Earlier this month, I had the privilege of attending Oracle’s Executive Leadership Forum, to mark the launch of the Oracle Cloud Singapore Region. Oracle now has 34 cloud regions worldwide across 17 countries and intends to expand their footprint further to 44 regions by the end of 2022. They are clearly aiming for rapid expansion across the globe, leveraging their customers’ need to migrate to the cloud. The new Singapore region aims to support the growing demand for enterprise cloud services in Southeast Asia, as organisations continue to focus on business and digital transformation for recovery and future success.

Here are my key takeaways from the session:

#1 Enabling the Digital Futures

The theme for the session revolved around Digital Futures. Ecosystm research shows that 77% of enterprises in Southeast Asia are looking at technology to pivot, shift, change and adapt for the Digital Futures. Organisations are re-evaluating and accelerating the use of digital technology for back-end and customer workloads, as well as product development and innovation. Real-time data access lies at the backbone of these technologies. This means that Digital & IT Teams must build the right and scalable infrastructure to empower a digital, data-driven organisation. However, being truly data-driven requires seamless data access, irrespective of where they are generated or stored, to unlock the full value of the data and deliver the insights needed. Oracle Cloud is focused on empowering this data-led economy through data sovereignty, lower latency, and resiliency.

The Oracle Cloud Singapore Region brings to Southeast Asia an integrated suite of applications and the Oracle Cloud Infrastructure (OCI) platform that aims to help run native applications, migrate, and modernise them onto cloud. There has been a growing interest in hybrid cloud in the region, especially in large enterprises. Oracle’s offering will give companies the flexibility to run their workloads on their cloud and/or on premises. With the disruption that the pandemic has caused, it is likely that Oracle customers will increasingly use the local region for backup and recovery of their on-premises workloads.

#2 Partnering for Success

Oracle has a strong partner ecosystem of collaboration platforms, consulting and advisory firms and co-location providers, that will help them consolidate their global position. To begin with they rely on third-party co-location providers such as Equinix and Digital Realty for many of their data centres. While Oracle will clearly benefit from these partnerships, the benefit that they can bring to their partners is their ability to build a data fabric – the architecture and services. Organisations are looking to build a digital core and layer data and AI solutions on top of the core; Oracle’s ability to handle complex data structures will be important to their tech partners and their route to market.

#3 Customers Benefiting from Oracle’s Core Strengths

The session included some customer engagement stories, that highlight Oracle’s unique strengths in the enterprise market. One of Oracle’s key clients in the region, Beyonics – a precision manufacturing company for the Healthcare, Automotive and Technology sectors – spoke about how Oracle supported them in their migration and expansion of ERP platform from 7 to 22 modules onto the cloud. Hakan Yaren, CIO, APL Logistics says, “We have been hosting our data lake initiative on OCI and the data lake has helped us consolidate all these complex data points into one source of truth where we can further analyse it”.

In both cases what was highlighted was that Oracle provided the platform with the right capacity and capabilities for their business growth. This demonstrates the strength of Oracle’s enterprise capabilities. They are perhaps the only tech vendor that can support enterprises equally for their database, workloads, and hardware requirements. As organisations look to transform and innovate, they will benefit from the strength of these enterprise-wide capabilities that can address multiple pain points of their digital journeys.

#4 Getting Front and Centre of the Start-up Ecosystem

One of the most exciting announcements for me was Oracle’s focus on the start-up ecosystem. They make a start with a commitment to offer 100 start-ups in Singapore USD 30,000 each, in Oracle Cloud credits over the next two years. This is good news for the country’s strong start-up community. It will be good to see Oracle build further on this support so that start-ups can also benefit from Oracles’ enterprise offerings. This will be a win-win for Oracle. The companies they support could be “soonicorns” – the unicorns of tomorrow; and Oracle will get the opportunity to grow their accounts as these companies grow. Given the momentum of the data economy, these start-ups can benefit tremendously from the core differentiators that OCI can bring to their data fabric design. While this is a good start, Oracle should continue to engage with the start-up community – not just in Singapore but across Southeast Asia.

