The COVID-19 pandemic is debilitating industries, and economies around the world are facing the prospect of a recession. Malaysia, like many other countries, is focussing on front-line medical efforts and security services to save lives and contain the deadly, rapidly spreading virus. Essential services such as food, water and energy supply, Telecommunications, Banking, eCommerce and logistics are working overtime in this new order to support basic functions. The measures put in place to mitigate the spread of the virus are obviously inhibiting other economic activities.

Until enough people develop an immunity to the virus – either through a vaccine or naturally – it is hard to envisage lifting these movement control measures and return to a pre COVID-19 state. Malaysia has a total of 4,987 positive cases, the highest in Southeast Asia and a death toll of 82 as of today. The number of the population tested remains low at 81,730 as reported by the Ministry of Health, mainly due to limited testing resources.

The biggest challenge is that this epidemic is unprecedented, and it is unclear when we can put this situation behind us. The Malaysian Industry of Economic Research (MIER) has predicted about 2.4 million job losses as well as the GDP to reduce by 2.9 percent in 2020. Public debt rise coupled by reduced income due to lower crude oil, natural gas and palm oil prices and demand, will hit the Government coffers hard. Interest rates are expected to be low through the current lockdown stage right up to the recovery stage to help support the economic recovery.

Government Initiatives for the Economy

Like many countries, Malaysia has announced economic stimulus packages to ensure help for the poor and needy, that workers do not lose their jobs and that companies avoid bankruptcy – albeit with an inevitably reduced output – to keep the economy functioning. The stimulus offered is short-term covering a few months, and more assistance will be required should the epidemic linger and for the recovery period.

The Government announced a stimulus package on the 27th February worth RM20 billion (US$4.5 billion) and another one on the 27th March worth RM230 billion (US$52.6 billion). The packages comprise of direct fiscal injection of RM25 billion (US$5.7 billion) as well as loan deferments, one-off cash assistance, credit facilities and rebates. The focus of the stimulus packages is to assist people in the lower-income (B40) and mid-income (M40) groups, aid for employees in the private sector and for traders during the movement control order (MCO) which is to run until 14th April 2020.

An additional COVID-19 stimulus package worth RM10 billion (US$2.2 billion) was announced on the 6th April to address the challenges of the small and medium enterprises (SMEs) that employ two-thirds of the workforce and contribute to 40 percent of the GDP. The wage subsidy is to benefit 4.8 million workers earning less than RM4,000 (US$915) per month. In addition, SMEs will have access to interest free loans of RM200 million (US$45.7 million) from the National Entrepreneur Group Economic Fund and a further RM500 million (US$114.4 million) via Bank Simpanan Nasional. The Government allowed 750,000 SMEs to postpone income tax payment for three months from 1st April – companies in the tourism sector are allowed to postpone income tax for six months.

Impact on Industries

Banking & Financial Services. Banking institutions will support the Government’s stimulus initiatives by providing a six months’ loan repayment moratorium, corporate loan restructuring and conversion of credit card balance to long term loans. Banking and financial institutions are focussing on business continuity planning to ensure minimal disruption to their business and customer support. Many key business processes are now being put to test in-home working with scaled-down office operations. Digital Transformation (DX) has been accelerated as a result.

Contactless payments have seen a boost and many financial institutions have increased payment limits for such payments. Early last month the World Health Organisation (WHO) and the Bank of England had issued advisories against the use of banknotes, as it could increase the chances of the virus spread, instead recommending the use of contactless payment where possible. This might give a boost to the use of Cryptocurrency and cross-border payment services in Malaysia. In 2019, cryptocurrency start-ups received an estimated 12 percent of Fintech funding – but, only three cryptocurrency exchanges were given conditional approval by the Securities Commission. The current situation may well see that changing.

Insurance. The Prime Minister announced that the Insurance industry is to create a fund of RM8 million (US$1.8 million) to cover the cost of RM300 (US$68.6) per policyholder to undergo COVID-19 tests. In addition to this, insurance companies are to offer a 3-month suspension on premiums for policyholders whose income is affected by the pandemic.

Agriculture. Even prior to COVID-19, there has been a brewing narrative against globalisation, favouring a nationalistic emphasis as reflected globally by Brexit and the China-US trade wars tension. Food security is key, and COVID-19 has further highlighted its importance with priorities shifting to local requirements over exports. The Government intends to distribute a food security fund of RM1 billion (US$228.8 million) to increase the local production of farms, fisheries and livestock. According to the Department of Statistics, Malaysia’s food and beverage imports amounted to RM54 billion (US$12.3 billion) in 2018 while food exports stood at RM35 billion (US$8.0 billion) resulting in a trade deficit of RM18.8 billion (US$4.3 billion). As countries focus on internal supplies instead of exports in the current scenario, Malaysia needs to address this risk by producing more locally.

