Enterprise mobility was a key area of focus for organisations for many years in the late 2000s and early 2010s. Many businesses invested significant amounts of money and time in helping their employees access the information they needed while on the go – until the consumer smartphone era drove our attention away from our employees. Now we are focused on providing the best mobile apps, websites and experiences possible.

The constant evolution of the capabilities of smartphones, along with the drive to offer an ever-improving customer experience (CX) has kept our attention firmly on our customers. However, smart businesses now understand that in order to offer a great CX, they need to keep their employees happy. And giving them access to the technology that delivers the right information at the right time is a key factor in achieving better employee experience.

“Investment in enterprise mobility tools and platforms is forecast to increase significantly over the next few years. And the COVID-19 pandemic may even see some of that spend accelerated as businesses look to better support their remote and work-from-home employees,” says Tim Sheedy, Ecosystm Principal Advisor.

What to Expect from this New Wave of Enterprise Mobility

#1 Growth of UEM Adoption

Sheedy adds,“Today, many businesses are empowering their employees by providing the best end-user computing experience that will drive the best outcome. This often sees them looking beyond a single device (phone, PC etc) towards the entire experience – including the application, interface, management and security of the experience.”

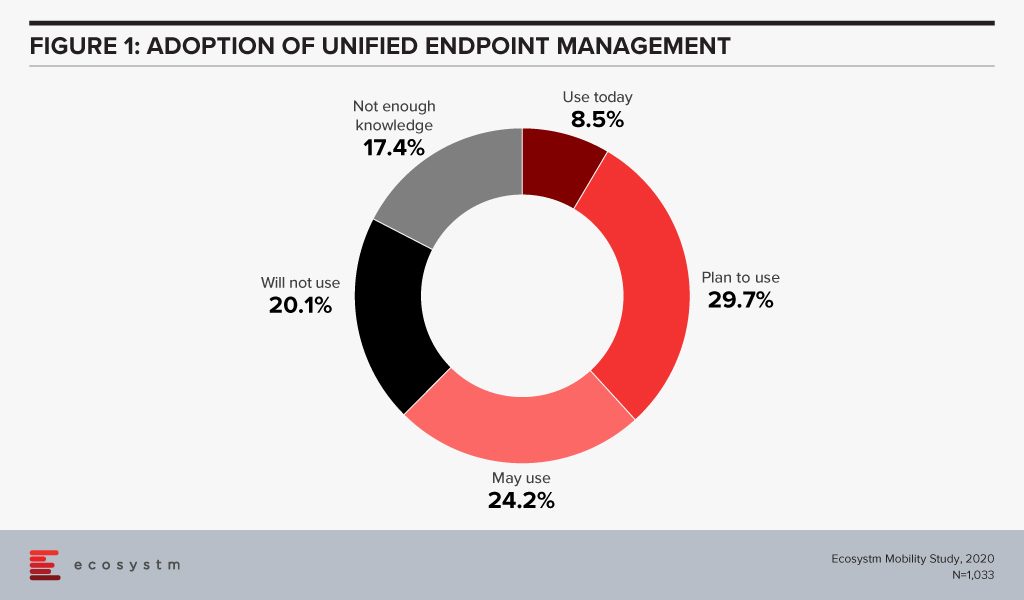

A robust unified endpoint management (UEM) solution provides IT teams with a transparent and traceable overview of all endpoints within the network as well as the power to manage all connected devices from a single platform. It maps out the network setup and structure by carrying out a complete inventory of all network devices, configurations, installed software, and the drivers for endpoint subsystems. Ecosystm research finds that more than 60% of global organisations have either adopted UEM or are evaluating it (Figure 1).

This trend will only go up with the rise in the number of devices organisations have to manage remotely. The workplace of the future will become exponentially digital and tech vendors will further strengthen their portfolio to offer UEM solutions.

