Generative AI has stolen the limelight in 2023 from nearly every other technology – and for good reason. The advances made by Generative AI providers have been incredible, with many human “thinking” processes now in line to be automated.

But before we had Generative AI, there was the run-of-the-mill “traditional AI”. However, despite the traditional tag, these capabilities have a long way to run within your organisation. In fact, they are often easier to implement, have less risk (and more predictability) and are easier to generate business cases for. Traditional AI systems are often already embedded in many applications, systems, and processes, and can easily be purchased as-a-service from many providers.

Unlocking the Potential of AI Across Industries

Many organisations around the world are exploring AI solutions today, and the opportunities for improvement are significant:

- Manufacturers are designing, developing and testing in digital environments, relying on AI to predict product responses to stress and environments. In the future, Generative AI will be called upon to suggest improvements.

- Retailers are using AI to monitor customer behaviours and predict next steps. Algorithms are being used to drive the best outcome for the customer and the retailer, based on previous behaviours and trained outcomes.

- Transport and logistics businesses are using AI to minimise fuel usage and driver expenses while maximising delivery loads. Smart route planning and scheduling is ensuring timely deliveries while reducing costs and saving on vehicle maintenance.

- Warehouses are enhancing the safety of their environments and efficiently moving goods with AI. Through a combination of video analytics, connected IoT devices, and logistical software, they are maximising the potential of their limited space.

- Public infrastructure providers (such as shopping centres, public transport providers etc) are using AI to monitor public safety. Video analytics and sensors is helping safety and security teams take public safety beyond traditional human monitoring.

AI Impacts Multiple Roles

Even within the organisation, different lines of business expect different outcomes for AI implementations.

- IT teams are monitoring infrastructure, applications, and transactions – to better understand root-cause analysis and predict upcoming failures – using AI. In fact, AIOps, one of the fastest-growing areas of AI, yields substantial productivity gains for tech teams and boosts reliability for both customers and employees.

- Finance teams are leveraging AI to understand customer payment patterns and automate the issuance of invoices and reminders, a capability increasingly being integrated into modern finance systems.

- Sales teams are using AI to discover the best prospects to target and what offers they are most likely to respond to.

- Contact centres are monitoring calls, automating suggestions, summarising records, and scheduling follow-up actions through conversational AI. This is allowing to get agents up to speed in a shorter period, ensuring greater customer satisfaction and increased brand loyalty.

Transitioning from Low-Risk to AI-Infused Growth

These are just a tiny selection of the opportunities for AI. And few of these need testing or business cases – many of these capabilities are available out-of-the-box or out of the cloud. They don’t need deep analysis by risk, legal, or cybersecurity teams. They just need a champion to make the call and switch them on.

One potential downside of Generative AI is that it is drawing unwarranted attention to well-established, low-risk AI applications. Many of these do not require much time from data scientists – and if they do, the challenge is often finding the data and creating the algorithm. Humans can typically understand the logic and rules that the models create – unlike Generative AI, where the outcome cannot be reverse-engineered.

The opportunity today is to take advantage of the attention that LLMs and other Generative AI engines are getting to incorporate AI into every conceivable aspect of a business. When organisations understand the opportunities for productivity improvements, speed enhancement, better customer outcomes and improved business performance, the spend on AI capabilities will skyrocket. Ecosystm estimates that for most organisations, AI spend will be less than 5% of their total tech spend in 2024 – but it is likely to grow to over 20% within the next 4-5 years.

The Retail industry has faced significant challenges in recent times. Retailers have had to deliver digital experiences and delivery models; navigate global supply chain disruptions; accommodate the remote work needs of their employees; and keep up with rapidly changing customer expectations. To remain competitive, many retailers have made significant investments in technology.

However, despite these investments, many retailers have struggled to create market differentiation. The need for innovation and constant evolution remains.

As retailers cope with hypersonalisation trends, supply chain vulnerabilities, and the rise of ESG consciousness, the industry is seeing several instances on innovation.

Read on to find out how brands such as Clinique, Gucci, Tommy Hilfiger, Nike, Woolworths, Prada, Levi Strauss, Mahsenei Hashuk and Instacart are using emerging technologies such as the Metaverse and Generative AI to create the much-needed market edge.

