Organisations are moving beyond digitalisation to a focus on building market differentiation. It is widely acknowledged that customer-centric strategies lead to better business outcomes, including increased customer satisfaction, loyalty, competitiveness, growth, and profitability.

AI is the key enabler driving personalisation at scale. It has also become key to improving employee productivity, empowering them to focus on high-value tasks and deepening customer engagements.

Over the last month – at the Salesforce World Tour and over multiple analyst briefings – Salesforce has showcased their desire to solve customer challenges using AI innovations. They have announced a range of new AI innovations across Data Cloud, their integrated CRM platform.

Ecosystm Advisors Kaushik Ghatak, Niloy Mukherjee, Peter Carr, and Sash Mukherjee comment on Salesforce’s recent announcements and messaging.

Read on to find out more.

Download Ecosystm VendorSphere: Salesforce AI Innovations Transforming CRM as a PDF

Authored by attending Ecosystm analysts, Ullrich Loeffler (Chief Operating Officer), Kaushik Ghatak (Principal Advisor, Digital Transformation and Supply Chain) and Liam Gunson (Director, Product and Solutions)

Bosch Software Innovation (Bosch SI) hosted its annual analyst briefing in Singapore on 6th December 2019 to provide an update on its business, strategy and solution portfolio in the APAC region.

Bosch has expanded its capability and reshaped its go-to-market approach in a bid to not only position itself as a world leading IoT company, but also help move the IoT market forward.

A number of new solutions were demonstrated through the day. From tenants asking their building management if the gym was busy, to smartphones detecting a manufacturing fingerprint so you could avoid buying a counterfeit.

At the heart of the business updates though was a new organisational approach to prove markets and integrate user perspectives into solution development. Bosch is looking to achieve this by setting up dedicated, cross-divisional entities which can focus on user needs to drive growth while collating requirements for the Bosch SI centres.

Bosch SI essentially will perform a role of an IoT business incubator within Bosch Group, and once a vertical within Bosch SI has reached a certain level of business, it is spun off into a separate company focusing on that area. There are three business units that have met the threshold and have spun off so far.

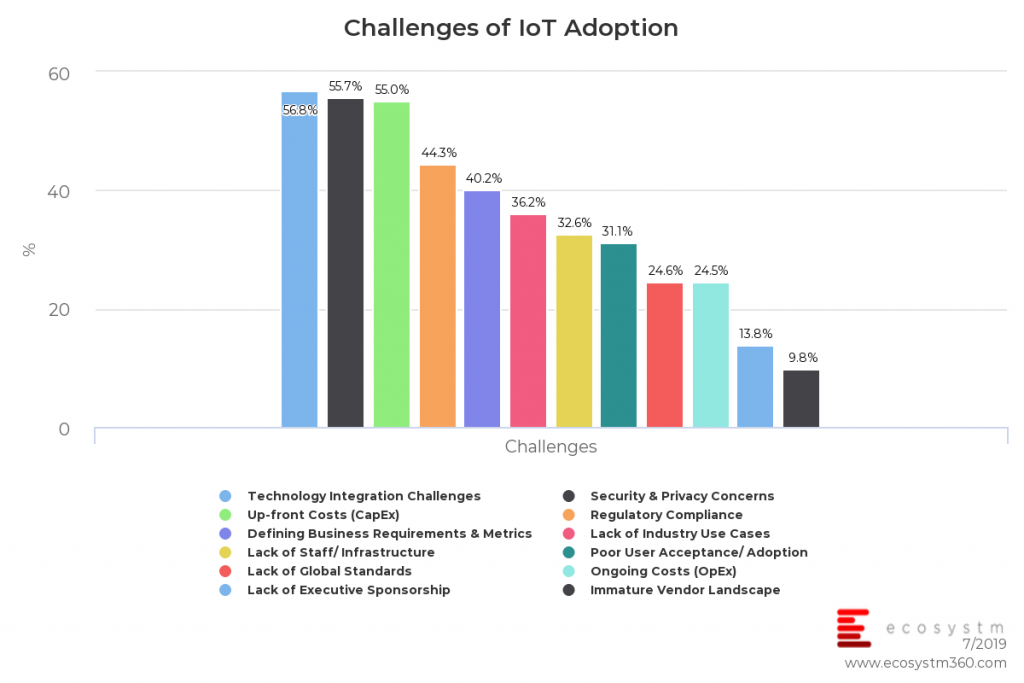

Broader challenges still remain for IoT adoption. Patchy connectivity, varied regulation, and a lack of standardisation will continue to hamper the IoT market. However, from a user perspective the timing is right. Ecosystm research shows that while IoT uptake is limited, intention is strong. Enterprises will be looking for partners with a willingness to understand their needs and design around them, in order to help get initial projects off the ground.

Bosch Business Update – From Innovation to Commercialisation

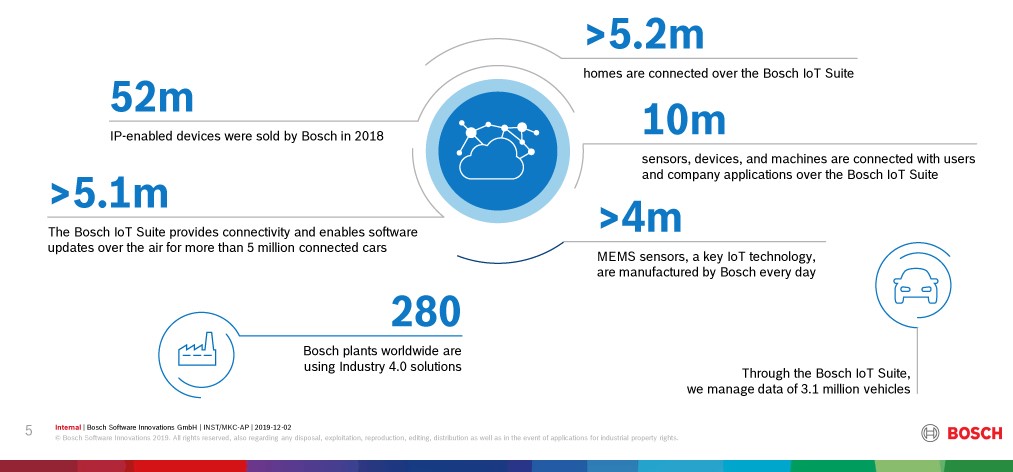

Bosch SI was created to build Internet of Things (IoT) solutions, leveraging Bosch’s 133-year experience in developing and manufacturing products for the automotive, industrial and consumer segments. Founded in 2008, by 2019 Bosch SI has established 10 global offices, of which some have solution development capabilities, employing over 700 IoT experts. Four of the Bosch SI offices are located in Asia Pacific – Singapore, Nanjing, Shanghai and Tokyo.

Figure 1: Bosch Software Innovations in Numbers

The Bosch IoT Vision and Strategy is not limited to Bosch SI’s but spans across the full Bosch Group. An indication of the dedication to the IoT story is that Bosch is committed to enabling connectivity for all existing product portfolios ranging across its industrial, automotive, manufacturing and consumer product lines by 2021.

Another indication of Bosch’s IoT business maturing is that in 2018 Bosch it formed 3 new subsidiaries, each being a dedicated entity to take targeted IoT Industry solutions to market. The new business entities focus on

- Connected Industry

- Connected Mobility

- Residential IoT

with other areas such as Agriculture, Retail, Energy, Mobility, Manufacturing and Home & Building as potential future spin-offs. The announcement is significant as it separates the innovation and commercialisation functions. Bosch SI becomes the dedicated R&D and incubation engine to take new industry solutions to a defined threshold before a dedicated entity is formed to achieve commercial scale.

