For many organisations migrating to cloud, the opportunity to run workloads from energy-efficient cloud data centres is a significant advantage. However, carbon emissions can vary from one country to another and if left unmonitored, will gradually increase over time as cloud use grows. This issue will become increasingly important as we move into the era of compute-intensive AI and the burden of cloud on natural resources will shift further into the spotlight.

The International Energy Agency (IEA) estimates that data centres are responsible for up to 1.5% of global electricity use and 1% of GHG emissions. Cloud providers have recognised this and are committed to change. Between 2025 and 2030, all hyperscalers – AWS, Azure, Google, and Oracle included – expect to power their global cloud operations entirely with renewable sources.

Chasing the Sun

Cloud providers are shifting their sights from simply matching electricity use with renewable power purchase agreements (PPA) to the more ambitious goal of operating 24/7 on carbon-free sources. A defining characteristic of renewables though is intermittency, with production levels fluctuating based on the availability of sunlight and wind. Leading cloud providers are using AI to dynamically distribute compute workloads throughout the day to regions with lower carbon intensity. Workloads that are processed with solar power during daylight can be shifted to nearby regions with abundant wind energy at night.

Addressing Water Scarcity

Many of the largest cloud data centres are situated in sunny locations to take advantage of solar power and proximity to population centres. Unfortunately, this often means that they are also in areas where water is scarce. While liquid-cooled facilities are energy efficient, local communities are concerned on the strain on water sources. Data centre operators are now committing to reduce consumption and restore water supplies. Simple measures, such as expanding humidity (below 20% RH) and temperature tolerances (above 30°C) in server rooms have helped companies like Meta to cut wastage. Similarly, Google has increased their reliance on non-potable sources, such as grey water and sea water.

From Waste to Worth

Data centre operators have identified innovative ways to reuse the excess heat generated by their computing equipment. Some have used it to heat adjacent swimming pools while others have warmed rooms that house vertical farms. Although these initiatives currently have little impact on the environmental impact of cloud, they suggest a future where waste is significantly reduced.

Greening the Grid

The giant facilities that cloud providers use to house their computing infrastructure are also set to change. Building materials and construction account for an astonishing 11% of global carbon emissions. The use of recycled materials in concrete and investing in greener methods of manufacturing steel are approaches the construction industry are attempting to lessen their impact. Smaller data centres have been 3D printed to accelerate construction and use recyclable printing concrete. While this approach may not be suitable for hyperscale facilities, it holds potential for smaller edge locations.

Rethinking Hardware Management

Cloud providers rely on their scale to provide fast, resilient, and cost-effective computing. In many cases, simply replacing malfunctioning or obsolete equipment would achieve these goals better than performing maintenance. However, the relentless growth of e-waste is putting pressure on cloud providers to participate in the circular economy. Microsoft, for example, has launched three Circular Centres to repurpose cloud equipment. During the pilot of their Amsterdam centre, it achieved 83% reuse and 17% recycling of critical parts. The lifecycle of equipment in the cloud is largely hidden but environmentally conscious users will start demanding greater transparency.

Recommendations

Organisations should be aware of their cloud-derived scope 3 emissions and consider broader environmental issues around water use and recycling. Here are the steps that can be taken immediately:

- Monitor GreenOps. Cloud providers are adding GreenOps tools, such as the AWS Customer Carbon Footprint Tool, to help organisations measure the environmental impact of their cloud operations. Understanding the relationship between cloud use and emissions is the first step towards sustainable cloud operations.

- Adopt Cloud FinOps for Quick ROI. Eliminating wasted cloud resources not only cuts costs but also reduces electricity-related emissions. Tools such as CloudVerse provide visibility into cloud spend, identifies unused instances, and helps to optimise cloud operations.

- Take a Holistic View. Cloud providers are being forced to improve transparency and reduce their environmental impact by their biggest customers. Getting educated on the actions that cloud partners are taking to minimise emissions, water use, and waste to landfill is crucial. In most cases, dedicated cloud providers should reduce waste rather than offset it.

- Enable Remote Workforce. Cloud-enabled security and networking solutions, such as SASE, allow employees to work securely from remote locations and reduce their transportation emissions. With a SASE deployed in the cloud, routine management tasks can be performed by IT remotely rather than at the branch, further reducing transportation emissions.

Organisations in Asia Pacific are no longer only focused on employing a cloud-first strategy – they want to host the infrastructure and workloads where it makes the most sense; and expect a seamless integration across multiple cloud environments.

