need not go to the cloud for processing and choke network bandwidth. In fact, some of this data need not be stored forever (like video feeds etc). As a result, with the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

More than ever before you are having to cater to digital-savvy customers and create a competitive edge through the customer experience (CX) that you provide. In this two-part feature, I explore the barriers organisations face in their goal to create a memorable CX; and what the organisations that are getting it right have in common.

Spend on digital services, technologies, platforms, and solutions is skyrocketing. As businesses adapt to a new normal, they are increasing their spend on digital strategies and initiatives well beyond the increase they witnessed in 2020 when all customer and employee experiences went digital-only. But many digital and technology professionals I meet or interview maintain that their digital experiences are poor – offering inconsistent and fragmented experiences.

The Barriers

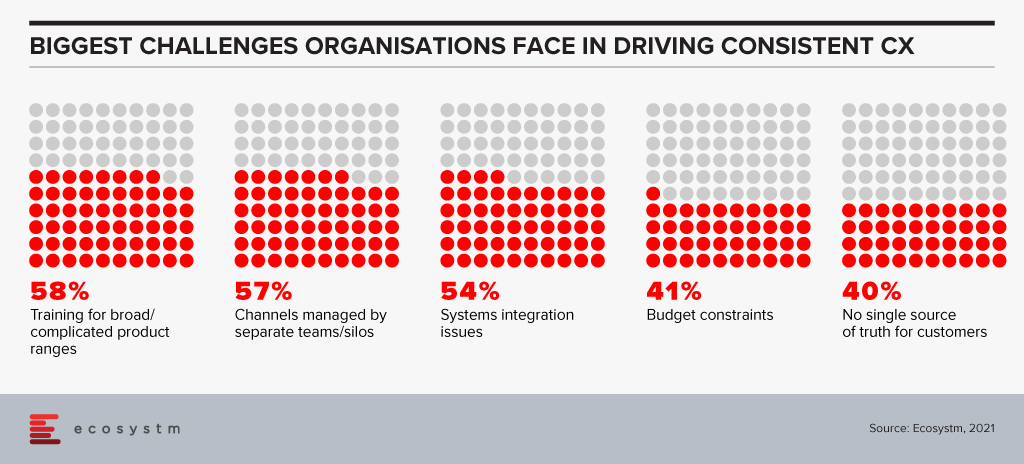

Digital, CX and tech leaders highlight their laundry list of challenges in getting their digital experiences to deliver a desired and on-brand customer experience:

A poorly informed view of the customer and their journey. Sometimes the customer personas and journey maps are simply wrong – they were developed by people with an agenda or a fixed idea of what problems need solving.

Inconsistent data. Too much, too little, or plain incorrect data means that automation or personalisation initiatives will fail. Poor access to data or lack of data sharing between teams, applications and processes means that businesses cannot even begin to build a consistent CX.

Too many applications and platforms. As digital initiatives took hold, technology teams witnessed an explosion of applications and platforms all conquering small elements of the digital journey. While they might be great at what they do, they sometimes make it impossible to create a simple and consistent customer journey. Some are beyond the control of the technology team – some are even introduced by partners and agencies.

Inconsistent content. For many businesses, content is at the heart of their digital experience and commerce strategy. But too often, that content is poorly planned, managed, and coordinated. Different teams and individuals create content; this content is then inconsistently delivered across customer touchpoints; the content is created for a single channel or touchpoint; and delivers to customers at the wrong stage of the journey.

Little co-ordination across channels. Contact centres, retail or other physical locations and digital teams often don’t sing from the same songbook. Not only is the customer experience inconsistent across different physical and digital touchpoints, but it may even be inconsistent across digital touchpoints – chat, web and mobile offer different experiences – even different parts of the web experience can be inconsistent!

