An Update (1 October 2021): This acquisition did not go through even after the boards of directors of both companies had approved it. It was voted down by Five9 shareholders, citing growth and valuation concerns. This is an unusual example of an acquisition not going through because of unwillingness of one of the companies. In recent times, regulators have stopped some acquisitions. Incidentally, there were some concerns raised by the by Federal Communications Commission (FCC) as Zoom is based in US. but has product development operations in China.

The partnership arrangement between the two companies will continue including support for integrations between their respective Unified Communications as a Service (UCaaS) and Contact Centre as a Service (CCaaS) solutions and joint go-to-market initiatives.

Zoom has announced their intention to acquire cloud contact centre service provider Five9 in an all-stock deal for about USD 14.7 Billion. This is Zoom’s largest-ever acquisition as the communications platform continues to expand their services and launch new products. The deal is expected to be completed in the first half of 2022 and Five9 will be an operating unit of Zoom.

The last year has seen Zoom scaling up their product offerings, including cloud calling solution – Zoom Phone, conference hosting solution – Zoom Rooms, and applications and productivity tools – Zoom Apps and Zoom Marketplace. Zoom also acquired real-time translation startup Kites GmbH to offer multi-language translation capabilities, and Keybase – a secure messaging and file-sharing service to build end-to-end encryption for its video conferencing platform.

Ecosystm Analysts share their thoughts on Zoom’s strategy and roadmap, how Five9 will augment Zoom’s capabilities, and the impact the acquisition will have on Zoom’s competitors and the market.

Why Contact Centre?

Ecosystm Principal Advisor Tim Sheedy says, “Zoom is moving beyond its period of ‘organic hypergrowth’ brought on by the pandemic. While the paying customer base for their core video collaboration service will continue to grow, growth rates are likely to begin to track the market. To grow beyond market rates, Zoom needs to move into new markets – through product development or acquisition.”

Talking about the importance of voice services, Sheedy adds, “Voice services are an obvious adjacent market to help drive growth, and Zoom already has seen some success with their Zoom phone service and associated devices – in fact, they already have 1.5 million users. The Five9 acquisition gives the company a stronger and deeper capability in the voice sector; buying them a significant chunk of the voice services in business – the contact centre. In many businesses, the contact centre already accounts for over 50% of their voice minute usage, so winning this space will go a long way towards winning the overall voice and collaboration supplier in enterprises.”

Ecosystm Principal Advisor Audrey William predicts exciting times ahead for Zoom. “With Zoom already having a platform for video, then bringing voice into that equation and now a contact centre solution, makes them take on their competitors in an all-native cloud stack. There is a still a large installed base of on-prem UC customers and with Zoom seeing success with Zoom phones in the short time frame since its launch, this is where this will get exciting for Zoom. The telephony piece is still important in the race to simplify how we work, communicate, and collaborate today. It is that same voice/telephony discussion that can lead to a routing discussion, which then leads to a contact centre discussion.”

Ecosystm research shows that 54% of organisations are challenged in their customer experience delivery because of integration issues between multiple platforms. William sees this as an opportunity for Zoom. “The use cases to integrate workflows into the video environment is going to be important for Zoom. Video is now being used to solve customer service issues like letting the agents take over the screen to see how to help solve the customer problem immediately by using video and contact centre applications. The ability to bring this natively together will be very powerful. Zoom is investing heavily into apps and working to partner with ISVs who can develop workflows suitable for easy customer communication in specific industries such as Healthcare and Financial Services.”

Why Five9?

Five9 is considered a pioneer in cloud contact centre solutions and owns a comprehensive suite of applications for contact centre delivery and customer management operations across different channels. Five9 has made several acquisitions and enhancements to their CCaaS solution in recent years to make their stack more complete with richer AI offerings. They include Inference Solutions to offer their customers a Conversational AI solution and Whendu’s iPaaS platform which provides a no-code, visual application workflow tool.

William says, “More contact centres want to do away with monolithic IVR systems that confuse customers with too many long menus. The Agent Assist solutions are also gaining importance especially in the hybrid work model where agents face challenges working in isolation and not being on a floor with their colleagues and managers.”

Five9 has acquired a cloud workforce optimisation provider Virtual Observer. “So, we are not looking at just a basic level contact centre solution but an offering with important capabilities demanded by customers,” says William. “During the investor call this week, Zoom’s Eric Yuan and Rowan Trollope made it clear that they have been listening to customer feedback on how effective it would be to have a single platform that can accommodate UC and contact centres in the cloud. Zoom also sees Five9 as a good fit culturally; and their goal now will be to disrupt all legacy systems with cloud-native communications.”

What lies ahead?

William thinks that Zoom’s competitors will be watching this integration closely, especially those that lack an all-in-one native cloud UCaaS and CCaaS stack. “However, some of Zoom’s competitors have an established base of large enterprise customers and have done well to grow revenues and defend their base over the years. Working with in-country partners and ISVs will be critical for Zoom’s growth across regions.”