While cloud can provide the agile infrastructure that underpins application modernisation, innovative leaders recognise that it is only the first step on the path towards developing AI-powered organisations. The true value of cloud is in the data layer, unifying data around the network, making it securely available wherever it is needed, and infusing AI throughout the organisation.

Cloud provides a dynamic and powerful platform on which organisations can build AI. Pre-trained foundational models, pay-as-you-go graphics superclusters, and automated ML tools for citizen data scientists are now all accessible from the cloud even to start-ups.

Organisations should assess the data and AI capabilities of their cloud providers rather than just considering it an infrastructure replacement. Cloud providers should use native services or integrations to manage the data lifecycle from labelling to model development, and deployment.

In this Ecosystm Byte, sponsored by Oracle, Ecosystm Principal Advisor, Darian Bird presents the top 5 trends for Cloud in 2023 and beyond. Read on to find out more.

Download ‘The Top 5 Cloud Trends for 2023 & Beyond’ as a PDF

In November 2021 Ecosystm had said: “With their global expansion plans and targeted offerings to help enterprises achieve their transformation goals, Oracle is positioned well to claim a larger share of the cloud market. Their strength lies in the enterprise market, and their cloud offerings should see them firmly entrenched in that segment.”

At the recently held Oracle CloudWorld Tour in Singapore, Oracle showcased their momentum in the enterprise segment first-hand. There are a number of reasons for this, and the customer and partner testimonials made it clear that Oracle’s vision is firmly aligned to what their customers require in the Asia Pacific region.

Read on to find out what Ecosystm Advisors Darian Bird, Sash Mukherjee, Tim Sheedy and Ullrich Loeffler say about the announcements and messaging during the session.

Download “Ecosystm VendorSphere: Oracle CloudWorld Tour Singapore” as a PDF

In the Ecosystm Predicts: The Top 5 Healthcare Trends in 2022 we have said that 2022 will be the year when we start seeing the second-order impacts of the pandemic and we will see healthcare providers address these impacts. This means an increase in tech adoption and a greater (and in some cases, renewed) interest in tech providers to focus on the Healthcare industry.

Last month, we saw announcements of Francisco Partners acquiring the healthcare data and analytics assets from the IBM Watson Health business unit. This was neither unexpected nor an isolated news – it follows a series of significant Healthcare tech news from last year.

Here are some announcements from 2021 that I feel give us an indication of where the Healthcare tech market is headed.

- Oracle’s acquisition of Cerner

- Microsoft’s continued focus on Healthcare with the Nuance acquisition

- The acquisition of athenahealth by private equity firms

- Examples of the focus on mental health such as the creation of Headspace Health

- The interest of consumer apps in Healthcare as witnessed by Peloton’s corporate wellness programme.

Read on to find out more about these announcements. And let me know what you think is the most interesting Healthcare tech announcement in the last year.

Download “Where is Healthcare Tech Headed?” slides as a PDF.

The emergence of COVID-19 last year caused a rapid shift towards work and study from home, and a pickup in eCommerce and social media usage. Tech companies running large data centre-based “webscale” networks have eagerly exploited these changes. Already flush with cash, the webscalers invested aggressively in expanding their networks, in an effort to blanket the globe with rapid, responsive connectivity. Capital investments have soared. For the webscale sector, spending on data centres and related network technology accounts for over 40% of the total CapEx.

Here are the 3 key emerging trends in the data centre market:

#1 Top cloud providers drive webscale investment but are not alone

The webscale sector’s big cloud providers have accounted for much of the recent CapEx surge. AWS, Google, and Microsoft have been building larger facilities, expanding existing campuses and clusters, and broadening their cloud region footprint into smaller markets. These three account for just under 60% of global webscale tech CapEx over the last four quarters. Alibaba and Tencent have been reinforcing their footprints in China and expanding overseas, usually with partners. Numerous smaller cloud providers – notably Oracle and IBM – are also expanding their cloud services offerings and coverage.

Facebook and Apple, while they don’t provide cloud services, also continue to invest aggressively in networks to support large volumes of customer traffic. If we look at Facebook, the reason becomes clear: as of early 2021, they needed to support 65 billion WhatsApp messages per day, over 2 billion minutes of voice and video calls per day, and on a monthly basis their Messenger platform carries 81 billion messages.

The facilities these webscale players are building can be immense. For instance, Microsoft was scheduled to start construction this month on two new data centres in Des Moines Iowa, each of which costs over USD 1 billion and measures over 167 thousand square metres. And Microsoft is not alone in building these large facilities.