#2 Greater C-Level Visibility in Mobility

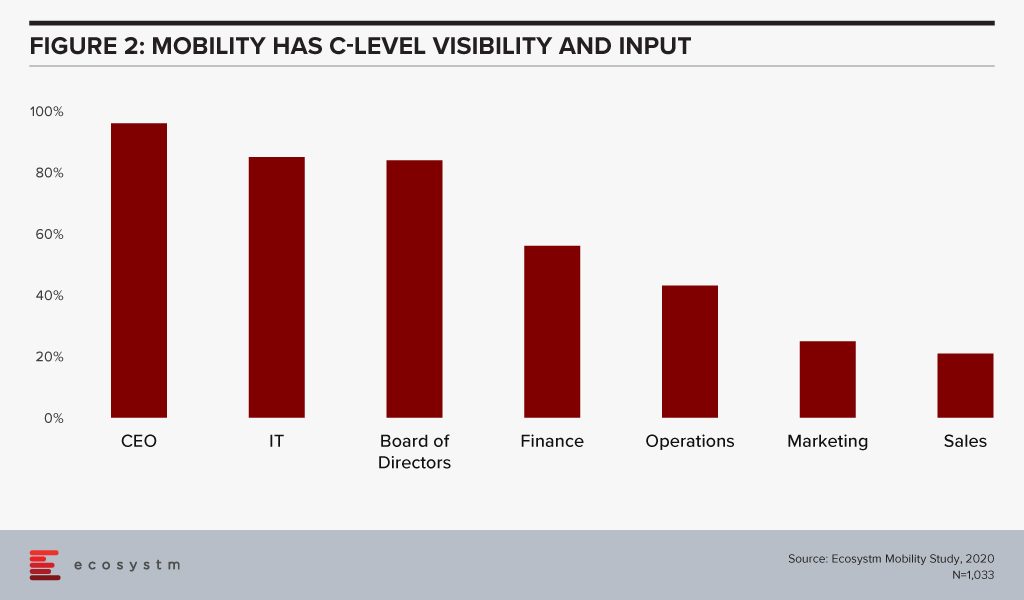

In his report, The Enterprise Mobile Landscape in 2020, Sheedy notes that enterprise mobility decision, including the choice of devices supported often have C-level involvement (Figure 2). “A large government agency in Australia has had the Director General intervene in their mobility decisions to stamp his personal preference on decisions, and a CIO at a large bank makes sure that Apple devices are always preferred – even when it makes little business sense to do so!”

Choice of mobile devices is personal and most organisations have realised that. Less than a third of global organisations issue corporate devices and only 6% continue to believe that they can manage by only supporting corporate devices. However, nearly no organisation has gone fully BYOD either.

Apart from mobile device choice, mobility solutions also have to take into consideration the huge amounts of traffic it has to support. When organisations adopt a Mobile First Strategy it is an acknowledgement that it will involve multiple stakeholders, right from the inception of the vision. This is clearly a technology area where user experience and uptake is of importance. So, the mobility strategy should have senior level overview and input so that it can be a company-wide policy.

#3 There will be renewed interest in Mobile Security

Ecosystm research finds that the global adoption rate of mobile device management (MDM) solutions is about 44%, while only about 17% of organisations indicate the adoption of a Mobile Security solution focused on identity management, multilayered security and threat analysis.

