The UN’s global stocktake synthesis report underscores the need for significant efforts to meet the ambitious goals of the Paris Agreement to keep the global warming limit to 1.5ºC, compared to pre-industrial levels. Achieving this requires collective action from governments, organisations, and individuals.

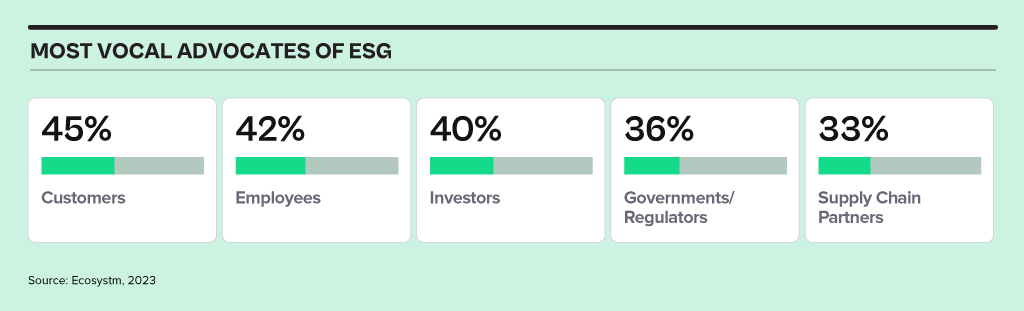

While regulators focus on mandates, organisations today are being influenced more by individual responsibility for positive impact. Customers and employees are leading ESG actions – another fast-emerging voice driving ESG initiatives are value chain partners looking to build sustainable supply chains.

Ecosystm research reveals that only 27% of organisations worldwide currently view ESG as a strategic imperative, yet we anticipate rapid change in the landscape.

Click below to find out what Ecosystm analysts Gerald Mackenzie, Kaushik Ghatak, Peter Carr and Sash Mukherjee consider the top 5 ESG trends that will shape organisations’ sustainability roadmaps in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 ESG Trends in 2024’ as a PDF.

#1 Organisations Will Evolve ESG Strategies from Compliance to Customer & Brand Value

Many of the organisations that we talk to have framed their ESG strategy and roadmaps primarily in relation to compliance and regulatory standards that they need to meet, e.g. in relation to emissions reporting and reduction, or in verifying that their supply chains are free from Modern Slavery.

However, organisations that are more mature in their journeys have realised that ESG is quickly becoming a strategic differentiator and compliance is only the start of their sustainability journey.

Customers, employees, and investors are increasingly selective about the brands they want to associate with and expect them to have a purpose and values that are aligned with their own.

#2 Sustainability Will Remain a Stepping-Stone to Full ESG

Heading into 2024, the corporate continues to navigate the nuances between Sustainability and Environmental, Social, and Governance (ESG) initiatives. Sustainability, focused on environmental stewardship, is a common starting point for corporate responsibility, offering measurable goals for a solid foundation.

Yet, the transition to comprehensive ESG, which includes broader social and governance issues alongside environmental concerns, demands broader scope and deeper capabilities, shifting from quantitative to qualitative measures. The trend of merging sustainability with ESG risks is blurring distinct objectives, potentially complicating reporting and compliance, and causing confusion in the market. Nevertheless, this conflation ultimately paves the way for more integrated, holistic corporate strategies.

By aligning sustainability efforts with wider ESG goals, companies will develop more comprehensive solutions that address the entire spectrum of corporate responsibility.

#3 ESG Consulting Will Grow – Till Industry Templates Take Over

At the end of 2022, LinkedIn buzzed with announcements of Chief Sustainability Officer appointments. However, the Global Sustainability Barometer Study reveals that only around one-third of global organisations have a dedicated sustainability lead. What changed?

Organisations have recognised that ESG is intricate, requiring a comprehensive focus and a capable team, not just a sustainability leader.

Each organisation’s path to sustainability is unique, shaped by factors like size, industry, location, stakeholders, culture, and values. Successfully integrating ESG requires a nuanced understanding of an organisation’s barriers, opportunities, and risks, making it challenging to navigate the sustainability journey alone. This is complicated by the absence of clear government/industry mandates and guidelines that frame best practices.

#4 Sustainability Tech Will Finally Gain Traction

Many organisations initiate sustainability journeys with promises and general strategies. While the role of technology in accelerating goals is recognised, alignment has been lacking. In 2024 sustainability tech will gain traction.

Environmental Tech. Improved sensors and analytics will enhance monitoring of air and water quality, carbon footprint, biodiversity, and climate patterns.