Download “The Future of Retail” as a PDF

It is true that the Retail industry is being forced to evolve the experiences they deliver to their customers. However, if Retail organisations are only focused on creating digital experiences, they are not creating the differentiation that will be required to leap ahead of the competition. It is time for Retail organisations to leverage data to empower multiple roles across the organisation to prepare for the different ways customers want to engage with their brands.

Another trend that is creating a shift in the industry is the rise of small and medium-sized retailers. Traditionally, larger retailers have made larger investments in technology – they simply had deeper pockets for the on-premise investments. However, with the rise of SaaS, size may no longer be such an advantage in Retail.

Here is how organisations such as Walmart, Adobe, GoDaddy and Google are empowering the SME retailer.

Since the start of this millennium, no region has transformed as much as Asia. There has been significant paradigm shifts in the region and the perception that innovation starts in the US or in Europe and percolates through to Asia after a time lag, has been shattered. Asia is constantly demonstrating how dynamic, and technology-focused it is. This is getting fueled by the impact of the growing middle class on consumerism and the spirit of innovation across the region. The region has also seen a surge in new and upcoming business leaders who are embracing change and looking beyond success to creating impact.

What is Driving Innovation in Asia?

The “If you ain’t got it, build it” attitude. One of the key drivers of this shift is the age of the average population in Asia. According to the UN the Asia Pacific region has nearly 60% of the world’s youth population (between the age of 17-24). With youth comes dynamism, a desire to change the world, and innovation. As this age group enters the workforce, they will transform their lives and the companies they work in. They are already showing a spirit of agility when it comes to solving challenges – they will build what they do not have.

The Need to enable Foundational Shifts. The younger generation is more aware of environmental, social and governance issues that the world continues to face. Many of the countries in the region are emerging economies, where these issues become more apparent. COVID-19 has also inculcated an empathy in people and they are thinking of future success in terms of impact. The desire to enable foundational shifts is giving direction to the transformation journey in the region. The wonderful new paradigm that is the Digital Economy allows us to cut across all segments; and technology and its advancements has immense potential to create a more sustainable and inclusive future for the world.

Realising the Power of Momentum. The pandemic has caused major disruptions in the region. But every crisis also presents an opportunity to perhaps re-imagine a brighter world through a digital lens. The other thing that the pandemic has done is made people and organisations realise that to succeed they need to be open to change – and that momentum is important. As organisations had to pivot fast, they realised what I have been saying for years – we shouldn’t “let perfect get in the way of better”. This adaptability and the readiness to fail fast and learn from the mistakes early for eventual success, is leading to faster and more agile transformation journeys.

Where are we seeing the most impact?

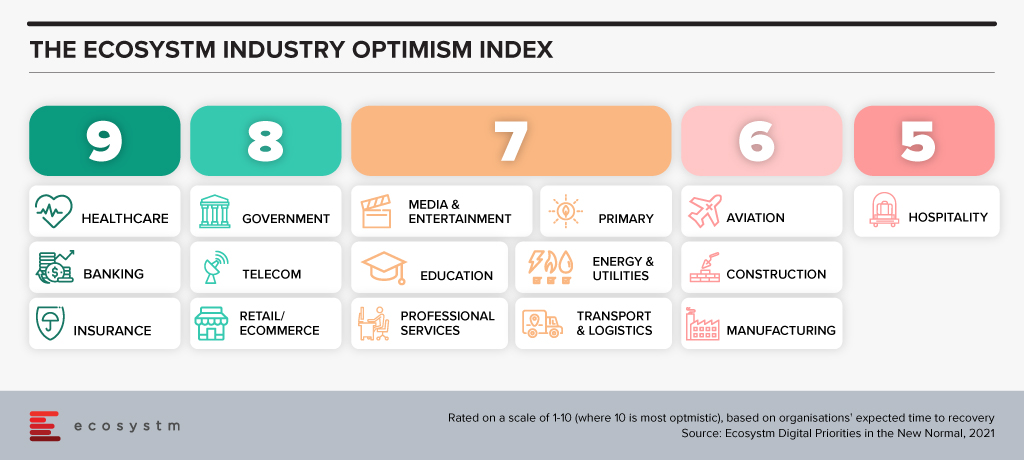

Industries are Transforming. There are industries such as Healthcare and Education that had to transform out of a necessity and urgency brought about by the COVID-19 pandemic. This has led to a greater impetus for change and optimism in these industries. These industries will continue to transform as governments focus significantly on creating “Social Safety Nets” and technology plays a key role in enabling critical services across Health, Education and Food Security. Then there are industries, such as the Financial Services and Retail, that had a strong customer focus and were well on their digital journeys before the pandemic. The pandemic boosted these efforts.