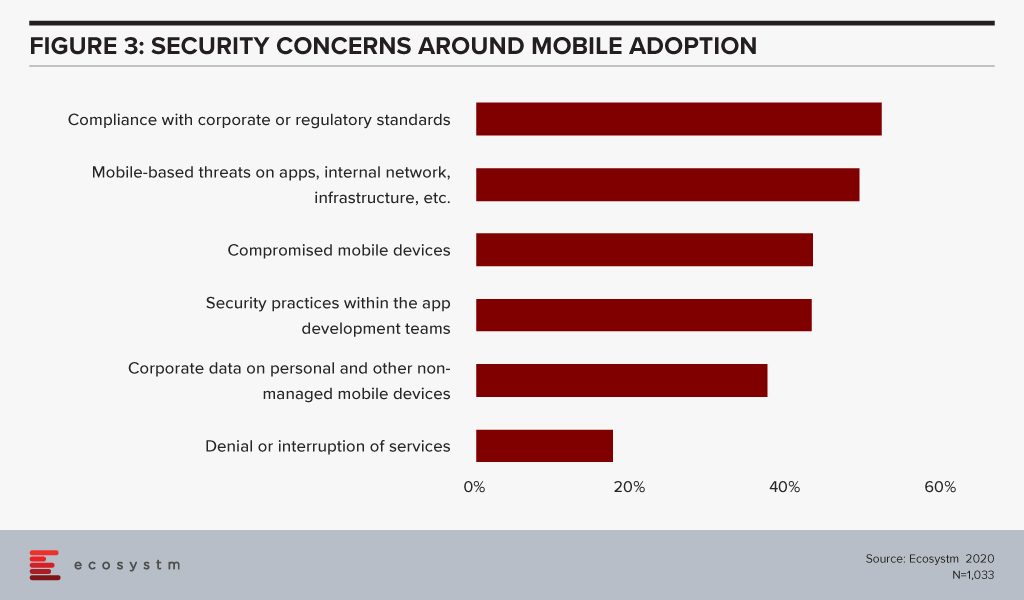

Organisations are aware that mobility initiatives increase their risk profile (Figure 3). An enterprise mobility solution that allows people to work on their device and OS of choice and from where they choose to, will become increasingly important in the current milieu. But the threats to organisation are equally real.

More than half of the organisations are concerned about compliance with corporate or regulatory standards in implementing mobility solutions. This is a good indication that the Mobile First strategy implementations have a strong compliance angle to them, both internally and for external agencies.

However, as Sheedy notes, it is still a challenge for the IT team. “Organisations provide one or two more operating systems that the IT team needs to manage, patch and secure. The mobile applications provide more entry points for would-be hackers and others to use and threaten the business. The devices and applications provide another set of user interface that need to be managed and governed to ensure regulatory compliance. They can also gather highly personal data (such as the location of customers when they are using – or not using – the application) so this data needs to be secured and governed.” As adoption matures, organisations will need to invest in niche Mobile Security solutions to combat their security concerns.

#4 Mobility will Drive SaaS Adoption

What organisations want most from their mobility solutions is cloud capabilities. One of the main reasons why organisations look for cloud capabilities is because mobile workloads tend to be unpredictable and cloud solutions are best equipped to handle the unexpected spikes. Most organisations also consider cloud solutions for a seamless integration with back-end systems and because a mobile workforce needs to make real-time decisions based on real-time data. Given the disparity of the data sources in a typical organisation, hosting on a neutral platform becomes more attractive. Also as organisations become more conscious about mobile security, cloud options also give them better traceability on remote device and data access.

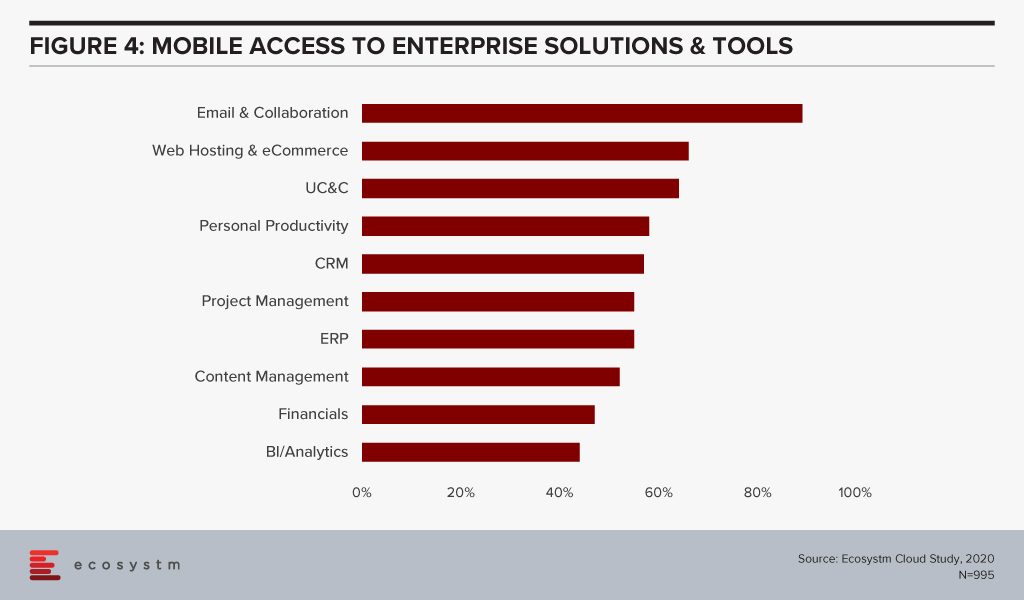

However, conversely mobility will also drive the adoption of SaaS enterprise solutions and tools. Many businesses have mobilised their email, eCommerce platforms and unified communications and collaboration tools. But beyond that, organisations are not really empowering their employees to work on their mobile devices (Figure 4). This will have to – and will change – fast.