Carbon-Neutral Transportation. Advancements in electric and hydrogen vehicles, batteries, and clean mobility infrastructure will persist.

Circular Economy. Innovations like reverse logistics and product lifecycle tracking will help reduce waste and extend product/material life.

Smart Grids and Renewable Energy. Smart grid tech and new solutions for renewable energy integration will improve energy distribution.

#5 Cleantech Innovation Will See Increased Funding

Cleantech is the innovation that is driving our adaptation to climate change. We expect that investments into, and the pace of innovation and adoption of Cleantech will accelerate into 2024.

As companies commit to their net-zero targets, the need to operationalise the technologies required to fuel this transition becomes all the more urgent. BloombergNEF reported that for Europe alone, nearly USD 220 billion was invested in Cleantech in 2022.

But to meet net-zero ambitions, annual investments in Cleantech will need to triple over the rest of this decade and quadruple in the next.

Setting and achieving Sustainability goals is complex in BFSI. To be truly sustainable, organisations need to:

- Reduce internal energy consumption and carbon footprint

- Fund the transition to decarbonisation in high emission industries

- Introduce “green” customer products and services

- Monitor carbon data for financed emissions

Data and AI have the potential to assist in achieving these objectives, provided they are used effectively. Here is how.

Download ‘Driving Sustainability with Data and AI in Financial Services’ as a PDF

After the resounding success of the inaugural event last year, Ecosystm is once again partnering with Elevandi and the State Secretariat for International Finance SIF as a knowledge partner for the Point Zero Forum 2023. In this Ecosystm Insights, our guest author Jaskaran Bhalla, Content Lead, Elevandi talks about the Point Zero Forum 2023 and how it is all set to explore digital assets, sustainability, and AI in an ever-evolving Financial Services landscape.

The Point Zero Forum is returning for its second edition between 26 to 28 June 2023 in Zurich, Switzerland. The inaugural Forum held in June 2022 attracted over 1,000 leaders and featured more than 200 esteemed speakers from Europe, Asia Pacific, the USA, and MENA. The Forum represents a collaboration between the Swiss State Secretariat for International Finance (SIF) and Elevandi and is organised in cooperation with the BIS Innovation Hub, the Monetary Authority of Singapore (MAS), and the Swiss National Bank.

As we gear up for this year’s Point Zero Forum, let’s take a moment to reflect on some of the pivotal developments that have shaped the Financial Services industry since the previous Forum and also moulded the three key themes that will take centre stage this year: Sustainability, Artificial Intelligence (AI), and Digital Assets.

COP27, the rise of blended finance and the groundbreaking Net-Zero Public Data Utility

In November 2022, the Government of the Arab Republic of Egypt hosted the 27th session of the Conference of the Parties of the UNFCCC (COP27), with a view to accelerate the transition to a low-carbon future. In the build-up to COP27, Ravi Menon, the Managing Director of the MAS spoke at the inaugural Transition Finance towards Net-Zero conference and shared with the audience that the world is currently not on a trajectory to achieve net-zero emissions by 2050. And according to the UN Emissions Gap report 2021, based on the current policies in place, the world is 55% short of the emissions reduction target for 2030. He also elaborated on the significant role that blended finance can play in tackling climate change, a theme that widely resonated with the global leaders at COP27. To enable easy and transparent reporting on climate commitments, the Climate Data Steering Committee (CDSC) outlined the next steps on its recommended plans for the Net-Zero Data Public Utility (NZDPU) at COP 27. NZDPU aims to aid efforts to transition to a net-zero economy by addressing data gaps, inconsistencies, and barriers to information that slow climate action.

The Point Zero Forum 2023 will deep-dive into the data, technologies, and capital and risk management solutions that can accelerate the fair transition towards a low-carbon future.

Panel Discussion Highlight: The opening panel discussion, “Data for Net-Zero: Views from the Climate Data Steering Committee,” scheduled for 26 June, will feature members of the CDSC, which include the Financial Conduct Authority, the MAS, Glasgow Financial Alliance for Net Zero (GFANZ), and the Swiss State Secretariat for International Finance. The panel will discuss the role of new technologies and collaborative platforms in promoting greater accessibility of transition data and innovative business models.

The launch of ChatGPT by OpenAI and its record for the fastest 100M monthly active users

The launch of ChatGPT by OpenAI on 30 November, 2022 led to widespread adoption by users globally – eventually setting the record for the fastest-growing, active users, hitting 100M monthly active users by Feb 2023. While on one hand users rushed to share enormous efficiency gains achieved by the use of ChatGPT, on the other hand ChatGPT soon became a disruptive tool to spread fake news.