Impact on Industry Transformation

Amidst the gloomy outlook, there are plenty of opportunities, especially to the country’s Digital Economy. Malaysia has been committed to the Digital Economy vision with the Malaysia Digital Economy Corporation (MDEC) estimating that the country’s Digital Economy is worth US$3 trillion. The COVID-19 crisis may well be the key driver in achieving that vision. DX efforts are being accelerated with businesses adopting more cloud and mobility solutions. More workloads have to be digitalised and there is greater adoption of Cloud for storage and services. AWS, Microsoft Azure and Google Cloud will be beneficiaries in this area.

I have already spoken about the Financial Services industry – other industries are also getting transformed out of a necessity to survive this crisis. The Education sector has seen an increase in access to educational content and traffic to education portals and blogs. Some schools have implemented online lessons and group chats between teachers, students and parents to ensure education continues through this pandemic. Many universities have used their e-learning platforms to move lectures online.

The Telecommunications industry is being appreciated more than ever and it is the backbone to normal life, in both a social and business sense. The Government’s stimulus package includes offers of free internet to all customers until the MCO is over at RM600 million (US$137.3 million) and an investment of about RM400 million (US$91.5 million) to improve coverage and quality of service. Leading operators Maxis, Digi, Celcom and U Mobile have offered 1GB free data during the MCO period. The Axiata Group recently announced a cash fund of RM150 million (US$34.3 million) to assist micro-SMEs within the ecosystem providing eCommerce, digital payments and related services.

Video conferencing traffic is on the rise as it is the next best thing to face-to-face meetings. Microsoft Teams and Zoom have been the biggest winners so far. The home working trend should continue in the recovery stage and beyond, due to improvements in the telecommunications infrastructure and the impending rollout of 5G.

The eCommerce sector should see a major improvement in Malaysia with physical channels to the market being suspended. Malaysians have not embraced eCommerce like mature economies have, and it has significant room for improvement. Development of the SME sector and eCommerce are twin focus areas for the Digital Economy vision. Statista reports that the average Malaysian eCommerce shopper spent just US$159 on online consumer goods purchases in 2018, considerably lower than the global average of US$634. There is huge opportunity to provide for necessities such as online grocery, food and delivery of goods. As a consequence, the Transport & Logistics sector will have to adapt their business operations in order to ride this wave successfully.

Video streaming and gaming has also seen an increase in consumption in these times as they provide for entertainment for millions stuck at home. Netflix, YouTube, Microsoft Xbox and PlayStation are among the winners in this sector. YouTube provides for a primary news source and commentary on the epidemic for many. There provides a tremendous opportunity for both telecom operators and content providers to increase their number of services in this area.

Malaysia, like all other countries, will have to ride out this wave. It has made a positive step in the direction with the stimulus packages, especially for the SME sector. How well the country rides this wave out will depend on how targeted the future stimulus packages are and how fast industries can transform to handle the new world order that will emerge after the COVID-19 crisis.

In The Top 5 Cloud trends for 2020, Ecosystm Principal Analyst, Claus Mortensen had predicted that in 2020, cloud and IoT will drive edge computing.

“Edge computing has been widely touted as a necessary component of a viable 5G setup, as it offers a more cost-effective and lower latency option than a traditional infrastructure. Also, with IoT being a major part of the business case behind 5G, the number of connected devices and endpoints is set to explode in the coming years, potentially overloading an infrastructure based fully on centralised data centres for processing the data,” says Mortensen.

Although some are positioning the Edge as the ultimate replacement of cloud, Mortensen believes it will be a complementary rather than a competing technology. “The more embedded major cloud providers like AWS and Microsoft can become with 5G providers, the better they can service customers, who want to access cloud resources via the mobile networks. This is especially compelling for customers who need very low latency access.”

Affirmed Networks Brings Microsoft to the 5G Infrastructure Table

Microsoft recently announced that they were in discussions to acquire Affirmed Networks, a provider of network functions virtualisation (NFV) software for telecom operators. The company’s existing enterprise customer base is impressive with over 100 major telecom customers including big names such as AT&T, Orange and Vodafone. Affirmed Networks’ recently appointed CEO, Anand Krishnamurthy says that their virtualised cloud-native network, Evolved Packet Core, allows for scale on demand with a range of automation capabilities, at 70% of the cost of traditional networks. The telecom industry has been steadily moving away from proprietary hardware-based infrastructure, opting for open, software-defined networking (SDN). This acquisition will potentially allow Microsoft to leverage their Azure platform for 5G infrastructure and for cloud-based edge computing applications.