But these are not the only industries that are transforming. There are industries that have been impacted more than others. There are several instances of how organisations in these industries are demonstrating not only resilience but innovation. The Travel & Hospitality industry has had several such instances. As business models evolve the industry will see significant changes in digital channels to market, booking engines, corporate service offerings and others, as the overall Digital Strategy is overhauled.

Technologies are Evolving. Organisations depended on their tech partners to help them make the fast pivot required to survive and succeed in the last year – and tech companies have not disappointed. They have evolved their capabilities and continue to offer innovative solutions that can solve many of the ongoing business challenges that organisations face in their innovation journey. More and more technologies such as AI, machine learning, robotics, and digital twins are getting enmeshed together to offer better options for business growth, process efficiency and customer engagement. And the 5G rollouts will only accelerate that. The initial benefits being realized from early adoption of 5G has been for consumers. But there is a much bigger impact that is waiting to be realised as 5G empowers governments and businesses to make critical decisions at the edge.

Tech Start-ups are Flourishing. There are immense opportunities for technology start-ups to grow their market presence through innovative products and services. To succeed these companies need to have a strong investment roadmap; maintain a strong focus on customer engagement; and offer technology solutions that can fulfil the global needs of their customers. Technologies that promote efficiency and eliminate mundane tasks for humans are the need of the hour. However, as the reliance on technology-led transformation increases, tech vendors are becoming acutely aware that they cannot be best-in-class across the different technologies that an organisation will require to transform. Here is where having a robust partner ecosystem helps. Partnerships are bringing innovation to scale in Asia.

We can expect Asia to emerge as a powerhouse as businesses continue to innovate, embed technology in their product and service offerings – and as tech start-ups continue to support their innovation journeys.

Ecosystm CEO Amit Gupta gets face to face with Garrett Ilg, President Asia Pacific & Japan, Oracle to discuss the rise of the Asia Digital economies, the impact of the growing middle class on consumerism and the spirit of innovation across the region.

Woolworths have announced the adoption of a new Software-as-a-Service capability from One Door to support the quality and compliance of their in-store merchandising. There are some valuable lessons from this announcement for other retailers.

The power of data, particularly as the capability of specialist AI tools improves, continues to help retailers improve their offering to customers.

SaaS Capabilities Offer Performance Improvements

Woolworths are working on improving the compliance of product merchandising in-store using One Door Visual Merchandising solution.

One Door will improve the accuracy of data available to both the in-store teams and for the central supermarket merchandising team. The supply chain in Woolworths is already highly automated but getting the shelf presence right is dependent on the quality of data being captured. While store teams already use a range of electronic tools to capture this information, the compliance with store planograms and visual merchandising standards has been difficult to automate.

One Door’s solution provides a single source of this information in an easy to use digital format. The AI tools that One Door have developed appear to be able to show the degree of compliance of the actual shelf layout and stock position.

For store teams, One Door will simplify tracking layout changes by highlighting them and making the data available on the shop floor. This should deliver productivity benefits to the store – benefits that can be reinvested in new activities or on better customer service.

Store teams will be able to verify that third party merchandisers are compliant. Major product manufacturers often use their own merchandising teams in supermarkets and One Door will provide a simple mechanism to verify they have done their jobs properly.

The central merchandise teams will be able to quickly get data-driven feedback on how the stores are making planned changes, as well as verifying the quality of compliance with their store layouts.

All of these factors should mean that the product that is available in-store is presented in the manner that the merchandising teams have defined, and the customers will see a more consistent presentation of products.

