It’s been barely one year since we entered the Generative AI Age. On November 30, 2022, OpenAI launched ChatGPT, with no fanfare or promotion. Since then, Generative AI has become arguably the most talked-about tech topic, both in terms of opportunities it may bring and risks that it may carry.

The landslide success of ChatGPT and other Generative AI applications with consumers and businesses has put a renewed and strengthened focus on the potential risks associated with the technology – and how best to regulate and manage these. Government bodies and agencies have created voluntary guidelines for the use of AI for a number of years now (the Singapore Framework, for example, was launched in 2019).

There is no active legislation on the development and use of AI yet. Crucially, however, a number of such initiatives are currently on their way through legislative processes globally.

EU’s Landmark AI Act: A Step Towards Global AI Regulation

The European Union’s “Artificial Intelligence Act” is a leading example. The European Commission (EC) started examining AI legislation in 2020 with a focus on

- Protecting consumers

- Safeguarding fundamental rights, and

- Avoiding unlawful discrimination or bias

The EC published an initial legislative proposal in 2021, and the European Parliament adopted a revised version as their official position on AI in June 2023, moving the legislation process to its final phase.

This proposed EU AI Act takes a risk management approach to regulating AI. Organisations looking to employ AI must take note: an internal risk management approach to deploying AI would essentially be mandated by the Act. It is likely that other legislative initiatives will follow a similar approach, making the AI Act a potential role model for global legislations (following the trail blazed by the General Data Protection Regulation). The “G7 Hiroshima AI Process”, established at the G7 summit in Japan in May 2023, is a key example of international discussion and collaboration on the topic (with a focus on Generative AI).

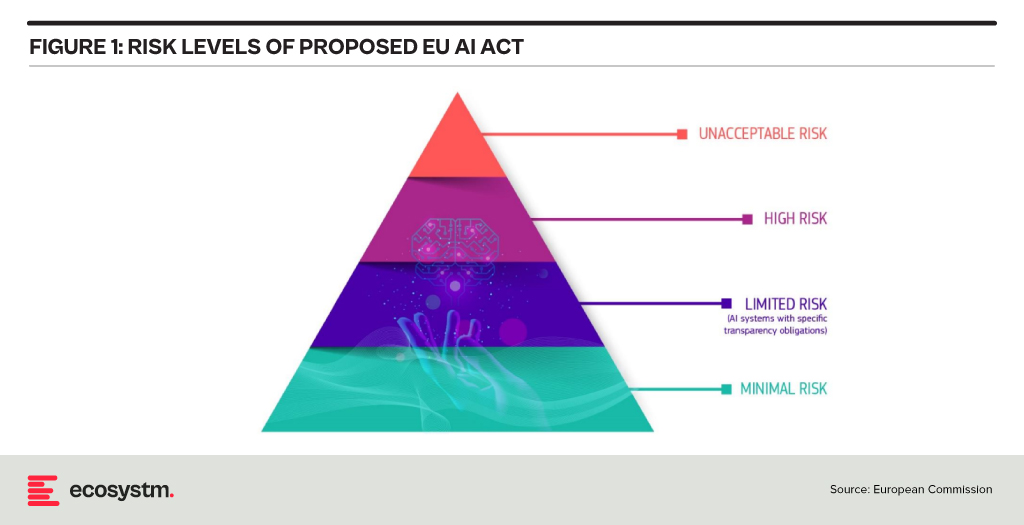

Risk Classification and Regulations in the EU AI Act

At the heart of the AI Act is a system to assess the risk level of AI technology, classify the technology (or its use case), and prescribe appropriate regulations to each risk class.

For each of these four risk levels, the AI Act proposes a set of rules and regulations. Evidently, the regulatory focus is on High-Risk AI systems.

Contrasting Approaches: EU AI Act vs. UK’s Pro-Innovation Regulatory Approach

The AI Act has received its share of criticism, and somewhat different approaches are being considered, notably in the UK. One set of criticism revolves around the lack of clarity and vagueness of concepts (particularly around person-related data and systems). Another set of criticism revolves around the strong focus on the protection of rights and individuals and highlights the potential negative economic impact for EU organisations looking to leverage AI, and for EU tech companies developing AI systems.