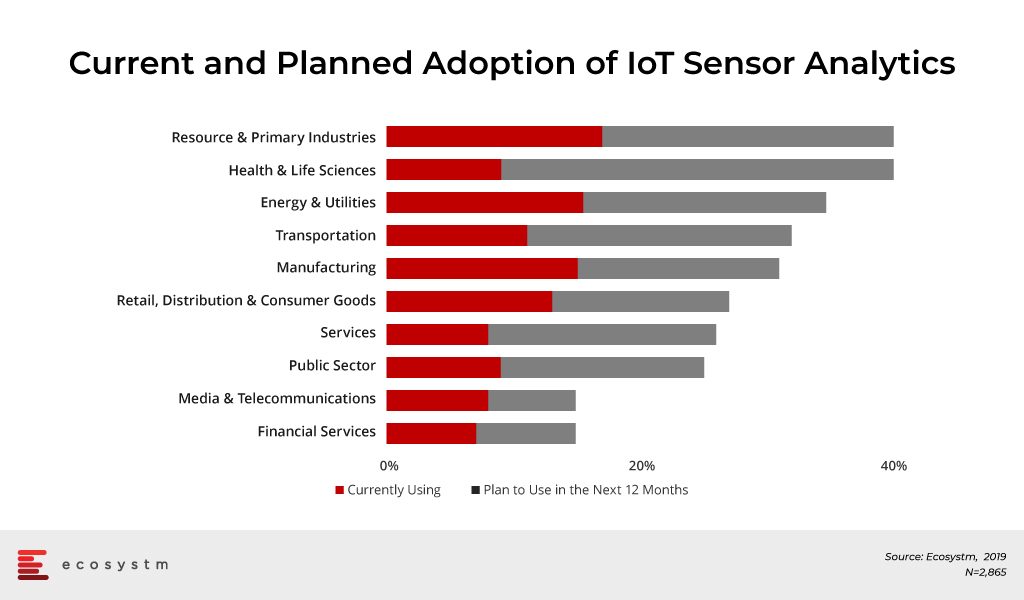

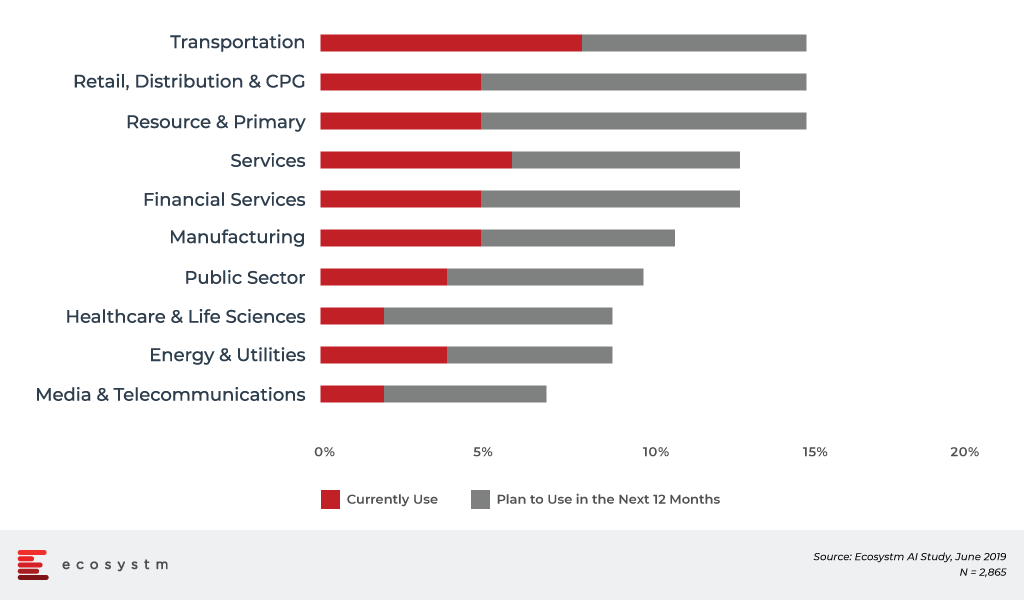

Despite the fact that IoT has been greatly overhyped since the term was coined by Kevin Ashton in 1999, Ecosystm research shows evidence that adoption is accelerating across the region. Figure 2 outlines the current and planned adoption of ‘sensor-based analytics’ within organisations. The research strongly supports Bosch’s timing for investments in scaling the commercialisation of its solutions.

Figure 2: Industry Adoption of Sensor-Based Analytics

Market Pull over Technology Push is creating proven Industry Use Cases

The locations and specialisations of Bosch’s Innovation Centres across Asia are no accident and result directly from engagements with local clients. Each innovation centre specialises in certain solutions that have arisen from the productisation of solutions developed for customers. This ‘market pull’ strategy is a clear differentiation to the commonly practiced ‘technology push’ approach which has seen many vendors struggle to gain traction for their IoT solutions. Key industry solutions developed by Bosch SI are:

- Agriculture – Bosch Plantect: (Japan). Plantect is a sensor-based monitoring system for early detection and prevention of plant diseases in greenhouses. The current solution targets greenhouse farmers for tomatoes, cucumber and strawberries.

- Smart Building – Bosch Lift Manager (Singapore). Lift Manager is an AI-supported solution that can be retrofitted in existing lifts with set algorithms to monitor and predict lift malfunctions and enable predictive maintenance.

- Smart Building – Connected Buildings (Singapore). Bosch Connected Building leverages cameras and sensors to optimise business operations such as Air Quality, Light Monitoring & Control, Lift Monitoring, Occupancy Tracking, Asset Tracking, Carpark Monitoring, and Object Tracking.

- Manufacturing – Secure Product Fingerprint Solutions (China). Secure Product Fingerprint captures a unique fingerprint for products to combat counterfeits and connect manufacturers with their users.

The Bosch IoT Ecosystem – Open Source and API enabled Platform

Bosch has realised that IoT is a concept that cannot be owned and delivered by a single entity. As such Bosch aims to establish its Bosch IoT Suite as the platform to connect any Bosch or third party “things” to deliver targeted industry services and solutions.

Bosch IoT Suite can be deployed on Bosch’s own IoT Cloud or through Cloud partners such as AWS, Microsoft or Huawei (for China only). It is a PaaS offering that packages unified device APIs to connect things with device management, software updates over the air, data management and security capabilities. An inbuilt analytics engine assists with business logic tools to drive business value out of the data collected. The open source and open standards architecture promote the development of in-house or third-party industry applications as platform add-ons and use cases.

Bosch and Market Outlook

IoT has been one of the most hyped ‘buzz words’ for the last few years but true market adoption is yet to follow suit. Ecosystm research shows that market intention is positive with more industry-focused uses cases and simpler ‘plug and play’ style solutions available that require less CapEx and shorter time to value.

Bosch is well positioned to capitalise on this trend. Its focus on developing proven use cases for targeted industry sectors and then working with anchor customers and testing the solutions internally within Bosch, is a clear differentiator in the market. Commercially scaling these solutions will remain the key challenge as decision stakeholders may not be the key beneficiary of the solution. In the connected building example, tenants will be the key beneficiary of finding quiet gym slots or having better air quality but it remains questionable whether this will convince the building owner or operator to put pen to paper and sign-off on relevant IoT investments. An area that Bosch needs to focus on, is the articulation of its business proposition and more importantly connect this to the business value to prospects and customers. As solutions scale in the market, broader sales and partner teams will need to be enabled to bring this message to the relevant stakeholders. The fact that these stakeholders may sit outside Bosch’s traditional comfort zone will not make this endeavor easier.

Bosch will also face varying market regulations that could create road bumps in scaling its solutions. The Bosch Lift Manager solution as an example provides sensor diagnostics for predictive maintenance scheduling. Many existing lift maintenance contracts however follow local regulations that require ongoing scheduled servicing of elevators which reduces the cost savings potential.

The decision to establish standalone IoT entities is seen as a strong commitment and the right move to take advantage of the presented IoT opportunity. The high degree of customer advocacy and industry experience further makes Bosch a strong contender of the Industry 4.0 revolution.

Authored by attending Ecosystm analysts, Sash Mukherjee (Principal Analyst, Government & Healthcare) and Sid Bhandari (Director, Consulting & Advisory Services)

The recently held AWS Public Sector Summit in Singapore showcased some of the regional AWS implementations, and how organisations are leveraging the Public Cloud differently.

In her keynote address, Teresa Carlson, Vice President, Worldwide Public Sector set the tone for the industry show cases by saying that a successful Digital Transformation (DX) starts from a radical rethinking of how an organisation uses cloud computing technology, people, and processes to fundamentally change business performance.

AWS Empowering the Public Sector

Carlson is clear on what Public Sector organisations must do and where AWS can help them:

- Define what Cloud refers to in the organisation. The first step in bringing about a Cloud First transformation is to be clear on the true definition of cloud computing.

- Create a “Cloud First” policy. To adopt a Cloud First policy, it is imperative to have leaders with a clear vision who really drive technology initiatives forward for all the right reasons like security, cost reduction, scalability, privacy and rapid acceleration of citizen services.

- Focus on Security & Compliance. AWS has global compliance certifications with 200+ services and key features focused on security, compliance and governance. New services such as the use of AI for threat detection have been implemented and are quickly evolving into a mainstream feature.

- Modify your Procurement vehicle. A formal cloud procurement model must be adopted instead of creating ad-hoc processes and a rush to adopt cloud to meet the specific needs of individual departments. AWS has the expertise to assist government IT leaders in selecting the right acquisition approach for their agency.