Ecosystm Principal Advisor, Shamir Amanullah says, “The telecommunications industry is suffering from a decline in traditional services leading to a concerted effort in reducing costs and introducing new digital services. To do this in preparation for 5G, carriers are working towards transforming their operations and business support systems to a more virtualised and software-defined infrastructure. 5G will be dynamic, more than ever before, for a number of reasons. 5G will operate across a range of frequencies and bands, with significantly more devices and connections, highly software-defined with computing power at the Edge.”

Microsoft is by no means the only tech giant that is exploring this space. Google recently announced a new solution, Anthos for Telecom and a new service called the Global Mobile Edge Cloud (GMEC), aimed at giving telecom providers compute power on the Edge. At about the same time, HPE announced a new portfolio of as-a-service offering to help telecom companies build and deploy open 5G networks. Late last year, AWS had launched AWS Wavelength that promises to bring compute and storage services at the edge of telecom providers’ 5G networks. Microsoft’s acquisition of Affirmed Networks brings them to the 5G infrastructure table.

Microsoft Continues to Focus on 5G Offerings

The acquisition of Affirmed Networks is not the only Microsoft initiative to improve their 5G offerings. Last week also saw Microsoft announce Azure Edge Zones aimed at reducing latency for both public and private networks. AT&T is a good example of how public carriers will use the Azure Edge Zones. As part of the ongoing partnership with Microsoft, AT&T has already launched a Dallas Edge Zone, with another one planned for Los Angeles, later in the year. Microsoft also intends to offer the Azure Edge Zones, independent of carriers in denser areas. They also launched Azure Private Edge Zones for private enterprise networks suitable for delivering ultra low latency performance for IoT devices.

5G will remain a key area of focus for cloud and software giants. Amanullah sees this trend as a challenge to infrastructure providers such as Huawei, Ericsson and Nokia. “History has shown how these larger software providers can be fast, nimble, innovative, and extremely customer-centric. Current infrastructure providers should not take this challenge lightly.”

Authored by Ullrich Loeffler and Kaushik Ghatak

Technology has been identified as a key enabler of innovation and transformation with great potential to disrupt and reshape entire industries. At the same time, the technology industry itself has been at the forefront of disruption with thousands of promising start-ups emerging in areas such as artificial intelligence (AI), Blockchain, cloud and cybersecurity to name a few.

In February 2020, Ecosystm had the opportunity to meet the executive team of Avanseus, an AI solution provider that promises to reshape traditional maintenance processes by leveraging AI-based algorithms for predictive maintenance and failure detection.

