The 2021 United Nations Climate Change Conference (COP26, that was held in Glasgow in 2021, highlighted the need to mobilise public and private sector finance to support global net-zero emissions targets and to protect communities and habitats.

Sustainable Finance and Green Bonds present opportunities for lenders, investors, and borrowers. It allows borrowers to obtain funding at decreased and competitive costs. And as investor demands continue to rise, Government institutions have expressed keen interest in issuing green bonds to support ecologically beneficial initiatives.

Here are some recent global announcements.

- France announces the issuance of USD 4 billion green bond sale.

- Germany raises USD 4 billion in green bonds to finance green expenditures and investments.

- Singapore sets a roadmap for its first sovereign green bond with the Singapore Green Bond Framework.

- Austria launches its first green bond.

- The UK launches an inquiry into the role of the financial sector in the country’s net zero transition.

Download Building a Climate Resilient Future with Sustainable Finance as a PDF

Innovation is at the core of Singapore’s ethos. The country has perfected the art of ‘structured innovation’ where pilots and proof of concepts are introduced and the successful ones scaled up by recalibrating technology, delivery systems, legislation, and business models. The country has adopted a similar approach to achieving its sustainability goals.

The Singapore Green Plan 2030 outlines the strategies to become a sustainable nation. It is driven by five ministries: Education, National Development, Sustainability and the Environment, Trade and Industry, and Transport, and includes five key pillars: City in Nature, Sustainable Living, Energy Reset, Green Economy, and Resilient Future. We will see a slew of new programs and initiatives in green finance, sustainability, solar energy, electric vehicles (EVs), and innovation, in the next couple of years.

Singapore’s Intentions of Becoming a Green Finance Leader

Singapore is serious about becoming a world leader in green finance. The Green Bonds Programme Office was set up last year, to work with statutory boards to develop a framework along with industry and investor stakeholders. We have seen a number of sustainable finance initiatives last year, such as the National Environment Agency (NEA) collaborating with DBS to raise USD 1.23 billion from its first green bond issuance. The proceeds will fund new and ongoing sustainable waste management initiatives. Temasek collaborated with HSBC for a USD 110 million debt financing platform for sustainable projects and Sembcorp issued sustainability bonds worth USD 490 million.

Building an Ecosystm of Sustainable Organisations

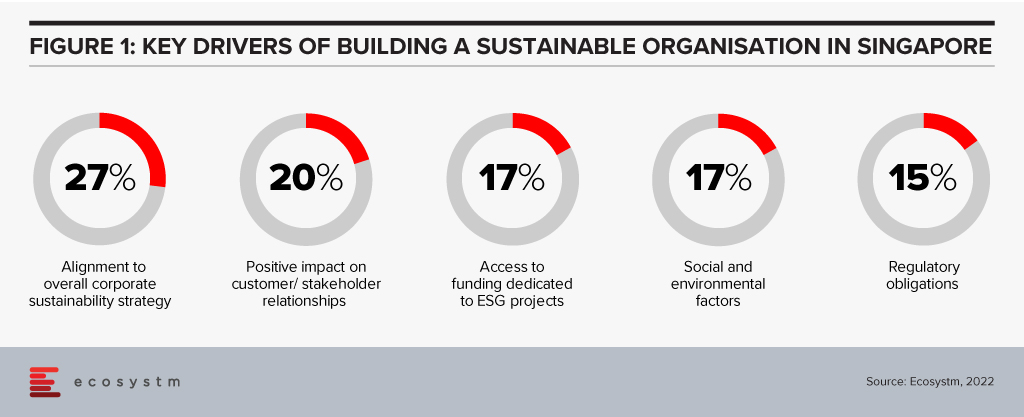

Sustainability has to be a collective goal that will require governments to work with enterprises, investors and consumers. To ensure that enterprises are focusing on Sustainability, governments have to keep in mind what drives these initiatives and the challenges organisations face in achieving their goals.

There are several reasons driving organisations in Singapore to adopt sustainability goals and ESG responsibilities (Figure 1)

It is equally important to address organisations’ challenges in building sustainability in their business processes. Last week, the Institute of Banking and Finance (IBF) and the Monetary Authority of Singapore (MAS) set out 12 Sustainable Finance Technical Skills and Competencies (SF TSCs) required by people in various roles in sustainable finance. This addresses the growing demand for sustainable finance talent in Singapore; and covers knowledge areas such as climate change policy developments, natural capital, green taxonomies, carbon markets and decarbonisation strategies. There are Financial Services related competencies as well, such as sustainability risk management, sustainability reporting, sustainable investment management, and sustainable insurance and reinsurance solutions. The SF TSCs are part of the IBF Skills Framework for Financial Services.

Sustainable Resources Initiatives

Singapore is not only focused on Sustainable Finance. If we look at NEA’s Green Bonds, there are specific criteria that projects must satisfy in order to qualify, including a focus on sustainable waste management.

Last week the Government announced that the National Research Fund (NRF) will allocate around USD 160 million to drive new initiatives in water, reuse and recycling technologies, as part of the Research, Innovation and Enterprise 2025 plan (RIE2025). Part of the fund will be allocated to the Closing the Resource Loop (CTRL) initiative, administered by the NEA that will fund sustainable resource recovery solutions.

Singapore faces severe resource constraints, and water security is not a new challenge for the country. The NRF funding will also be used partially for R&D in 3 water technology focus areas: desalination and water reuse; used water treatment; and waste reduction and resource recovery.