Integration is Critical for Rapid Deployment

Effective integration with existing systems and new cloud capabilities is critical to support the real-time operation in Retail.

The ability to introduce and scale up new capabilities that can be delivered by cloud services such as One Door will only be effective if integration is simple and quick. This requires compatibility at a number of levels including data semantics and the ability to exchange data effectively. Woolworths have been growing their capability for managing and supporting APIs that will make this integration smoother.

In addition, the cloud service providers have made the development of integration capabilities an investment priority.

The introduction of One Door is showing how the company can integrate new capability and introduce it to almost 10% of their stores as a pilot capability, with the full deployment to be completed across their chain during 2022.

Other retailers who don’t have this capability to integrate cloud services quickly, reliably and cost-effectively are going to lag companies that have invested to achieve this capability.

CIOs and CDOs should be leading their organisations in the development of a rich and scalable set of APIs to enable the integration of this type of high-value specialised solution.

Deployment without Consistent Architectures will be Complex

Rapid deployment of new capabilities requires a well-architected cloud, network, and edge infrastructure – and a well-trained team.

It is highly likely that the deployment of the One Door solution will be delivered over the existing Woolworths infrastructure. The capability is delivered from the cloud, with little or no deployment costs or time required. With the existing network and hybrid cloud capabilities that Woolworths have developed this type of rollout will be a relatively simple technical activity.

The integration of the service into the Woolworths environment is likely to be the most complex activity to make sure accurate data is exchanged.

It doesn’t take long to identify a wide range of different digital initiatives that Woolworths are pursuing. With the platform that they have established, they are well-positioned to take advantage of new capabilities as start-ups and existing suppliers develop them.

Every retailer needs to maintain their focus on their digital capabilities. As companies such as One Door develop AI-based enhancements, CIOs and their teams need to be ready to integrate these capabilities quickly.

Strong architectures for both infrastructure and digital services are needed to achieve these outcomes.

Recommendations for Retailers

Retail organisations continue to find new ways to leverage the power of the data that they are able to collect. The flexibility that SaaS developments deliver will be essential to maintaining an organisation’s competitive positioning.

CIOs and their teams need to lead their organisations and ecosystems by:

- Identifying new SaaS capabilities that support the strategic positioning of their companies

- Preparing their environments by supporting a rich set of APIs to support the rapid integration of these new capabilities

- Developing and maintaining strong architectures that provide organisations a solid framework to develop within

Checkout Alan’s previous insight on Woolworths micro automation technology adopted to speed up the fulfilment of online grocery orders

Ecosystm research finds that more than 80% of retail providers had to start or re-calibrate their digital transformation initiatives in 2020. While retailers will continue to focus on the shift in customer expectations, a mere focus on customer experience will not be enough. In this Ecosystm Bytes, we discuss what Retailers should prioritise in the years ahead and where technology will help.

View the latest Ecosystm Bytes below, and reach out to our experts if you have questions.

Ecosystm Predicts: The Top 5 Retail & eCommerce Trends for 2021

Need more insight into 2021’s retail and eCommerce Industry trends? Ecosystm predictions explore how the industry is shaping and revamping the rules of retail in 2021. Learn more about our insights and trends on retail in 2021 below.

The ways we connect, create, collaborate in our workplaces has seen major shifts in the last year. And the tech industry has continually supported that shift as they create new capabilities and upgrade existing ones. Technology providers will continue to revamp their product offerings to support the increase in adoption of the hybrid work model work – a fusion of remote and in-office. In the Top 5 Future of Work Trends for 2021, Ecosystm had predicted, “Every major digital workspace provider (such as Microsoft, Google, Zoom, Cisco, AWS and so on) will broaden their digital workplace capabilities and integrate them more effectively, making them easier to procure and use. Instead of a “tool-centric” approach to getting work done (chat vs video vs document sharing vs online meetings vs whiteboards and so on), it will become a platform play.”

Ecosystm Principal Advisor, Ravi Bhogaraju says, “It is becoming clear that companies and individuals are grappling with three issues – the changing size and composition of the workforce; the productivity of those who are driving the businesses; and attracting, reskilling and engaging the broader workforce.” These are the challenges that tech providers will have to help organisations with.