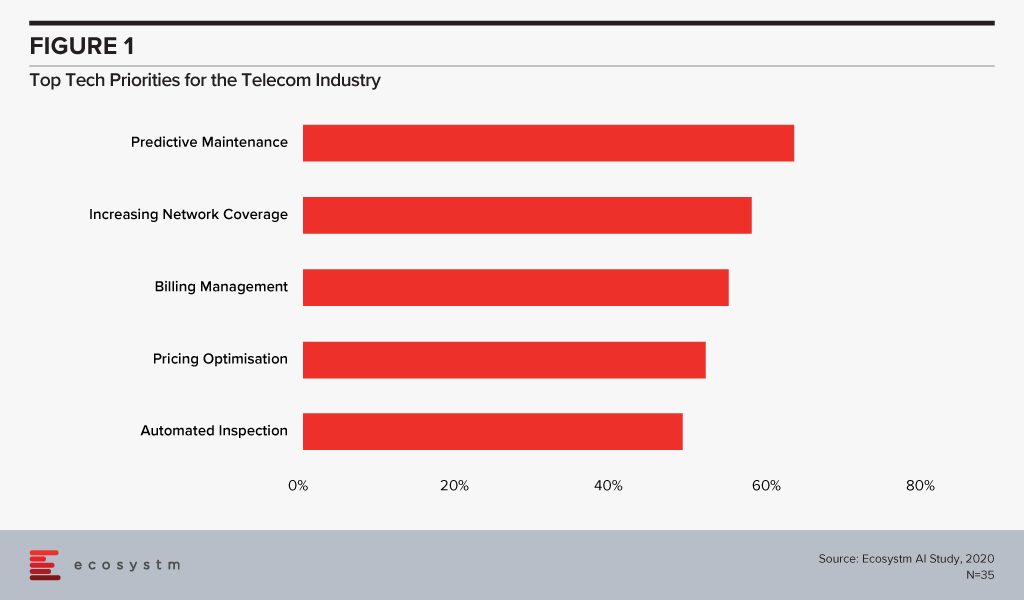

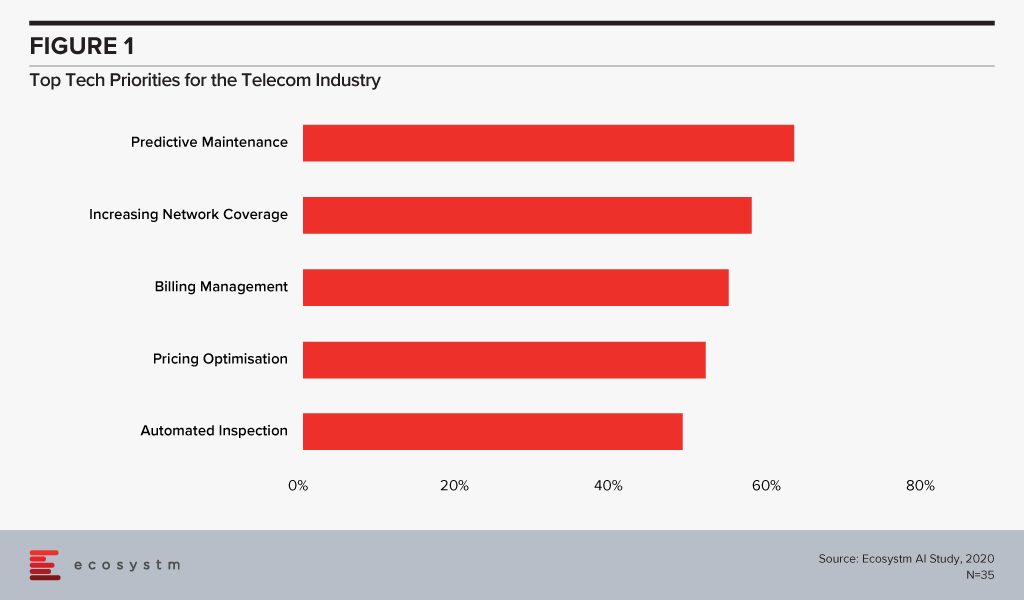

Avanseus is not the newest kid on the block having been launched in June 2015 with headquarters in Singapore. The founding team has extensive experience in the telecommunications sector from executive careers in both the operator and the network provider segments. The problem statement and value proposition that Avanseus was founded on is to support telecom companies to tackle the costly challenge of maintaining their increasingly complex networks and to ensure network performance and customer satisfaction. Ecosystm research finds that predictive maintenance is a key priority for telecom providers looking to invest in newer technologies (Figure 1).

The solution Avanseus offers aims to be simple in the way that its proprietary AI-enabled algorithms can assess and predict network performance and network failures with as little as 6 months of network data history to achieve a high degree of prediction accuracy across telecom networks. The simplicity of the solution further allows cost-effective proofs of concept (PoCs) which lets telecom prospects experience first-hand its potential to drive down maintenance cost and ensure network performance.

Avanseus had secured seed capital of US$2.5 million till the middle of 2017. At the end of 2018, Avanseus secured funding via convertible notes of US$1.3m – main noteholders being TNB Spring and SEEDS Capital (Enterprise Singapore). A global network equipment manufacturer and managed services provider became its first commercial customer in 2016. From there Avanseus has demonstrated steady growth achieving revenue of US$1 million in 2018 and US$2.3 million in 2019. 2020 is forecast to be a milestone year with predictions to become cash-flow positive and to achieve revenue growth of 150% over 2019.

As of February 2020, Avanseus employs 41 staff across multiple international locations including its headquarters in Singapore, its development centre in Bangalore and sales offices in Delhi, North and Latin America and Italy to grow its global presence. The team is complemented by 8 part-time consultants and a growing partner ecosystem which includes major consulting firms as well as technology partners such as Dell, Splunk and Siemens. Expanding its partnerships globally is a key part of its strategy in order to scale up on the opportunities it can contest.