- Do not ignore Skills Development. Investing in cloud skills development – whether at the central IT level or in the individual business units in the Public Sector – is imperative, as roles evolve and new roles emerge. AWS has over the years offered free courses and industry certifications to Public Sector employees interested in learning the foundations of cloud computing, storage, and networking on AWS to advanced skills courses in emerging technologies such as AI.

Ecosystm Comment:

While cloud may have started off as a means of offsetting CapEx, its role has since evolved into being a major vehicle for DX. Several governments across the world have adopted Cloud First policies to spearhead innovation, increase agility, and improve citizen services. Cloud is increasingly seen as a foundation for many emerging technologies that governments are experimenting with and implementing such as AI, automation, Big Data analytics and Smart Nation initiatives.

The skepticism around Public Cloud security seems to have diminished over the years, with the perception that cloud providers use state-of-the-art technologies to protect their environment and continue to upgrade their security features in the face of new and evolving threats. However, the Ecosystm Cybersecurity study finds that nearly 53% of Public Sector and allied organisations that use Public Cloud feel that the security measures offered are sufficient. Leading cloud providers such as AWS should make it clear that essentially it is a shared responsibility and impress on organisations that the responsibility to secure their own applications and the interface with the Public Cloud ultimately lies with the deploying organisations.

Industry Use Cases

There were several industry use cases presented over the 2 days and it was heartening to see so many Asia Pacific examples of transformation. Tan Kok Yam, Deputy Secretary, Smart Nation & Digital Government Office shared that the key to a successful Smart Nation initiative is to build user-centric services rather than having an agency-centric approach, in his presentation on Singapore’s “The Moments of Life” app. Edwin H. Chaidir, IT Manager at WWF Indonesia presented on how AWS’s machine learning capabilities has helped the organisation to automate identification of specific orangutans in the wild, freeing up resources (money and time) to reinvest in other wildlife protection initiatives.

One of the implementation stories that impressed the Ecosystm analysts was the one shared by Rookie Nagtalon, Consultant for Digital Transformation at the Chinese General Hospital and Medical Center (CGHMC) in the Philippines, where he spoke about how they were able to bring about transformation in their patient life-cycle management. Healthcare in Asia Pacific is a diverse and disparate market with organisations at different levels of IT and business maturity – against a backdrop of different country-level goals and healthcare policies. It was encouraging to hear about a transformation project in a not-for-profit organisation from an emerging economy.

The challenges that healthcare organisations face are unique in many ways:

- Legacy systems that still work and hence there is no business case for replacing them

- Approximately 2/3rd of the IT budget going into running the basics, leaving limited resources for emerging technology adoption and transformation projects

- The shift to value-based healthcare and the need for data-driven insights to support it

- The unpredictability of the workload and the need for an agile IT infrastructure

- Security and compliance mandates that protect patient data and require storage of records over extended periods

Working with these challenges, how does a healthcare organisation bring about Digital Transformation?

Nagtalon’s team was assigned the task to bring about this transformation within a 10-month timeframe.

- The key challenge. An awareness that no one vendor can provide the entire gamut of functionalities required for patient lifecycle management. In spite of recent trends of multi-capability vendors, hospitals need multiple vendors for the hospital information system (HIS), ERP, HR system, document management systems, auxiliary department systems and so on. Each of these vendors have their own development team and infrastructure requirement, which stresses the internal IT resources. DX involving multiple legacy systems requires a step-by-step approach. The challenge is to identify the right systems to start the journey with.

- Vendor selection criteria. The need to find one solution that would enable seamless data sharing across the disparate systems. The vendor selection criteria that were used focused on ease of use and speed especially when working with multiple data sources. In keeping with the industry, the ability of the vendor to support mission-critical applications was put through the filter of what was referred to as ‘Code Blue’.

- The solution choice. A cloud solution that can empower teams and remove worries about the infrastructure. The hospital chose AWS as their transformation partner, who used a system interface blueprint to integrate data from their SAP ERP system, Medcurial’s MeRx HIS, 128 HR system, Canon’s documentation system and multiple diagnostics systems.

- The future roadmap. Enabling the organisation to be a Digital Hospital. The solution was implemented in 7 months and hit the right ROI requirements, reducing billing time and impacting the bottom line in terms of both recovery and revenue. It has created the base foundation for future plans such as device integration and the provider is well set on its journey of Cloud, IoT and Robotics.

Ecosystm Comment:

Nagtalon raised an important point when he was asked the key reason for the success of the project – executive buy-in. Transformation projects work best when it is enterprise-wide and senior management sponsorship is a must to enable that. However, he also mentioned humorously that he had become extremely unpopular during the implementation. This is where a centre-of-excellence with ‘champions to the cause’ from each key department helps. Organisations should look to engaging with the stakeholders early and to get their buy-in as well as the executive’s.

AWS’s marketing message to healthcare providers includes allowing them to focus on their mission and create their differentiation, and enabling them to incorporate new and emerging technologies. This implementation certainly ticked those boxes. What was particularly positive was the big thumbs up the AWS implementation team received. Organisations will increasingly partner with platform providers in their transformation journeys and implementation capabilities and best practice guidance will be the key differentiators for vendors.

I recently attended a briefing with Ramco Systems – if you haven’t heard of them, they are one of an emerging group of software vendors who are challenging the big application software companies – SAP and Oracle. They put innovation at the centre of their business – aiming to constantly drive improvement for their customers, and bringing companies the benefits of systems that consumers see in their web-based and mobile apps but have been sorely missing from the enterprise application market. To be honest they are a breath of fresh air in a market that needs it – and their endeavours are seeing results both in plaudits from analyst firms and new customer wins.

At the briefing, Ramco demonstrated some of the AI capabilities they have been weaving into their software platforms. And in doing so they have shown the gap between today’s systems and systems that actually work for their clients. ERP, HR, Payroll and other enterprise applications are data sinks – they demand constant input, and while they do a good job in automating business processes, they could do so much more.

Within Ramco they have moved away from email completely for employee inquiries – all interactions now happen with their transactional chatbot, including scheduling meetings, checking leave balances, discovering and understanding personal achievements, raising a travel request and claiming travel expenses – as well as understanding company policies and supporting employees with speculative queries. This same bot is available for clients as they aim towards a zero-UI interface – no more logging onto systems and interrogating applications, running searches. Now you ask a question and get an answer – using an IM client or a voice interface (such as Google Home or Amazon Alexa devices). This is the way systems should serve employees.

Like other enterprise application vendors, they have added an AI capability to their platform – but they are taking the extra step to make that AI work out of the box (or the cloud). For example, with all the information in your HR systems (employee skills, time and attendance, incentives, expenses, payroll) they are looking at making that information accessible and actionable for potential users – creating systems that understand the context and anticipate needs.

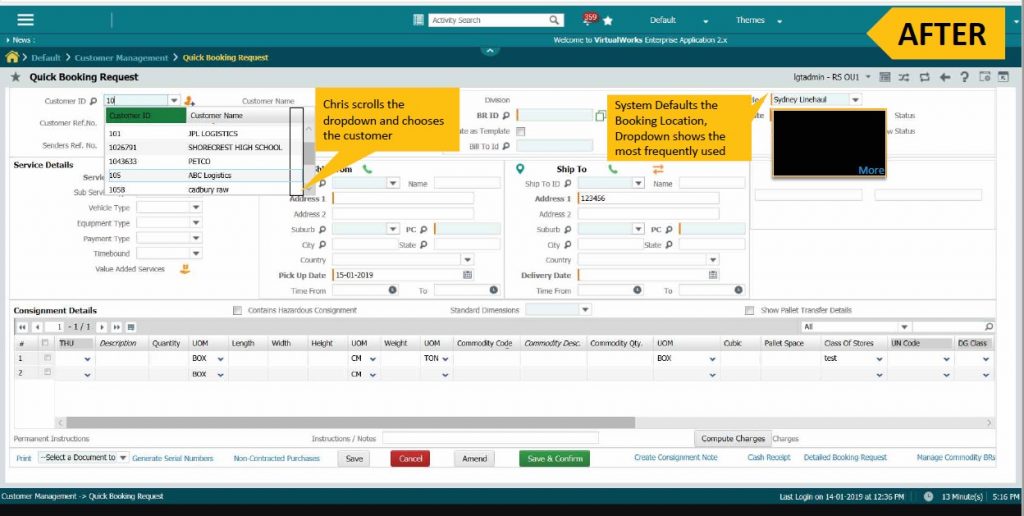

In your finance or ordering systems, they are applying machine learning so it understands that ‘client A’ tends to order specific items from specific locations – so ordering agents are guided towards those options versus having to scroll through long lists.

