2024 will be another crucial year for tech leaders – through the continuing economic uncertainties, they will have to embrace transformative technologies and keep an eye on market disruptors such as infrastructure providers and AI startups. Ecosystm analysts outline the key considerations for leaders shaping their organisations’ tech landscape in 2024.

Navigating Market Dynamics

Continuing Economic Uncertainties. Organisations will focus on ongoing projects and consider expanding initiatives in the latter part of the year.

Popularity of Generative AI. This will be the time to go beyond the novelty factor and assess practical business outcomes, allied costs, and change management.

Infrastructure Market Disruption. Keeping an eye out for advancements and disruptions in the market (likely to originate from the semiconductor sector) will define vendor conversations.

Need for New Tech Skills. Generative AI will influence multiple tech roles, including AIOps and IT Architecture. Retaining talent will depend on upskilling and reskilling.

Increased Focus on Governance. Tech vendors are guide tech leaders on how to implement safeguards for data usage, sharing, and cybersecurity.

5 Key Considerations for Tech Leaders

#1 Accelerate and Adapt: Streamline IT with a DevOps Culture

Over the next 12-18 months, advancements in AI, machine learning, automation, and cloud-native technologies will be vital in leveraging scalability and efficiency. Modernisation is imperative to boost responsiveness, efficiency, and competitiveness in today’s dynamic business landscape.

The continued pace of disruption demands that organisations modernise their applications portfolios with agility and purpose. Legacy systems constrained by technical debt drag down velocity, impairing the ability to deliver new innovative offerings and experiences customers have grown to expect.

Prioritising modernisation initiatives that align with key value drivers is critical. Technology leaders should empower development teams to move beyond outdated constraints and swiftly deploy enhanced applications, microservices, and platforms.

#2 Empowering Tomorrow: Spring Clean Your Tech Legacy for New Leaders

Modernising legacy systems is a strategic and inter-generational shift that goes beyond simple technical upgrades. It requires transformation through the process of decomposing and replatforming systems – developed by previous generations – into contemporary services and signifies a fundamental realignment of your business with the evolving digital landscape of the 21st century.

The essence of this modernisation effort is multifaceted. It not only facilitates the integration of advanced technologies but also significantly enhances business agility and drives innovation. It is an approach that prepares your organisation for impending skill gaps, particularly as the older workforce begins to retire over the next decade. Additionally, it provides a valuable opportunity to thoroughly document, reevaluate, and improve business processes. This ensures that operations are not only efficient but also aligned with current market demands, contemporary regulatory standards, and the changing expectations of customers.

#3 Employee Retention: Consider the Strategic Role of Skills Acquisition

The agile, resilient organisation needs to be able to respond at pace to any threat or opportunity it faces. Some of this ability to respond will be related to technology platforms and architectures, but it will be the skills of employees that will dictate the pace of reform. While employee attrition rates will continue to decline in 2024 – but it will be driven by skills acquisition, not location of work.

Organisations who offer ongoing staff training – recognising that their business needs new skills to become a 21st century organisation – are the ones who will see increasing rates of employee retention and happier employees. They will also be the ones who offer better customer experiences, driven by motivated employees who are committed to their personal success, knowing that the organisation values their performance and achievements.

#4 Next-Gen IT Operations: Explore Gen AI for Incident Avoidance and Predictive Analysis

The integration of Generative AI in IT Operations signifies a transformative shift from the automation of basic tasks, to advanced functions like incident avoidance and predictive analysis. Initially automating routine tasks, Generative AI has evolved to proactively avoiding incidents by analysing historical data and current metrics. This shift from proactive to reactive management will be crucial for maintaining uninterrupted business operations and enhancing application reliability.

Predictive analysis provides insight into system performance and user interaction patterns, empowering IT teams to optimise applications pre-emptively, enhancing efficiency and user experience. This also helps organisations meet sustainability goals through accurate capacity planning and resource allocation, also ensuring effective scaling of business applications to meet demands.

#5 Expanding Possibilities: Incorporate AI Startups into Your Portfolio

While many of the AI startups have been around for over five years, this will be the year they come into your consciousness and emerge as legitimate solutions providers to your organisation. And it comes at a difficult time for you!

Most tech leaders are looking to reduce technical debt – looking to consolidate their suppliers and simplify their tech architecture. Considering AI startups will mean a shift back to more rather than fewer tech suppliers; a different sourcing strategy; more focus on integration and ongoing management of the solutions; and a more complex tech architecture.

