Last week, NVIDIA announced that it had agreed to acquire UK-based chip company Arm from Japanese conglomerate SoftBank in a deal estimated to be worth USD 40 billion. In 2016, SoftBank had acquired Arm for USD 32 billion. The deal is set to unite two major chip companies; power data centres and mobile devices for the age of AI and high-performance computing; and accelerate innovation in the enterprise and consumer market.

Rationale for the Deal

NVIDIA has long been the industry leader in graphics chips (GPUs), and a smaller but significantly profitable player in the chip stakes. With graphic processing being a key component in AI applications like facial recognition, NVIDIA was quick to capitalise. This allowed it to move into data centres – an area long dominated by Intel who still holds the lion’s share of this market. NVIDIA’s data centre business has grown tremendously – from near zero less than ten years ago to nearly USD 3 billion in the first two quarters of this fiscal year. It contributes 42% of the company’s total sales.

The gaming PC market has been the fastest-growing segment in the PC market. The rare shining light in an otherwise stagnant-to-slightly declining market. NVIDIA has benefited greatly from this with a huge jump in their graphics revenues. Its GeForce brand is one of the most desired in the industry. However, with their success in AI, NVIDIA’s ambition has now grown well beyond the graphics market. Last year NVIDIA acquired Mellanox – who makes specialised networking products especially in the area of high-performance computing, data centres, cloud computing – for almost USD 7 billion. There is clearly a desire to expand the company’s footprint and position itself as a broad-based player in the data centre and cloud space focused on AI computing needs.

The acquisition of Arm though adds a whole new dimension. Arm is the leading technology provider in the mobile chip market. A staggering 90% of smartphones are estimated to use Arm technology. Arm is the colossus of the small chip industry – having crossed 20 billion in unit shipments in 2019.

Acquiring Arm is likely to result in NVIDIA now having a play in the effervescent smartphone market. But the company is possibly eyeing a different prize. Jensen Huang, Founder and CEO of NVIDIA said “AI is the most powerful technology force of our time and has launched a new wave of computing. In the years ahead, trillions of computers running AI will create a new internet-of-things that is thousands of times larger than today’s internet-of-people. Our combination will create a company fabulously positioned for the age of AI.”

With thoughts of self-driving cars, connected homes, smartphones, IoT, edge computing – all seamlessly working with each other, the acquisition of Arm provides NVIDIA a unique position in this market. As the number of connected devices explodes, as many billions of sensors become an ubiquitous part of 21st century living, there is going to be a huge demand for low power processing everywhere. Having that market may turn out to be a larger prize than the smartphone market. The possibilities are endless.

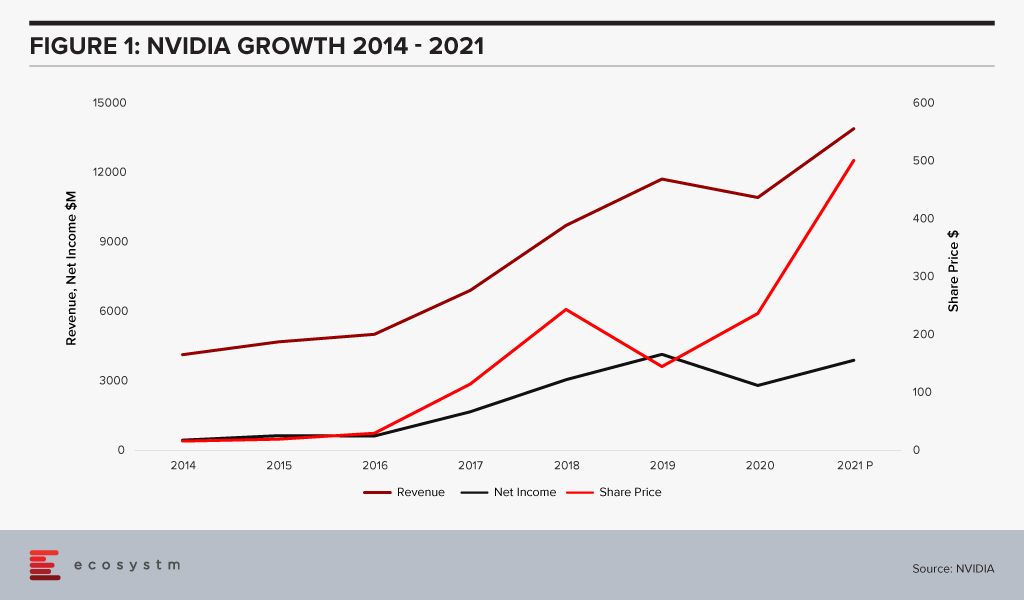

While this deal is supposed to be worth around USD 40 billion, somewhere between USD 23-28 billion is going to be paid in the form of NVIDIA stock. This brings us to an extremely interesting dynamic. At the beginning of 2016 NVIDIA’s market cap was less than USD 20 billion. Mighty Intel was at USD 150 billion. AMD the other player in the market for chips who also sell graphics was at a mere USD 2 billion. In July this year, NVIDIA’s value passed Intel’s and today it is sitting at around USD 300 billion! Intel with a recent dip is now close to USD 200 billion. AMD too with all the tech-fueled growth in recent years has grown to just shy of USD 100 billion market cap.