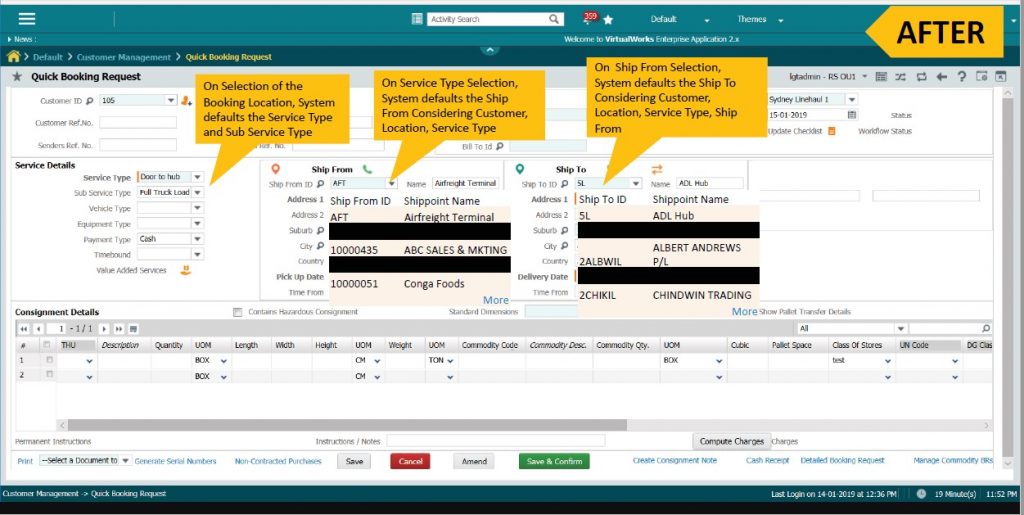

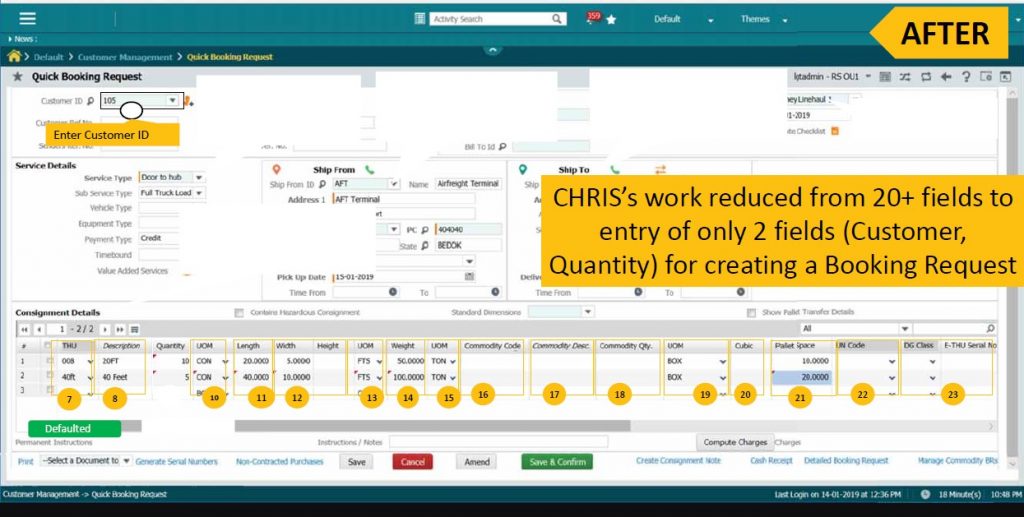

(see images for an example of that in the process)

They are recommending where costs should be allocated or validating inputs based on historical learnings. The systems can catch a mistake, errors or even fraud – saving the business significant amounts of money and of time in error correction or re-work.

Ramco’s vision is that agents only have to manage exceptions in enterprise applications – not every single detail. Complete automation is still an unrealistic expectation, but businesses should aim for 85% automation, with 12% of processes needing intervention for mild intervention and 3% needing deep intervention. In Ecosystm’s experience speaking to businesses that have automated to such a degree, an 85% automation does NOT lead to an 85% saving – as you typically automate the easier cases anyway. But the savings should be real and measurable – up to 50% time saving for accounts receivable or payable teams, for payroll teams, for help desks or for other highly manual processes should be achievable.

And while the business case can be built on the saving, the pay-off also comes in happier and more engaged employees who have the information right at their fingertips to make better business decisions or drive smarter business processes.

So why highlight Ramco’s AI capabilities? For a number of reasons:

- For AI to be widely adopted, it needs to be easy and accessible – Many other vendors (the big cloud players in particular) are making AI tools and assets available for customers, but they still have to do the hard work – find a business problem, gather the data, train the algorithm, deploy the algorithm and then train users on the new process. There are hundreds – or even thousands of examples of processes in business that can be made smarter and easier through the use of machine learning and AI – and vendors should be building these capabilities into the products and platforms. Ramco is doing that – they are by no means alone – but they are a good example of a software vendor that is disrupting a market by focusing on helping their customer succeed.

- I believe there is a bigger trend going on in the way businesses buy software (and look out for an upcoming report on this topic). More and more I see businesses adopt the best solution for their needs – NOT the one that does 80% of what they want. And the best software is often built by smaller, more agile companies. They build for specific business needs and specific niches – and they focus on providing exactly what customers want. I am seeing a general move away from the big platform providers towards the smaller ISVs. Partly because they cost less (I regularly hear companies say they saved up to 90% by using a specialist provider!) – but also because they provide the best solution – and businesses can no longer compromise when it comes to driving the best customer and employee experiences. Again, Ramco is a part of this change.

You should demand more from your applications provider – an AI platform is not enough. They need to make your actual application smart – they need to be able to automate processes you are already doing. If you have data the system should be able to learn, they need to focus on making the system work for you, your employees and your customers – not the other way around (as is too often the case). AI needs to be a core component of your business applications, not a bolt-on.

Zoom is no stranger in today’s world of video and collaboration. Organisations would have heard of Zoom, trialled the product or are now users of the product for video collaboration. Zoom’s success is built on the simplicity of their technology and the ability of the solution to be deeply embedded within workflows. They have put some serious thoughts into user design and how that experience through the app or when launching the solution from the PC/ laptop allows for a smooth integration to email, calendars as well as other popular collaboration applications (including Slack). The market for cloud videoconferencing is growing rapidly. As the market shifts towards new and more agile ways of working and as co-working spaces rise globally, the need to collaborate and communicate instantaneously without too much hassle and interruptions will be critical. We are living in an era where it will be all about the experience.

Zoom’s share value has risen more than 120% from the $36 IPO debut price. Zoom has been focusing on building a base of high-value customers (those that spend more than USD 100,000 per year for services). In the last quarter alone the number of high-value customers went up by over 17%.

Rapid expansion outside of the ANZ region

Zoom has witnessed rapid growth in the ANZ region in recent years. Demand for the solution continues to come from both medium and large enterprises. Japan will be an important market for Zoom and they are starting to work with some big names in the market such as Rakuten and are expanding on growing their partner network. With a good data centre footprint which is critical for video and collaboration, other key markets for Zoom in Asia include India, South East Asia, Hong Kong and China. Their wins in these markets are from some of the biggest brands and conglomerates. Zoom’s growth in Asia is demonstrating how their cloud-based video solution is becoming the preferred platform, even if IT has already invested in other cloud video offerings. Demand is coming from the lines of business and not necessarily through IT. That is a big differentiator – Zoom being used by lines of business changes the entire sales process. It is now driven by word of mouth and individual user experience and LOBs which then becomes a companywide opportunity for Zoom. When you put that into context, the sheer numbers in terms of users within an organisation becomes large.

The launch of Zoom Phone

Zoom launched their Zoom Phone cloud phone service in Australia, supporting local phone numbers and PSTN access with new metered and unlimited call plans. Customers have the option of using their own carrier or using a Zoom number. The launch of Zoom phone should not be taken lightly by their competitors as they have so far succeeded in pulling customers to their app and impressing them with the user experience. Once the customer is locked into Zoom, the user experience has somehow led them to want to use it even more. With the launch of voice, they are now pushing themselves deeper into an account by creating upsell opportunities in workplace video, collaboration and voice technologies. This allows them to take on UC players across the stack of video, voice and collaboration.

Accelerating deep partnerships with leading cloud innovators

Zoom has strong partnerships with leading cloud platforms. Zoom’s partnership with Dropbox allows customers of both services to start a Zoom Meeting while viewing or working on shared files via shortcuts built into Dropbox’s viewer tool. The Atlassian partnership, for instance, allows Jira Ops to be integrated with Zoom. Users will be able to start a meeting directly from a Jira Ops ticket with anyone associated with the ticket. These are some of the partnerships and it demonstrates how Zoom has thought about other critical cloud apps that are important for day-to-day work and collaboration and the ability that can make Zoom the app that can provide that in-between integration for collaboration.