The Point Zero Forum 2023 will deep-dive into Generative AI’s potential for enhancing efficiency, improving risk management, and providing better customer experience in the Financial Services industry, while highlighting the need for ensuring fair, ethical, accountable, and transparent use of these technologies.

Panel Discussion Highlight: The session “Breaking New Ground with Generative AI: Project MindForge”, scheduled for 27 June, will feature global leaders from NVIDIA, the MAS, Citigroup and Bloomberg. The panel will discuss the opportunities of Generative AI for the Financial Services sector.

MiCA regulation gets adopted by the EU lawmakers and sets a precedent for digital asset regulations

More than 2.5 years after it was first proposed, the EU Markets in Crypto-Assets (MiCA) regulation was approved in April 2023 by EU Parliament. While there is still work to be done to implement MiCA and measure its success, and to answer open questions around regulation for out-of-scope assets (like DeFI and NFTs), the digital assets industry is keenly observing whether MiCA could serve as a template for global crypto regulation. In May 2023, the International Organization Of Securities Commissions (IOSCO), the global standard setter for securities markets, also joined the global discussion on digital asset regulation by issuing for consultation detailed recommendations to jurisdictions across the globe as to how to regulate crypto assets.

The Point Zero Forum 2023 will do a stocktake on key global regulatory frameworks, market infrastructure, and use cases for the widespread adoption of digital assets, asset tokenisation, and distributed ledger technology.

Panel Discussion Highlight: The sessions “State of Global Digital Asset Regulation: Navigating Opportunities in an Evolving Landscape” and “Interoperability and Regulatory Compliance: Building the Future of Digital Asset Infrastructure”, scheduled on 26 and 27 June respectively, will feature global leaders from both public sector (such as the MAS, Bank of Italy, Bank of Thailand, U.S. Commodity Futures Trading Commission, EU Parliament) and private sector organisations (such as JP Morgan, Sygnum, SBI Digital Assets, Chainalysis, GBBC, SIX Digital Exchange). The discussions will centre around digital asset regulations and key considerations in the rapidly evolving world of digital assets.

Register here at https://www.pointzeroforum.com/registration. Receive 10% off the Industry Pass by entering the code ‘JB10’ at check out. (Policymakers, regulators, think tanks, and academics receive complimentary access/ Founders of tech companies (incorporated for less than 3 years) can apply for a discounted Founder’s Pass)

Ecosystm supported by their partner EY, conducted an invitation-only Executive ThinkTank at the Point Zero Forum in Zurich. A select group of regulators, investors, technology providers, and senior leaders from financial institutions from across the globe came together to share their insights and experiences on the practicability, regulatory support, and implications of sustainable finance portfolios.

Here are some of the key takeaways from the ThinkTank.

- The Barriers to a Sustainable Future. The first step towards a sustainable future is recognising the challenges organisations face when pursuing Net Zero targets. Often, Net Zero targets are looked upon as additional costs.

- Overcoming the Challenges. It is important to connect Net Zero back to business goals, given that there might be sudden shifts in regulations and because of the emergence of environment-conscious consumers.

- A Sustainable Future Requires a Collaborative Approach. Global governments, regulators, Financial Services institutions, other enterprises, and technology providers need to collaborate on building a sustainable future.

- A Time for Simplification. Clear mandates on reporting climate aspects similar to how financial aspects are reported, will result in greater adoption of sustainability and ESG measures.

- The Role of Digital Architecture. The path to a Net Zero, decarbonised world will be technology-led.

Read below to find out more.

Download Risks and Opportunities of Net Zero Commitments and Decarbonisation Pathways as a PDF

The 2021 United Nations Climate Change Conference (COP26, that was held in Glasgow in 2021, highlighted the need to mobilise public and private sector finance to support global net-zero emissions targets and to protect communities and habitats.

Sustainable Finance and Green Bonds present opportunities for lenders, investors, and borrowers. It allows borrowers to obtain funding at decreased and competitive costs. And as investor demands continue to rise, Government institutions have expressed keen interest in issuing green bonds to support ecologically beneficial initiatives.

Here are some recent global announcements.

- France announces the issuance of USD 4 billion green bond sale.

- Germany raises USD 4 billion in green bonds to finance green expenditures and investments.

- Singapore sets a roadmap for its first sovereign green bond with the Singapore Green Bond Framework.

- Austria launches its first green bond.

- The UK launches an inquiry into the role of the financial sector in the country’s net zero transition.