The Government is Leading the Way

The Government’s concerted efforts to make the Singapore Green Plan 2030 a success is seeing corporate participation in the vision. In February, Shell started supplying sustainable aviation fuel (SAF) to customers such as SIA Engineering Company and the Singapore Air Force in Singapore. Shell has also upgraded their Singapore facility to blend SAF at multiple, key locations. Last week, Atlas announced their commitment to Web 3.0 technologies and “tech for good”. They aim to increase their green energy use to 75% by 2022; 90% by 2023; and 100% by 2024. ESG consciousness is percolating down from the Government.

The success of Singapore’s Sustainability strategies will depend on innovation, the Government’s ongoing commitment, and the support provided to enterprises, investors, and consumers. The Singapore Government is poised to lead from the front in building a Sustainable Ecosystem.

Earlier this month, I had the privilege of attending Oracle’s Executive Leadership Forum, to mark the launch of the Oracle Cloud Singapore Region. Oracle now has 34 cloud regions worldwide across 17 countries and intends to expand their footprint further to 44 regions by the end of 2022. They are clearly aiming for rapid expansion across the globe, leveraging their customers’ need to migrate to the cloud. The new Singapore region aims to support the growing demand for enterprise cloud services in Southeast Asia, as organisations continue to focus on business and digital transformation for recovery and future success.

Here are my key takeaways from the session:

#1 Enabling the Digital Futures

The theme for the session revolved around Digital Futures. Ecosystm research shows that 77% of enterprises in Southeast Asia are looking at technology to pivot, shift, change and adapt for the Digital Futures. Organisations are re-evaluating and accelerating the use of digital technology for back-end and customer workloads, as well as product development and innovation. Real-time data access lies at the backbone of these technologies. This means that Digital & IT Teams must build the right and scalable infrastructure to empower a digital, data-driven organisation. However, being truly data-driven requires seamless data access, irrespective of where they are generated or stored, to unlock the full value of the data and deliver the insights needed. Oracle Cloud is focused on empowering this data-led economy through data sovereignty, lower latency, and resiliency.

The Oracle Cloud Singapore Region brings to Southeast Asia an integrated suite of applications and the Oracle Cloud Infrastructure (OCI) platform that aims to help run native applications, migrate, and modernise them onto cloud. There has been a growing interest in hybrid cloud in the region, especially in large enterprises. Oracle’s offering will give companies the flexibility to run their workloads on their cloud and/or on premises. With the disruption that the pandemic has caused, it is likely that Oracle customers will increasingly use the local region for backup and recovery of their on-premises workloads.

#2 Partnering for Success

Oracle has a strong partner ecosystem of collaboration platforms, consulting and advisory firms and co-location providers, that will help them consolidate their global position. To begin with they rely on third-party co-location providers such as Equinix and Digital Realty for many of their data centres. While Oracle will clearly benefit from these partnerships, the benefit that they can bring to their partners is their ability to build a data fabric – the architecture and services. Organisations are looking to build a digital core and layer data and AI solutions on top of the core; Oracle’s ability to handle complex data structures will be important to their tech partners and their route to market.

#3 Customers Benefiting from Oracle’s Core Strengths

The session included some customer engagement stories, that highlight Oracle’s unique strengths in the enterprise market. One of Oracle’s key clients in the region, Beyonics – a precision manufacturing company for the Healthcare, Automotive and Technology sectors – spoke about how Oracle supported them in their migration and expansion of ERP platform from 7 to 22 modules onto the cloud. Hakan Yaren, CIO, APL Logistics says, “We have been hosting our data lake initiative on OCI and the data lake has helped us consolidate all these complex data points into one source of truth where we can further analyse it”.

In both cases what was highlighted was that Oracle provided the platform with the right capacity and capabilities for their business growth. This demonstrates the strength of Oracle’s enterprise capabilities. They are perhaps the only tech vendor that can support enterprises equally for their database, workloads, and hardware requirements. As organisations look to transform and innovate, they will benefit from the strength of these enterprise-wide capabilities that can address multiple pain points of their digital journeys.

#4 Getting Front and Centre of the Start-up Ecosystem

One of the most exciting announcements for me was Oracle’s focus on the start-up ecosystem. They make a start with a commitment to offer 100 start-ups in Singapore USD 30,000 each, in Oracle Cloud credits over the next two years. This is good news for the country’s strong start-up community. It will be good to see Oracle build further on this support so that start-ups can also benefit from Oracles’ enterprise offerings. This will be a win-win for Oracle. The companies they support could be “soonicorns” – the unicorns of tomorrow; and Oracle will get the opportunity to grow their accounts as these companies grow. Given the momentum of the data economy, these start-ups can benefit tremendously from the core differentiators that OCI can bring to their data fabric design. While this is a good start, Oracle should continue to engage with the start-up community – not just in Singapore but across Southeast Asia.

#5 Commitment to Sustainability at the Core of the Digital Futures

Another area where Oracle is aligning themselves to the future is in their commitment to sustainability. Earlier this year they pledged to power their global operations with 100% renewable energy by 2025, with goals set for clean cloud, hardware recycling, waste reduction and responsible sourcing. As Jacqueline Poh, Managing Director, EDB Singapore pointed out, sustainability can no longer be an afterthought and must form part of the core growth strategy. Oracle has aligned themselves to the SG Green Plan that aims to achieve sustainability targets under the UN’s 2030 Sustainable Development Agenda.