Ecosystm Comments

Zoom’s architecture is video-first, cloud-native and optimised to process and deliver high-quality video across devices. They reported recently that their approach to video has been uniquely different from that taken by others who have attempted to add a video to an aging, pre-existing conference call or chat tool. Zoom developed a proprietary multimedia router optimised for the cloud that separates content processing from the transporting and mixing of streams.

With the launch of Zoom Phone and the adoption they are witnessing of their video platform, Zoom is set to be a leading provider in video and voice collaboration. We can expect Zoom to further build on the office collaboration stack in the near future. As organisations start deploying solutions from cloud innovators such as AWS, Slack, Microsoft, Google and others, Zoom stands out from that standpoint. They are a cloud innovator that has thought about the issues of the past and the pain points of those using video. The thinking behind user design and simplicity and the integration to workflows has paved the way for the success they are seeing today.

As they grow their presence with some of the largest brands and Fortune 500 companies in the Asia Pacific region, they will also start attracting partners who will want to be part of that journey with them so it’s a win-win for both parties. These partnerships will include a range – from the existing players in the video to other workplace collaboration vendors.

For the fiscal year ended January 31, 2019, Zoom reported that 55% of their 344 high-end customers started with at least one free host prior to subscribing. These 344 customers also contributed to 30% of revenue in that fiscal year.

The journey has just started for Zoom in Asia Pacific and we can expect the next 12 months to be good for them as they expand rapidly across the region.

During the past 12 months, Cisco has worked hard at refining and relaunching their IoT strategy. Initial overall impressions of the progress are good with strong alignment with both Cisco and their customer needs. Launching IoT to three different audiences at Cisco Live Barcelona, Hanover Messe and Cisco Live San Diego was critical as it enabled Cisco to talk to network, industry and enterprise audiences in a focused and personalised manner. However, there are other market dynamics at play that will challenge Cisco’s IoT Edge strategy and ecosystem play. Both the progress and challenges are discussed in this review.

Overall Rating B+

Much of the 2018-2019 efforts may be collated under three main categories.

- Hardware. Establish a hardware foundation from which any IoT device or customer can reap the benefits of Cisco’s larger corporate strategy built around initiatives such as Cisco DNA Center, Intent Based Networking, ACI and Security. With the acquisition of Sentryo and the refresh and launch of their routers, Cisco is now well placed to have legitimate discussions with Industrial IoT or IIoT customers and prospects. Bringing IBN functions to the edge of the network will enable Cisco’s customers to begin to develop richer business outcomes from the network. Rating: A-

- Developers: Raise the availability of IoT-based applications through Cisco’s DevNet developer community. Cisco has a significant advantage over their competitors by having over 500,000 developers who understand how to write apps for Cisco’s product line and who now have access to new types of data that can enrich traditional network outcomes. Over time this advantage will become more and more valuable as data becomes utilised across markets as well as within markets thus creating wealth in a much larger ecosystem. Rating: B+

- Partners: Transform their partner management through the Customer Experience (CX) program. Much of Cisco’s business is conducted through partners. It is a critical success factor for Cisco to enable the partners to be IoT-data savy. IoT will enable Cisco to accelerate the transition from product sales to higher value subscription services. However, based on discussions with customers, partners and Cisco management, we believe that there is much more work to integrate an IoT strategy in to CX. Rating: B-

The Industrial IoT (IIoT) and Cisco

Cisco identified the IIoT market as one where Cisco’s strengths in hardware, software and partner ecosystem will play well with their customers and prospects. While having a strong foothold in the industrial space, we believe that Cisco’s success will be much dependent on the customer’s workloads and what they want to achieve with their data as it is reducing the complexity between IT and OT (Operations Technology) issues. Cisco has addressed the IoT connectivity and network security at the edge of the network through its ruggedized routers while their competitors are building distributed computing environments. Competitors who are adopting a full IT stack at the edge of the network aim to offer up more OT-based industrial services as well as emerging innovation services such as digital twin, augmented reality and robotic process automation. One key consequence of a customer choosing either approach will result in differing partner ecosystems to form and support the customer. These ecosystems will also be different in how they are managed and by who manages them.

Our recent IoT study shows that while security (a sweet spot for Cisco’s strategy) remains extremely important to an organisation’s solution, technology integration is equally important. When vendors are considering implementing an industrial solution, they need to be able to provide an end-to-end solution that encompasses both the IoT Edge and the IoT Enterprise while smoothly bringing together the OT and IT procedures.

This all starts with an easy on-boarding of any IoT device that is secured and managed with confidence and reliability. The good news for Cisco is that these challenges are also a natural opportunity for Cisco’s partner organisation and systems integrators by creating a new styled IoT ecosystem. However, despite which hardware path an end-user takes, we believe that Cisco and others do not have all of the necessary components of the full ‘IoT’ stack to fulfil a complete solution. To that end, everything will pivot to the vendor who either has the better systems integrations partnership, or, plays in the strongest ecosystem.

IoT Services

Most of Cisco’s business is driven through partners and therefore any success for Cisco’s IoT strategy is dependent on how well they execute it. IoT will accelerate the shift from product based solutions to subscription/as a Service deliverables as more information is generated from the connected devices. and as such the Cisco partner community should be trained/incentivised to offer up IoT. Cisco partners are already undergoing their own business transformation as Cisco’s Customer Experience (CX) strategy is introduced to them. Having the IoT hardware align with the broader Cisco vision was critical to enabling any CX IoT strategy. However, partners may be in ‘transformation’ overload as they embrace the traditional Cisco customer needs and requirements and may be slower to take up the IoT opportunities.

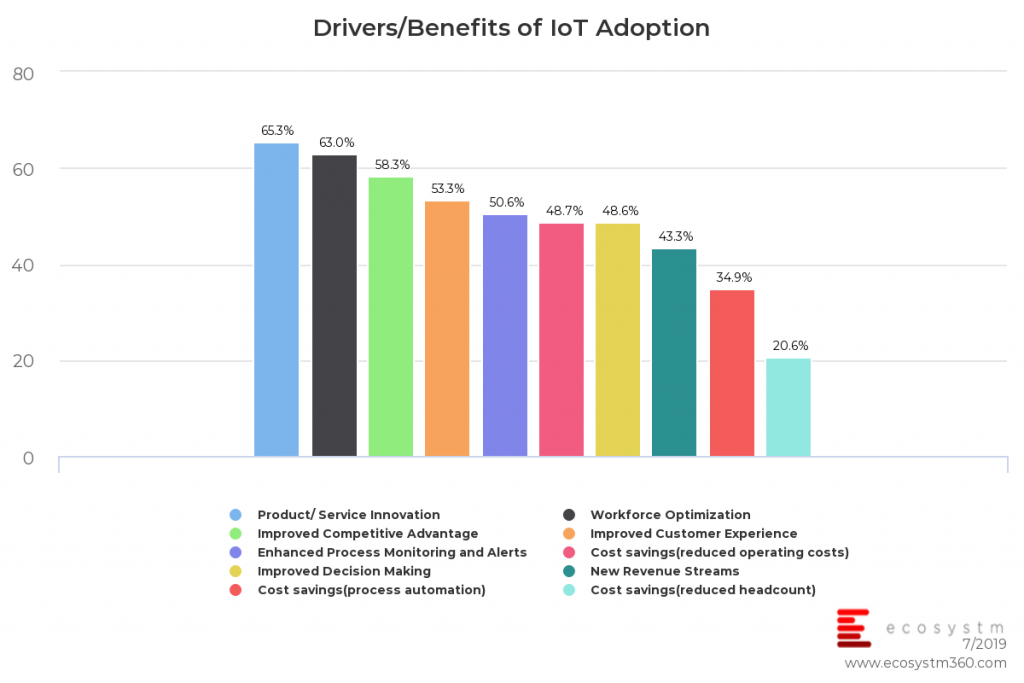

Our IoT study shows that customers believe that the transition from products to services innovation is the highest scoring benefit from an IoT implementation.

However, this is a difficult but critical part of any company aspiring to become a digitally driven business. An IoT strategy is a corner stone of this vision as it will provide the data to be able to run a services or subscription-based business model

Cisco is well positioned here but there is a maturity and readiness gap between Cisco and their customers. Patience will be a key asset as Cisco and their partners close technology gaps for their customers (e.g. adopting and implementing widespread analytics as part of the corporate digital strategy. Most customers are not ready to take advantage of IoT-based analytics outcomes and therefore the RoI case has not been fully articulated).