In his report, Make Remote Working Successful, Sheedy notes, “It goes without saying that your employees’ productivity levels will improve if they have access to the applications they need. And while many organisations already have enabled universal (or near-universal) application access from PCs and laptop computers, many of these applications should also be available from smartphones and tablets. This will allow your employees to work when they are on the move – not just when they are at home.”

It is time for organisations to re-evaluate their enterprise mobility if they have to remain productive in these difficult times, and beyond. Sheedy says, “Ultimately, our employee’s reliance on great mobile and targeted end-user computing experiences is increasing – and 5G services will only accelerate the transition away from traditional telephony, communications services and desktop applications. Businesses will need to continue to mobilise their enterprise systems to make them easier to use. Employees have now experienced great mobile apps and systems – and most enterprise mobility systems don’t stand up in that comparison.”

The Oil and Gas industry has seen volatile times and is affected by its own set of unique challenges ranging from commodity price fluctuations, a potential supply crunch, geo-political events, and energy policies including energy transition. Moreover, the challenges and requirements are distinct at different stages of operations – upstream, midstream and downstream. The industry has been an early adopter of a few emerging technologies and is looking to leverage them to remain competitive and better employee management.

Drivers of Transformation in the Oil and Gas Industry

Remaining competitive in an evolving market

Oil and Gas companies are having to clean up old processes, as the market gets increasingly competitive. Ecosystm research finds that the top business priorities for Oil and Gas companies do not stop at cost reduction and revenue growth. The industry also has to focus on employee experience and safety, compliance, and increasingly even customer experience. And they must remain competitive through potential disruption in supply, demand and production; the rising costs of processes; and ongoing exploration costs. Oil and Gas companies are also focusing more on their downstream operations including retail in order to remain competitive.

Shortage of skilled workforce

The industry also faces the challenge of skills shortage. A survey conducted by the Global Energy Talent Index (GETI) found that nearly 70% of Oil and Gas professionals think the industry is already facing skills shortage or will be hit by it within the next 5 years. This is due to a number of reasons, including a reluctance of younger professionals to commit to a profession that has harsher conditions than many. Moreover, as energy transition becomes a topic of global discussion, many have a perception that the industry is not sustainable in the future. The industry also goes through cycles where they cut back on exploration and production, which results in the loss of skills and inadequate knowledge transfer. It has a long-term challenge around knowledge management.

Safety and environmental regulations

The industry has to contend with green energy movements and environmental regulations. There are several country-level regulations around air and water quality. Most Oil and Gas companies have cross-border operations and have to comply with a number of regulations on harmful emissions, greenhouse gases and offshore activities, in several countries. Increasingly, all leading Oil and Gas companies have to work in alignment with the Paris Agreement when developing solutions across functions – exploration, extraction and supply chain. There are also worker safety regulations and standards that they have to comply with.