To meet business requirements will mean that business cases will need to be watertight – often the value will need to be delivered before a contract has been signed.

The tech industry tends to move in waves, driven by the significant, disruptive changes in technology, such as cloud and smartphones. Sometimes, it is driven by external events that bring tech buyers into sync – such as Y2K and the more recent pandemic. Some tech providers, such as SAP and Microsoft, are big enough to create their own industry waves. The two primary factors shaping the current tech landscape are AI and the consequential layoffs triggered by AI advancements.

While many of the AI startups have been around for over five years, this will be the year they emerge as legitimate solutions providers to organisations. Amidst the acceleration of AI-driven layoffs, individuals from these startups will go on to start new companies, creating the next round of startups that will add value to businesses in the future.

Tech Sourcing Strategies Need to Change

The increase in startups implies a change in the way businesses manage and source their tech solutions. Many organisations are trying to reduce tech debt, by typically consolidating the number of providers and tech platforms. However, leveraging the numerous AI capabilities may mean looking beyond current providers towards some of the many AI startups that are emerging in the region and globally.

The ripple effect of these decisions is significant. If organisations opt to enhance the complexity of their technology architecture and increase the number of vendors under management, the business case must be watertight. There will be less of the trial-and-error approach towards AI from 2023, with a heightened emphasis on clear and measurable value.

AI Startups Worth Monitoring

Here is a selection of AI startups that are already starting to make waves across Asia Pacific and the globe.

- ADVANCE.AI provides digital transformation, fraud prevention, and process automation solutions for enterprise clients. The company offers services in security and compliance, digital identity verification, and biometric solutions. They partner with over 1,000 enterprise clients across Southeast Asia and India across sectors, such as Banking, Fintech, Retail, and eCommerce.

- Megvii is a technology company based in China that specialises in AI, particularly deep learning. The company offers full-stack solutions integrating algorithms, software, hardware, and AI-empowered IoT devices. Products include facial recognition software, image recognition, and deep learning technology for applications such as consumer IoT, city IoT, and supply chain IoT.

- I’mCloud is based in South Korea and specialises in AI, big data, and cloud storage solutions. The company has become a significant player in the AI and big data industry in South Korea. They offer high-quality AI-powered chatbots, including for call centres and interactive educational services.

- H2O.ai provides an AI platform, the H2O AI Cloud, to help businesses, government entities, non-profits, and academic institutions create, deploy, monitor, and share data models or AI applications for various use cases. The platform offers automated machine learning capabilities powered by H2O-3, H2O Hydrogen Torch, and Driverless AI, and is designed to help organisations work more efficiently on their AI projects.

- Frame AI provides an AI-powered customer intelligence platform. The software analyses human interactions and uses AI to understand the driving factors of business outcomes within customer service. It aims to assist executives in making real-time decisions about the customer experience by combining data about customer interactions across various platforms, such as helpdesks, contact centres, and CRM transcripts.

- Uizard offers a rapid, AI-powered UI design tool for designing wireframes, mockups, and prototypes in minutes. The company’s mission is to democratise design and empower non-designers to build digital, interactive products. Uizard’s AI features allow users to generate UI designs from text prompts, convert hand-drawn sketches into wireframes, and transform screenshots into editable designs.

- Moveworks provides an AI platform that is designed to automate employee support. The platform helps employees to automate tasks, find information, query data, receive notifications, and create content across multiple business applications.

- Tome develops a storytelling tool designed to reduce the time required for creating slides. The company’s online platform creates or emphasises points with narration or adds interactive embeds with live data or content from anywhere on the web, 3D renderings, and prototypes.

- Jasper is an AI writing tool designed to assist in generating marketing copy, such as blog posts, product descriptions, company bios, ad copy, and social media captions. It offers features such as text and image AI generation, integration with Grammarly and other Chrome extensions, revision history, auto-save, document sharing, multi-user login, and a plagiarism checker.

- Eightfold AI provides an AI-powered Talent Intelligence Platform to help organisations recruit, retain, and grow a diverse global workforce. The platform uses AI to match the right people to the right projects, based on their skills, potential, and learning ability, enabling organisations to make informed talent decisions. They also offer solutions for diversity, equity, and inclusion (DEI), skills intelligence, and governance, among others.

- Arthur provides a centralised platform for model monitoring. The company’s platform is model and platform agnostic, and monitors machine learning models to ensure they deliver accurate, transparent, and fair results. They also offer services for explainability and bias mitigation.