Google Upgrades its Collaboration Platform

The Google Workspace was launched in October last year, and last week saw the tech giant announce a series of upgrades and innovations to better support the flexibility needs of frontline and remote workers.

Workspace is Google’s office productivity suite comprising video conferencing, cloud storage, collaboration tools, security and management controls built into a cohesive environment. The new features announced by Google Workspaces include Focus Time to avoid distractions by limiting notifications, recurring out-of-office and location indicators to make colleagues aware if the person is working from home or office, support for Google voice assistant in workplaces, second-screen experiences to support multiple devices, and features for frontline workers designed to help mobile employees collaborate and communicate better with the rest of the organisation. Google is also working on a trimmed down version of Google Workspace – Google Workspace Essentials – which will provide support for Chat, Jamboard, and Calendar. Workspace is estimated to have 2.6 billion monthly active users.

Bhogaraju says, “One of the issues that is fast emerging as significant is not just the employee experience or customer experience but the complexity of the digital workplace as platforms introduce newer and advanced features. In the end, there has to be simplicity, clarity, and a clear focus on the goals – not just an overload of features that makes life more complex for the employee. It would be critical to enable these features thoughtfully and reskill staff adequately so that the adoption and impact to business process is felt in their day-to-day activities.”

Workspace Transformation across Industries

With many of Google’s employees and developers working remotely, the company has first-hand experience of the challenges of remote working and is leveraging the experience. Google Workspace is also working on custom solutions for various industries. In Retail for example, Woolworths, rolled out Google Workspace and Chrome for geographically dispersed teams to collaborate in real-time and adopt custom-made applications linked to global servers to allow managers to log and address tickets from the shop floor itself. Similarly in Aviation, All Nippon Airways uses Google Workspace to allow pilots, cabin attendants, HR and finance staff to communicate and collaborate in real-time across the globe, using Google Meet, Google Docs, Google Sheets and Google Slides from their PCs, smartphones or tablets. Google retains its focus on the Education industry – Google Workspace Education Fundamentals is free for all qualifying institutions. Solutions such as Google’s Classroom, Teach from Anywhere hub, roster sync, mobile grading and EdTech tools aim to enable better learning and teaching experience for students and educators.

Tech Companies Revamping their Collaboration Offerings

With more companies rethinking their work policies, leaders in the collaboration space are also stepping up their game to evolve their offerings for the hybrid norm. Microsoft’s Viva unifies the experience across Teams and Microsoft 365 for employee communications, wellbeing, learning and knowledge discovery. Similarly, Zoom too has upgraded and integrated various utility, sharing, and management features to support a hybrid workforce. Tech companies are being forced to invest in creating next-generation tools to stay relevant, as Future of Work models continue to shift and evolve.

As tech companies evolve their capabilities, Bhogaraju warns organisations on how they should leverage them. “While technology companies continue to deliver feature rich suites – in reality the uptake and embedding of these programs into the day-to-day business processes is still in its early stages. Business, HR and IT teams continue to struggle. They tend to operate within independent thought silos and there is limited consensus on which feature is really needed and how it can add to the productivity and efficiency. Without this crucial context and an effective change management program – they remain rich features and not impactful ones.”

The hybrid workplace model is gaining popularity in 2021. Check out Ecosytsm’s top 5 Future of Work Trends For 2021. Signup for Free to download the report.

Microsoft introduced a second Vertical Cloud offering, last week – this time turning the focus on Retail, after having launched Microsoft Cloud for Healthcare in October 2020.

The Microsoft Cloud for Retail aims to offer integrated and intelligent capabilities to retailers and brands to improve their end-to-end customer journey. It brings industry-specific capabilities to the Microsoft suite including Microsoft Azure, Microsoft Power Platform, Microsoft 365, and Microsoft Dynamics 365 – and is aimed at the growing need for “intelligent retail’. Microsoft’s partner ecosystem will also be involved in the new platform to address challenges in the sector and future proof the retail evolution.