Download Building a Climate Resilient Future with Sustainable Finance as a PDF

It’s been a while since I lived in Zurich. It was about this time of year when I first visited the city that I instantly fell in love with. Beautiful blue skies and if you’re lucky enough, you can see the snow-capped mountains from Lake Zurich. It’s hard not to be instantly drawn to this small city of approximately 1.4 million people, which punches well above its weight class. One out of every eleven jobs in Switzerland is in Zurich. The financial sector generates around a quarter of the city’s economic output and provides approximately 59,000 full time equivalent jobs – accounting for 16% of all employment in the city.

Between 21-23 June, Zurich will also be home to the Point Zero Forum – an exclusive invite-only, in-person gathering of select global leaders, founders and investors with the purpose of developing new ideas on emerging concepts such as decentralised finance (DeFi), Web 3.0, embedded finance and sustainable finance; driving investment activity; and bringing together public and private sector leaders to brainstorm on regulatory requirements.

The Future of DeFi

Zug is a little canton outside of Zurich and is famously known as “Crypto Valley”. When I lived in Zurich, Zug was the home of many of the country’s leading hedge funds as Zug’s low tax, business friendly environment and fantastic quality of life attracted many of the world’s leading fund managers and companies. Today the same can be said about crypto companies setting up shop in Zug. And crypto ecosystems are expanding exponentially.

However, with the increase in the global adoption of cryptocurrency, what role will the regulators play in aligning regulation without stifling innovation? How can Crypto Valley and Singapore play a role in defining the role regulation will play in a DeFi world?

DeFi is moving fast and we are seeing an explosion of new ideas and positive outcomes. So, what can we expect from all of this? Well, that is what I will discuss with a group of regulators and industry players in a round table discussion on How an Adaptive and Centralised Regulatory Approach can Shape a Protected Future of Finance at the Point Zero Forum. We will explore the role of regulators in a fast-moving industry that has recently seen some horror stories and how industry participants are willing to work with regulators to meet in the middle to build an exciting and sometimes unpredictable future. How do we regulate something in the future? I am personally looking forward to the knowledge sharing.

For the industry to strive and innovate, we need both regulators and industry players to work together and agree to a working framework that helps deliver innovation and growth by creating new technology and jobs. But we also need to keep an eye out on the increasing number of scams in the industry. It is true to say that we have seen our fair share of them in recent months. The total collapse of TerraUSD and Luna and the collapse of the wider crypto market that saw an estimated loss of USD 500 billion has really spooked global markets.

So is cryptocurrency here for good and will it be widely adopted globally? How will regulators see the recent collapse of Luna and view regulations moving forward? We have reached an interesting point with cryptocurrencies and digital assets in general. Is it time to reflect on the current market or should we push forward and try to find a workable middle ground?

Let’s find out. Watch this space for my follow-up post after the Point Zero Forum event!

Innovation is at the core of Singapore’s ethos. The country has perfected the art of ‘structured innovation’ where pilots and proof of concepts are introduced and the successful ones scaled up by recalibrating technology, delivery systems, legislation, and business models. The country has adopted a similar approach to achieving its sustainability goals.

The Singapore Green Plan 2030 outlines the strategies to become a sustainable nation. It is driven by five ministries: Education, National Development, Sustainability and the Environment, Trade and Industry, and Transport, and includes five key pillars: City in Nature, Sustainable Living, Energy Reset, Green Economy, and Resilient Future. We will see a slew of new programs and initiatives in green finance, sustainability, solar energy, electric vehicles (EVs), and innovation, in the next couple of years.

Singapore’s Intentions of Becoming a Green Finance Leader

Singapore is serious about becoming a world leader in green finance. The Green Bonds Programme Office was set up last year, to work with statutory boards to develop a framework along with industry and investor stakeholders. We have seen a number of sustainable finance initiatives last year, such as the National Environment Agency (NEA) collaborating with DBS to raise USD 1.23 billion from its first green bond issuance. The proceeds will fund new and ongoing sustainable waste management initiatives. Temasek collaborated with HSBC for a USD 110 million debt financing platform for sustainable projects and Sembcorp issued sustainability bonds worth USD 490 million.

Building an Ecosystm of Sustainable Organisations

Sustainability has to be a collective goal that will require governments to work with enterprises, investors and consumers. To ensure that enterprises are focusing on Sustainability, governments have to keep in mind what drives these initiatives and the challenges organisations face in achieving their goals.