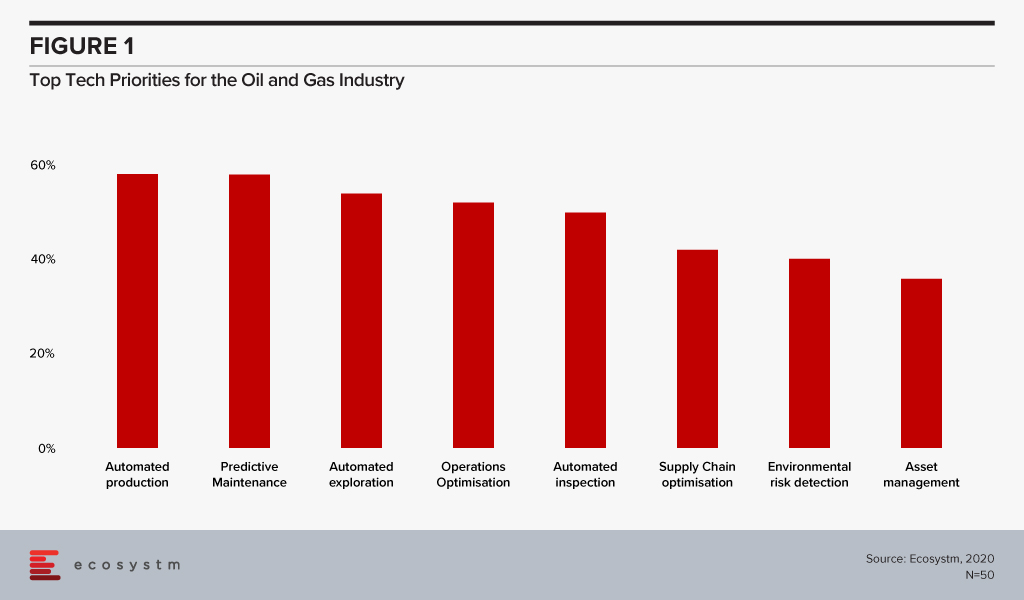

The global Ecosystm AI study reveals the top priorities for Oil and Gas companies that are focused on adopting emerging technologies (Figure 1). It is very clear that the key areas of focus are process automation, asset and supply chain management and compliance.

Technology as an Enabler of Oil and Gas Transformation

Several emerging technologies are being used by the Oil and Gas industry as they continue their struggle to remain competitive across the different stages of operations – upstream, midstream and downstream.

IIoT

As the costs of sensors go down, connectivity widens and computing power increases, the industry is seeing greater uptake of Industrial IoT (IIoT) solutions. From wearables (to monitor employee safety) to drones with smart cameras (for remote inspections, environmental monitoring), IoT solutions have an immense role to play in the Oil and Gas industry. The industry has had to be cautious about the choice of devices, however, due to pervasive inflammable hydrocarbons and the related regulations.

Not only are they implementing sensors, Ecosystm research finds that 30% of Oil and Gas companies are also leveraging the IoT sensor data for analytics and intelligence. A common application is in predictive maintenance. Two years ago, Chevron launched predictive maintenance solutions in its oil fields and refineries. While the pilot ran on heat exchangers, the company aims to connect all assets by 2024 and expects to save millions on asset management.

AI

AI and machine learning have applications across Oil and Gas operations, leveraging IoT sensor data. “Smart fields” where production is monitored centrally, has a high level of automated controls. AI/Analytics is allowing companies to run simulations, use predictive data models and identify patterns to gauge risks associated with new projects. This has an impact on production, exploration and making efficient use of existing infrastructure. Oilfield services company Baker Hughes has worked on an AI-based application that allows well operators to view real-time production data and predict future production with more accuracy.

AI is also helping organisations monitor environmental risk and has the potential to help Oil and Gas companies with their compliance requirements. Gazprom Neft, one of the largest suppliers of natural gas to Europe and Seismotech are exploring using AI for seismic data processing, for solutions that are specific to the needs of the industry.

While the applications of AI in the industry are often focused on upstream activities, AI has applications across all operations. In the midstream, transporting crude oil to refineries has always had its unique challenges. Since transport lead times are long and prices fluctuate based on the availability of products, organisations benefit from demand forecasting and price risk modelling. While the common perception of the industry does not include customer interactions, the truth is that the industry is increasingly focusing on the retail space. The need is enough for Shell to begin experimenting with virtual assistants as far back as in 2015, to interact with their retail customers. In fact, the company anticipates a higher adoption of AI in the industry and is collaborating with Udacity to bridge the skills gap.

Technologies empowering employees

As discussed earlier, one of the key challenges of the industry is the inability to manage a reliable knowledge management system that can help consistent knowledge and skills transfer. A single source of truth that can be accessed by all employees on processes, including safety requirements has an immense role to play to help with the skills shortage in the industry.

Enterprise mobility is another tech area that holds immense potential for the industry, with its huge proportion of mobile workers, many in remote locations. Mobility solutions can help in productivity, process optimisation and monitoring of health and safety of the employees and are increasingly incorporating wearables and location-based services. GIS and GPS systems are helping employees with accurate directions, easier access to drilling locations and more. Given the number of devices, platforms and OSs, the industry is seeing an increased interest in unified enterprise mobility (UEM) solutions. Ecosystm finds that more than a third of Oil and Gas companies have implemented or are evaluating UEM, while another 20% are expressing early interests.