Cloud infrastructure is going to be pivotal in shaping the future of the Digital Economy; but the ability to keep sustainability at its core will become a key differentiator. To quote Sir David Attenborough from his speech at COP26, “In my lifetime, I’ve witnessed a terrible decline. In yours, you could and should witness a wonderful recovery”

Conclusion

Oracle operates in a hyper competitive world – AWS, Microsoft and Google have emerged as the major hyperscalers over the last few years. With their global expansion plans and targeted offerings to help enterprises achieve their transformation goals, Oracle is positioned well to claim a larger share of the cloud market. Their strength lies in the enterprise market, and their cloud offerings should see them firmly entrenched in that segment. I hope however, that they will keep an equal focus on their commitment to the start-up ecosystem. Most of today’s hyperscalers have been successful in building scale by deeply entrenching themselves in the core innovation ecosystem – building on the ‘possibilities’ of the future rather than just on the ‘financial returns’ today.

It is estimated that nearly 1.7 billion adults remain unbanked globally. Besides the unbanked there are large sections of the world that are underbanked or underserved because of geographical, educational and gender divides. And then there are the entrepreneurs and small and medium enterprises that find it harder to secure funds.

There are several ongoing initiatives by policy organisations, governments, corporates and FinTechs that aim to fulfil the goal of creating an inclusive world.

This Ecosystm Snapshot looks at some recent examples from central banks such as MAS, RBI, BSP Philippines, the Royal Monetary Authority of Bhutan; financial services providers such as Mastercard and Citi; and FinTechs such as Microchip Payments and Sempo.

To download this VendorSphere as a PDF for easier sharing, please click here.

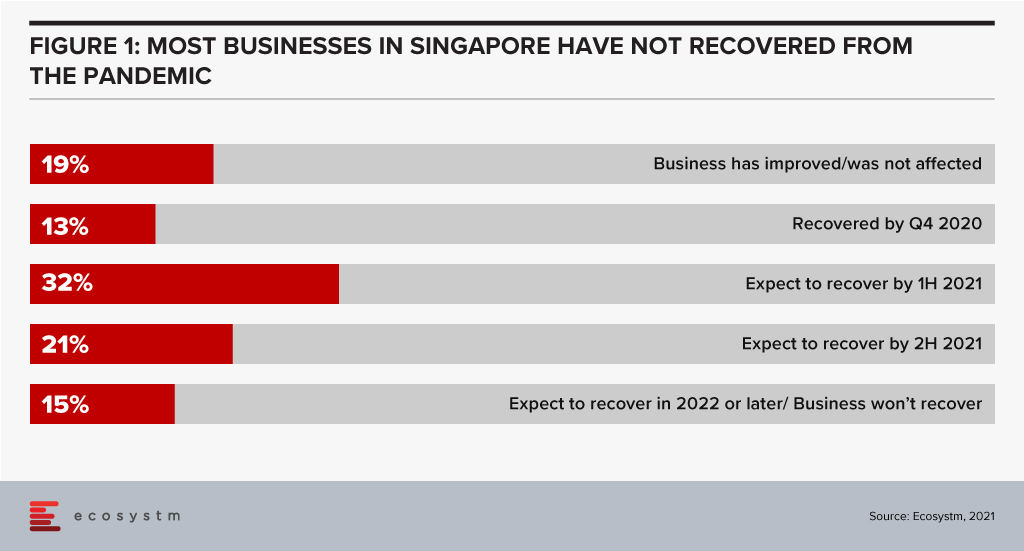

The past twelve months have been tough. Most businesses in Singapore (68%) still haven’t seen revenue recover to pre-pandemic levels. Many budgets are down and you are likely to have a long list of spending options that might help you grow revenue and pull your business out of the pandemic-induced slump. Even if your business is doing well, the pressure on budgets is real.

Increasing your CX Spend

Despite the pressure on budgets Ecosystm data makes a strong case to not cut your customer experience (CX) spend! Businesses in Singapore that are cutting their CX spend are less likely to return to growth, more likely to be competing on price (hence cutting margins), not focused on their digital and omnichannel customers, and have lower levels of innovation. Funnily enough, these are also the businesses with complex, legacy systems which need more focus to provide an improved CX! To be quite frank, businesses in Singapore who are cutting CX spend are setting themselves up for failure. With other businesses increasing CX spend, the gap between the customer experiences will grow to a point where customers will leave and it will be hard to catch up.

Prioritising your CX Spend

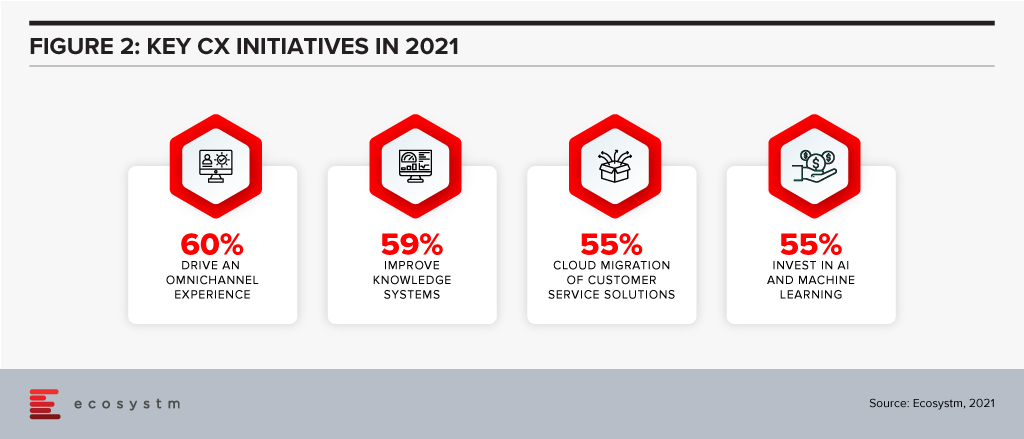

So now that you have secured your CX spend, where will you get the biggest bang for your buck? Let’s look at where businesses in Singapore are focusing their CX initiatives in 2021.