Finally, Cisco needs to address the mid-tier market with solutions that are compatible with budgets. While it is important to have an ecosystem of high calibre partners within systems integrators, we feel that there will be many customers who cannot afford Cisco’s end-to-end solution. As a result of this Cisco partners are still not ready to address the mid-tier market. Cisco will need to promote offerings across all markets by participating in high-, mid-, and low-end ecosystems. This may mean acknowledging non-5G licensed spectrum/ non WiFi solutions for the most cost sensitive customers for the sake of broader market and industry share.

Recommendations For Cisco IoT

The following are our recommended actions for Cisco IoT based on C-Scape and the prior 12 months of strategy rollout:

- Create stronger value proposition for network based IoT business outcomes. Customers are asking for end-to-end validation which means that Cisco needs to articulate a role with the likes of Salesforce, SAP and Microsoft to enhance customer’s enterprise management systems. This is where Cisco’s CX and partner organisation will also be challenged but can open up a lot of opportunity. Move the message up the value chain. More work has to be done with CX. More has to be done with developers.

- Articulate a stronger comprehensive Industry 4.0 solution that gives customers all of the application qualifiers to run on Cisco’s hardware. Cisco will be challenged by the IT-lead distributed IoT compute stack over its industrial strength routers. More marketing has to be invested in the IoT Edge campaigns.

- Segment the IoT market by customer maturity/readiness/size and their IoT connected assets. Based on asset churn and customer size will dictate the type of new IoT ecosystem that Cisco will either build, manage or participate. For example, an IoT solution of Capex intensive assets with longevity is very different for agriculture supply chain management. Segmentation is critical for Cisco to be successful.

Critical Communications World, 2019 – TCCA’s largest event in global public safety communication – was held in Kuala Lumpur in June. Mission-critical communications are essential to maintaining safety and security across a range from daily operations to extreme events including disaster recovery. A UN report estimated that economic losses from natural disasters could reach USD 160 billion annually by 2030.

I attended the event as a guest of Motorola Solutions – one of the leaders in this field. Many people associate Motorola only with phones not knowing that they have been the cornerstone of some of the largest critical communications deployments around the globe. For instance, Victoria Police completed its AUD 50M+ rollout of Motorola Solutions managed services, enabling almost 10,000 police officers across Victoria access to mobile devices loaded with smart apps, and data when and where they need it most.

Motorola’s ability to provide customers with a private network which is secure, robust and redundant in the event of disaster has also been one of the reasons for their success in the industry. In the event of natural disasters or terrorist attacks, situations can arise where networks will not be available to send and transport any information. Having a secure and private network is critical. That explains why some of the largest police departments in Asia work with Motorola and these include Singapore, Malaysia and Indonesia.x

Motorola acquired Australian mobile application developer Gridstone in 2016 and Avigilon, an advanced video surveillance and analytics provider in 2018. These acquisitions demonstrate how Motorola is innovating in the areas of software, video analytics and AI.

Key Takeaways:

Public Safety Moving to a Collaborative Platform with AI and Machine Learning

Andrew Sinclair, Global Software Chief for Motorola Solutions sees AI enhancing future command and control centres and allowing greater analytics of emergency calls. Call histories and transcriptions, the incident management stack, community engagement data and post incidence reporting are all important elements for command and control centres. Using AI to sieve through the information will empower the operator with the right data and to make the right on-the-spot decisions.

The Avigilon acquisition, enhances Motorola’s AI capabilities and less time is spent monitoring videos, giving first responders more time to do their jobs. The AI technology can make “sense” of the information by using natural language technology. For example, if asked to find a child in a red t-shirt, the cameras can detect the child and also create a fingerprint of the child. The solution enables faster incidence detection by using an edge computing platform. It gathers the information and processes it to relevant agencies making the search operation faster and more streamlined. The application of AI in the video monitoring space is still in its early days and the potential ahead for this technology is enormous.

The other area that can empower first responders better are voice activated devices. The popularity of Alexa and Echo in the consumer world will see greater innovation in the application of public safety solutions. For example, police officers responding to an emergency may have very little time to look at screens or attend to other applications that need touching or pressing of a button as time and attention is essential is such scenarios. The application of voice activated devices will be critical for easing the job of the police officer on the ground. This will not only save administrative work on activities such as transcription, but also help in creating better accounts of the actual happenings for potential court proceedings.

While it is still early days for a full-fledged AR deployment in public safety, there are potential use cases. For example, firemen standing outside a building to make sense of the surrounding area could use AR to send information back to the command and control centres.

The Growth of Cloud-driven Collaboration

Seng Heng Chuah, VP for Motorola APJ talked about the importance of all agencies in public safety to be more open and collaborative. For instance, currently most ambulance, police and fire departments work in silos and have their own apps and legacy systems. To achieve the Smart City or Safe City concept, collaborating and sharing information on one common platform will be key. He talked about the “Home Team” concept that the Singapore Government has achieved. Allowing all agencies to collaborate and share information will mean the ability to make faster decisions during a catastrophe. Making “sense” of the IoT, voice and video data will be important areas of innovation. Normally when a disaster happens, operators at command and control centres – as well as onsite staff – face elevated stress levels and accurate information can help alleviate that.

The move towards the public cloud is also becoming more relevant for agencies. In the past there was resistance and it was always about having the data on their own premises. In recent years more public safety agencies are embracing the cloud. When you have vast amounts of data from video, IoT devices and other data sources, it becomes expensive for public safety agencies to store the data on premise. Seng Heng talked about how public safety agencies are starting to “trust’’ the cloud more now. According to him, Microsoft has done a good job in working with local governments around the world, and their government clouds have many layers of certifications as well as a strong data centre footprint in countries. The collaboration between agencies and more importantly agencies embracing the cloud will drive greater efficiency in analysing, transcribing and storing the data.

The Rise of Outcome-based, Services-led Opportunities

Steve Crutchfield, VP of Motorola Solutions for ANZ, talked about how Motorola is a services-led business in the ANZ market. 45% of Motorola’s business in ANZ is comprised of managed services. The ANZ region is unique as it is seen as early adopters and innovators around public safety implementations. Organisations approach Motorola for the outcomes. Police and Ambulance for example in the state of Victoria use their services on a consumption model. Customers across Mining, Transportation, and Emergency Services want an end-to-end solution across the network, voice, video and analytics.

The need for a private and secure network is significant in several industries. In the mines, safety is of priority and as soon as the radio goes down it impacts productivity and when production stops that can results in huge losses for the mines. Hence the need for a reliable private network that is secure for the transportation of voice and video communication is critical.

Crutchfield talked about how the partner ecosystem is evolving with Motorola working with partners such as Telstra and Orion but increasingly looking for specialised line of business partners and data aggregation partners. Motorola works with 55 channel partners in the region.

Ecosystm Comment:

Motorola Solutions is an established player in providing an end-to-end solution in the critical communications segment. The company is innovating in the areas of software and services coupled with the application of AI. Dr Mahesh Saptharishi, CTO at Motorola Solutions talked about how AI will eventually evolve into “muscle memory”. That will mean that there is far greater “automatic’’ intelligence in helping the first responders make critical decisions when faced with a tough situation.

In the end the efficacy of critical communications solutions will not just be the technology stack, but the desire and ability for cross-agency collaboration. As public safety agencies analyse large volumes of data sets from the network right to the applications, they will have to embrace the cloud, and which will help them achieve scale and security when storing information in the cloud. From the discussions, it was clear that the public safety agencies have started acknowledging the need to do so and we can expect that shift to happen soon.

Motorola will need to keep evolving their channel partner model and start partnering with new providers that can help in delivering some of the end-to-end capabilities across Mobility, AI, software, analytics and IoT. Many of their traditional partners may not be able to be that provider as the company evolves into driving end-to-end intelligent data services for their clients. The company is playing in a unique space with very few competitors that can offer the breadth and depth of critical communications solutions.

I was invited recently by NEC to attend their briefing where Walter Lee, their Evangelist and Government Relations Leader presented to analysts and journalists about how they are winning large contracts across various sectors in the areas of biometrics and surveillance. Biometrics is not just used as a way to drive greater security, but is also helping increase speed in processing times, reducing waiting period in queues and used as a way to drive efficiency and reduce costs which was highlighted by Lee through the various projects NEC had won recently.

NEC’s Artificial intelligence (AI) engine, NeoFace’s strength lies in its tolerance of poor-quality images. The NeoFace solution can match images with low resolutions down to 24 pixels between the eyes and this has allowed it to demonstrate the matching accuracy which is hard to achieve for most vendors offering Facial Recognition solutions. It is its ability to work across various challenges around low resolution, light and images that has allowed NEC to be one of the leading suppliers of Facial Recognition solutions globally.