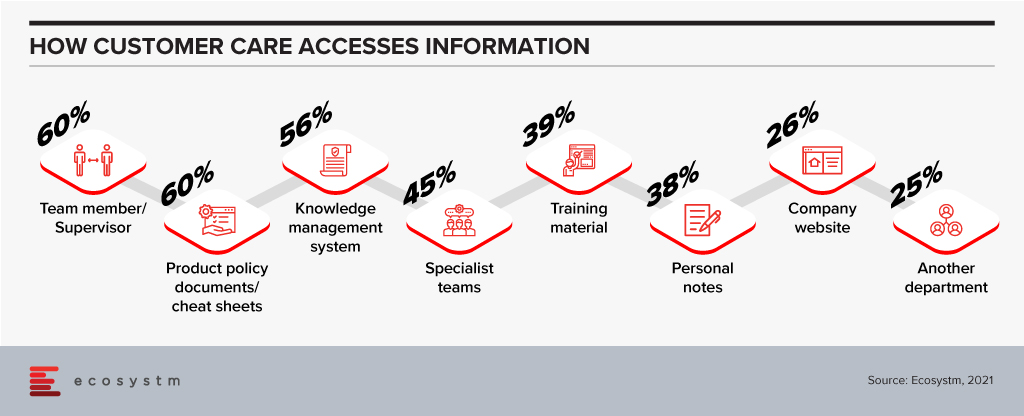

Knowledge is not shared between channels. Smart customers will “game” a company – finding the best offer across different customer touchpoints. But more often than not, inconsistent knowledge leads to very poor customer experiences. For example, a telecom provider might give different or conflicting information about their plans across web, mobile, contact centre and retail outlets; and with the increasing popularity of marketplaces, customers receive inconsistent product information when they deal with the brand directly than through the marketplace. Knowledge systems are often created to serve individual channels and are not trusted by customer service or retail representatives. We see this in Ecosystm data – when customer service agents are asked a question, they don’t know the answer to, the first place they look is NOT their Knowledge Management tool.

Poor prioritisation of customer pain points. Customer teams may find that it is easier to tackle the small customer challenges and score easy points – and just deprioritise the bigger ones that will take significant effort and require considerable change. Unifying the customer journey between the contact centre and digital is one big challenge that many businesses continue to delay.

And it gets worse… According to Ecosystm data, 55% of organisations consider getting board and management buy-in as their biggest CX challenge. This means that Chief Digital Officers, CX professionals and digital teams are still spending a disproportionate amount of time selling their vision and strategy to the senior management teams!

But some organisations are getting it right – creating a memorable digital experience that retains their customers and attracts more. I will talk about what is working for them in the next feature.

Customer Experience teams are focused on creating a great omnichannel experience for their customers – allowing customers to choose their preferred channel or touchpoint. And many of these teams are aware of the challenges of omnichannel – often trying to prise the experience from one channel into another. Too often we create sub-optimal experiences, forcing customers to work harder for the outcome than if they were using other channels.

I know there have been times when I have found it easier to jump in the car and drive to a store or service centre, rather than filling in a convoluted online form or navigating a complex online buying process. I constantly crave larger screens as full web experiences are often better than mobile web experiences (although perhaps that is my ageing eyes!).

One of the factors that came out in a study conducted by Ecosystm and Sitecore is that customers don’t just want personalised experiences – they want optimised experiences. They want to have the right experience on the right device or touchpoint. It is not about the same experience everywhere – the focus should be on optimising experiences for each channel.

We call this “opti-channel”.

Use an Opti-Channel Strategy to Guide Investment and Effort

This is what you are probably doing already – but by accident. I suggest you formalise that strategy. Design customer experiences that are optimised for the right channel or touchpoint – and personalised for each customer. Stop forcing customers into sub-optimal experiences because you were told to make every customer experience an omnichannel one.

The move towards opti-channel accelerates your ability to provide the best experience for each customer, as you ask the important question “Does this channel suit this experience for this customer?” before the fact – not after the experience has been designed. It also eliminates the rework of existing experiences for new channels and provides clear guidance on the next-best action for each employee.

There Will be Conflict Between Opti-Channel and Personalisation

The challenge for opti-channel strategies will be to align them to your personalisation strategy. How will it work when you have analytics driving your personalisation strategy that say customer X wants a fully digital experience but your opti-channel strategy says part of the digital experience is sub-standard? And the answer to this lies in understanding the scope of your experience creation – are you trying to improve the existing experience or are you looking to create a new improved experience?

- If you are improving the existing experience, then you have less license to shift transactions and customer between channels – even if it is a better experience.

- If you are creating a new experience, you have the opportunity to start again with the overall experience and prove to customers that the new experience is actually a better one.

For example, when airlines moved away from in-person check-in to self-check-in kiosks, there was an initial uproar from customers who had not yet experienced it – claiming that it was less personal and less human. But the reality is that the airlines took the check-in screen that the agents were using and made it customer-facing. Travellers can now see the seats and configuration and select what is best for them.

This experience was reinvented again when the check-in moved to web and mobile. By turning the screen around to the customer, the experience actually felt more human and personal – not less. And by scattering agents around the screens and including a human check-in desk for the “exceptions”, the airlines could continue to optimise AND personalise the experience as required.

Opti-Channel Opens Many New Business Opportunities

Your end-state experience should consider what is the best channel or touchpoint for each step in a journey – then determine the logic or ability to shift channels. Pushing customers from a chatbot to web chat is easy. Moving from in-store to online might be harder, but there are currently some retailers looking to merge the in-store and digital experience – from endless aisle solutions to nearly 100% digital in-store. Some shoe and clothing stores offer digital foot and body scans in-store that help customers choose the right size when they shop online. And we are beginning to see the rollout of “magic mirrors” – such as one retailer who has installed them in fitting rooms and you can virtually try different colours of the same item without actually getting them off the shelf.