Offering an omnichannel experience. Your customers expect more than just a great digital experience – they want the right experience at the right touchpoint. The CX leaders in Singapore (who, unsurprisingly are often the market leaders) are already offering great omnichannel experiences, so this is quickly becoming about catching up – and not about getting ahead. Providing a consistent, personalised, and optimised experience across your digital touchpoints needs to be a top priority for your business today. If you are not offering conversational commerce solutions, start that strategy as soon as possible – you need to be where your customers are today. Extending this to physical channels and broader ecosystem partners should also be on your agenda.

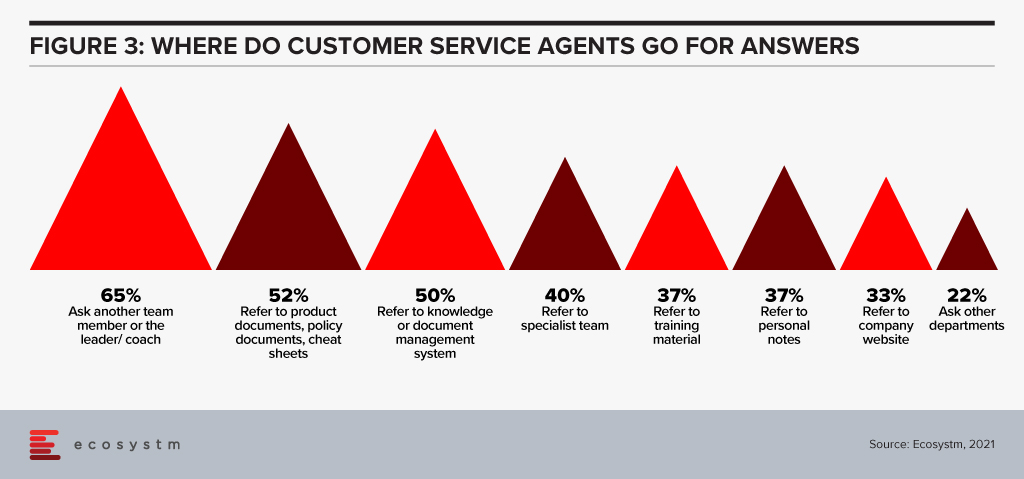

Improving knowledge systems. Your knowledge systems don’t do what they say on the box. They don’t provide answers to questions – for employees or customers. In fact, if your customer service agents get asked a question they don’t know the answer to, their number one source for answers is actually their colleagues or team leaders – NOT the knowledge management system! Start investing in systems – or ideally a single system – that help your employees get better, faster answers to questions. Make sure that the system is providing the same answers to both your employees and your customers across all touchpoints – physical and digital.

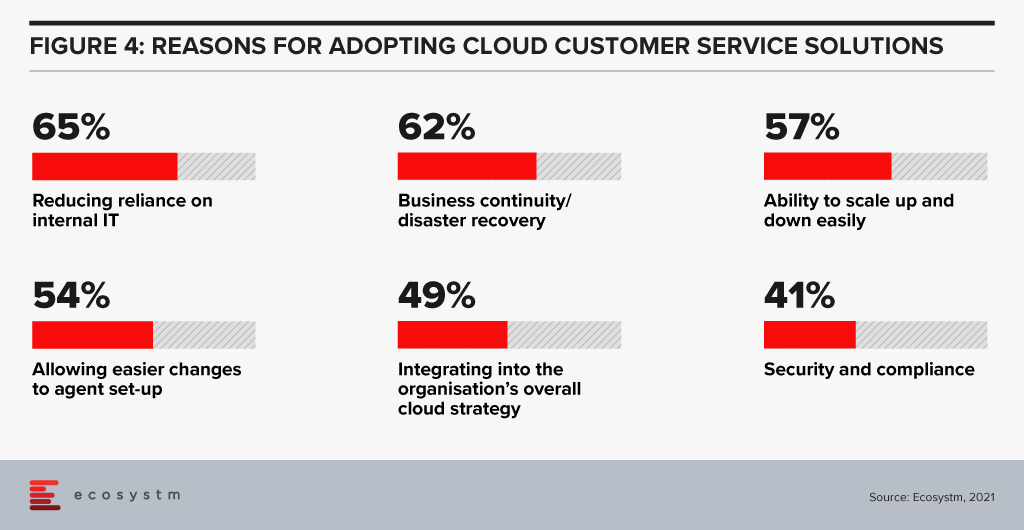

Migrating customer service platforms to the cloud. Over half the businesses in Singapore that we assessed have this as a top CX priority. Cloud solutions offer faster time to value, lower management costs, give access to more regular improvements and often provide the ability to easily integrate with partners who offer product extensions and customisations. This trend will continue in 2021 and 2022 as more businesses realise that their legacy customer service or contact centre platform is inhibiting their ability to innovate their customer experience. These systems also help businesses to stay compliant and reduce the reliance on internal IT – which has traditionally struggled to keep up with the fast-changing nature of the contact centre and customer service teams.

Investing in AI and machine learning. Many businesses are using AI to provide the personalised and optimised customer experiences they aspire to. AI and machine learning are allowing businesses to create personalised offers, offer a next-best action and automate services. Advanced banks in Singapore can create interest rate offers for each individual customer based on their credit profile and history. 46% of businesses in Singapore are already using AI to offer recommendations for customer service agents, 44% to optimise or test messaging and campaigns and 43% to provide faster, more accurate access to information and knowledge. 18 months ago, AI was a business differentiator – allowing your business to create a stand-out CX. Today AI is quickly becoming a standard practice – the battle now is around using AI to create personalised and optimised experiences.

A great customer experience will be the most important factor in lifting your business to pre-pandemic growth levels and helping your business remain competitive in today’s tough business conditions. When it comes to CX, there is no such thing as “saving your way to growth”.

