Technology has been reshaping the Real Estate industry landscape. Advancements in manufacturing technologies, digital tools, AI & analytics, and IoT – coupled with customer and employee expectations – are revolutionising how properties are built, bought, sold, managed, and experienced.

The evolution of RealTech and PropTech has a far-reaching impact on the industry, streamlining processes, improving customer experiences, and driving innovation across the entire sector.

Read on to find out how technology impacts the entire value chain; the key drivers of Real Estate evolution; the strong influence of “smart consumers”; and what Ecosystm VP Industry Insights Sash Mukherjee thinks where the industry is headed.

Download ‘The Future of Real Estate’ as a PDF

In the last few months, we have seen greater adoption of Fintech especially in the area of digital payments, as more organisations and consumers adopt eCommerce. However, Fintech also appears to grow in areas such as Regtech and blockchain for ease of reporting and enhanced transaction security. As we prepare for recovery, there will be a need for a more open and interconnected economy that is borderless and transparent and does not need counter-party trust to operate. Blockchain has a role to play in enabling that environment where transactions and processes are secure, interoperable and risk-free.

Australian Banking Leveraging Blockchain

Major Australian banks – ANZ Bank, the Commonwealth Bank of Australia (CBA) and Westpac – have joined hands with property management firm Scentre Group and IBM for the expansion and commercial launch of a Blockchain technology platform Lygon that manages end-to-end bank guarantees on retail property leases.

Financial guarantee is an essential part of retail property leases and involves a lot of paperwork such as payment assurances, financial guarantee, bank bonds, credit letters and other legal documents. Bank guarantees have primarily been issued through paper-based processes – digitalising the entire route will reduce the risks, manual errors and significantly speed up the complete procedure. The use of blockchain provides a trusted system of record for digitised documents, removes the risk of document loss and allows secure sharing of data. It also has a strong cryptography security aimed at eliminating fraud and enabling the sharing of key information across organisational boundaries.

Ecosystm Principal Advisor, Phil Hassey says, “This joint venture shows the value of applying new technology to bring legacy and overlooked business processes into the digital age. The ability to reduce the bank guarantee process time frame from one month to one hour, alongside a 15-minute onboarding highlights the speed and scale that can be gained from the technology.”

“It helps the landlord, retailer and bank alike. One of the key benefits for the retail tenant is that they can concentrate on running a business rather than the back-end administration required for the new lease. Furthermore, the blockchain technology will enable heightened security capabilities and reduce the risk to all parties of fraud and data loss.”

From this month, early adopters will be able to join the platform. The intention is to expand the services into New Zealand, with the view to creating a true cross-border solution. The platform will be open to the general public, along with new features, in early 2021.

A Successful Pilot

The platform was piloted in July 2019 and was proved successful later in the year. The outcomes reported to have been achieved include reduction of time to issue a bank guarantee from one month to one day; onboarding new applicants to the platform in less than 15 minutes; and supporting other common bank guarantee processes including amendments and cancellations. The pilot used live data and legal transactions from about 20 Australian businesses, with an aim to improve customer experience and process automation.

IBM, one of the 5 shareholders and the technology provider for the platform, is responsible for developing, operating, and maintaining the platform. The initial proof of concept (POC) was developed within the IBM Research division. The platform also runs on the IBM Blockchain Platform and IBM provides services such as the security.

Hassey says, “This initiative highlights that in a digital world – regardless of the platform – joint ventures can readily provide benefits to all stakeholders if digital enablement and technology is at the core of the execution.”

COVID-19 is accelerating digital transformation activities across industries. Remote working is now standard practice and digital engagement is replacing face-to-face interaction. Cloud technology has become essential rather than an option, and rollouts of new technologies such as augmented reality (AR) and intelligent automation are being expedited.

One of the industries that offer great potential for technology-driven transformation is the property sector.

Many activities within the property ecosystem have remained unchanged for decades. There are several opportunities for digital engagement and automation in this sector, ranging from the use of robots in construction to the ‘uberisation’ of the residential property customer journey.

The processes associated with buying or renting property remain cumbersome and complex for customers. Indeed, customers engage with many different organisations throughout their residential property lifecycles. When compared to some other industries, the customer experience can be poor. Components of the journey – such as property search – offer some great experiences but other parts such as exchanging contracts can rarely be described as positive customer experiences.

Although AR and virtual reality (VR) technologies can facilitate property inspection, most inspections are still undertaken on-premise, together with a real estate agent. Contract exchanges often involve interactions with legal professionals in-person. Securing a mortgage or a rental agreement also typically requires face-to-face interaction. Deposits commonly necessitate the physical presentation of a cheque.