In The Top 5 Retail & eCommerce Trends for 2021, Ecosystm notes that while retailers will focus on the shift in customer expectations, a mere focus on customer experience will not be enough this year. From the customer experience angle, they will strongly focus on omnichannel, catering to ‘glocal’ consumption, using location-based services, and improving both their onsite and online customer experience. They will also have to work on their supply chain and pricing capabilities, as distribution woes continue. These trends are seeing a deeper need for transformational technologies and leading cloud providers are introducing solutions targeted at the industry. Google has introduced its cloud retail solutions aiming to help retailers get more from data. Similarly, AWS has cloud offerings for the retail industry leveraging its retail domain experience and cloud deployment services.

Ecosystm Comments

“Global cloud vendors continue to “move up the stack” to provide more of the technology landscape for organisations. The focus of these tech giants is on adding unique value to customers by tailoring the combination of the different cloud services they can provide to specific industries. Providing the full-stack will mean higher customer retention rates – as the implementation time should be lower than traditional on-premises implementations. Microsoft has a diverse range of capabilities. Having a software company and implementation partner that can deliver the full stack of technology and business processes should improve the time to value for organisations.

But I see three key difficulties in implementing systems such as these:

- People adapting effectively to use the new processes

- Migrating enough high-quality data to leverage the new capabilities

- Integrating the new capabilities into an organisation’s existing landscape.

This is why it is likely that initial use will come from Microsoft’s existing Retail customers as they expand the range of services they use. New adopters of these Microsoft solutions will find that much of the complexity and cost of implementing a new business solution will remain.

However, these value-added cloud services open access to smaller organisations. If Microsoft is able to work with their partners to simplify the implementation of these capabilities, it will allow smaller organisations to access these complex capabilities affordably.“

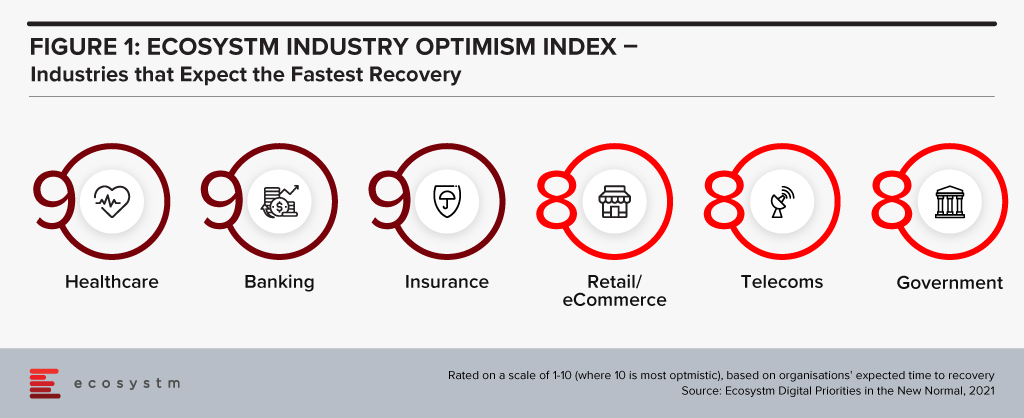

“The Ecosystm Digital Priorities in the New Normal Study aims to determine how optimistic industries are about successfully negotiating these uncertain times (Figure 1). The industries that are rated the most optimistic fall into two clear categories. In the first category, there are industries, such as Healthcare that had to transform urgently – mostly in an unplanned manner. This has led to a greater appetite for change and optimism in these industries. Then there are industries, such as Retail, that had some time to re-focus their technology roadmap when the crisis hit. These industries have a strong customer focus and had started their digital journeys before the pandemic.

Microsoft’s industry focus appears to be spot-on. Their first two vertical clouds target enterprises that have had to – and will continue to – pivot. The ‘modular’ approach taken in the Microsoft Cloud for Healthcare offering allows providers to choose the right capability for their organisation – whether it is workflow automation, patient engagement through virtual health, collaboration within care teams or better clinical and operational insights. As healthcare organisations across the world negotiate the challenges of mass vaccination, they may well find themselves leveraging these industry-specific capabilities as they revamp their workflows, processes, and data use.”

Get to know the right research, insights and technologies for you to be one step ahead in this new world of retail in our top 5 retail trends for 2021 that represent the most significant shifts in 2021

2020 has seen extreme disruption – and fast. The socio-economic impact will probably outlast the pandemic, but several industries have had to transform themselves to survive during these past months and to walk the path to recovery.

