We are increasingly seeing digital becoming a priority as governments look at socio-economic recovery. It is not just imperative that countries push the adoption of digital technologies – the crisis has also presented an opportunity for them to do so. In March this year, when governments across the world had started announcing stimulus packages designed to keep the economy afloat, Ecosystm Principal Advisor Tim Sheedy had said in his blog, Government Should Focus Coronavirus Stimulus on Digital Initiatives, “Good stimulus packages will have a broad impact but also drive improved business and employment outcomes. Stimulus packages have an opportunity to drive change – and the COVID-19 virus has shown that some businesses are not well equipped for the digital era.”

The pandemic has fast demonstrated the power of being aligned to the digital economy. Ecosystm CEO Amit Gupta says, “Organisations that were digital-ready were able to manage their business continuity almost immediately in enabling a remote workforce. The transfer was almost seamless for such businesses as the teams had already imbibed the principles of remote collaboration and were already familiar with tools that enable collaboration and communication. For many of these organisations, it was almost a matter of employees packing up their work-issued laptop and heading home.”

“In addition, those that were fully digitalised were better prepared to continue not only interacting with their clients remotely but also in many cases were able to deliver their offerings to their customers through their website or mobile apps.”

Gupta also notes that Ecosystm research shows that before the COVID-19 outbreak only about 35% of SMEs considered themselves ready for the digital economy, compared to half of the large enterprises. “This needs to change – and change fast!”

Singapore’s Digital Government Blueprint

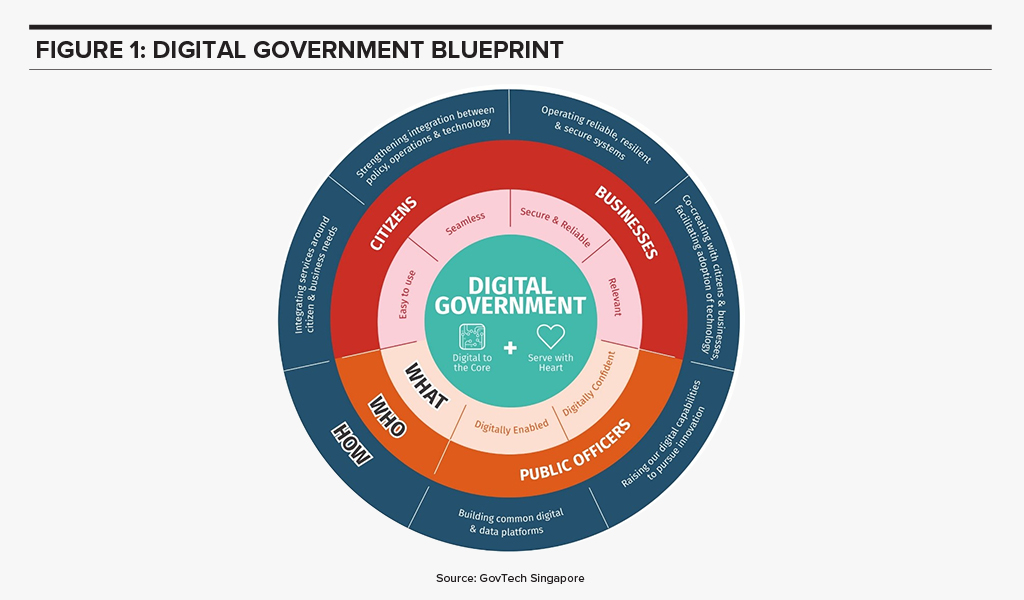

In Singapore’s Digital Government Blueprint that supports its Smart Nation vision, digitalisation is positioned as a key pillar for public service transformation. The focus for business stakeholders in this journey includes co-creating and facilitating the adoption of technologies (Figure 1).

Small and medium enterprises (SMEs) often struggle with going digital because of lack of resources – both financial and skills – and vision. In a country such as Singapore, where SMEs are estimated to account for 99% of all enterprises and 77% of employment, it is imperative that the Digital Economy vision includes a special focus on them.

Gupta says, “Despite significant incentives, there has been resistance from SMEs to go digital as it still involves time and monetary investment from them. The need to retrain and upskill their teams is also a perceived roadblock to the uptake.”

Singapore Empowering SMEs to go Digital

As the Government looks to open the economy up in a phased manner, it sees this as the right opportunity to make SMEs digital-ready. It is “seizing the moment” and has established the SG Digital Office (SDO) in an effort to enable every individual, worker and business to go digital. Initiatives include the recruitment and deployment of 1,000 Digital Ambassadors by end June to provide personalised as well as small group support to seniors and owners of local eateries, who require additional assistance to adopt digital solutions and technology.

In 2018, the Monetary Authority of Singapore (MAS) and Infocomm Media Development Authority (IMDA) had launched SGQR to unify the fragmented e-payment landscape in the country, making it compatible with 27 payment schemes. The SDO aims to drive SMEs (especially in the F&B sector) to adopt SGQR codes for e-payments. The goal is to engage 18,000 stallholders of local eateries (hawker centres, wet markets, coffee shops and industrial canteens) to have the unified e-payment solution by June 2021. Further, multiple government agencies – IMDA, National Environment Agency (NEA), Jurong Town Corporation, Housing Development Board (HDB) and Enterprise Singapore – come together to offer a bonus of SGD 300 per month over five months to encourage more F&B SMEs to adopt e-payments.

“Financial Inclusion is one of the mainstays of a progressive economy. Given the significant investment that has gone into the e-payments infrastructure by government agencies led by MAS, we are placed well compared to other nations,” says Gupta. “However, there is work to be done in certain demographics and sectors. The drive to support F&B outlets and local eateries to get on the bandwagon will be an exceptional step and will be well received by consumers.”

“There are only a handful of governments that can compare with what the Singapore Government has put in place when it comes to initiatives to drive the uptake of technology by SMEs. This current crisis may well become the catalyst for SMEs to recognise the urgency of getting digital-ready and they should use this as an opportunity to leverage the government support around technology adoption and emerge as digital-savvy organisations.”