Sheedy thinks that the most important takeaway from this acquisition is not that Zoom is moving into the contact centre space. “It is that Zoom realises they have a “once in a generation” opportunity to grow beyond their core and cement their position as a supplier of collaboration and communication services – and that they are willing to flex their balance sheet and share price to create their future. The competition – from Microsoft in particular – will be strong. Google, AWS, Salesforce, and Facebook are also making a play for this market. Zoom has found themselves in their current position of strength due to good luck and good timing – and they appear to be telling the market that they aren’t going to give up their leadership without a significant battle.”

“Enterprises will be the true winners in this battle – with better, more integrated, lower cost and easier to implement communications and collaboration solutions for their employees and customers,” adds Sheedy.

Cisco has recently announced their intention to acquire Socio Labs, a US-based event technology platform – the latest in a series of acquisitions. Cisco’s Webex Events provides meeting, webinar and webcast capabilities, including polling, Q&A, chat and real-time translation. This acquisition will allow Webex Events to cater to large-scale, hybrid events and conferences. Solution capabilities will include live streaming, sponsorship, networking, and advanced analytics – including for pre-event and post-event activities.

Collaboration Platforms are Here to Stay

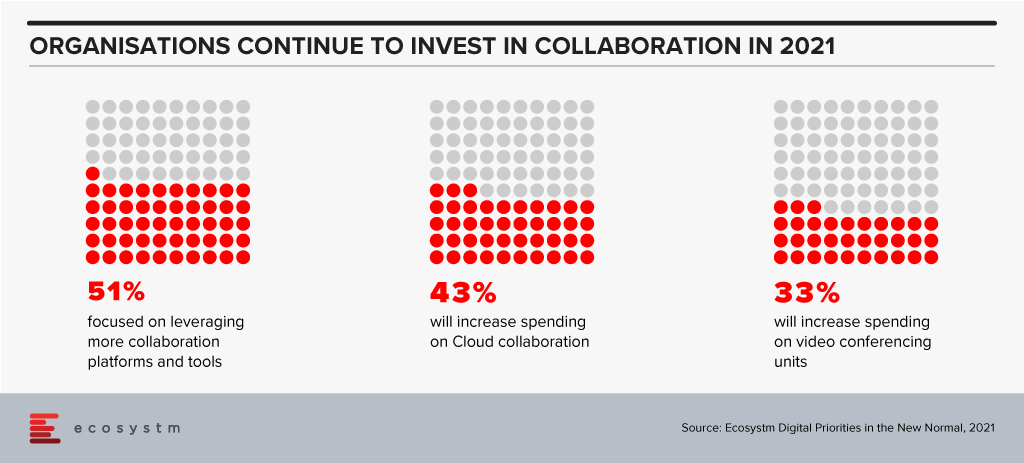

2020 was the year video conferencing and collaboration finally became mainstream. With the exponential rise of remote and hybrid working, the investments in collaboration technologies has increased – and Ecosystm research shows that the trend is continuing well into 2021.

The other aspect that has been impacted by the pandemic is the Events business. With social distancing regulations, Events and Marketing teams are being challenged in their outreach and go-to-market initiatives. Even when countries allow in-person events, it is becoming increasingly difficult to get people to attend events. With most organisations allowing remote working many attendees are away from the CBD/ commercial areas and are reluctant to commute to attend events. This has seen the rise of a hybrid event model that caters to both in-person and virtual attendees.

While some countries are beginning to bring back in-person events, they will remain largely virtual. Event organisers will have to cater for those who are happy to attend in-person and those who want to access the event virtually. Providing a better experience for hybrid events, will require richer features using video and collaboration platforms to allow live streaming, chat, feedback, analytics – to gauge audience engagement – polling and other interesting ways to retain audience attention. Additionally, it will be important for these platforms to facilitate sponsorship, registrations and even ticketing capabilities directly from within the platform. These new dimensions to step up engagements for both virtual and in-person events have become necessary for the world we are living in.

Cisco Strengthening Collaboration Capabilities

Cisco is enhancing the virtual/hybrid meeting and events experience they provide and this has been evident from their recent acquisitions. They clearly see the need to enhance audience participation and engagement from pure static video and collaboration environments. Socio Labs’ business accelerated during the pandemic and they built a platform that offers a deeper engagement with the audience. Their customers include Google, Microsoft, PepsiCo and Hyundai.

Last year Cisco acquired BabbleLabs, a noise removal technology provider and the product has been integrated into their Webex platform, to improve the audio experience. Earlier this month Cisco also completed their acquisition of Slido. This means that Webex users can now leverage Slido’s capability of gathering real-time audience feedback, rather than just asking questions via text or chat. The solution can also enhance the learning experience during team training sessions and offers built-in analytics to gauge audience participation and where the gaps are. These acquisitions are an indication that Cisco is serious about their market presence in the video and collaboration space – and is keen on making a mark in the Events market.