Avanseus’ Potential Growth Path

Considering its young history, Avanseus has shown an impressive growth path which can be credited to staying true to its game plan and its original value proposition and solution design. A new fund-raising round had been kicked off at the end of 2019 with the aim to secure sufficient capital to accelerate growth over the coming years. Half of the anticipated funding will be invested into on-site consultants and sales teams while the other half will be invested in R&D to expand automation into APIs and other machine learning technologies. R&D has been a key focus from its early days which has led to the filing of 8 patents, 2 of which have been granted.

In order to accelerate growth further, Avanseus is also re-assessing the industries that could benefit from its predictive maintenance solutions. As with many startups and growth companies, innovation is often not a straight path and new opportunities and ideas arise as the market and customers are engaged. Several industries face similar challenges and benefit from reduced maintenance cost, reduced downtime, extended equipment lifecycles and improved services quality. To transfer the value proposition across use cases and industry applications Avanseus is looking to leverage approximately 80% of its existing solution and apply 20% of industry-specific domain expertise. This has opened up new growth opportunities in a number of areas such as Industrial IoT, Utilities, Manufacturing and supply chain. There are also opportunities in customer-focused industries such as Banking in niche areas such as maintenance of data centre operations.

Ecosystm Comments

As companies collect and manage an exploding amount of data assets within their operations or from their customers, there is an increasing opportunity for innovative technology vendors to support these companies in driving value from their data assets. Avanseus has demonstrated a clear vision and execution in addressing one of these opportunities by focusing on a clear problem statement and offering a ‘simple’ solution that presents a strong business case. As with every growth company, the challenge is to leverage this opportunity and secure the right funding and resources to scale up as quickly as possible.

Partnerships will be critical in its growth path but signing up partners alone may not translate to creating value. The challenge for Avanseus will be to achieve partner commitment and enablement across different geographies. This will require time and a dedicated channel strategy beyond opportunistic partnerships that are born out of specific client engagements.

Another opportunity that could turn into a challenge is the new range of solution applications that Avanseus has identified. Being a high growth company, the greater challenge is often to decide what not to do rather than what can be done. Avanseus is well advised to carefully select which industries it wants to expand into and focus on. Each new solution set will present a magnet for additional resources and funding and may well be a distraction.

The telecommunications industry has long been an enabler of Digital Transformation (DX) in other industries. Now it is time for the industry to transform in order to survive a challenging market, newer devices and networking capabilities, and evolving customer requirements. While the telecom industry market dynamics can be very local, we will see a widespread technology disruption in the industry as the world becomes globally connected.

Drivers of Transformation in the Telecom Industry

Remaining Competitive

Nokia Bell Labs expects global telecom operators to fall from 10 to 5 and local operators to fall from 800 to 100, between 2020 and 2025. Simultaneously, there are new players entering the market, many leveraging newer technologies and unconventional business models to gain a share of the pie. While previous DX initiatives happened mostly at the periphery (acquiring new companies, establishing disruptive business units), operators are now focusing on transforming the core – cost reduction, improving CX, capturing new opportunities, and creating new partner ecosystems – in order to remain competitive. There is a steady disaggregation in the retail space, driving consolidation in traditional network business models.

“The telecom industry is looking at gradual decline from traditional services and there has been a concerted effort in reducing costs and introducing new digital services,” says Ecosystm Principal Advisor, Shamir Amanullah. “Much of the telecom industry is unfortunately still associated with the “dumb pipe” tag as the over-the-top (OTT) players continue to rake in revenues and generate higher margins, using the telecom infrastructure to provide innovative services.”

Bringing Newer Products to Market

Industries and governments have shifted focus to areas such as smart energy, Industry 4.0, autonomous driving, smart buildings, and remote healthcare, to name a few. In the coming days, most initial commercial deployments will centre around network speed and latency. Technologies like GPON, 5G, Wifi 6, WiGig, Edge computing, and software-defined networking are bringing new capabilities and altering costs.

Ecosystm’s telecommunications and mobility predictions for 2020, discusses how 5G will transform the industry in multiple ways. For example, it will give enterprises the opportunity to incorporate fixed network capabilities natively to their mobility solutions, meaning less customisation of enterprise networking. Talking about the opportunity 5G gives to telecom service providers, Amanullah says, “With theoretical speeds of 20 times of 4G, low latency of 1 millisecond and a million connections per square kilometre, the era of mobile Internet of Everything (IoE) is expected to transform industries including Manufacturing, Healthcare and Transportation. Telecom operators can accelerate and realise their DX, as focus shifts to solutions for not just consumers but for enterprises and governments.”