Your opportunity to drive greater business success lies in your ability to better win, serve and retain your customers. Refresh your customer strategy and capability today to make 2021 an exceptional year for your business.

Organisations are finding that the ways to do work and conduct business are evolving rapidly. It is evident that we cannot use the perspectives from the past as a guide to the future. As a consequence both leaders and employees are discovering and adapting both their work and their expectations from it. In general, while job security concerns still command a big mindshare, the simpler productivity measures are evolving to more nuanced wellness measures. This puts demands on the CHRO and the leadership team to think about company, customer and people strategy as one holistic way of working and doing business.

Organisations will have to re-think their people and technology to evolve their Future of Work policies and strategise their Future of Talent. There are multiple dimensions that will require attention.

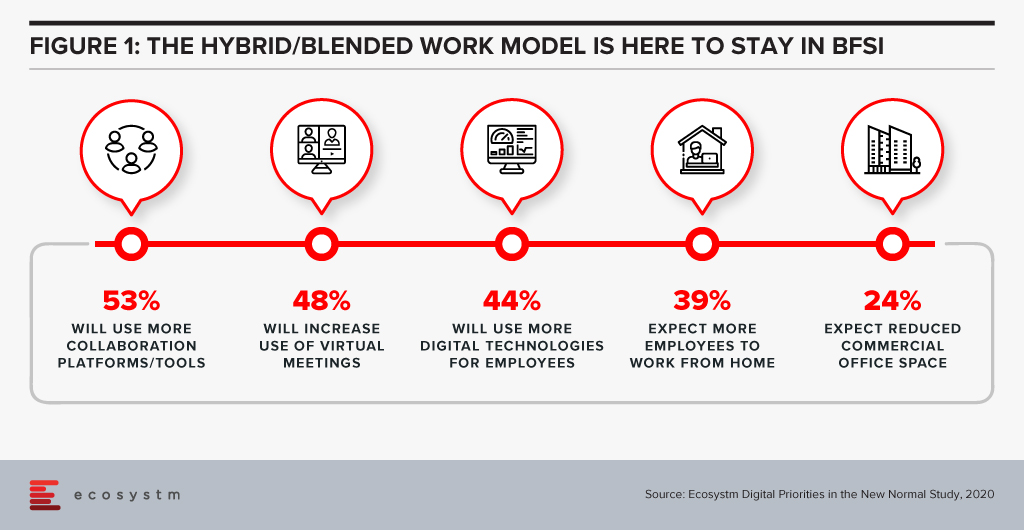

Hybrid is Becoming Mainstream

It is clear that hybrid workplaces are here to stay. Ecosystm research finds that in 2021 BFSI organisations will use more collaboration tools and platforms, and virtual meetings (Figure 1). Nearly 40% expect more employees to work from home, but only about a quarter of organisations are looking to reduce their physical workspaces. Organisations will give more choice to employees in the location of their work – and employees will choose to work from where they are more productive. The Hybrid model will be more mainstream than it has been in the last few months.

Companies are coming to terms with the fact that there is no single answer to operating in the new world. Experimentation and learnings are continuously captured to create the right workforce and workplace model that works best. Agility both in terms of being able to undersand the market as well as quickly adapt is becoming quite important. Thus being able to use different models and ways of working at the same time is the new norm.

Technology and Talent are Core

Talent and tech are the two core pillars that companies need to look at to be successful against their competition. It is becoming imperative to create synergy between the two to deliver a superior value proposition to customers. Companies that are able to bring the customer and employee experience journeys together will be able to create better value. HR tech stacks need to evolve to be more deliberate in the way they link the employee experience, customer experience, and the culture of the organisation. That’s how the Employee Value Proposition (EVP) comes to life on a day-to-day basis to the employers. With evolving work models, the tech stack is a key EVP pillar.

Governments will also need to partner with industry to make such talent available. Singapore is rolling out a new “Tech.Pass” to support the entry of up to 500 proven founders, leaders and experts from top tech companies into Singapore. Its an extension of the Tech@SG program launched in 2019, to provide fast-growing companies greater assurance and access to the talent they need. The EDB will administer the pass, supported by the Ministry of Manpower.

Attracting the Right Talent

Talent has always been difficult to find. Even with globalisation, significant investment of time and resources is needed to find and relocate talent to the right geography. In many instances this was not possible given the preferences of the candidates and/or the hiring managers. COVID-19 has changed this drastically. Remote working and distributed teams have become acceptable. With limitations on immigration and travel for work, there is a lot more openness to finding and hiring talent from outside the traditional talent pool.

However it is not as simple as it seems. The cost per applicant (CPA) – the cost to convert a job seeker to a job applicant – had been averaging US$11-12 throughout 2019 according to recruiting benchmark data from programmatic recruitment advertising provider, Appcast. But, the impact of COVID-19 saw the CPA reach US$19 in June – a 60% increase. I expect that finding right talent is going to be a “needle in a haystack” issue. But this is only one side of the coin – the other aspect is that the talent profile needed to be successful in roles that are all remote or hybrid is also significantly different from what it was before. Companies need to pay special attention to what kind of people they would like to hire in these new roles. Without this due consideration it is very likely that there would be difficulty in on-boarding and making these new hires successful within the organisation.

