There have been some long-term shifts in market dynamics in the telecom industry. Network traffic growth rates have accelerated; new business models emerged; and cloud services matured and spread to new verticals, applications and customer sizes. Networks are more important than ever. Revenue growth rates and profitability in the three segments – telecom, webscale, and carrier-neutral – have been stronger in recent quarters than anticipated.

Looking ahead, networks will increasingly revolve around data centres, which will continue to proliferate both at the core and edge.

Data centre innovation will be rapid, as webscalers push the envelope on network design and function, and telecom operators seek cheaper ways of running their networks. The telecom operator’s need for cost efficiency will increase as overhyped 5G-based opportunities fail to materialise in any big way. Carrier-neutral operators (CNNOs) will benefit from an ongoing wave of new capital which will help them transform to more integrated providers of “digital infrastructure” assets.

Read on to find out about

- The interdependence of network operators

- The growth potential of the telecom, webscale, and CNNO markets

- How webscalers such as Facebook and Alibaba are leveraging scale

- Acquisition and deals in the CNNO market such as the American Tower-CoreSite acquisition and the Digital Realty deal with Ciena.

- The growth of environmental consciousness in the telecom industry

Click here to download The Future of Telecom: Industry Outlook for 2022 and Beyond slides as a PDF.

2020 was a watershed year for the industry as they proved to be the backbone for the rapid changes in work practices, communication and entertainment. This has led telecom providers to embark on their won digital transformation journeys.

The challenges continue for the industry, especially as 5G has not yet delivered on the early promises. Telecom operators today are having to provide cutting-edge services and top-notch customer experience as they continue to be challenged by new market entrants and strong regulatory pressures.

In 2022, telecom providers will be driven by the need to innovate and improve their product and service lines; improve customer experience; comply with changing regulations; and to optimise costs.

Read on to find out what Ecosystm Analysts Darian Bird and Matt Walker think will be the key trends in the telecom industry in 2022.

IBM has made several significant announcements in the last year and are clearly pivoting fast for continued success.

In October, IBM held a series of analyst briefings to highlight their future strategies. This included a view into the “New IBM”, the re-branding of IBM Global Business Services as IBM Consulting, and the future roadmap for Kyndryl.

Going forward IBM is betting big on the dual capabilities of the Hybrid Cloud and Data & AI. Their strategy keeps a firm eye on the evolving needs of the enterprise with offerings such as the IBM Cloud Satellite, IBM Garage, and industry clouds.

Ecosystm Analysts, Tim Sheedy, Ullrich Loeffler, Matt Walker, Venu Reddy and Sash Mukherjee comment on IBM’s strategy going forward and the associated opportunities.