- DNSFilter is a cloud-based, AI-driven content filtering and threat protection service, that can be deployed and configured within minutes, requiring no software installation.

- Spot AI specialises in building a modern AI Camera System to create safer workplaces and smarter operations for every organisation. The company’s AI Camera System combines cloud and edge computing to make video footage actionable, allowing customers to instantly surface and resolve problems. They offer intelligent video recorders, IP cameras, cloud dashboards, and advanced AI alerts to proactively deliver insights without the need to manually review video footage.

- People.ai is an AI-powered revenue intelligence platform that helps customers win more revenue by providing sales, RevOps, marketing, enablement, and customer success teams with valuable insights. The company’s platform is designed to speed up complex enterprise sales cycles by engaging the right people in the right accounts, ultimately helping teams to sell more and faster with the same headcount.

These examples highlight a few startups worth considering, but the landscape is rich with innovative options for organisations to explore. Similar to other emerging tech sectors, the AI startup market will undergo consolidation over time, and incumbent providers will continue to improve and innovate their own AI capabilities. Till then, these startups will continue to influence enterprise technology adoption and challenge established providers in the market.

Digital and IT organisations are going through some dramatic changes as they adopt cloud and as-a-service capabilities. In this post, I want to write about two of these – one that is very much a consequence of the other.

Contract Numbers are Exploding

We’re seeing an explosion in the number of IT suppliers to a typical organisation.

Pre-cloud, the typical organisation probably had five to ten contracts that covered most of the external services that were in use. With suppliers increasingly providing niche functionality and the increased use of credit cards to buy external services, it is often difficult to determine exactly how many contracts are in place. Or, indeed, have a clear understanding of the terms and conditions of each of these contracts.

Where once an organisation might have had contracts for an on-premises ERP and CRM system, a typical organisation will still have those contracts as well as a supply chain forecasting service, a marketing email management tool, not to mention online spreadsheets and task management capabilities.

So with many more contracts in place, the complexity of managing these contracts and understanding the technical, legal and business risks encapsulated in these contracts has become dramatically more difficult.

I’ll return to this point in a later post, as most organisations struggle with this increasing complexity.

What Is Happening to Your People?

The existence of these contracts means that you are increasingly becoming dependent on the people employed by these external organisations. But when you sign up for these contracts, do you investigate how these suppliers develop their talent?

The New Zealand Herald recently carried an interesting article on one organisation that has developed a paid intern program. Something very rare in the industry.

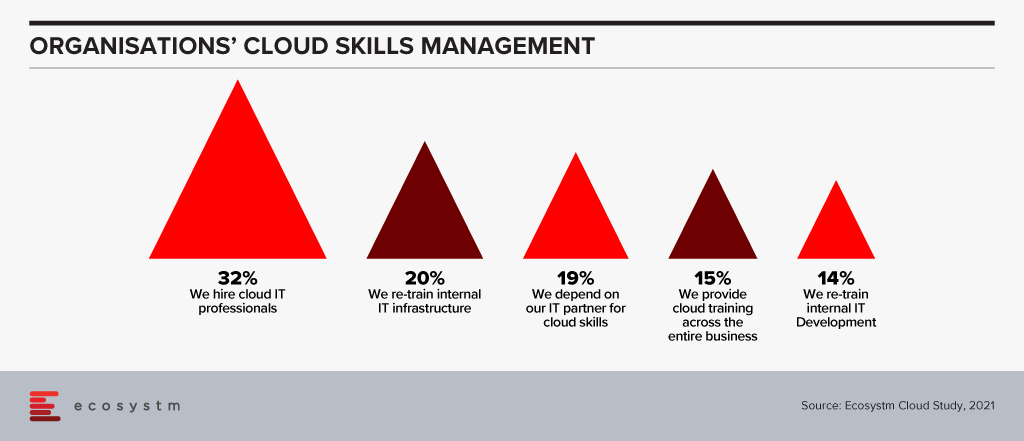

The article prompted me to think through some of the implications of using cloud services. Tech buyer organisations will have less need for technical capabilities as increasingly these are delivered by the cloud suppliers.

But the growth in demand for digital and IT skills just continues to increase as more and more industries digitalise. In the past, tech buyer organisations would have invested (at least the good employers did!) in the development of their people. The cloud suppliers are increasingly doing this talent development.

Most contract negotiations are based on cost, quality and customer service. A significant proportion of cloud contracts are now boilerplate – you pay with a credit card for a monthly service and have little or no ability to negotiate terms and conditions.