Changing Customer Profile

Amanullah adds, “Telecom operators can no longer offer “basic” services – they must become customer-obsessed and customer experience (CX) must be at the forefront of their DX goals.” But the real challenge is that their traditional customer base has steadily diverged. On the one hand, their existent retail customers expect better CX – at par with other service providers, such as the banking sector. Building a customer-centric capability is not simple and involves a substantial operational and technological shift.

On the other hand, as they bring newer products to market and change their business models, they are being forced to shift focus away from horizontal technologies and connecting people – to industry solutions and connecting machines. As their business becomes more solution-based, they are being forced to address their offerings at new buying centres, beyond IT infrastructure and Facilities. Their new customer base within organisations wants to talk about a variety of managed services such as VoIP, IoT, Edge computing, AI and automation.

The global Ecosystm AI study reveals the top priorities for telecom service providers, focused on adopting emerging technologies (Figure 1). It is very clear that the top priorities are driving customer loyalty (through better coverage, smart billing and competitive pricing) and process optimisation (including asset maintenance).

Technology as an Enabler of Telecom Transformation

Several emerging technologies are being used internally by telecom service providers as they look towards DX to remain competitive. They are transforming both asset and customer management in the telecom industry.

IoT & AI

Telecom infrastructure includes expensive equipment, towers and data centres, and providers are embedding IoT devices to monitor and maintain the equipment while ensuring minimal downtime. The generators, meters, towers are being fitted with IoT sensors for remote asset management and predictive maintenance, which has cost as well as customer service benefits. AI is also unlocking advanced network traffic optimisation capabilities to extend network coverage intelligently, and dynamically distribute frequencies across users to improve network experience.

Chatbots and virtual assistants are used by operators to improve customer service and assist customers with equipment set-up, troubleshooting and maintenance. These AI investments see tremendous improvement in customer satisfaction. This also has an impact on employee experience (EX) as these automation tools free workforce from repetitive tasks and they be deployed to more advanced tasks.

Telecom providers have access to large volumes of customer data that can help them predict customer usage patterns. This helps them in price optimisation and last-minute deals, giving them a competitive edge. More data is being collected and used as several operators provide location-based services and offerings.

In the end, the IoT data and the AI/Analytics solutions are enabling telecom service providers to improve products and solutions and offer their customers the innovation that they want. For instance, Vodafone partnered with BMW to incorporate an in-built SIM that enables vehicle tracking and provides theft protection. In case of emergencies, alerts can also be sent to emergency services and contacts. AT&T designed a fraud detection application to look for patterns and detect suspected fraud, spam and robocalls. The system looks for multiple short-duration calls from a single source to numbers on the ‘Do Not Call’ registry. This enables them to block calls and prevent scammers, telemarketers and identity theft issues.

Cybersecurity

Talking about the significance of increasing investments in cybersecurity solutions by telecom service providers, Amanullah says, “Telecom operators have large customer databases and provide a range of services which gives criminals a great incentive to steal identity and payment information, damage websites and cause loss of reputation. They have to ramp up their investment in cybersecurity technology, processes and people. A telecom operator’s compromised security can have country-wide, and even global consequences. As networks become more complex with numerous partnerships, there is a need for strategic planning and implementation of security, with clear accountability defined for each party.”

One major threat to the users is the attack on infrastructure or network equipment, such as routers or DDoS attacks through communication lines. Once the equipment has been compromised, hackers can use it to steal data, launch other anonymous attacks, store exfiltrated data or access expensive services such as international phone calls. To avoid security breaches, telecom companies are enhancing cybersecurity in such devices. However, what has become even more important for the telecom providers is to actually let their consumers know the security features they have in place and incorporate it into their go-to-market messaging. Comcast introduced an advanced router to monitor connected devices, inform security threats and block online threats to provide automatic seamless protection to connected devices.

Blockchain

Blockchain can bring tremendous benefits to the telecom industry, according to Amanullah. “It will undeniably increase security, transparency and reduce fraud in areas including billing and roaming services, and in simply knowing your customer better. With possibilities of 5G, IoT and Edge computing, more and more devices are on the network – and identity and security are critical. Newer business models are expected, including those provided for by 5G network slicing, which involves articulation in the OSS and BSS.”

Blockchain will be increasingly used for supply chain and SLA management. Tencent and China Unicom launched an eSIM card which implements new identity authentication standards. The blockchain-based authentication system will be used in consumer electronics, vehicles, connected devices and smart city applications.

Adoption of emerging technologies for DX may well be the key to survival for many telecom operators, over the next few years.