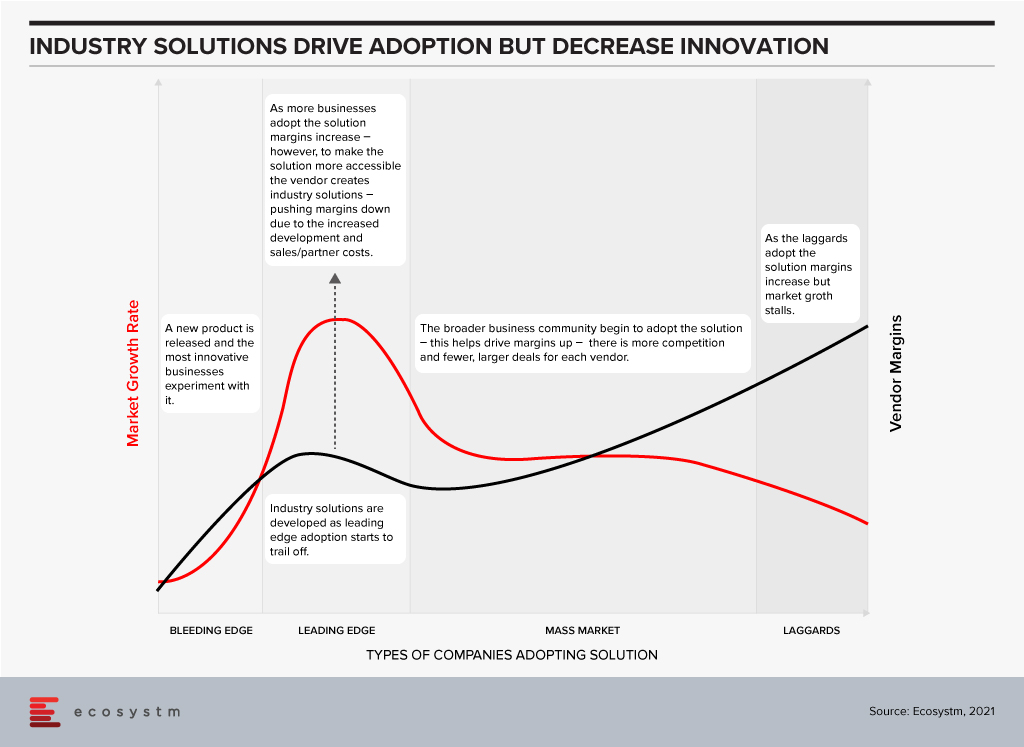

Moving from a product or regional focus to an industry focus appears to be the “strategy du jour” for many technology vendors today. For some it is a new strategy – with the plan to improve customer focus and increase growth; for others it is the pendulum moving back to where they were five or ten years ago as they bounce from being industry-centric to product-centric to geography-centric and back again.

Getting your industry focus right is much harder than it seems – and has to be timed with client needs and market opportunity. The need to focus on the industry varies for different technology products, services and capabilities. For example, most technology buyers want their vendors to understand what their business does and how they add value to customers – that is a given and industry-aligned Sales teams make a lot of sense. Many tech buyers also want certain software functions to align directly to their processes – there is little appetite to customise ERP and financial suites to specific industry needs and processes – and tech vendors should support these out-of-the-box or cloud needs.

Industry Solutions May Not Drive Competitive Advantage

If the industry solution you are selling is the same as what any of their competitors can buy from you, then organisations get the exact same benefit as the market – no more, no less. For example, about 10-15 years ago, large telecom providers around the globe made significant investments in CRM platforms (often from Siebel) – bringing in one of a few large global systems integrators to deploy their standard processes and systems. These CRMs were supposed to provide business and customer benefit, and drive competitive advantage. And while they did deliver positive change (often at SIGNIFICANT cost!) when every telecom provider was using the same solution with the same or similar processes, any competitive advantage was lost.

Industry Solutions are Often the Sign of a Mature Market

The widely accepted hypothesis is that the technology innovation and adoption happens in waves. The market has 5-7 year waves of innovation, followed by 5-7 year waves of deployment, adoption and consolidation.

The Innovation Phase. In this stage new companies emerge, new products or services are launched and leading/bleeding edge companies embrace these new technologies to drive competitive advantage and business growth. They experiment with new technologies that drive new business capabilities – sometimes failing, but always pushing the envelope for business innovation and forging the path for mass market adoption. In this stage there is often little demand for industry solutions – as both the providers and buyers of the solutions are still working out where the business benefit is; where the technology might be able to drive change or help them get ahead of competitors. If you examine the growth of a company such as Salesforce, you see that the early stage products are targeted towards a generic market – customers are expected to customise the solution based on their needs and individual requirements. In 2002 I worked for a challenger telecom provider that had deployed a traditional Peoplesoft CRM capability, and I was part of the team that brought Salesforce into the business – and as a cloud-based solution, we saw the competitive advantage was the pace at which we could customise the product (by excluding IT teams and processes). However, the solution was a “one-size-fits-all” product. The innovation stage is typically characterised by high growth of smaller vendors and technology service providers who challenge the status quo.

The Deployment, Adoption and Consolidation Phase. This stage of market growth is when the mass market starts to adopt these solutions. Many of these buyers walk the paths that have been forged before them by the more innovative, leading edge businesses. This stage typically sees less innovation, less experimentation, and more standard deployments. To make the solutions more palatable and easier to sell to the mass market tech vendors typically pre-configure or customise the solutions to specific needs – for business teams, roles or industries. It is usually in this stage of market growth and deployment that the industry solutions see significant interest and adoption. This is where the mass market gets access to the business benefits the more innovative businesses received many years earlier (and often profited from in this time). In my example of the Salesforce deployment in 2002, over the following years many partners started to create industry solutions, and eventually Salesforce themselves sold industry-specific solutions – or at least targeted certain products and capabilities at specific industries and provided accelerated deployment models to drive advantage at a faster rate. The deployment and consolidation stage of market growth is typically characterised by steady, slow growth across the entire market as benefits are being driven to all providers (product vendors and solutions or implementation providers). Legacy providers either play catch up or suffer declining business as they realise the solution they sell no longer provides the business and customer the benefits that it used to.