Key Case Studies Presented

In 2018 Delta Airlines launched the first ‘biometric terminal’ in the US at the international terminal in Atlanta’s Hartsfield-Jackson airport. The biometric push according to Lee replaces tickets and customers now check in by using their face. The system recognises their face and they are checked in. Customers no longer need to use their passports to get through checkpoints around the airport. Lee emphasised on how it takes 9 minutes to board an international flight. Apart from driving identification and security, this use case highlights how airports around the world can increase efficiency in their overall check in and boarding processes at airports. Other core benefits derived from this implementation include better security for border control, seamless service, speed of boarding (savings of 9 minutes per flight). Privacy issues were addressed with regards to where the data was residing and how long the data would be kept for and in this case the data was kept for only 24 hours.

According to the global Ecosystm AI study of current and planned Facial Recognition adoption by industry, the transportation industry is leading the number of deployments globally.

Adoption of Facial Recognition by Industries

Another case study presented is the upcoming 2020 Summer Olympic and Paralympic Games in Tokyo., for which NEC will provide the Facial Recognition solution. The solution will be used to identify over 300,000 people at the games including athletes and officials. It is the first time that Facial Recognition technology will be used for this purpose at an Olympic Games. The NEC solution will allow the matching of tens of thousands of faces in a nano second according to Lee.

The Tokyo 2020 implementation will involve linking photo data with an IC card to be carried by accredited people. NEC says that it has the world’s leading face recognition tech based on benchmark tests from the US’s National Institute of Standards and Technology (NIST).

Ecosystm Comment.

NEC has years of experience in biometrics and Facial Recognition. Not many vendors have solutions that can capture vast amounts of images in a nano second. Their solutions are used by some of the largest organisations in the world. NEC has also perfected the art of handling low resolution images which if not analysed accurately can lead to unintended consequences. The ability to process low resolution images with speed and accuracy is not something that is easily achievable. Security and the rise of terrorism are some of the needs as to why Facial Recognition is important. Additionally, speed and efficiency in administrating passenger boarding at airports whilst ensuring that the security and identity checks have been made is important. The Delta Airlines case study is a great example of how there can be a savings of 9 minutes per flight. NEC continues to gain traction in the market and the Ecosystm AI study has them as one of the top vendors being evaluated for planned implementations for Facial Recognition globally.

The benefits of Facial Recognition solutions are huge – however there must be greater scrutiny around the possible outcomes of AI. Whilst regulation on AI is still at its infancy, 2019 and 2020 will see greater scrutiny and regulation around AI implementations. These will be directed towards protecting individual’s data but also there will be greater emphasis on addressing issues around privacy, ethics and bias in AI implementations. Feeding the machine with the right data (unbiased and ethical) and measuring the various outcomes before the project goes live must be looked at with greater diligence.

2 weeks ago, San Francisco became the first US city to ban the use of Facial Recognition technology by the police and local government agencies. One of the reasons for the ban was with regard to bias. When designing the systems, if technology specialists feed the wrong information for example recognising only a certain skin colour, then the problem of making the wrong and unwanted assumptions start arising. The ecosystem of players in the AI industry ranging from government, academia right down to vendors have a greater role to play in ensuring ethics and bias issues are addressed from the onset of the project. There are consultants in the market as I highlighted in my recent Ecosystm report, that prepare companies for the impact of ethics, fairness and bias. We can expect more of such consultancies and specialist agencies to grow in the market.

NEC has taken this into consideration and published a set of principles for the application of biometrics and AI. The “NEC Group AI and Human Rights Principles” will guide the company along the lines of privacy and human rights. These initiatives were led by the Digital Trust Business Strategy Division, in collaboration with several other divisions within the company, as well as industry stakeholders including industry experts and non-profit organisations.

The 5th VeeamON event held in Miami Beach recently, attracted around 2,000 customers and partners. The 2-day conference is the annual Veeam gathering of mainly IT admins to learn about and get certification for Veeam’s latest product releases. Veeam Co-Founder and EVP, Sales and Marketing, Ratmir Timashev provided Veeam’s update on business affairs and strategy.

Business Updates

What Timashev describes as Veeam’s ‘Act I’ has seen them emerge as a leader in backup and availability solutions for virtual environments over the last 10 years. ‘Act I’ further helped Veeam reach the milestone of US$1 billion in sales – over the current 12 months period – which elevates Veeam into an exclusive club of only 34 software companies that have achieved this milestone (and very few privately owned software companies have achieved this globally). Going forward, Veeam will continue to focus on their Hybrid Cloud strategy and what they describe as ‘Act II’ of their growth journey.

In line with the market moving from on-premises to cloud to hybrid environments, the next phase of growth will focus on adding hybrid cloud functionality to their existing hypervisor- and physical agent-centred software portfolio. By continuing their strategy on partnering and channels, the solutions are designed to make it easy for service providers to deliver Veeam as managed services to the market.

Ecosystm Comment. Ecosystm’s ongoing Cloud research shows that almost 100% of companies have shifted at least one workload onto the cloud which makes cloud undoubtedly mainstream. Despite that broad adoption we see cloud maturity still at an early stage as the number of SaaS workloads and the complexity of on-premises and cloud integration will increase over time. Our research shows that companies currently use an average of 3 separate SaaS applications which is expected to double over the next 12 months.

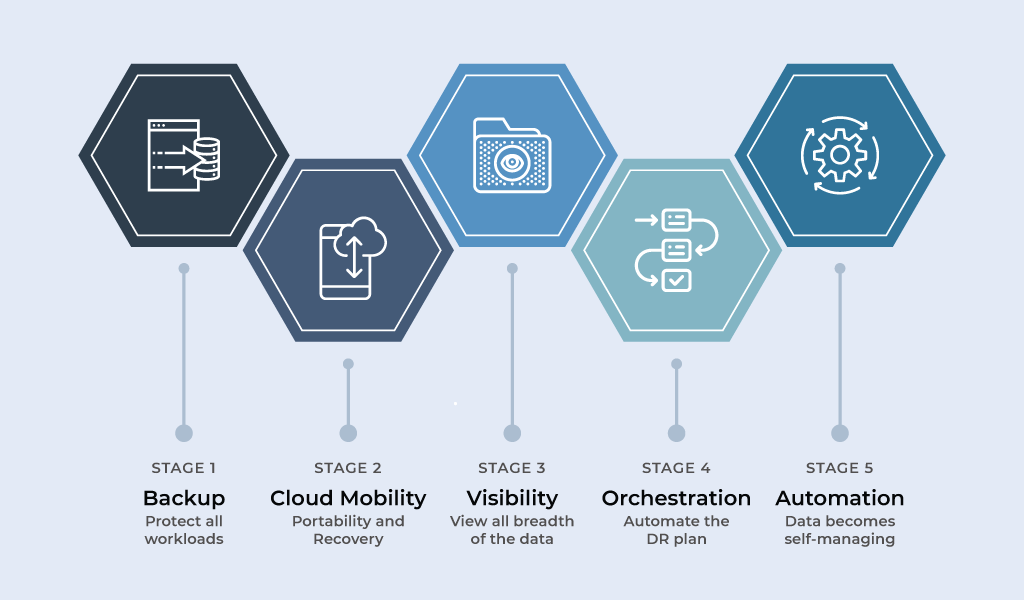

Stages of Cloud Management

Organisations’ requirements to manage their data assets in the hybrid world will mature in tandem with their expanded cloud footprint. Veeam describes this path as the ‘5 Stages of Cloud Management’.

Figure 1: Veeam’s Stages of Cloud Management

Veeam sees the majority of the market currently sitting at stage 1 or 2 providing a strong pipeline and growth path in taking customers along their ‘Act II’ journey.