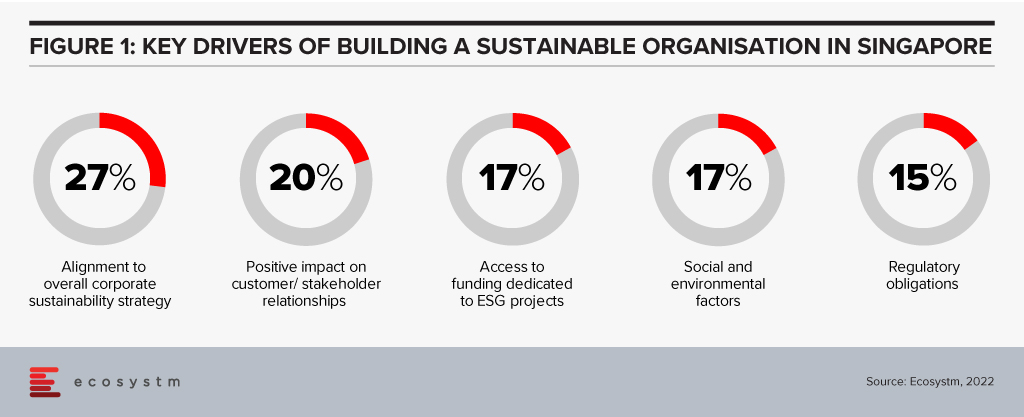

There are several reasons driving organisations in Singapore to adopt sustainability goals and ESG responsibilities (Figure 1)

It is equally important to address organisations’ challenges in building sustainability in their business processes. Last week, the Institute of Banking and Finance (IBF) and the Monetary Authority of Singapore (MAS) set out 12 Sustainable Finance Technical Skills and Competencies (SF TSCs) required by people in various roles in sustainable finance. This addresses the growing demand for sustainable finance talent in Singapore; and covers knowledge areas such as climate change policy developments, natural capital, green taxonomies, carbon markets and decarbonisation strategies. There are Financial Services related competencies as well, such as sustainability risk management, sustainability reporting, sustainable investment management, and sustainable insurance and reinsurance solutions. The SF TSCs are part of the IBF Skills Framework for Financial Services.

Sustainable Resources Initiatives

Singapore is not only focused on Sustainable Finance. If we look at NEA’s Green Bonds, there are specific criteria that projects must satisfy in order to qualify, including a focus on sustainable waste management.

Last week the Government announced that the National Research Fund (NRF) will allocate around USD 160 million to drive new initiatives in water, reuse and recycling technologies, as part of the Research, Innovation and Enterprise 2025 plan (RIE2025). Part of the fund will be allocated to the Closing the Resource Loop (CTRL) initiative, administered by the NEA that will fund sustainable resource recovery solutions.

Singapore faces severe resource constraints, and water security is not a new challenge for the country. The NRF funding will also be used partially for R&D in 3 water technology focus areas: desalination and water reuse; used water treatment; and waste reduction and resource recovery.

The Government is Leading the Way

The Government’s concerted efforts to make the Singapore Green Plan 2030 a success is seeing corporate participation in the vision. In February, Shell started supplying sustainable aviation fuel (SAF) to customers such as SIA Engineering Company and the Singapore Air Force in Singapore. Shell has also upgraded their Singapore facility to blend SAF at multiple, key locations. Last week, Atlas announced their commitment to Web 3.0 technologies and “tech for good”. They aim to increase their green energy use to 75% by 2022; 90% by 2023; and 100% by 2024. ESG consciousness is percolating down from the Government.

The success of Singapore’s Sustainability strategies will depend on innovation, the Government’s ongoing commitment, and the support provided to enterprises, investors, and consumers. The Singapore Government is poised to lead from the front in building a Sustainable Ecosystem.

Recognising FinTechs that are changing lives, creating impact, demonstrating innovation, and building ecosystems to shape the Digital Future.

CATEGORIES:

Global Platform. Organisations that provide a platform to bring together industry stakeholders such as financial services institutions and FinTechs to drive ease of collaboration and innovation by accelerating proof of concept deployments

Financial Inclusion Impact. Organisations that promote financial inclusion in the unbanked and the underbanked with a focus on bridging the economic divide

Sustainable Finance Impact. Organisations that promote sustainable finance and have ESG values

Global Banking. Banks and financial services organisations that embrace digital technology for excellence in customer experience, process efficiency and/or compliance

Global Payments. Innovative use of technology and business models in payment areas

Global Lending. Innovation in alternative finance in areas such as microfinance for individuals and small & medium enterprises, P2P lending and crowdfunding

Customer Experience. Organisations that are driving an exceptional experience for their customers and setting new benchmarks within the industry

Global InsureTech. Excellence and innovation in InsureTech in areas such as micro-insurance, usage-based pricing, process optimisation and underwriting efficiency

To find out about the winners, read on.

To download Ecosystm Red: Global Digital Futures Awards for FinTech Awards Winners as a PDF, please click here.