#2 Building it all alone is not an option for even the biggest players

The largest webscalers – Google, AWS, Facebook and Microsoft – clearly prefer to design and operate their own facilities. Each of them spends heavily on both external procurement and internal design for the technology that goes into their data centres. Custom silicon and the highest speed, most advanced optical interconnect solutions are key. As utility costs are a huge element of running a data centre, webscalers also seek out the lowest cost (and, increasingly, greenest) power solutions, often investing in new power sources directly. Webscalers aim to deploy facilities that are on the bleeding edge of technology. Nonetheless, in order to reach the far corners of the earth, they have to also rely on other providers’ network infrastructure. Most importantly, this means renting out space in data centres owned by carrier-neutral network operators (CNNOs) in which to install their gear.

The Big 4 webscalers do this as little as possible. For many smaller webscalers though, piggybacking on other networks is the norm. Of course, they want some of their own data centres – usually the largest ones closest to their main concentrations of customers and traffic generators. But leasing space – and functionalities like cloud on-ramps – in third-party facilities helps enormously with time to market.

Oracle is a case in point. They have expanded their cloud services business dramatically in the last few years and attracted some marquee names to their client list, including Zoom, FedEx and Cisco. To ramp up, Oracle reported a rise in CapEx, growing to USD 2.1 billion in the 12 months ended June 2021, which represents a 31% increase from the previous year. However, when compared to Microsoft’s spending this appears modest. Microsoft reported having spent USD 20.6 billion in the 12 months ended June 2021 – a 33% increase over the previous year – to help drive the growth of their Azure cloud service.

One reason behind Oracle’s more modest spending is how heavily the company has relied on colocation partners for their cloud buildouts. Oracle partners with Equinix, Digital Realty, and other providers of neutral data centre space to speed their cloud time to market. Oracle rents space in 29 Digital Realty locations, for instance, and while Equinix doesn’t quantify its partnership with Oracle, Oracle’s cloud regions across the globe access the Oracle Cloud Infrastructure (OCI) via the Equinix Cloud Exchange Fabric. Oracle also works with telecom providers; their Dubai cloud region, launched in October 2020, is hosted out of an Etisalat owned data centre.

#3 Carrier-neutral data centre investment is surging in concert with webscale/cloud growth

As the webscale sector has raced to expand over the last 2 years, companies that specialise in carrier-neutral data centres have benefited. Industry sources estimate that as much as 50% or more of the cloud sector’s total data centre footprint is actually in these third-party data centres. That is unlikely to change, especially as some CNNOs are explicitly aiming to build out their networks in areas where webscalers have less incentive to devote resources. It’s not just about the webscalers’ need for space; the need for highly responsive, low latency networks is also key, and interconnection closer to the end-user is a driver.

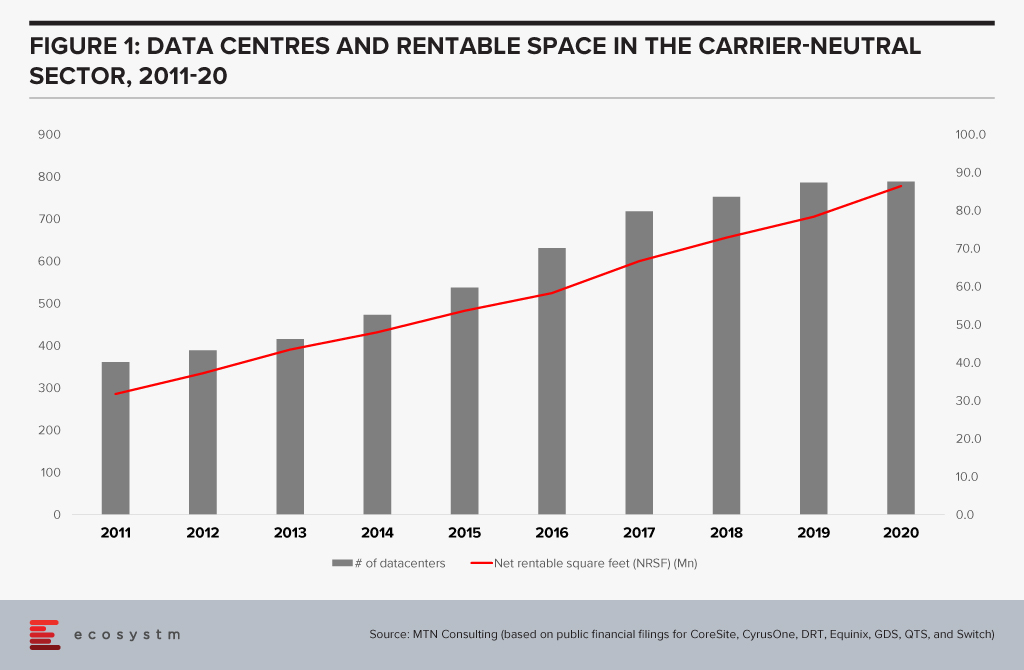

Looking at the biggest publicly traded carrier-neutral providers in the data centre sector shows that their capacity has expanded significantly in the last few years (Figure 1)