A white paper by the UK government published in March 2023, perhaps tellingly, named “A pro-innovation approach to AI regulation” emphasises on a “pragmatic, proportionate regulatory approach … to provide a clear, pro-innovation regulatory environment”, The paper talks about an approach aiming to balance the protection of individuals with economic advancements for the UK on its way to become an “AI superpower”.

Further aspects of the EU AI Act are currently being critically discussed. For example, the current text exempts all open-source AI components not part of a medium or higher risk system from regulation but lacks definition and considerations for proliferation.

Adopting AI Risk Management in Organisations: The Singapore Approach

Regardless of how exactly AI regulations will turn out around the world, organisations must start today to adopt AI risk management practices. There is an added complexity: while the EU AI Act does clearly identify high-risk AI systems and example use cases, the realisation of regulatory practices must be tackled with an industry-focused approach.

The approach taken by the Monetary Authority of Singapore (MAS) is a primary example of an industry-focused approach to AI risk management. The Veritas Consortium, led by MAS, is a public-private-tech partnership consortium aiming to guide the financial services sector on the responsible use of AI. As there is no AI legislation in Singapore to date, the consortium currently builds on Singapore’s aforementioned “Model Artificial Intelligence Governance Framework”. Additional initiatives are already underway to focus specifically on Generative AI for financial services, and to build a globally aligned framework.

To Comply with Upcoming AI Regulations, Risk Management is the Path Forward

As AI regulation initiatives move from voluntary recommendation to legislation globally, a risk management approach is at the core of all of them. Adding risk management capabilities for AI is the path forward for organisations looking to deploy AI-enhanced solutions and applications. As that task can be daunting, an industry consortium approach can help circumnavigate challenges and align on implementation and realisation strategies for AI risk management across the industry. Until AI legislations are in place, such industry consortia can chart the way for their industry – organisations should seek to participate now to gain a head start with AI.

Technology is reshaping the Public Sector worldwide, optimising operations, improving citizen services, and fostering data-driven decision-making. Government agencies are also embracing innovation for effective governance in this digital era.

Public sector organisations worldwide recognise the need for swift and agile interventions. With citizen expectations resembling those of commercial customers, public sector organisations face mounting pressure to break down the barriers to provide seamless service experiences.

Read on to find out how public sector organisations in countries such as Australia, Vietnam, the Philippines, South Korea, and Singapore are innovating to stay ahead of the curve; and what Ecosystm VP Consulting, Peter Carr sees as the Future of Public Sector.

Click here to Download ‘The Future of the Public Sector’ as a PDF

Healthcare has transformed rapidly in the last few years – processes have become more agile; clinicians, administrative staff, and patients have changed their views on how healthcare can and should be delivered; and there is a greater reliance on technology today.

Despite challenges such as healthcare inequality and limited access to care for underserved populations, the future of Healthcare looks promising.

We will see continued advancements in technology, increased collaboration between healthcare providers and patients, and a clear shift in focus on preventative care.

Read on to find out how South Australia Health, Tan Tock Seng Hospital in Singapore, Montana State University and Billings Clinic, Microsoft, Epic, Zuellig Pharma, and iHIS Singapore are innovating to improve patient and employee experiences and clinical outcomes.

Download “The Future of Healthcare” as a PDF

Southeast Asia has evolved into an innovation hub with Singapore at the centre. The entrepreneurial and startup ecosystem has grown significantly across the region – for example, Indonesia now has the 5th largest number of startups in the world.

Organisations in the region are demonstrating a strong desire for tech-led innovation, innovation in experience delivery, and in evolving their business models to bring innovative products and services to market.

Here are 5 insights on the patterns of technology adoption in Southeast Asia, based on the findings of the Ecosystm Digital Enterprise Study, 2022.

- Data and AI investments are closely linked to business outcomes. There is a clear alignment between technology and business.

- Technology teams want better control of their infrastructure. Technology modernisation also focuses on data centre consolidation and cloud strategy

- Organisations are opting for a hybrid multicloud approach. They are not necessarily doing away with a ‘cloud first’ approach – but they have become more agnostic to where data is hosted.

- Cybersecurity underpins tech investments. Many organisations in the region do not have the maturity to handle the evolving threat landscape – and they are aware of it.

- Sustainability is an emerging focus area. While more effort needs to go in to formalise these initiatives, organisations are responding to market drivers.

More insights into the Southeast Asia tech market below.

Click here to download The Future of the Digital Enterprise – Southeast Asia as a PDF