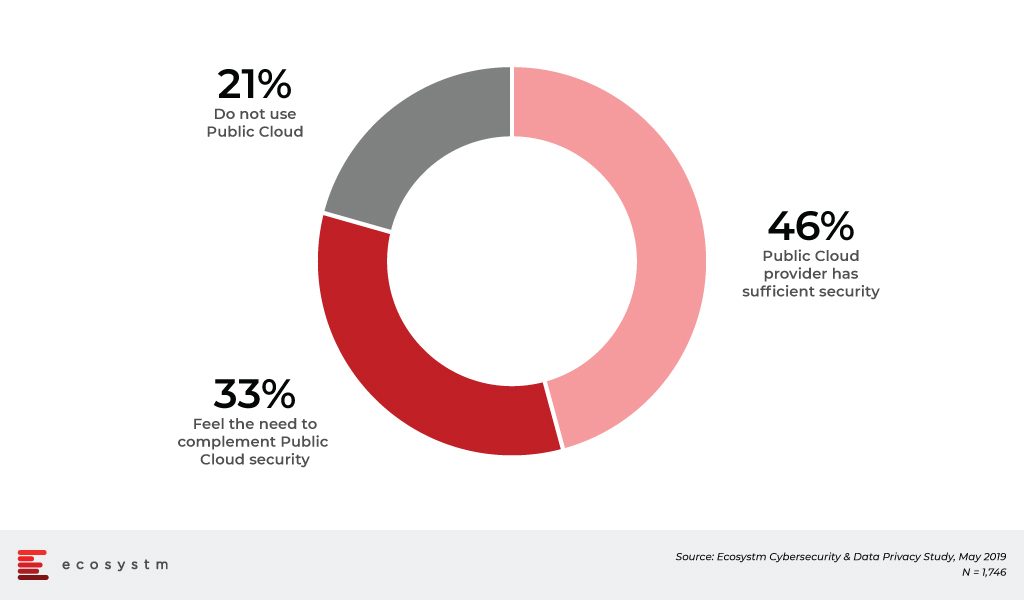

Ecosystm Comment. We would raise some caution as the execution of this strategy may play out as more challenging than anticipated. Our research shows that a majority of companies – especially in emerging markets – see cloud as a means to shift the responsibility of data protection and availability, onto their cloud providers. The ongoing global Ecosystm Cybersecurity research reveals that nearly half the organisations rely solely on their public cloud provider to secure even their most sensitive data.

Figure 2: Perception on Public Cloud Security

This finding is concerning when competitiveness has increasingly moved away from the traditional measures such as cost, quality and time to a company’s data and IP assets. So Veeam is urged to equip their partners and sales team with a strong educational message that the responsibility of data protection and availability cannot be shifted solely onto the cloud provider. The responsibility and accountability remains with the organisation and has to be managed across the increasingly hybrid environments.

Product Announcements

Keeping with the tradition, Veeam leveraged VeeamON 2019 as the platform for a number of product releases and announcements. In alignment with the business strategy, most of the new features support data management in hybrid cloud environments as well as new integrations and features for SaaS and Cloud platforms.

The most anticipated release of version 10 of Veeam’s flagship Availability Suite has not yet happened. Announced at VeeamON 2017, Version 10 will be released towards the second half of 2019. While the delay may be of concern, we would give Veeam credit for adopting a true SaaS model for their product development process. They have constantly released newer features and functionality to the current suite, opting to release some features faster to market to answer to specific customer demands at the time, such as centralised agent management support and Universal Storage API support. The key new features of Availability Suite 9.5 Update 4 include easy management of cloud migration and cloud mobility, cloud-native backup, cost-effective data retention, and portable cloud-ready licensing, increased security and data governance.

Veeam Availability Orchestrator v2 is the second generation of Veeam’s DR orchestration platform reducing the manual processes to achieve auditable DR, operational recovery and platform migrations. With increasing industry regulations this capability could give organisations of all sizes and resources the tools to prove and proactively remediate service level agreement (SLA) attainment for internal and external compliance regulations and audits with extensive reporting and compliance capabilities.

Nutanix Mine with Veeam is another product which received a lot of interest at VeeamON. With availability announced for late 2019, Mine is a partnership with Nutanix to provide more comprehensive and affordable solutions for secondary storage layers. Similar joint offerings have also been announced with ExaGrid. Mine provides Nutanix hyper-converged infrastructure with highly integrated Veeam Backup & Replication solutions to provide easy deployment and scaling, faster time to value and standardised IT operations management.

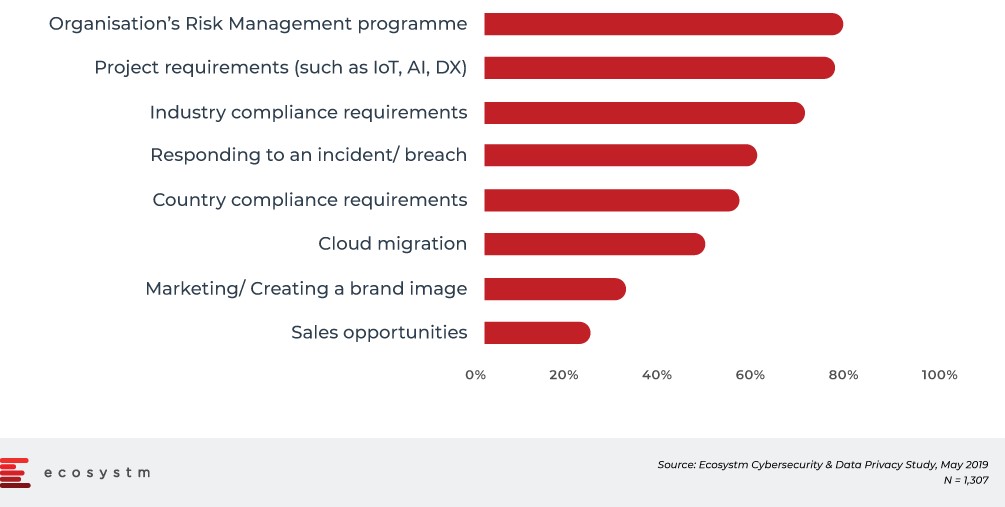

Ecosystm Comment. Ecosystm’s research shows that regulatory requirements are key to organisations’ propensity to invest in data protection and availability solutions. They are often built into the organisations’ risk management programmes as well.

Figure 3: Drivers of Continued Focus on Cybersecurity

Availability Orchestrator v2 presents a strong entry point for Veeam to start the discussions for a more holistic data management solution. Providing the automation of the DR orchestration, scenario planning and auditable DR documentation strengthens Veeam’s claim to be the rightful owner of the Governance, Risk & Compliance (GRC) discussion. Furthermore, although it may be from leftfield, Ecosystm sees a great opportunity for some partnerships with Cybersecurity insurance companies to make Veeam Availability Orchestrator an accepted standard for Cybersecurity premium assessments and rebates. Ecosystm has seen a rapid rise of Cybersecurity insurance adoption with nearly 50% of global organisations already signed on to different policies. With adoption expected to accelerate over the coming years, Cybersecurity insurers could present a new route to market that is not in competition to its existing network of more than 60,000 partners.

Looking Ahead

Veeam has announced ‘Act II’ as the second stage of growth to carry on from their initial virtual machine-centred availability solution. The strategy follows the natural evolution and path of the market and will not require a major rethink or restructure of the Veeam business.

What is changing is the scale of business in geographical coverage, product portfolio and most importantly the Veeam partner ecosystem. In the same way that Veeam expanded their breadth in ‘Act I’ from the original VMware hypervisor backup to the broader hypervisor market and core infrastructure integrations, ‘Act II’ will require expansion across the key cloud platforms, exponentially growing SaaS landscape and the different tiered infrastructure providers.

Veeam’s product development teams have been one of the main beneficiaries of Veeam’s $500 million fund raising exercise earlier in 2019 (investors include Insight Venture Partners & Canada Pension Plan Investment Board) as they invested further in organic internal development instead of acquiring and integrating third party capabilities.

Geographical expansion is another area where the $500 million has been invested in. Veeam currently sits at 350,000 customers with 4,000 being added on a monthly basis. Emerging markets such as Asia Pacific are the engines of the growth but there are still markets and partnerships to be explored and developed. Across Asia Pacific alone Veeam opened 4 new offices in the first 5 months of 2019 and further expansions are planned for the months to come. The race for scale is essential to execute on ‘Act II’ but it brings operational challenges to scale in tandem with their operations while maintaining the culture that made Veeam what they are.

Ecosystm Comment. There is no doubt that there is a lot of work ahead of Veeam in executing on ‘Act II’. We have seen early proof that execution is following strategy, with new partnerships in the tiered storage space (such as Nutanix and ExaGrid), new products focussed across mainstream SaaS applications such as Office365 and tighter cloud integrations with Azure and AWS. There is currently lesser compatibility with Alibaba Cloud and no integration with Google which would be essential to accelerate their growth especially in Asia Pacific which has been highlighted as Veeam’s growth engine. The SaaS landscape presents an even tougher challenge for Veeam. Veeam Backup for Office365 has demonstrated the strong opportunity of workload-based availability solutions but developing the same capability across hundreds or thousands of diverse SaaS applications will present challenges. At the same time, we agree with Veeam’s focus on going deep into their solutions integration with the key partners and workloads that present the greatest opportunity today rather than spreading resources to put breadth over depths at this stage.

In 2013 Ratmir Timashev predicted to reach $1 billion within 6 years which was achieved just in time for VeeamON 2019. There were no new predictions made for ‘Act II’ but we see Veeam on the right path to announce tangible progress on their ‘Act II’ execution at VeeamON 2020 in Las Vegas.