The trade-off is required to get a short commitment term and a variable cost profile. No tech vendor can afford to negotiate bespoke contracts for this type of commercial arrangement.

This situation leaves the question of how tech buyers can influence tech vendors to develop their people’s talent appropriately. Some would say that the tech vendors will do this as a matter of course, but the statistics, as highlighted in the Ecosystm research data in Figure 1, show that we are not bringing people in at the rate the industry requires.

Advice for Tech Buyers

I recommend you look closely at using two tactics with the tech vendors that you are working with:

- First, look to consolidate as much workload as practical under a single contract with the supplier. This is not a new recommendation for contracts – but with the increasing use of boilerplate contracts, it is one of the few ways an organisation can increase its value and importance to a tech vendor.

- Second, start finding those tech vendors that are developing new and existing talent in practical ways and favour these organisations in any purchase decision.

Most organisations, individually, do not have the commercial power to dictate terms to the cloud providers. Still, if enough tech buyers adopt this critical criterion, the cloud providers may see the value in investing in the industry’s talent development in meaningful ways.

The downside? Talent development does not come free. Tech buyers may need to pay a higher fee to encourage the suppliers but paying a low-cost provider who does not develop their talent sounds like a recipe for poor quality service.

If you would like to discuss any of these thoughts or issues further, please feel free to reach out and contact me. This is an industry issue and one for our broader society, so I would be interested in hearing how your organisations are addressing this challenge.

With the advancements in the technology landscape, the CIO’s role has become increasingly complex. One of the key challenges they face is in emerging and newer technology implementations, which require them to identify and partner with newer tech vendors. The common challenges that tech buyers face today include:

- The emergence of newer technologies that are catching the fancy of the C-suite and they are expected to adopt and deliver

- Getting management buy-in for IT investments (increasingly including discussions on ROI)

- Need to involve business stakeholders in tech decision-making

- Lack of sufficiently skilled internal IT

- Engagement with multiple tech vendors (including newer vendors that they have to establish a relationship with)

- Digital transformation projects that might require an overhaul (or at least a re-think) of IT systems

- Backdrop of compliance and risk management mandates

Many of these challenges will require the sourcing of new technology or a new tech partner and rethinking their vendor selection criteria. And selecting a tech vendor can be hard. The mere fact that there is an industry whose sole purpose is to help businesses select tech vendors goes to show the massive gap between what these providers sell and what businesses want. If there was easy alignment, the Tech Sourcing professionals and businesses would not have existed.

But over my time working with Tech Sourcing professionals, CIOs and business leaders, I have picked up on a few key factors that you should incorporate in your vendor selection process best practices. First and foremost, you are looking for a partner – someone who will be with you through the good and bad. Someone whose skills, products, services – and most importantly – culture, match your business and its needs.

I believe that the technology ecosystem is not really as competitive as we think. Yes, in practice Google competes with Microsoft in the office productivity space. But I often hear about companies moving from one to the other not for features, function or even price – but for a cultural match. Some traditional businesses were hoping Google can help them become more innovative, but in reality, their business culture smothered Google and meant they could not benefit from the difference in the ways of working. And I am not suggesting Microsoft is not innovative – more that Office represents the traditional ways of working – and perhaps can help a business take a more stepwise approach to change its own culture.

And I regularly hear about IT services deals (managed services, systems integration, consulting etc) going to the company that made the most sense from a cultural fit – where they were willing to take on the culture of their customer and embrace that way of working. In fact, I have been brought into many deals where a company hired a strategic consultant to create a new digital strategy or AI strategy, only to receive a document that is unworkable in their business and their culture.

So, I believe every strategic technology relationship should start and end with a cultural match. This company is a partner – not just a provider. How do you determine if they are a partner and measure cultural match? Well, that is the topic of an upcoming report of mine, so watch this space!

Questions You Should Ask Before Stepping in the Ring

There are also a number of questions that you should ask along with the partnership discussion:

- How will this solution change the organisation?

- What are the risks either way (of implementing or not implementing the solution)?

- Does the solution solve a key business problem?

- Is it likely to have more impact than the solution it is replacing?

- Where will the funding for the implementation come from?

- Have you calculated the ROI and the time to deployment?

- Have you baselined the current scenario so that you can measure improvement?

These can inform you of the business impact of the solution – and what you need to do to prepare for successful implementation (if you plan for success, you are more likely to be able to get faster benefits than if you do not plan for the change!)