Industry Focus Should be Aligned to Customer Segments, Solution Type and Geography

The decision to sell industry-focused solutions should be driven by the type of solution you are selling; the business benefit you are promising; and the type of business you are targeting the solution towards. Businesses that are more innovative will still buy some pre-configured, industry-specific solutions that don’t differentiate their business or drive competitive advantage. But where they expect competitive advantage, they need to stand apart – to be the only business with that capability.

It is also worth understanding that an innovation in one market might be standard practice in another (and vice-versa). Countries across the globe and specifically here in Asia Pacific have different approaches to technology and innovation. China and parts of Southeast Asia are often innovators – pushing the boundaries of new and emerging tech to do things we never thought possible (in the same way Silicon Valley traditionally has done). Australia and India are traditional markets that adopt industry solutions after they have been tried and tested by others. Innovation in Japan seems to happen in stages and at pace but only once every 10-15 years or so. New Zealand and Singapore are generally more nimble economies where businesses often have to be innovative to gain global competitive advantage quickly.

Evidence indicates that the rate of innovation is increasing across the entire region – even in the less innovative economies. The window for industry solutions is much smaller regardless of location – as the next new innovation is just around the corner. Even the large, traditionally less agile businesses are driving innovation programs – for example, many of the big financial services “dinosaurs” such as DBS and Commonwealth Bank often win tech innovation awards and offer market-leading customer experiences.

Use this lens to better develop your industry approach. The depth of your industry solution or capability will dictate the opportunities that you will drive based on the type of customer and technology stage. Do you want to drive innovation or efficiency in your clients? Do you want to win the big “safer” deals – but be thought of as a technology solution provider; or win the smaller deals in companies that will become the market leaders of tomorrow – and be considered a market leader and king maker? Understanding your own business goals, the current sales and delivery capabilities, and the capacity to change will help your company create a go-to-market strategy that suits your current and future customers and will likely dictate the growth rate of your business over the next 5-7 years.

Keep yourself abreast with the latest industry trends

Ecosystm market insights, data, and reports are jam-packed with industry analysis and digital trends across several industry verticals to help you keep tabs on the fast-paced world of tech.

Organisations were forced to do a complete rethink on how to continue doing business and maintain social interactions last year – and this led to accelerated digitalisation of consumers and enterprises.

The telecom industry was the pillar that enabled the fast pivots that were required. The industry was impacted very differently by the pandemic compared to most other industries. More than a third of telecom providers indicate that it was either business as usual for them or that their business actually accelerated during the global crisis, according to Ecosystm research.

What lies ahead now for the telecom industry?

The rise in data use coupled with the fervent growth of the digital economy augurs well for the telecom sector in 2021. Ecosystm predicts 5 trends in the telecommunications industry that will drive innovation. Click below to learn more.

Never before has the world experienced a shutdown in both supply and demand which has effectively slammed the brakes on economic activities and forced a complete rethink on how to continue doing business and maintain social interactions. The COVID-19 pandemic has accelerated digitalisation of consumers and enterprises and the telecommunications industry has been the pillar which has kept the world ticking over.

It is unthinkable just how the human race would have coped with such massive disruption, two decades ago in the absence of broadband internet. The technology and telecom sector has seen a rise in their visible importance in recent months. Various findings show that peak level traffic was about 20-30% higher than the levels before the pandemic. The rise in traffic coupled with the fervent growth of the digital economy augurs well for the technology and telecom sector in Southeast Asia.

Revenues Hit Despite Rise in Traffic

Unfortunately, the rise in network traffic has not translated to an increase in revenue for many operators in the region. The winners, that enjoyed YoY growth in Q1 2020 despite challenging circumstances were: Maxis (4.9%) and DiGi (3.4%) in Malaysia; dtac (3.3%) and True (5.7%) in Thailand; PDLT (7.5%) and Globe (1.4%) in the Philippines; and Indosat Ooredoo (7.9%) and XL Axiata (8.8%) in Indonesia. The telecom operators that struggled include: Celcom (-6.1%) and TM (-8.0%) in Malaysia; Singapore’s trio of Singtel (-6.5%), StarHub (-15.2%) and M1 (-10.3%); and AIS (-1.0%) in Thailand.

Key market trends include a dip in prepaid subscribers due to fall in tourist numbers, roaming income losses due to travel restrictions, and a general decline in average revenue per user (ARPU) due to weaker customer spend. The postpaid customer segment was resilient while the fixed broadband revenue stream was stable due to the increase in work from home (WFH) practices. With fixed tariffs, there are no incremental gains with an increase in usage. Voice revenue has been hit with the increase in collaboration-based communication applications such as Zoom and Microsoft Teams.