#5 Commitment to Sustainability at the Core of the Digital Futures

Another area where Oracle is aligning themselves to the future is in their commitment to sustainability. Earlier this year they pledged to power their global operations with 100% renewable energy by 2025, with goals set for clean cloud, hardware recycling, waste reduction and responsible sourcing. As Jacqueline Poh, Managing Director, EDB Singapore pointed out, sustainability can no longer be an afterthought and must form part of the core growth strategy. Oracle has aligned themselves to the SG Green Plan that aims to achieve sustainability targets under the UN’s 2030 Sustainable Development Agenda.

Cloud infrastructure is going to be pivotal in shaping the future of the Digital Economy; but the ability to keep sustainability at its core will become a key differentiator. To quote Sir David Attenborough from his speech at COP26, “In my lifetime, I’ve witnessed a terrible decline. In yours, you could and should witness a wonderful recovery”

Conclusion

Oracle operates in a hyper competitive world – AWS, Microsoft and Google have emerged as the major hyperscalers over the last few years. With their global expansion plans and targeted offerings to help enterprises achieve their transformation goals, Oracle is positioned well to claim a larger share of the cloud market. Their strength lies in the enterprise market, and their cloud offerings should see them firmly entrenched in that segment. I hope however, that they will keep an equal focus on their commitment to the start-up ecosystem. Most of today’s hyperscalers have been successful in building scale by deeply entrenching themselves in the core innovation ecosystem – building on the ‘possibilities’ of the future rather than just on the ‘financial returns’ today.

Global supply chains were impacted early and badly by the COVID-19 pandemic. The fact that the pandemic started in China – the leader in the Manufacturing industry – meant that many enterprises globally had to re-evaluate their supply chain and logistics. This was compounded by the impact on demand – for some sectors the demand went down significantly, while in others, especially for items required to fight the crisis, there was an unexpected spike in demand. There was also the need for many manufacturers and retailers to shift to eCommerce, to directly access the market and sustain their businesses. These sudden shifts that were required of the industry, opened up the need for a global supply chain that is more integrated, agile and responsive.

Last week, global heavyweights with a stake in the global supply chain, joined a consortium to work on creating that agility. This includes PepsiCo, BMW, Shopify, DHL, and the United States Postal Service and some emerging tech companies. The alliance will actively work on solutions to embed automation and digitalisation in the logistics and supply chain systems. While this consortium was formed last year, recent events have accelerated the need to fix a global problem.

Co-Creation and Innovation

LINK is a collaborative ecosystem, co-founded by Innovation Endeavors and Sidewalk Infrastructure Partners (SIP) to bring together emerging tech start-ups, institutions and global organisations to innovate and make supply chains resilient. The tech start-ups involved include the likes of Fabric, that has large automated micro-fulfillment centres for faster deliveries, and Third Wave Automation, that has developed automated forklifts with enhanced safety measures.

LINK aims to transform global supply chains, with the use of technologies such as automation, IoT, AI, and Robotics. The solutions developed by the start-ups will be tested in real-life situations, often in large organisations with complex operations. On the other hand, the start-ups will have access to the internal systems of these large organisations to understand the data and their organisational needs.

Ecosystm Principal Advisor, Kaushik Ghatak says, “COVID-19 has brought the need for supply chain agility and resilience to a completely new level of criticality. Companies in the ‘New Normal’ will need higher levels of nimbleness and flexibility to be able to recover from this crisis quickly and sustain in an increasing disruptive world. Increased ability to sense and respond to disruptions will be key to success. It will require better visibility of their entire supply chain, increasing efficiencies, building necessary redundancies (in form of inventory and capacity) where they are required the most – redundancy comes at a cost – and being flexible and innovative to cater to the rapid market and supply-side changes. Rapid digitalisation to build such capabilities will be a key to success.”

“Managing such rapid changes is usually a struggle for organisations with large and complex supply chains, because of the years of past practices, systems and culture. For them Innovation is a must, but the path to innovation is difficult. The LINK collaboration model is the right step towards addressing that challenge. Collaborating with start-ups can infuse new ideas, more innovative ways of solving a problem and rapid testing of use cases in the areas of IoT, AI and automation.”