By my estimation, for the first 6 months of 2021, CapEx reported publicly for these CNNOs increased 18% against 1H20, to an estimated USD 4.1 Billion. Beyond the big public names, private equity investment is blossoming in the data centre market, in part aimed at capturing some of the demand growth generated by webscalers. Examples include Blackstone’s acquisition of QTS Realty Trust, Goldman Sachs setting up a data centre-focused venture called Global Compute Infrastructure; and Macquarie Capital’s strategic partnership with Prime Data Centers.

Some of this new investment target core facilities in the usual high-traffic clusters, but some also target smaller country markets (e.g. STT’s new Bangkok-based data centre), and the network edge (e.g. EdgeConneX, a portfolio company of private equity fund EQT Infrastructure).

EdgeConneX is a good example of the flexibility required by the market. They build smaller size facilities and deploy infrastructure closer to the edge of the network, including a PoP in Boston’s Prudential Tower. The company offers data centre solutions “ranging from 40kW to 40MW or more.” They have built over 40 data centres in recent years, including both edge data centres and a number of regional and hyperscale facilities across North America, Europe, and South America. Notably, EdgeConneX recently created a joint venture with India’s property group Adani – AdaniConneX – which looks to leverage India’s status of being the current hotspot for carrier-neutral data centre investment.

As enterprises across many vertical markets continue to adopt cloud services, and their requirements grow more stringent, the investment climate for new data centre capacity is likely to remain strong. Webscale providers will provide much of this capacity, but carrier-neutral specialists have an important role to play.

“Cloud is universal – everything is going to be on the cloud soon! If you are not moving to the cloud, you are going extinct! AWS, Microsoft and Google are going to rule the world!” This has been the hyped narrative for some time now. But watch out New World – the Old World is fighting back!

Traditional vendors like HP Enterprise, Cisco, and Oracle are all deploying strategies to remain relevant in the new world. For these vendors – especially for HPE and Cisco that come from a predominantly hardware background – the future is hybrid. They picture a world in which the data centre – either on-prem or in a co-located facility – thrives on, in tandem with the cloud. This is a reasonably good bet. For most large enterprises with a huge repository of applications and data sitting in the data centre, migrating everything to the cloud is a nightmare – fraught with risk and very expensive.

Ecosystm research shows that 32% of organisations have deployed containerisation – and this percentage will only grow. The ability for firms to toggle between data centre bare metal based applications and completely on-the-cloud ones is becoming more manageable by the day. This enormous flexibility allows a firm that has large compute needs to keep some stable workloads in a data centre, whether on-prem or co-located, while simultaneously using cloud-based workloads, optimising spends and performance.

Here is a glimpse into the strategies of three key vendors.

HPE’s ‘as-a-service’ Messaging is Spot on

Two years ago, Antonio Neri boldly went where no HPE CEO had gone before, promising that HPE’s entire portfolio would be available ‘as-a-service’ within 3 years. At the recently concluded HPE Discover event, there were a flurry of announcements to showcase that GreenLake is indeed on its way to meet that ambitious goal in 2022.

HPE’s recent announcements show customers that GreenLake is an end-to-end solution for managing their IT infrastructure moving forward. It ticks all the boxes: providing flexibility and scalability; the advantage of using both data centre and cloud; and high manageability and security with a full suite of applications.

Examples are the partnership with Azure Stack HCI, to add to earlier ones with leading vendors like SAP, Citrix, and VMware. HPE is building a platform that provides customers with the comfort that they can adopt GreenLake and pretty much have access to any application they may choose to implement – offering full coverage from the Edge to the Cloud. It is extremely interesting that GreenLake allows the option of switching on and switching off processor cores as needed, and the customer pays based on usage. This is surely a first for the industry!

Another example is Lighthouse, which allows the customer to rapidly configure, and provision workloads based on dynamic needs. While all the hyperscalers provide similar services when the workload is on the cloud, Lighthouse allows the same flexibility and speed for cloud services which can be run in the data centre, on-prem, co-located, or even at the Edge.

A third example was the announcement of Project Aurora which will add an additional security layer from validating the input data all the way to verifying the workload at the start and then as it is running. It appears to use an AI/ML system that checks for unexpected behaviours to detect any kind of malware.