Against this backdrop, the Retail industry has been impacted early due to supply chain disruptions, measures such as lockdowns and social distancing, demand spikes in certain products (and diminished demands in others) and falling margins. Moreover, it is facing changed consumer buying behaviour. In the short-term consumers are focusing on essential retail and conservation of cash. The impact does not end there – in the medium and long term, the industry will face consumers who have acquired digital habits including buying directly from home through eCommerce platforms. They will expect a degree of digitalisation from retailers that the industry is not ready to provide at the moment. This raises the question on how they should transform to adapt to the New Normal and what could be a potential game-changer for them.

Translating Business Needs into Technology Capabilities

In his report, The Path to Retail’s New Normal, Ecosystm Principal Advisor, Kaushik Ghatak says, “Satisfying their old consumers, now set in their new ways, should be the ‘mantra’ for the retailers in order to survive in the New Normal.” To be able to do so they have to evaluate what their new business requirements are and translate them into technological requirements. Though it may sound simple, it may prove to be harder than usual to identify their evolving business requirements. This is especially difficult because even before the pandemic, the Retail industry was challenged with consumers who are becoming increasingly demanding, providing enhanced customer experience (CX), offering more choices and lowering prices. The market was already extremely competitive with large retailers fighting for market consolidation and smaller and more nimble retailers trying to carve out their niche.

In the New Normal, retailers will struggle to retain and grow their customer base. They will also have to focus aggressively on cost containment. A robust risk management process will become the new reality. But above all else, they will have to innovate – in their product range as well as in their processes. These are all areas where technology can help them. This can come in the form of technology partnerships, adopting hybrid models, increased usage of technology across all channels and investing in reskilling or upskilling the technology capabilities of employees.

Re-evaluating the Supply Chain

One of the first business operation to get disrupted by the current crisis was the supply chain. Ecosystm Principal Advisor, Alea Fairchild says, “Retailers are finding themselves at the front-end of the broken supply chain in the current situation and there is an enormous gap between suppliers and buyers. Retailers will have to aim to combine inventory with local sourcing and become agile and adopt change quickly. This will highlight to them the importance of transparency of information, traceability, and information flow of goods.”

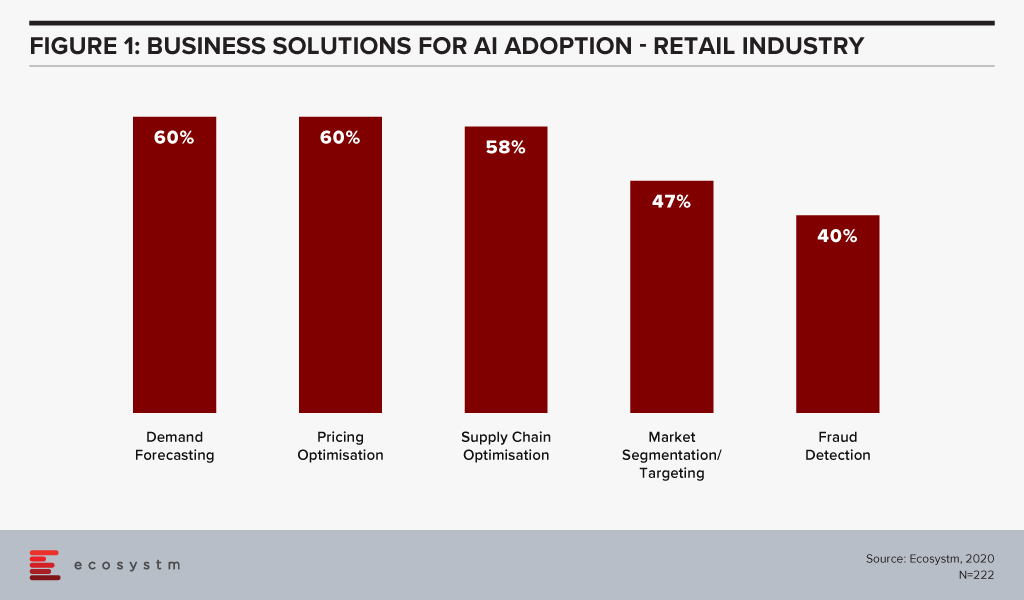

Ecosystm research shows that supply chain optimisation and demand forecasting among the top 5 business solutions that firms in Retail consider using AI for (Figure 1).