Equipment sales fell as global supply chains were severely disrupted and impacted new sign-ups of the more premium customers. Most markets in Southeast Asia depend on retail outlets as a key channel to the market, which has been hampered.

With the job losses across the world, bad debts and weakened customer spend is inevitable and it is imperative that the operators provide for reflective pricing strategies, listen to new customer requirements to ensure customer retention and strengthening of their market position. In May, Verizon’s CEO Hans Vestberg said nearly 800,000 of their subscribers were unable to pay their monthly bills. Discussions with operators in Southeast Asia also highlighted this as a current concern.

Enterprise Segment Target for New Growth

Ecosystm research shows that enterprises in Southeast Asia are increasingly considering telecom operators as go-to-market partners (Figure 1). Enterprises are demanding more than just devices and connectivity and with the fervent digital transformation (DX) efforts underway, services such as managed services, business application services, cybersecurity and network services are in demand. Technology vendors have an opportunity to partner with the right telecom operator in each market to enhance their IT market offerings, ahead of the 5G rollouts.

The broad 5G ecosystem inculcates cross-sector innovation and greater collaboration leading to new business models and exciting new opportunities. Singtel is the leading operator in the region and has the enterprise segment contributing approximately 65% to its revenue in its domestic market. In the World Communications Award 2019, Singtel won both “Best Enterprise Service” and “The Broadband Pioneer” awards. This places Singtel in a fine position to capitalise on the 5G enterprise services.

5G Needed Now More Than Ever

The pandemic has seen a rise in network traffic, onboarding of the digital customer and rapid DX of businesses which has whetted the appetite for faster broadband speeds and new services. Southeast Asia countries stand to profit from the trade war between the US and China and 5G features of low latency and higher security can boost adoption of IoT, Smart Manufacturing and broader Industry 4.0 goals to drive the economy.

Fixed Wireless in Southeast Asia is expected to be very popular considering the low penetration of fibre to the home (with the exception of Singapore) and will provide enterprises with a viable secondary connection to the internet. Popular applications – including video streaming and gaming – which are speed, latency and volume hungry will also be a target market for operators. Mobile operators that do not have a fixed broadband offering can enter this space and provide a serious “wireless fibre” alternative to homes and businesses.

Governments and telecom regulators ought to make spectrum available to the major telecom operators as soon as possible in order to ensure that the cutting edge 5G communications services are made available to consumers and businesses. Many experts believe 5G can raise the competitiveness of a nation.

Recent research from World Economic Forum (WEF) has found that significant economic and social value can be gained from the widespread deployment of 5G networks, with 5G facilitating industrial advances, productivity and improving the bottom line while enabling sustainable cities and communities. GSMA notes that mobile technologies and services in the wider Asia Pacific region generated USD 1.6 trillion of economic value while the mobile ecosystem supported 18 million jobs as well as contributing USD 180 billion of funding to the public sector through taxation.

US-China Trade War Threatens to Change Equipment Supplier Landscape

Despite severe pressures caused by the US-China trade war, Huawei posted an impressive 13.1% YoY growth in 1H 2020 registering revenue of USD 64.88 billion. Both Huawei and ZTE generate approximately 60% of their business from their domestic markets which is critical with the current unfavourable global sentiments. Huawei has diversified its business and built its consumer devices business which should withstand the disruptions caused by the political challenges.

Ericsson and Nokia stand to benefit from Huawei’s current global position and this was evident with the wins for the 5G contracts by Singtel and JVCo (Singtel and M1). The JVCo announced it selected Nokia to build the Radio Access Network (RAN) for the 5G standalone (SA) mmWave network infrastructure in the 3.5GHz radio frequency band. Singtel selected Ericsson to provide for the RAN on the same mmWave network.

However, while there is an opportunity for NEC and Samsung to join the party, Huawei is expected to do well in most other countries in Southeast Asia.

The Rise of the Digital Economy in Southeast Asia

A recent Google report valued the internet economy in Southeast Asia at USD 100 billion in 2019, more than tripling since 2015, and the sector is expected to hit USD 300 billion in 2025. With a population of approximately 570 million people, the region has some of the fastest-growing internet economies in the world.