It makes good sense for HPE to push GreenLake and move to offering ‘everything-as-a-service’. As one of the incumbent enterprise hardware business leaders, this is a good response rather than to watch one’s business continue to shrink YoY. GreenLake is HPE’s way of futureproofing themselves and making sure they stay relevant in the new cloud world.

Cisco Secures the Hybrid Workplace

Cisco has been active launching Cisco Plus earlier this year, as their bridge to the as-a-service model with a network-as-a-service (NaaS) offering. Somewhat like GreenLake, Cisco Plus offers flexible consumption for compute, storage, and networking. They are committed to offering most of their portfolio as-a-service over time.

Cisco has shown some resilience in terms of revenue but has still been struggling to grow. After a steady growth since 2017, the revenues dropped by 7% in 2020 almost as a direct impact of COVID-19. The post-pandemic world has the potential of being a bigger threat for Cisco. Many estimates show the number of people working from home is likely to go up dramatically and Cisco’s key networking offering could rapidly become redundant. However, at Ecosystm we believe that the hybrid work model will be predominant.

Cisco is also betting on a hybrid world. No matter where one works from, there are networking needs. Cisco’s focus, therefore, is on security – this will be on the mind of virtually any enterprise as it chalks out its future strategy. With a hybrid environment, making everything secure becomes more complex while continuing to be vital. Cisco has a heavy emphasis on Secure Access Service Edge (SASE) – the idea that the security envelope now has to be a flexible form that has a presence everywhere that the enterprise needs to be. This will make a lot of sense to most enterprises as they tread the hybrid path.

Cisco will offer a portfolio of tools to make it increasingly easier for customers to use multi-cloud, multi-vendor environments, offering the best of both worlds.

Oracle Incentivises Cloud Migration

Oracle has a different approach because they are trying to solve a different problem. They are competing with the hyperscalers, while fully acknowledging a hybrid world. However, as a company with less legacy in hardware, it makes sense for them to focus on migrating to cloud rather than on hybridisation. Oracle has just announced that they will subsidise existing customers who add cloud workloads with them, by providing discounts on the existing licensing fees that the customer is paying Oracle. This discount appears to be around 25% to 33%. In essence, this means that if a customer spends about USD 100k with Oracle on licensing and decides to start moving workloads to the Oracle Cloud worth somewhere between USD 300-400k, they can potentially write off the entire license fees they are currently paying!

Conclusion

There is a strong effort from every vendor right now to retain and consolidate their customer share and build a vision that convinces the customer that they are the way to go. For the traditional hardware players that vision is of a hybrid world – attractive to today’s large enterprise. For the likes of AWS, Microsoft, Google, and Oracle it is all about moving the customer to their cloud. The assumption of course is that moving someone to your cloud will lead to more of your apps being used by the customer. For the hardware vendors like Cisco and HPE, it is all about moving the customer to their own platforms which empower hybridisation. In all cases, a necessary component is to offer ‘everything-as-a-service’ upending the traditional models of selling.

In my opinion, with time the IaaS portion of the cloud is likely to gradually devolve into something like a utility. There will be a lot of upheavals and market disruption before we get there, but eventually, software and other services are likely to stand separate from the infrastructure provider. All the vendors are therefore depending on capturing the customer at the platform-as-a-service (PaaS) level, but even this is likely to get commoditised over time. Eventually, the winners will be disparate providers of the best applications for different functions. Meanwhile, we are in for an extremely interesting ride as we see all the vendors jockeying for space!

In this edition of Ecosystm RNx – an objective vendor ranking based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform – we rank the Top 10 Global Cybersecurity Vendors.

If you are an End User, you are having to re-evaluate your Cybersecurity risks and measures as both solution capabilities and the threat landscape become more complex. In a fragmented market, it is difficult to select the right Cybersecurity partner to safeguard your organisation. This vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are Cybersecurity Vendor, you are aware that end users are looking more for Cybersecurity services than solutions – this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

Ecosystm RNx is an objective vendor ranking based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform. In this edition, we rank the Top 10 Global AI & Automation Vendors.

If you are an End-User, you are realising that the right investments in Data & AI now will be the key to your future success. This vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are an AI & Automation Vendor, it’s an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

In this first edition of Ecosystm RNx we rank the Top 10 Global Cloud Vendors.

Ecosystm RNx is an objective vendor ranking based on in-depth and quantified ratings from technology decision-makers on the Ecosystm platform.

If you are an technology user, this Cloud Vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are a Cloud Vendor, this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.