Engagement Criteria for Your Shortlisting Process

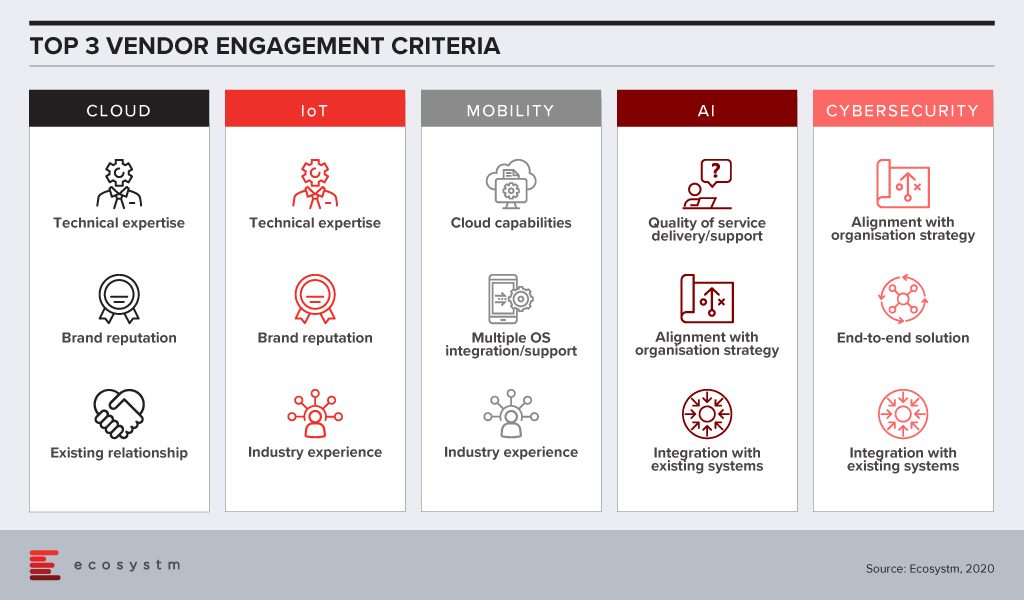

In order to determine vendor selection process best practices, Ecosystm research tries to unearth the top criteria that organisations employ when shortlisting the vendors that they want to engage, across multiple technologies.

There is still a skills gap in internal IT and organisations want technical guidance from their Cloud and IoT vendors. With the plethora of options available in these tech areas, CIOs and IT teams also tend to look at the brand reputation when engaging with the vendor. Very often, organisations looking to migrate their on-prem solutions on the cloud engage with existing infrastructure providers or systems integrators for guidance, and existing relationships are significant. IoT solutions tend to be very industry-specific and a portfolio of specific industry use cases (actual deployments – not proofs of concept) can be impactful when selecting a vendor for planned deployments.

Artificial intelligence (AI) deployments are often linked with digital transformation (DX). Organisations look for a vendor that can understand the organisational strategy and customise the AI solutions to help the organisation achieve its goal. Adoption of AI is still at a nascent stage globally across all industries. Many organisations do not have the right skills, such as data scientists, yet. They appreciate that integration with internal systems will be key to reap the full benefits of the solutions, especially if the entire organisation has to benefit from the deployments. They also anticipate that they would have to have a continuous period of engagement with their vendors, right from identifying the right data set, data cleaning to the right algorithms that keep learning. Organisations will look at vendor partners who are known for delivering better customer experience.

This is true for cybersecurity solutions as well, as organisations are driven to continue their investments to adhere to the internal risk management requirements. Given how fragmented the cybersecurity landscape has become, organisations will also wish to engage with vendors that have an end-to-end offering, especially a managed security service provider (MSSP). Cybersecurity vendors are increasingly strengthening their partner ecosystem so that they can provide their client with the single-point-of-contact that they want.

Of the technologies mentioned in the figure, mobility is arguably the most mature. As organisations revisit their enterprise mobility solution as they go increasingly ‘Mobile First’, their requirements from their mobility vendors are more specific. They have decided over the years which OSs they want to support their enterprise applications and are looking for vendors with robust cloud offerings.

The vendor selection criteria will likely be different for each technology area. And as your knowledge and understanding of the technology increases, you should be able to drill the requirements down to the solution level, while making sure you engage with a vendor with the right culture.

Tim Sheedy’s upcoming report, ‘Best Practices for Vendor Evaluation and Selection’ is due to be published in February 2020.