The Indonesia market is the largest in the region and is expected to hit USD 133 billion from USD 40 billion in 2025. Indonesia’s lack of a world-class telecom infrastructure coupled with their slowness in 5G adoption has not impeded the country’s attractiveness for global technology investors who see the 270 million population as an immense opportunity. US tech giants, Facebook, Google, and PayPal have invested in Indonesia to reap the benefits from the growing digital economy powered by unicorns such as Gojek, Bukalapak, Tokopedia. In June 2020, Google Cloud launched in Jakarta, only the second in the region after Singapore with the four big unicorns being anchor customers.

In 2025, Google predicts Thailand to be the second-largest internet economy worth USD 50 billion. The internet economy for Singapore, Malaysia and the Philippines are estimated to be over USD 27 billion each. Shopee and Lazada are the top eCommerce apps in the region and have seen an increase in sales due to the disruption in the Retail industry. In-store shopping contributes to more than 50% of Retail in Singapore and Malaysia – this provides a tremendous opportunity for eCommerce players.

While movement restrictions are gradually being lifted, some things may never return where they were before COVID-19. Public debts have risen with numerous aids and handouts impacting economic growth forecast and rising unemployment is impacting customer spending power. On the plus side, DX of businesses and sharp onboarding of customers have redefined interactions, and sectors such as Education, are going online which will boost the digital economy. While the challenges are evident, exciting times are ahead for the technology and telecom sector in Southeast Asia.

India has clearly been a target market for Facebook due to the size of the country’s untapped market and the proportion of its younger population. It is estimated that nearly 45% of the population is below 25 years – a prime target for social media and eCommerce platforms. Facebook’s Free Basic program, launched in 2016 to introduce the potential of the Internet to the underprivileged and digitally unskilled, failed primarily because it did not have knowledge of the telecommunications market in India. Facebook returned to the India market the following year, this time in collaboration with Airtel, to launch Express WiFi, aimed at setting up WiFi hotspots to provide internet in public places – again aimed at India’s connectivity issues.

Making its largest foray into the Indian market yet, last week Facebook announced that it is investing US$5.7 billion in Jio Platforms – India’s largest telecom operator – for a 9.9% minority stake. Facebook makes its intentions very clear and is targeting the 60 million small and medium enterprises (SMEs) who can be the backbone of India’s growing digital economy. This includes a rather unorganised retail sector, which has had to adopt digital at breakneck speed following the Government’s earlier financial reforms, which impacted the smaller retailers, dependent primarily on cash transactions. Facebook is by no means the only global giant with an interest in India’s retail business – with Amazon and Walmart leading the way.

The JioMart and WhatsApp Pilot

Just days after the announcement, JioMart – an eCommerce venture also a wholly-owned subsidiary of Reliance Industries, like Jio Platforms – has launched a pilot in Mumbai which allows users to order groceries through WhatsApp. Customers can now place grocery orders through WhatsApp Business with JioMart reaching out to small-scale retailers and brick and mortar stores – or “Kirana stores” as they are referred to in India – to fulfil the order. More than 1,200 local stores have been engaged for this pilot. It currently does not include a digital payment option and invoices and alerts are sent through WhatsApp. Mukesh Ambani, Chairman and MD of Reliance Industries, says that the JioMart and WhatsApp collaboration has the potential to make it possible for around 30 million neighbourhood stores to transact digitally.

India Emerging as the New Battlefield

India is an important eCommerce market for global giants such as Facebook and Amazon, who have struggled with establishing a presence in China. Walmart has also set it its sights on India, with its recent acquisition of Flipkart. Ecosystm Principal Advisor, Kaushik Ghatak says. “India represents the final frontier, where the battle lines are being drawn, and the three are heading towards a collision path. Facebook’s recent move has just upped the game for Amazon and Walmart, as well as for the eCommerce and Fintech start-ups who have been eyeing this market.”

Amazon has been the early mover, establishing its eCommerce presence in India way back in 2013. Ghatak says, “From its initial marketplace approach of curating suppliers to start selling on its platform, Amazon graduated to offering its own delivery and fulfilment services, by establishing dozens of warehouses across India. This was to ensure the quality and timeliness of deliveries, upholding its ‘Fulfilment by Amazon’ (FBA) brand promise. There was a considerable cost though, in terms of time to ramp up and investments – with the associated asset risks. Also, reaching out to the diffused retail sector, with their non-existent or very low level of digitalisation, has been difficult for all the major eCommerce players such as Amazon and Flipkart. Jeff Bezos’ announcement of an additional investment of $ 1 billion, earlier this year, to digitise SMEs, allowing them to sell and operate online, is a step to extend its reach into this diffused retail market.”