The Uberisation of the Property Sector

So, in the residential sector, there are clear opportunities for start-ups and property search platforms to offer greatly enhanced customer experiences. The COVID-19 crisis will speed up the rate at which digital technologies are used to automate activities throughout the residential property customer journey and to engage customers digitally.

Property search platforms such as Singapore-based PropertyGuru, have been creating innovative ways of engaging customers and extending their range of services, for many years. For PropertyGuru, its news features, mortgage calculator, and ability to search for investment properties overseas, have enabled it to offer customers more value from its platform. Its PropertyGuru Lens feature uses AR and artificial intelligence (AI) to give customers a more immersive and improved experience. In common with other real estate platforms, it offers AR and VR tools for inspections.

Today’s crisis creates opportunities for platforms such as ProperyGuru to engage customers throughout their journey. It can potentially transform the residential property business, by becoming an Uber-style platform for agents, movers, shippers, storage companies, interior designers, renovation firms and all other stakeholders within the residential property ecosystem. Subject to regulation, it could also act as a mortgage broker and an agency for the exchange of contracts. In other words, it could ‘own’ the customer journey and act as a platform for all services associated with residential property. From the customer perspective, such a platform would be a welcome way of enhancing the experience associated with buying, renting, maintaining, improving, managing, and selling residential property.

IoT and the Commercial Property Sector

From a commercial property perspective, the COVID-19 crisis can also be expected to accelerate the digitalisation of many activities associated with the construction, maintenance, and management of buildings.

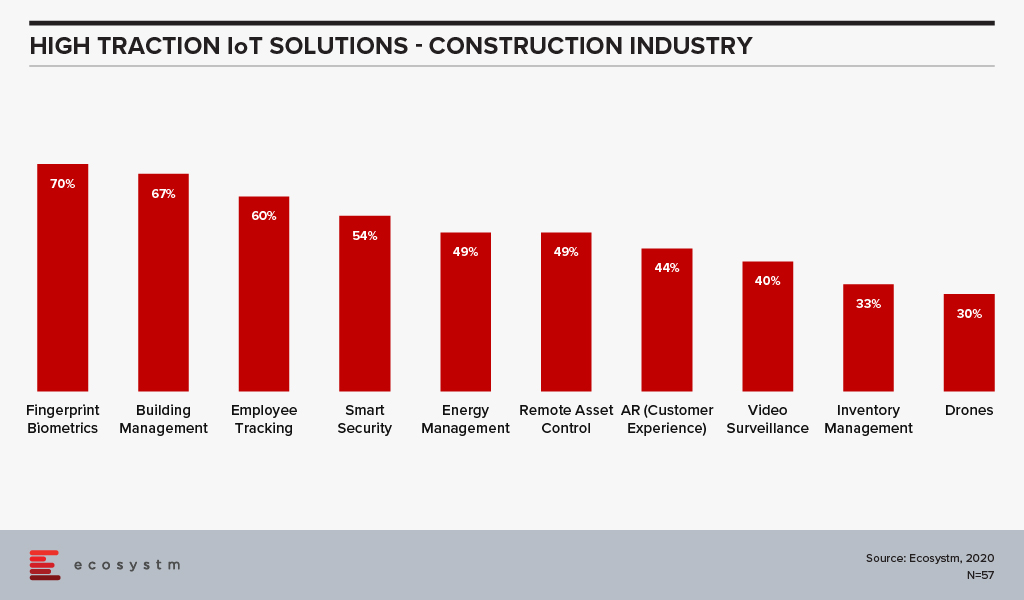

According to the findings of the Ecosystm IoT Study, the Construction industry is evaluating several technology solutions that are expected to benefit the industry (Figure 1).

While the industry views these solutions as beneficial, the adoption has so far been low. This will change. Drones have been used to inspect the outside of tall buildings for several years, but this is not yet standard practice. Structural inspections and maintenance of buildings will be automated at a much faster rate post COVID-19. IoT technology will be used for building management. Using IoT technology for the predictive maintenance and management of lighting, climate control, elevators, security, windows and doors will become standard as firms seek to reduce human interactions. Technology that measures footfall, manages safe distancing, takes peoples’ temperatures and identifies those who enter and leave buildings will be introduced, as organisations guard against disease clusters developing within or around their premises.

In essence, the COVID-19 crisis will act as a catalyst for the digital transformation of the property sector. There is a huge opportunity to create new business models not least by offering customers a digital platform on which all of their property-related needs can be addressed. For the commercial property sector, a similar platform can be offered. Additionally, many core activities ranging from construction to building management will be automated, fully leveraging robot, AI and IoT technologies.