Blockchain

The sheer quantity of documents, transaction records and contracts that a typical Oil and Gas company has to manage – including cross-border transactions – poses some difficulty for the industry. The companies have to reconcile and handle issues involving multiple contractors, sub-contractors, and suppliers. Supply chain and inventory management is also a challenge. With the adoption of Blockchain, the industry can automate the management of purchase orders, change orders, receipts, and other trade-related documentation, as well as inventory data with more efficiency and transparency. Blockchain is enabling a seamless supply chain, improved project management and simplifying contractual obligations at each point along the way. Gazprom Neft’s aviation refuelling business is an early adopter of Blockchain-based smart contracts. All refuelling operations are undertaken exclusively on the basis of digital contracts approved by both parties near real-time and eliminates the possibility of any breach of contract and makes the accounting process more transparent.

As the market continues to be volatile for Oil and Gas companies and uncertainties loom in the future, the industry will increasingly depend on technology to remain competitive.

The nature of the workplace has changed over the years and so has the number of devices being used by today’s employees. More and more organisations are adopting a ‘Mobile First’ strategy – designing an online experience for Mobile users before designing it for the desktop/ Web. This is a paradigm shift from the past, where enterprises modified or adapted their websites, business processes and digital means of communications, to fit Mobile users.

Mobile First Drives the Adoption of UEM

Mobile First application designs take into consideration that Mobile users are constantly on the move. Information needs to be presented to them on smaller screens/displays with multi-media interfaces (voice/video), and multiple network connectivity options (Wi-Fi, cellular, and so on).

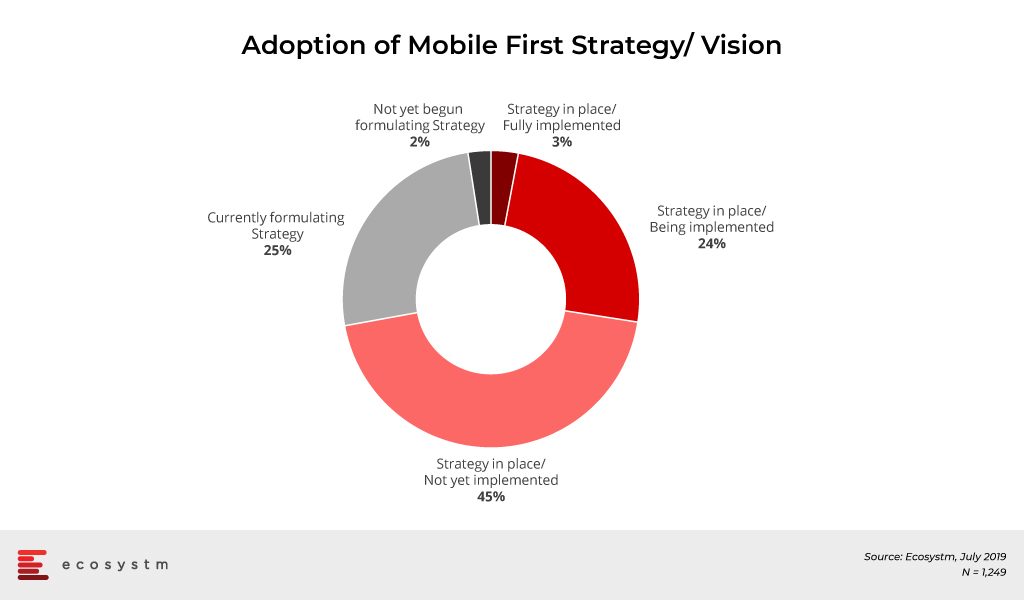

The global Ecosystm Mobility Study reveals that 73% of organisations have a Mobile First Strategy in place and are at various stages of implementation. About another 25% of organisations feel the need for a Mobile First vision and are formulating a strategy.