JioMart’s model, according to Ghatak is in stark contrast to Amazon’s. “JioMart’s currently ongoing pilot in Mumbai is a classic B2C marketplace model, with little or no asset risk. The orders placed by the customers are routed to the nearest Kirana store based on stock availability, with the customers going to pick up the ordered items themselves at times.”

Ecosystm Principal Advisor, Niloy Mukherjee says, “Jio has unparalleled market access in India with reports showing north of 370 million subscribers. Even at a $1.7 per month revenue from such a huge number, one can get to a $7.5 billion-dollar annual business. But even this is dwarfed by what that subscriber base itself is worth – through the data it provides, the products that can be sold and so on. Similarly, WhatsApp will prove to be more important than Facebook in India, with more than 400 million users. Using WhatsApp to get Kirana stores to do delivery can be a true game-changer.”

Talking about how this competes with Amazon, Mukherjee says, “This can eat into the business of an Amazon and my guess is, it will be far more efficient. The proximity to the customer will allow multiple deliveries per day at short notice, and fresh produce guarantees – maybe even door returns if not satisfied – that would be hard to match. Given the traffic situation in large Indian cities, delivery logistics from a more distant source will always struggle to compete. This is one tip of a multi-pronged spear – there are obviously other products that can be contemplated, leading to additional revenues.”

The Possibilities Ahead

Mukherjee explains why he thinks Facebook invested in Jio Platforms, rather than just forging a collaboration model. “Clearly both parties want to tie the other down and make sure that this alliance is long term. And this possibly means revenue will be shared instead of the usual commission model. Also, the go-to-market implications can run to more than just the Indian market. WeChat Pay is huge in China but not really elsewhere. If this works, there could be a potential “WhatsApp Pay” in the rest of the world. For Jio who already dominates the telecom landscape in India, this deal is a step towards taking their earnings to a new level, above the top end of the telecom category – they can access profit pools available to hardly any telecom provider worldwide.”

At a time when a market entry for foreign players in India is getting tougher with increasing regulatory pressures, a tie-up with the biggest player in India is indeed a very promising step – for both Facebook and Reliance. “For Facebook, this is a great opportunity to take its dependence away from a primarily ad-driven revenue model. The digitalisation of the diffused retail sector in India will open up new revenue opportunities from its WhatsApp Business App, WhatsApp Business API, and WhatsApp Pay-UPI gateway (pending regulatory approval). There is a potential of revenues from a variety of marketing services, membership fees, customer management services, product sales, commissions on transactions, and software service fees,” says Ghatak.

Talking about the potential for Reliance Industries, Ghatak says, “The technology horsepower of Facebook will help propel them ahead of Fintech and eCommerce companies in India – challenging already established players such as Amazon and Flipkart, and the newbie start-ups. Ability to drive transactions and digital payments in the diffused retail sector will open up huge revenue opportunities that were largely untapped until now, with low asset risks. Also, this sector has traditionally operated on a cash-based model and the recent COVID-19 crisis has exposed how vulnerable the sector is with a limited view of the supply chain, and limited funding for working capital. Developing relationships with the millions of Kirana stores spread across India also gives the opportunity of revenue generation through supply chain financing – a largely ignored sub-sector until now.”

Mukherjee thinks that this alliance will challenge players such as Amazon and Amazon Pay, Google Pay and PayTM. Ghatak also thinks that eventually, Jio Platform will have to either choose between or integrate the best features of WhatsApp Pay and the Jio Money Merchant payment gateways.

However, Ghatak offers a word of caution on the downside risks as well. “Partnering with Facebook is a hugely ambitious game plan for Reliance Industries. The success of its plans will also depend on how well it is able to curate the suppliers who are responsible for the actual delivery. In a consumer-driven business model, trust and customer experience cannot be compromised. The low asset, high leverage and high reach model can unravel itself if the customer gets the short end of the stick, in this rush for eCommerce domination.”

The COVID-19 pandemic has highlighted the importance of the telecommunications industry which has now become the backbone of the new normal, both in a social and business sense. The last few months have seen a number of changes including more video usage, location of traffic and time of traffic. Network usage is on the rise and telecom carriers are prioritising on the resilience of their networks and the quality of services offered to their customers.