Involving Start-ups for Innovation

This initiative is a great example of how larger enterprises are looking to leverage innovations by the start-up community. The Financial Services industry has been an early beneficiary, when it stopped competing with Fintech organisations, partnering with them instead. Other industries have started to recognise the benefits of fast pivots and the role start-ups can play.

Ecosystm Principal Advisor, Ravi Bhogaraju says, “Bringing together companies that have complementary and unique capabilities to solve industry issues is a great way to speed up experimentation and innovation.”

However, he recognises that forming alliances such as this, comes with its own set of challenges. “One of the key things to recognise in such a construct is that the team members from different possessions bring with them their unique belief systems, organisational and country cultural constructs. Expectations on how things should work, can become quite tricky to navigate. The talent and expertise in such an environment need to be facilitated be able to deliver high quality outcomes.”

Talking about how these constructs can work successfully, delivering what started out to deliver, Bhogaraju says, “An agile team setup can help tremendously as it uses two key principles – People and Interactions over processes; as well as Working models over documentation.”

“A clear expectation setting through contracting at the beginning of the project cycle can help establish the ways of working and rules of engagement. Increased regular feedback and problem solving should continuously fine tune the ways of working. This way teams can get through the norming process at pace and scale and eventually focus on outcomes, rather than fumble over each other and/or have ego flareups.”

“The key is to get to creative problem-solving working cohesively – the intent being to challenge the status quo – stepping outside the box and using all capabilities within the team. Blending the subcultures together using agile way of working and principles, can be a fantastic way to make that happen – failing which you have the challenge of trying to somehow bring together different work products, people and preferences.”

Authored by Ullrich Loeffler and Kaushik Ghatak

Technology has been identified as a key enabler of innovation and transformation with great potential to disrupt and reshape entire industries. At the same time, the technology industry itself has been at the forefront of disruption with thousands of promising start-ups emerging in areas such as artificial intelligence (AI), Blockchain, cloud and cybersecurity to name a few.

In February 2020, Ecosystm had the opportunity to meet the executive team of Avanseus, an AI solution provider that promises to reshape traditional maintenance processes by leveraging AI-based algorithms for predictive maintenance and failure detection.

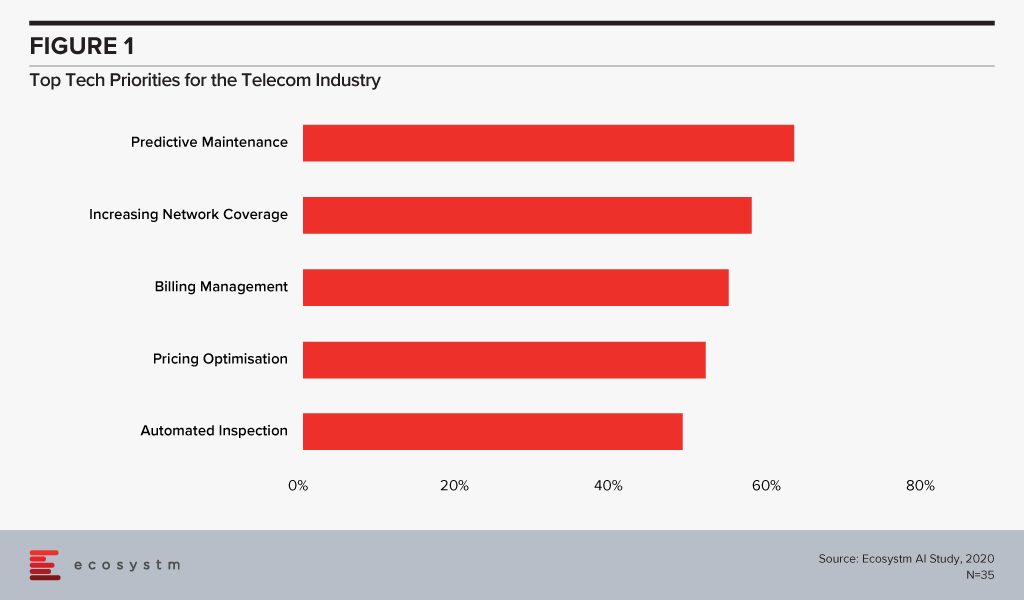

Avanseus is not the newest kid on the block having been launched in June 2015 with headquarters in Singapore. The founding team has extensive experience in the telecommunications sector from executive careers in both the operator and the network provider segments. The problem statement and value proposition that Avanseus was founded on is to support telecom companies to tackle the costly challenge of maintaining their increasingly complex networks and to ensure network performance and customer satisfaction. Ecosystm research finds that predictive maintenance is a key priority for telecom providers looking to invest in newer technologies (Figure 1).