Automation Augmentation and Skills

The pace at which companies are choosing to automate or apply AI is increasing. This is changing the work patterns and job requirements for many roles within the industry. According to the BCG China AI study on the financial sector 23% of the roles will be replaced by AI by 2027. The roles that will not be replaced will need a higher degree of soft skills, critical thinking and creativity. However, automation is not the endgame. Firms that go ahead with automation without considering the implications on the business process, and the skills and roles it impacts will end up disrupting the business and customer experience. Firms will have to really design their customer journeys, their business processes along with roles and capabilities needed. Job redesign and reskilling will be key to ensuring a great customer experience

Analytics is Inadequate Without the Right Culture

Data-driven decision-making as well as modelling is known to add value to business. We have great examples of analytics and data modelling being used successfully in Attrition, Recruitment, Talent Analytics, Engagement and Employee Experience. The next evolution is already underway with advanced analytics, sentiment analysis, organisation network analysis and natural language processing (NLP) being used to draw better insights and make people strategies predictive. Being able to use effective data models to predict and and draw insights will be a key success factor for leadership teams. Data and bots do not drive engagement and alignment to purpose – leaders do. Working to promote transparency of data insights and decisions, for faster response, to champion diversity, and give everyone a voice through inclusion will lead to better co-creation, faster innovation and an overall market agility.

Creating a Synergy

We are seeing a number of resets to what we used to know, believe and think about the ways of working. It is a good time to rethink what we believe about the customer, business talent and tech. Just like customer experience is not just about good sales skills or customer service – the employee experience and role of Talent is also evolving rapidly. As companies experiment with work models, technology and work environment, there will a need to constantly recalibrate business models, job roles, job technology and skills. With this will come the challenge of melding the pieces together within the context of the entire business without falling into the trap of siloed thinking. Only by bringing together businesses processes, talent, capability evolution, culture and digital platforms together as one coherent ecosystem can firms create a winning formula to create a competitive edge.

Singapore FinTech Festival 2020: Talent Summit

For more insights, attend the Singapore FinTech Festival 2020: Infrastructure Summit which will cover topics on Founders success and failure stories, pandemic impact on founders and talent development, upskilling and reskilling for the future of work.

In this blog, our guest author Chandru Pingali talks about the potential benefits of the Blended working model and the impact it will have on FinTech and financial services organisations. “FinTech innovation and performance is here to stay and thrive. It needs to be backed by a well-oiled machine to support implementation of a blended workforce plan to institutionalise and scale.”

When under pressure to reduce costs and survive, we reimagine everything we do to build resilience and thrive. Never before have the buzzwords frugality, prudence and agility gained as much prominence – not just in one country or industry, but across global economies simultaneously (a phenomenon not seen since the Great Depression). And these words have sliced through the employment opportunities ruthlessly, leaving an abundance of talent to be gainfully employed differently.

So, is the freelance economy surging? Statistics appear to say yes. In 2018, freelancers had contributed almost USD 1.40 trillion to the US economy; 162 million freelancers work across US and EU-15. So, who are these people? Why is blended workforce new or relevant for the Asia Pacific? Why is it gaining more prominence now? How can enterprises create and implement a blended workforce strategy to reduce costs more permanently, while running and scaling businesses? What does the Future of Work and workforce mean? How can FinTech enterprises successfully implement a blended workforce strategy?

Let us take Singapore as an example. With 1000+ FinTech firms and increasing investments, the “smart financial centre” initiative of Singapore is a huge success story, recognised globally. To sustain this, apart from innovation and technology, the main ingredient is consistent availability of talent as the demand for expertise in technology and financial services increases, while the supply is inconsistent, uncurated and fragmented. Recent data from the Singapore government job portals reveal that there are several hundred jobs at any point in time posted by FinTech companies that are open for months! This invariably slows down the ability to build businesses, innovate or scale. Interestingly, while the local talent for technology and BFSI may be limited in Singapore, the crisis this year presented a significant opportunity to reimagine the Future of Work and workforce. While efforts should continue to upskill and reskill local talent, it is now possible to create dedicated local and cross-border talent hubs to work part-time, fulltime-short term with the option of working physically or remotely. We expect the plug and play of freelance management experts and expertise to cost 25-30% less to an enterprise, keeps costs flexible and dramatically shortens time to “hire and deploy” from an average of 120 days to 15 days.