What goes up must come down

According to Speedtest, global mobile and broadband speeds have suffered as a result of the increase in traffic with speeds dropping in March 2020 for mobile to 30.47 Mbps (from 31.62 Mbps in February) and fixed broadband to 74.64 Mbps (from 75.41 Mbps in February). In Southeast Asia, only Singapore and Vietnam averaged mobile speeds of 54.37 Mbps and 33.97 Mbps respectively, exceeding the global average speeds. As for fixed broadband, Singapore ranked highest globally achieving 197.26 Mbps while Thailand and Malaysia clocked 149.95 Mbps and 79.86 Mbps respectively, trumping the global average speeds.

Southeast Asian carriers increase network efficiency and quality

Singapore. The country’s ICT regulator, Infocomm Media Development Authority (IMDA), reported an increase in internet usage and its intentions to support telecom carriers in boosting network capacity to ensure essential services run smoothly. Priority will be given to high traffic and residential areas where a larger proportion of the population are working from home. The Ministry of Communications and Information (MCI) reported that Singapore has at least 30 percent buffer in network capacity even during peak periods. Major TV operators Mediacorp, Singtel and Starhub have made more content available for free during this period. This may further impact network speeds as customers are consuming more content over wifi (on mobile apps) or over the fibre networks.

Thailand. Part of the country’s public assistance measures during the pandemic, include offering about 30 million mobile subscribers 10GB free data. The National Broadcasting and Telecommunications Commission (NBTC) will also upgrade the speeds of fixed broadband to at least 100 Mbps which is expected to benefit 1.2 million household subscribers. Leading operator Advanced Info Service (AIS) recently announced that it has deployed 5G networks at hospitals to boost network capacity and speeds, and is deploying robots for telemedicine to empower the healthcare system to fight COVID-19.

Malaysia. Maxis and Telekom Malaysia (TM) reported a surge in traffic since the movement control order (MCO) was implemented by the Government on the 18th March 2020. The MCO is expected to run at least until 28th April 2020. TM cited a 30 percent increase in usage attributed to the increase in traffic for streaming, online games and teleconferencing. Leading operators Maxis, Digi, Celcom and U Mobile have offered 1GB free data during the MCO period as part of the Government’s stimulus package. Maxis, TM, Digi and Celcom have also committed significant manpower to ensure that the networks are operating efficiently and to ensure customer support. Leading TV operator Astro has made all movie, news and cartoon networks available to all its customers until the 28th April 2020.

Social distancing fillip for video conferencing

The rise of social distancing has made us all seek new ways to connect, mainly through video chat. Video conferencing traffic is on the rise as it is the next best thing to face-to-face meetings. Microsoft Teams and Zoom have been big benefactors. The American Economic Institute (AEI) notes that Zoom hit some 200 million users daily from a daily average 10 million. Microsoft Teams added some 12 million registrations to a total of 44 million.

Many predict that the home working trend will continue in the recovery stage and beyond, due to improvements in the telecommunications infrastructure and impending rollout of 5G. It is also predicted that the commercial property sector is likely to suffer due to this trend. This period also highlights the critical importance of cybersecurity with increasing occurrences of hacking and fraud. Zoom is being forced to reinforce their privacy and security measures, as an example.

COVID-19 has changed the way we web

On the social front, many are also using video conferencing to communicate with friends and family. Operators relaxing and offering additional data has undoubtedly contributed to the increase in this usage too. Now that many are homebound, network traffic in residential areas are higher than ever. In the past, peak hours of traffic at homes were at night – this has changed with adults and children homebound. Adults are using video conferencing and more voice calls; while children are using elearning, playing games or streaming videos. The European Commission had asked Netflix and other streaming platforms to reduce streaming quality to standard definition (SD). Netflix has assured that it has the capability to manage levels of streaming quality in accordance with the networks quality requirement of individual countries.

Online gaming and video streaming have emerged as winners and have seen an increase in consumption in these times as they provide for entertainment for millions stuck at home. There is tremendous opportunity for both telecom operators and content providers to increase their number of services in this area. Netflix, YouTube, Microsoft Xbox and PlayStation are among the winners in this sector. YouTube provides for a primary news source and commentary on the epidemic for many. Netflix’s stocks are near an all-time high at present.

eCommerce boost for essentials goods and services

The eCommerce sector should see a major improvement in Southeast Asia as physical channels to market have reduced. Emerging economies such as Malaysia and Thailand should see an improvement in services and embrace eCommerce like their mature counterparts. Statista reports that the average Malaysian eCommerce shopper spent just US$159 and Thailand just US$100 on online consumer goods purchases in 2018, considerably lower than the global average of US$634. There is huge opportunity to provide for basic necessities such as online grocery, food and delivery of goods. As a consequence, contactless payment and the transport and logistics sector will be forced to adapt their business operations to ride this wave successfully. As eCommerce transactions diversify and increase in emerging markets, it will give telecom providers an opportunity to keep engaging with platform players.