The solution Avanseus offers aims to be simple in the way that its proprietary AI-enabled algorithms can assess and predict network performance and network failures with as little as 6 months of network data history to achieve a high degree of prediction accuracy across telecom networks. The simplicity of the solution further allows cost-effective proofs of concept (PoCs) which lets telecom prospects experience first-hand its potential to drive down maintenance cost and ensure network performance.

Avanseus had secured seed capital of US$2.5 million till the middle of 2017. At the end of 2018, Avanseus secured funding via convertible notes of US$1.3m – main noteholders being TNB Spring and SEEDS Capital (Enterprise Singapore). A global network equipment manufacturer and managed services provider became its first commercial customer in 2016. From there Avanseus has demonstrated steady growth achieving revenue of US$1 million in 2018 and US$2.3 million in 2019. 2020 is forecast to be a milestone year with predictions to become cash-flow positive and to achieve revenue growth of 150% over 2019.

As of February 2020, Avanseus employs 41 staff across multiple international locations including its headquarters in Singapore, its development centre in Bangalore and sales offices in Delhi, North and Latin America and Italy to grow its global presence. The team is complemented by 8 part-time consultants and a growing partner ecosystem which includes major consulting firms as well as technology partners such as Dell, Splunk and Siemens. Expanding its partnerships globally is a key part of its strategy in order to scale up on the opportunities it can contest.

Avanseus’ Potential Growth Path

Considering its young history, Avanseus has shown an impressive growth path which can be credited to staying true to its game plan and its original value proposition and solution design. A new fund-raising round had been kicked off at the end of 2019 with the aim to secure sufficient capital to accelerate growth over the coming years. Half of the anticipated funding will be invested into on-site consultants and sales teams while the other half will be invested in R&D to expand automation into APIs and other machine learning technologies. R&D has been a key focus from its early days which has led to the filing of 8 patents, 2 of which have been granted.

In order to accelerate growth further, Avanseus is also re-assessing the industries that could benefit from its predictive maintenance solutions. As with many startups and growth companies, innovation is often not a straight path and new opportunities and ideas arise as the market and customers are engaged. Several industries face similar challenges and benefit from reduced maintenance cost, reduced downtime, extended equipment lifecycles and improved services quality. To transfer the value proposition across use cases and industry applications Avanseus is looking to leverage approximately 80% of its existing solution and apply 20% of industry-specific domain expertise. This has opened up new growth opportunities in a number of areas such as Industrial IoT, Utilities, Manufacturing and supply chain. There are also opportunities in customer-focused industries such as Banking in niche areas such as maintenance of data centre operations.

Ecosystm Comments

As companies collect and manage an exploding amount of data assets within their operations or from their customers, there is an increasing opportunity for innovative technology vendors to support these companies in driving value from their data assets. Avanseus has demonstrated a clear vision and execution in addressing one of these opportunities by focusing on a clear problem statement and offering a ‘simple’ solution that presents a strong business case. As with every growth company, the challenge is to leverage this opportunity and secure the right funding and resources to scale up as quickly as possible.

Partnerships will be critical in its growth path but signing up partners alone may not translate to creating value. The challenge for Avanseus will be to achieve partner commitment and enablement across different geographies. This will require time and a dedicated channel strategy beyond opportunistic partnerships that are born out of specific client engagements.

Another opportunity that could turn into a challenge is the new range of solution applications that Avanseus has identified. Being a high growth company, the greater challenge is often to decide what not to do rather than what can be done. Avanseus is well advised to carefully select which industries it wants to expand into and focus on. Each new solution set will present a magnet for additional resources and funding and may well be a distraction.