What this tells us is that the stock portion of the deal is cheaper for NVIDIA today by around 55% compared to if this deal was consummated on 1st January 2020. If there was a right time for NVIDIA to buy – it is now. This also shows the way the company has grown revenue at a massive clip powered by Gaming PCs and AI. The deal to buy Arm appears to be a very good idea, which would establish NVIDIA as a leader in the chip industry moving forward.

Ecosystm Comments

While there appears to be some good reasons for this deal and there are some very exciting possibilities for both NVIDIA and Arm, there are some challenges.

The tech industry is littered with examples of large mergers and splits that did not pan out. Given that this is a large deal between two businesses without a large overlap, this partnership needs to be handled with a great deal of care and thought. The right people need to be retained. Customer trust needs to be retained.

Arm so far has been successful as a neutral provider of IP and design. It does not make chips, far less any downstream products. It therefore does not compete with any of the vendors licensing its technology. NVIDIA competes with Arm’s customers. The deal might create significant misgivings in the minds of many customers about sharing of information like roadmaps and pricing. Both companies have been making repeated statements that they will ensure separation of the businesses to avoid conflicts.

However, it might prove to be difficult for NVIDIA and Arm to do the delicate dance of staying at arm’s length (pun intended) while at the same time obtaining synergies. Collaborating on technology development might prove to be difficult as well, if customer roadmaps cannot be discussed.

Business today also cannot escape the gravitational force of geo-politics. Given the current US-China spat, the Chinese media and various other agencies are already opposing this deal. Chinese companies are going to be very wary of using Arm technology if there is a chance the tap can be suddenly shut down by the US government. China accounts for about 25% of Arm’s market in units. One of the unintended consequences which could emerge from this is the empowerment of a new competitor in this space.

NVIDIA and Arm will need to take a very strategic long-term view, get communication out well ahead of the market and reassure their customers, ensuring they retain their trust. If they manage this well then they can reap huge benefits from their merger.

Today Samsung announced their new “Samsung Galaxy Fold” device – and while it won’t be available until at least April 26. This foldable hybrid phone/tablet device is not the first foldable phone – but it will likely be the first one to have mass market availability and will be the first that businesses consider deploying.

But what is the business opportunity for the Samsung Galaxy Fold? It is not a slim, sexy phone, and it is not a large screen tablet like an iPad or Galaxy Tab S4 (although the screen is actually bigger than the smaller screen Tab A 7” tablet). It will be an expensive device (US$1,980) – but depending on the configuration will likely be cheaper than a high-end phone plus a high-end tablet. It doesn’t come with a stylus, but has the ability to help users multi-task (supporting up to three apps at the same time) and also supports DeX – Samsung’s under-rated ability to turn the phone into a PC-like experience. It also supports Samsung Knox, so the security capabilities that Samsung is becoming well known for will be supported by the Galaxy Fold.

Initially, it looks like a device that could replace the “phone and tablet” combination, but the reality is that many of the types of role that have both devices (engineers, repair people etc) typically require ruggedized devices – even a white goods repair person is working in wet and dirty environments and would at least have some type of case on their device. The unique nature of the Galaxy Fold likely prohibits a ruggedized case – and possibly any case at all (as the fingerprint sensor is on the side of the device).

A “Shareable” Device

One factor that strikes me about the Fold is the fact that large screens not only make content easier to consume – but also easier to share. Travelling salespeople – who typically do meetings in cafes or offsite meeting rooms often pull out their tablet or laptop to demonstrate a product or show a presentation or video. Laptops are not great for this – as the interface is designed for one user – not multiple, and many don’t have 4G connections.

You often see software salespeople pull out their tablet to demonstrate their SaaS platform – so this is one of the use cases for the Galaxy Fold – it is a pocketable tablet that has 4G (or 5G) connectivity. Any situation where a white collar executive is sharing information is a potential opportunity for the Galaxy Fold. Only time will tell whether such executives are willing to accept the compromises (thicker device, smaller front screen).

The Ultra-Portable Laptop

The Fold could be the device that shows the real benefit of Samsung DeX – the extra memory and processing power might convince some businesses or end-user computing teams to dump the laptop for some of their employees – and give them a device that can be a phone, tablet and PC. Carrying your laptop between work and home in your pocket might be an attractive option for some users.

An Executive Status Symbol

The Fold will make its way into the senior management ranks too. The device will draw attention and interest – so those who seek such attention will be drawn to it. But if you look around the senior executive community you see those who don’t mind having a larger device in their pocket normally do so because they have covered the phone in a massive “Otter Box” case – they are looking to protect their asset – again the lack of protection may be an inhibitor for this buyer. And the other execs who like a slim, sexy device may be put off by the size. It is hard to know exactly where the Galaxy Fold will land.

Whatever happens, it is great to see the rate of innovation in the smartphone market start to accelerate again after 3-4 years of stagnation. From an engineering and design perspective, the Fold looks incredible. What role it takes in the end-user computing strategy of businesses across the globe isn’t yet clear – but the idea of a device that helps your business users better share content could certainly be an opportunity.

If you’d like to discuss your End User Computing strategy feel free to reach out to me at: tim.sheedy@ecosystm360.com – or if you have any thoughts of other use cases for the Samsung Galaxy Fold please post them in the comments below – let’s keep the conversation going!