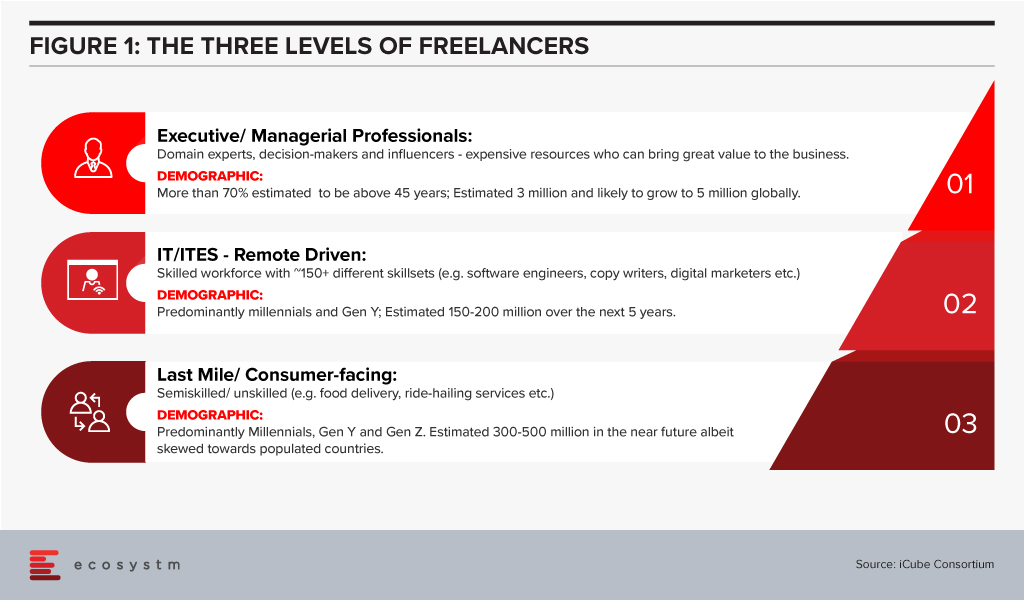

Gigs and Generations – Conceptual Clarity of Who We Need

Culturally, the US and Europe are more accepting of freelancing as full-time careers compared to the Asia Pacific. It is predicted that by 2027 the majority of the workforce in the US will be freelancers overtaking traditional employment. The buzz in the Asia Pacific has just started with both employers and employable talent accepting a new reality – learning to run businesses with a blended workforce, starting at the top of the pyramid. Particularly, since the ratio of new jobs to lost jobs is skewed in the wrong direction.

Power of Blended Workforce

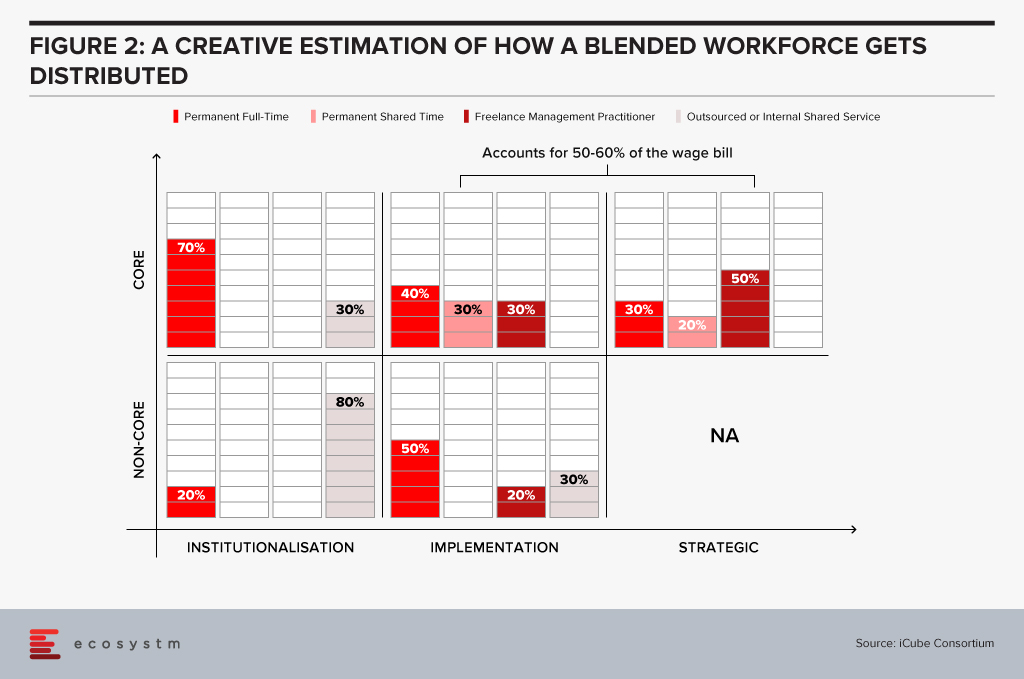

A blended workforce is a combination of permanent, part-time, full time-short term and turnkey practitioners, working as a single collaborative workforce. It is built around business activity clusters – Strategy, Implementation and Institutionalisation, applied to create a plan for core and non-core workforce to drive business.

A creative estimation of how a blended workforce gets distributed across the three business clusters is depicted below (Figure 2). What is important here is to recognise that the ratio of permanent to flexible workforce has to start at 10-15% across different levels. Enterprises will gain the most on cost optimisation when they focus on the management layer to go blended. Not an easy change to drive but then change is often driven by some tough calls and some low hanging fruits to build a sustainable cost model.

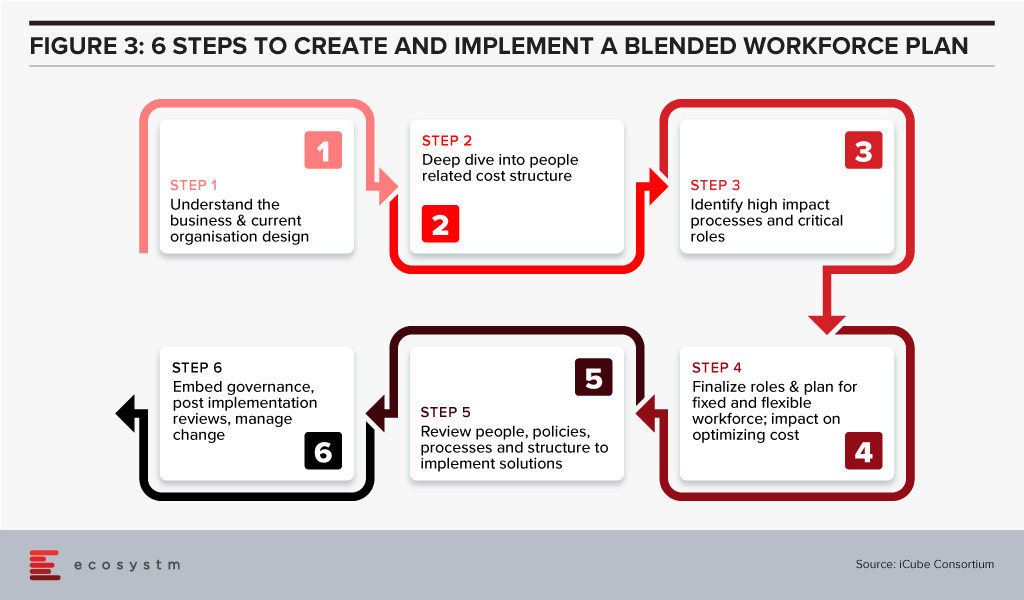

Developing & Implementing a Blended Workforce Strategy: What to Consider

Fix the core and flex the non-core should be the mantra

- Identify roles by each business and function

- Segregate core and non-core roles by job profiles

- Classify them into buckets of permanent full time, permanent part time, cyclical, and freelance on demand, based on:

- Time demand for the roles

- Importance to business goals

- Criticality to daily business output

- Criticality to daily or weekly business continuity

- Set up a process to engage and create a blended workforce strategy

- Implement the plan with a blend of a common self-service platform and a central client service team to source, engage and deploy workforces

Once the process review is completed, the organisation structures will be finalised. Creation of a strategy and the process are the easier parts. A disciplined fulfilment of the plan is critical to success. So, is this the new normal? Pretty much yes, if organisations need to optimise costs and be agile to reduce or scale with freelance experts and shared talent pools.

The Potential Benefits of a Blended Workforce

A Blended Workforce will help reduce your talent scarcity gap, while providing thousands of work opportunities to locals who are freelance experts. So, what are these benefits that can make you sleep better at night better?

- Cost optimisation. Freelance experts do not need the fully loaded costs. They can work remotely or physically and do not need investment in regular training, insurance, or other related benefits.

- Targeted purpose-hire for short term. With deliverables specified upfront, measurable, results focused and tracked for closure.

- Job Sharing. Two or may be three, for the prize of one! Jobs can be dismantled to tasks or activity clusters to hire more than one expert in place of a full-time role. Enables razor sharp focus on sourcing for expertise, increases employment opportunities and accelerates productivity.

- Boundaryless with an opportunity to find cross-border talent pools to work on-demand, remotely. It cuts both ways- Singaporean talent finding work opportunities outside the country whilst the best talent from other countries made available to grow Singapore’s economy.

- Speed of hire is dramatically reduced (we have several client cases, with a reduction from an average of 120 days to 15 days, to clients’ delight!)

- Reduced infrastructure costs because the workforce works remotely or at best part-time physically. Easy to implement with hot desking, if needed but enables permanent cost reduction.

- Builds resilience by staying agile and nimble in the cost line, with an ability to scale up or down rapidly based on business needs.

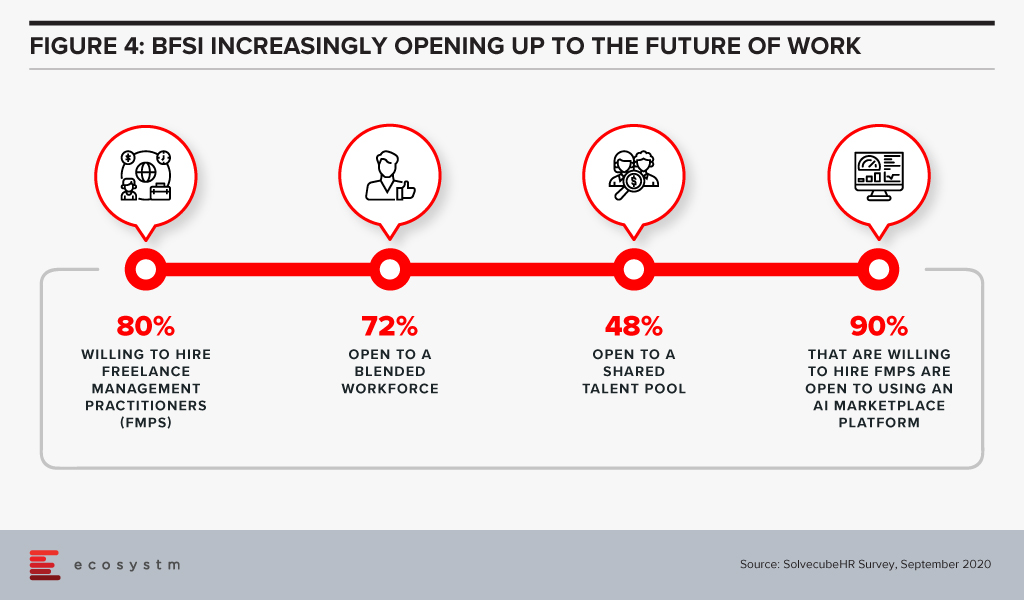

How Open is the Financial Services Industry to Blended Workforce and Future of Work?

SolvecubeHR conducted a recent survey with CXOs across 22 countries, predominantly focused on the Asia Pacific region. Some key findings for the financial services industry are:

In summary, a blended workforce is the Future of Work. Asia Pacific will see a massive shift in its mindset from “jobs to work opportunities”. Employers and talent pools will embrace new ways of working to remain agile and prudent. The power of aggregation, curation, and collaboration by leveraging an AI matchmaking platform, backed by creation of shared talent pools, will be a game changer.

FinTech innovation and performance is here to stay and thrive. It needs to be backed by a well-oiled machine to support implementation of a blended workforce plan to institutionalise and scale.

We can build technologies to disintermediate people dependency, but we cannot take humans out of the human capital needed to build these technologies.

About iCube: iCube Consortium is a Singapore based, Human Capital Management (HCM) solutions firm, with an award-winning AI platform to source and manage freelance management experts and execute turnkey assignments in Asia and Middle East

Singapore FinTech Festival 2020: Talent Summit

For more insights, attend the Singapore FinTech Festival 2020: Infrastructure Summit which will cover topics on Founders success and failure stories, pandemic impact on founders and talent development, upskilling and reskilling for the future of work.