With Mobile First strategies, organisations are adding a wide range of devices and operating systems (OSs), regular innovative mobile-centric workload rollouts, new mobile apps across multiple functions, and IoT initiatives. As a result, organisations now have the need to support multiple devices and endpoints (including IoT sensors and wearables) multiple OSs, applications, and mobility policies such as BYOD. Organisations struggle to manage these devices, their data, apps and software updates across heterogeneous OSs and platforms. “The way companies are growing and fuelling their teams with devices now, shows the trend that these organisations will follow in the next few years, which will require a higher level of sophistication from the Unified Endpoint Management (UEM) solutions in the market,” says Amit Sharma, Principal Advisor, Ecosystm.

How does UEM Help?

An UEM solution can configure, monitor and manage multiple OSs, devices including IoT sensors, and gateways, and

- Unify application and configuration

- Manage profiles

- Monitor compliance

- Enforce Data Protection policies

- Provide a single view of multiple users

- Collate data for Analytics

It can ease the burden of management activity of internal IT teams and allow organisations to create a more streamlined lifecycle that secures mission-critical technology. It can also offer proactive threat monitoring, access control and identity, and patch management.

A good UEM solution provides IT managers with a transparent and traceable overview of all endpoints within the network as well as the power to manage all connected devices from a single platform. It maps out the network setup and structure by carrying out a complete inventory of all network devices, configurations, installed software, and the drivers for endpoint subsystems.

There are simply too many endpoints within Industrial IoT (IIoT) for IT managers to efficiently monitor manually. Mistakes will be made, and opportunities to stop breaches before they escalate will be missed. “An UEM solution not only shows the software and licensing situation but scans the IT environment for any irregularities or vulnerabilities and allows risk assessment and patch installation where it is necessary”, says Sharma. “Providing IT administrators with automated vulnerability management will enable them to filter and set search criteria by device, security vulnerability and threat level for the higher and most timely degree of protection.”

Industry Adoption of UEM

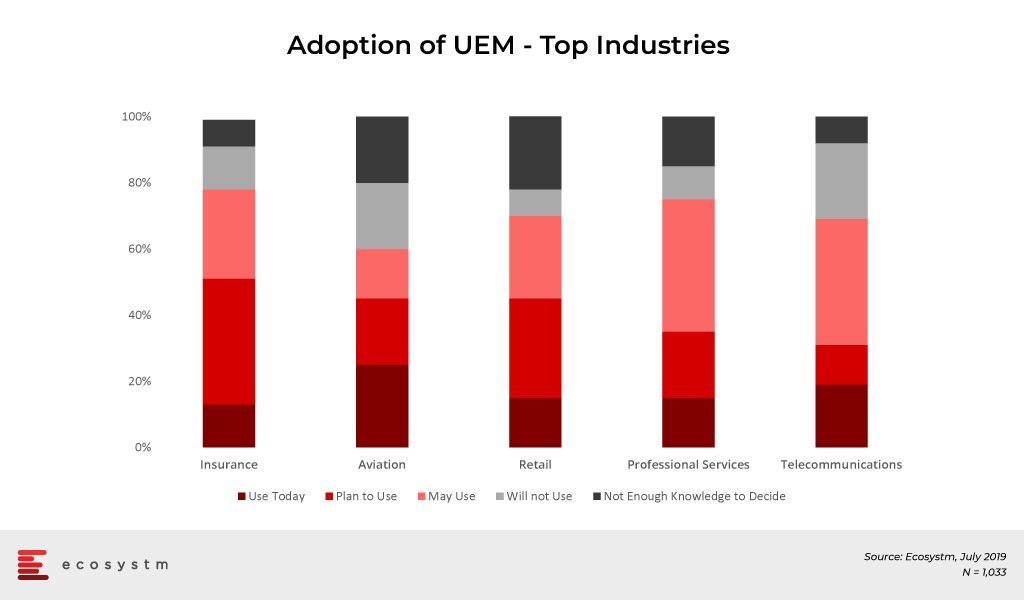

Customer-focused industries, with mobile workforces, are adopting UEM faster than other industries. The global Ecosystm Mobility study found the top industries that have implemented UEM or plan to in the near future. Most of the top industries cater to a high percentage of mobile workers. Their need to adopt UEM can come from different angles. According to the study, the Telecommunications industry leads in Mobile Content Management (MCM) adoption, and mobile apps for logistics and operations appear to be the key driver for the industry uptake of Mobile Applications Management (MAM).