Businesses are trying to change customer behaviour – whether it is getting them into stores or mainly shopping online or encouraging them to call the contact centre or to even visit a service centre. Creating reasons for why that might be a better option, while also providing scaled-back omnichannel options is a great way to meet the needs of existing customers, create brand loyalty and attract new customers to your company or brand.

Last week Microsoft announced the acquisition of Nuance for an estimated USD 19.7 billion. This is Microsoft’s second largest acquisition ever, after they acquired LinkedIn in 2016. Nuance is an established name in the Healthcare industry and is said to have a presence in 10,000 healthcare organisations globally. Apart from Healthcare, Nuance has strong capabilities in Conversational AI and speech solutions to support other industries. This acquisition is in line with Microsoft’s go-to-market roadmap and strategies.

Microsoft’s Healthcare Focus

Microsoft announced their Healthcare Cloud last year and this acquisition will bolster their Healthcare offerings and market presence. Nuance’s product portfolio includes clinical speech recognition SaaS offerings – Dragon Ambient eXperience, Dragon Medical One and PowerScribe One for radiology reporting – on Microsoft Azure. The acquisition builds on already existing integrations and partnerships that were in place over the years.

“Microsoft Cloud for Healthcare offers its solution capabilities to healthcare providers using a ‘modular’ approach. Given how diverse healthcare providers are in their technology maturity and appetite for change, the more diverse the ‘modules’, the greater the opportunities for Microsoft. This partnership with Nuance also brings to the table established relationships with EHR vendors, which will be useful for Microsoft globally.

The Healthcare industry continues to struggle as the world negotiates the challenges of mass vaccination. But on the upside, the ongoing Healthcare crisis has given remote care a much-needed shot in the arm. Clinicians today will be more open to documentation and transcription services for process automation and compliance. The acquisition of Nuance’s Healthcare capabilities will definitely boost Microsoft’s market presence in provider organisations.

However, Healthcare is not the only industry that Microsoft and Nuance are focused on. The Microsoft Cloud for Retail that was launched earlier this year aims to offer integrated and intelligent capabilities to retailers and brands to improve their end-to-end customer journey. Nuance has omnichannel customer engagement solutions that can be leveraged in Retail and other industries. As Microsoft continues to verticalise their offerings, they will consider more acquisitions that will complement their value proposition.“

Microsoft’s Focus on Conversational AI

Microsoft already has several speech recognition offerings, speech to text services, and chatbots; and they continue to invest in the Conversational AI space. They have created an open-source template for creating virtual assistants to help Bot Framework developers. In February, Microsoft announced their industry specific cloud offerings for Financial services, Manufacturing, and Non-Profit, and also introduced a series of AI and natural language features in Microsoft Outlook, Microsoft Teams, Microsoft Office Lens and Microsoft Office mobile to deliver interactive, voice forward assistive experiences.

“There is no slowing down in this space and the acquisition clearly demonstrates the vision that Microsoft is building with Nuance – a vendor that has made speech recognition, text to speech, conversational AI the foundation of the company. This is a brilliant move by Microsoft in the Conversational AI space and a win-win for both companies.

This move could also mark further inroads for Microsoft into the contact centre space. With Teams now being integrated into contact centre technologies, working with large customers using speech and conversational AI, Dynamics 365 could herald the start of more acquisitions for Microsoft to bolster a wider customer engagement vision.

The Conversational AI war is heating up and various other cloud vendors such as Google and AWS are starting to get aggressive and have made investments in recent years to enhance their Conversational AI capabilities. Google Dialogflow has been seeing rapid uptake and they now have deep partnerships with Genesys, Avaya, Cisco and other contact centre players. Microsoft coming into the game and acquiring a company with years of history and IP in the speech space, demonstrates how the cloud battle and the war between Google, Microsoft and AWS is heating up in the Conversational AI. All of a sudden you have Microsoft as a powerhouse in this game.”

It is crucial that businesses engage with customers across multiple digital channels and move from being ‘’reactive’’ to ‘’proactive”. To deliver that proactive customer experience (CX), contact centres need to have the ability to predict the customer’s next move and/or send preemptive notifications before problems occur. When you start doing that, you are getting ahead in understanding how to deepen customer engagement.

Ecosystm research finds that 56% of organisations globally consider driving an omnichannel experience a key business priority. The need to repeat personal details and queries each time the customer is on a new channel continues to drive poor CX. Resolving the omnichannel dilemma is an arduous task. It requires a complete overhaul in bringing all channels together.

This whitepaper written by Ecosystm in partnership with Local Measure, discusses the multiple challenges that are hindering companies from delivering on their omnichannel vision and talks about the steps organisations should take to modernise their contact centres.

Find out why not integrating your customer channels is costing your contact centre.

Click below to download the Whitepaper

(Clicking on this link will take you to Local Measure website where you can download the Whitepaper )