Telecom carriers are likely to suffer financial losses due to the scale of the disruption COVID-19 has brought about. However, there are some positives takeaways from this period. The increase of network traffic and the changing patterns have driven carriers to better understand network traffic management. The sharp consumer and business onboarding as far as applications and digital services are concerned, has given the digital economy and 5G use cases a shot in the arm. This is likely to spur innovation in services including communications, eCommerce, payments, logistics and healthcare among others.

In The Top 5 Cloud trends for 2020, Ecosystm Principal Analyst, Claus Mortensen had predicted that in 2020, cloud and IoT will drive edge computing.

“Edge computing has been widely touted as a necessary component of a viable 5G setup, as it offers a more cost-effective and lower latency option than a traditional infrastructure. Also, with IoT being a major part of the business case behind 5G, the number of connected devices and endpoints is set to explode in the coming years, potentially overloading an infrastructure based fully on centralised data centres for processing the data,” says Mortensen.

Although some are positioning the Edge as the ultimate replacement of cloud, Mortensen believes it will be a complementary rather than a competing technology. “The more embedded major cloud providers like AWS and Microsoft can become with 5G providers, the better they can service customers, who want to access cloud resources via the mobile networks. This is especially compelling for customers who need very low latency access.”

Affirmed Networks Brings Microsoft to the 5G Infrastructure Table

Microsoft recently announced that they were in discussions to acquire Affirmed Networks, a provider of network functions virtualisation (NFV) software for telecom operators. The company’s existing enterprise customer base is impressive with over 100 major telecom customers including big names such as AT&T, Orange and Vodafone. Affirmed Networks’ recently appointed CEO, Anand Krishnamurthy says that their virtualised cloud-native network, Evolved Packet Core, allows for scale on demand with a range of automation capabilities, at 70% of the cost of traditional networks. The telecom industry has been steadily moving away from proprietary hardware-based infrastructure, opting for open, software-defined networking (SDN). This acquisition will potentially allow Microsoft to leverage their Azure platform for 5G infrastructure and for cloud-based edge computing applications.

Ecosystm Principal Advisor, Shamir Amanullah says, “The telecommunications industry is suffering from a decline in traditional services leading to a concerted effort in reducing costs and introducing new digital services. To do this in preparation for 5G, carriers are working towards transforming their operations and business support systems to a more virtualised and software-defined infrastructure. 5G will be dynamic, more than ever before, for a number of reasons. 5G will operate across a range of frequencies and bands, with significantly more devices and connections, highly software-defined with computing power at the Edge.”

Microsoft is by no means the only tech giant that is exploring this space. Google recently announced a new solution, Anthos for Telecom and a new service called the Global Mobile Edge Cloud (GMEC), aimed at giving telecom providers compute power on the Edge. At about the same time, HPE announced a new portfolio of as-a-service offering to help telecom companies build and deploy open 5G networks. Late last year, AWS had launched AWS Wavelength that promises to bring compute and storage services at the edge of telecom providers’ 5G networks. Microsoft’s acquisition of Affirmed Networks brings them to the 5G infrastructure table.

Microsoft Continues to Focus on 5G Offerings

The acquisition of Affirmed Networks is not the only Microsoft initiative to improve their 5G offerings. Last week also saw Microsoft announce Azure Edge Zones aimed at reducing latency for both public and private networks. AT&T is a good example of how public carriers will use the Azure Edge Zones. As part of the ongoing partnership with Microsoft, AT&T has already launched a Dallas Edge Zone, with another one planned for Los Angeles, later in the year. Microsoft also intends to offer the Azure Edge Zones, independent of carriers in denser areas. They also launched Azure Private Edge Zones for private enterprise networks suitable for delivering ultra low latency performance for IoT devices.

5G will remain a key area of focus for cloud and software giants. Amanullah sees this trend as a challenge to infrastructure providers such as Huawei, Ericsson and Nokia. “History has shown how these larger software providers can be fast, nimble, innovative, and extremely customer-centric. Current infrastructure providers should not take this challenge lightly.”