Other industries to look out for in the future are Banking and Healthcare, as they lead the pack when it comes to MDM adoption. Banks are incorporating technologies, such as mobile banking, and enabling payments via smartphones to provide enhanced services to customers. We have also seen the advent of Smart Point of Sale devices which are managed remotely on cloud infrastructure and these millions of devices will also be required to be managed by the banks that issued the devices.

The healthcare industry is another vertical where we can expect a higher uptake of UEM in the coming years. Clinicians and care providers are increasingly mobile, switching from device to device, depending on the task and location. Accessing mHealth applications and patient data from any device securely enables caregivers to focus on patients and outcomes. It also allows them to complete critical tasks from any device whether they are on call or off work. UEM makes HIPAA, SOC 2 and other healthcare regulation compliance easy for the providers.

Challenges of UEM Implementation

User experience must be at the centre of any mobility initiative. If the device, app management, or content is not something users want or are able to use, then it simply will not be adopted. The success of an UEM solution lies in the ability of users to quickly authenticate and gain seamless access to corporate apps and data from their devices. Users should also have access to self-service tools that help them manage basic device features and troubleshoot problems quickly.

“We can expect most Enterprise Mobility Management (EMM) and MDM suites to migrate to complete UEM suites that manage personal computers, mobile devices and Internet of Things (IoT) and Enterprise of Things (EoT) deployments,” forecasts Sharma. “Organisations should look for a purpose-built UEM solution which is platform-neutral and which cultivates a thriving ecosystem of complimentary mobile solution providers.”

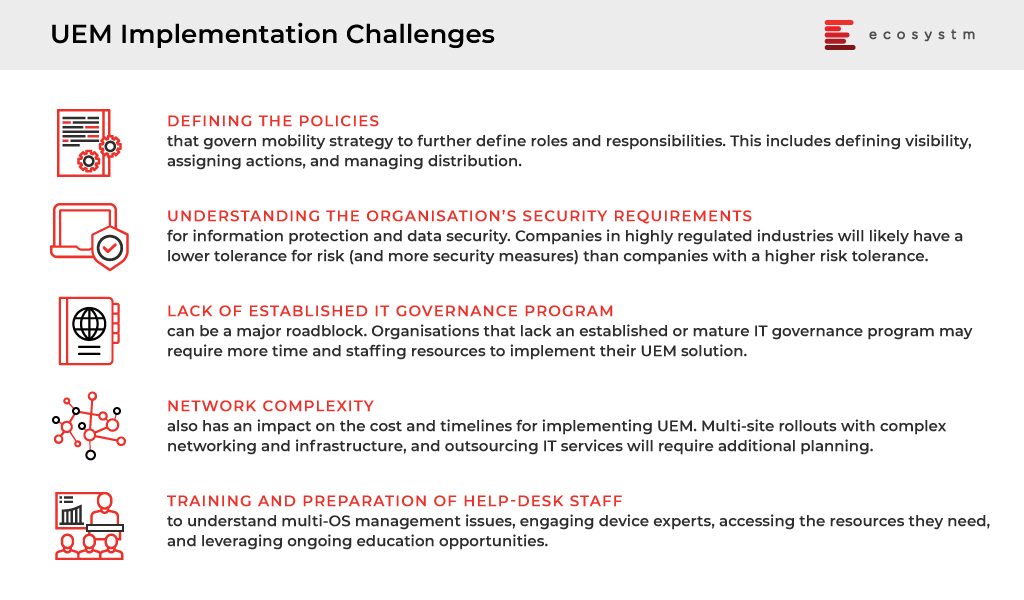

However, there are several challenges that organisations face when they are developing and deploying an UEM solution. Sharma lists the top UEM implementation challenges that can be broadly classified into the following five categories.

“As AI finds its way into mobile devices and virtual personal assistants proliferate in offices and boardrooms, IT admins will have to manage more – and more sophisticated – endpoints. AI will continue its push into mobile hardware and enterprise communication devices, challenging IT shops’ EMM capabilities while at the same time offering potential security benefits.” Sharma adds. “Also, in 2019, voice-activated assistants such as Amazon Alexa and Cisco Spark Assistant will find their way into more corporate offices and conference rooms – becoming yet one more enterprise device encouraging the adoption of an UEM strategy.”

Have you adopted an UEM strategy in your organisation yet? Share your experience with us in the comments section.