“In the New Normal, consumers are going to demand the same level of perfection that they have received and at the same cost. In order to make that possible, at the right time and at a lower cost, automation has to be implemented to improve the supply chain process, fulfill expectations and enhance visibility,” says Ghatak. “Providing differentiated CX is intimately dependent upon an aligned, flexible and efficient supply chain. Retailers will not only need to innovate at the store (physical or online) level and offer more innovative products – they will also need to have a high level of innovation in their supply chain processes.”

Digital Transformation in the Retail Industry

Ecosystm research reveals that only about 34% of global retailers had considered themselves to be digital-ready to face the challenges of the New Normal, before the pandemic. The vast majority of them admit that they still have a long way to go.

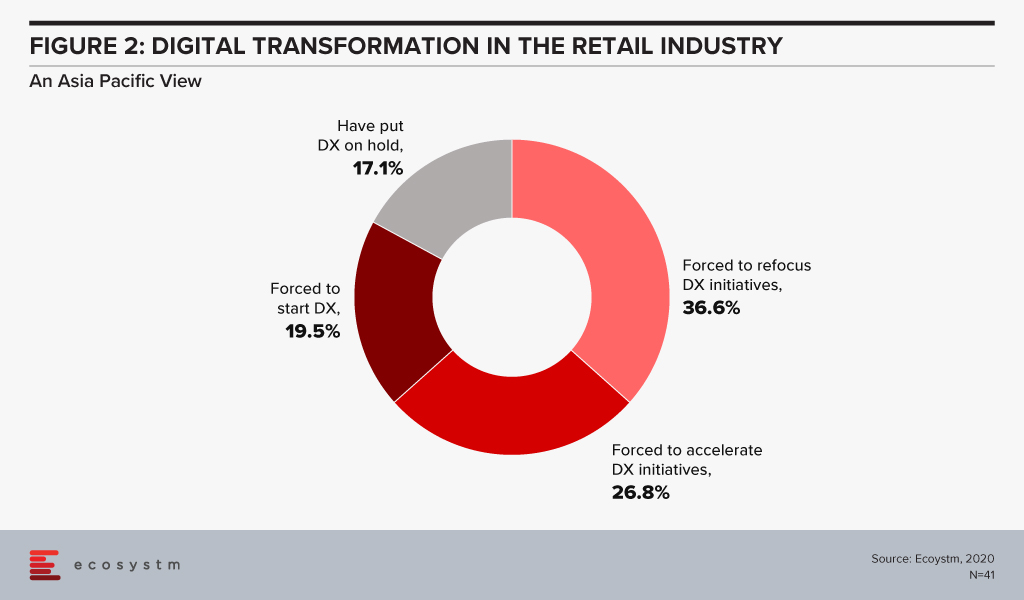

With COVID-19, the timeframes for digitalisation have imploded for most retailers. The study to evaluate the Digital Priorities in the New Normal reveals that in Asia Pacific nearly 83% of retailers have been forced to start, accelerate or refocus their Digital Transformation (DX) initiatives (Figure 2).

So, what technology areas will Retail see increased adoption oF?

Fairchild sees retailers adopt IoT, mobility, AI and solutions that deliver personalised experiences such as push notifications. What they are likely to do is blend different aspects of their physical and virtual environment to create a solution for customers. “To address in-store processing, hygiene, safety standards and compliance requirements, retailers will change their processes through a combination of resources, KPIs, automation, task management software and switching the information flow.”

Ghatak thinks automation has a significant role to play in improving both CX and the supply chain. “This is also an opportunity for retailers – both online and in-store – to create a solution experience where technologies such as Augment/Virtual Reality (AR/VR) can help. While retailers are adopting these technologies, with 5G rollouts, there is potential that the adoption will implode in a short time-frame.”

Those retailers that are not re-evaluating their business models and technology investments now will find themselves unprepared to handle the customer expectations when the global economy opens up.