The ways we connect, create, collaborate in our workplaces has seen major shifts in the last year. And the tech industry has continually supported that shift as they create new capabilities and upgrade existing ones. Technology providers will continue to revamp their product offerings to support the increase in adoption of the hybrid work model work – a fusion of remote and in-office. In the Top 5 Future of Work Trends for 2021, Ecosystm had predicted, “Every major digital workspace provider (such as Microsoft, Google, Zoom, Cisco, AWS and so on) will broaden their digital workplace capabilities and integrate them more effectively, making them easier to procure and use. Instead of a “tool-centric” approach to getting work done (chat vs video vs document sharing vs online meetings vs whiteboards and so on), it will become a platform play.”

Ecosystm Principal Advisor, Ravi Bhogaraju says, “It is becoming clear that companies and individuals are grappling with three issues – the changing size and composition of the workforce; the productivity of those who are driving the businesses; and attracting, reskilling and engaging the broader workforce.” These are the challenges that tech providers will have to help organisations with.

Google Upgrades its Collaboration Platform

The Google Workspace was launched in October last year, and last week saw the tech giant announce a series of upgrades and innovations to better support the flexibility needs of frontline and remote workers.

Workspace is Google’s office productivity suite comprising video conferencing, cloud storage, collaboration tools, security and management controls built into a cohesive environment. The new features announced by Google Workspaces include Focus Time to avoid distractions by limiting notifications, recurring out-of-office and location indicators to make colleagues aware if the person is working from home or office, support for Google voice assistant in workplaces, second-screen experiences to support multiple devices, and features for frontline workers designed to help mobile employees collaborate and communicate better with the rest of the organisation. Google is also working on a trimmed down version of Google Workspace – Google Workspace Essentials – which will provide support for Chat, Jamboard, and Calendar. Workspace is estimated to have 2.6 billion monthly active users.

Bhogaraju says, “One of the issues that is fast emerging as significant is not just the employee experience or customer experience but the complexity of the digital workplace as platforms introduce newer and advanced features. In the end, there has to be simplicity, clarity, and a clear focus on the goals – not just an overload of features that makes life more complex for the employee. It would be critical to enable these features thoughtfully and reskill staff adequately so that the adoption and impact to business process is felt in their day-to-day activities.”

Workspace Transformation across Industries

With many of Google’s employees and developers working remotely, the company has first-hand experience of the challenges of remote working and is leveraging the experience. Google Workspace is also working on custom solutions for various industries. In Retail for example, Woolworths, rolled out Google Workspace and Chrome for geographically dispersed teams to collaborate in real-time and adopt custom-made applications linked to global servers to allow managers to log and address tickets from the shop floor itself. Similarly in Aviation, All Nippon Airways uses Google Workspace to allow pilots, cabin attendants, HR and finance staff to communicate and collaborate in real-time across the globe, using Google Meet, Google Docs, Google Sheets and Google Slides from their PCs, smartphones or tablets. Google retains its focus on the Education industry – Google Workspace Education Fundamentals is free for all qualifying institutions. Solutions such as Google’s Classroom, Teach from Anywhere hub, roster sync, mobile grading and EdTech tools aim to enable better learning and teaching experience for students and educators.

Tech Companies Revamping their Collaboration Offerings

With more companies rethinking their work policies, leaders in the collaboration space are also stepping up their game to evolve their offerings for the hybrid norm. Microsoft’s Viva unifies the experience across Teams and Microsoft 365 for employee communications, wellbeing, learning and knowledge discovery. Similarly, Zoom too has upgraded and integrated various utility, sharing, and management features to support a hybrid workforce. Tech companies are being forced to invest in creating next-generation tools to stay relevant, as Future of Work models continue to shift and evolve.

As tech companies evolve their capabilities, Bhogaraju warns organisations on how they should leverage them. “While technology companies continue to deliver feature rich suites – in reality the uptake and embedding of these programs into the day-to-day business processes is still in its early stages. Business, HR and IT teams continue to struggle. They tend to operate within independent thought silos and there is limited consensus on which feature is really needed and how it can add to the productivity and efficiency. Without this crucial context and an effective change management program – they remain rich features and not impactful ones.”

The hybrid workplace model is gaining popularity in 2021. Check out Ecosytsm’s top 5 Future of Work Trends For 2021. Signup for Free to download the report.

In 2009 one of the foremost Financial Services industry experts was giving my team a deep dive into the Global Financial Crisis (GFS) and its ramifications. According to him, one of the key reasons why it happened was that most people in key positions in both industry and government had probably never seen a full downturn in their careers. There was a bit of a hiccup during the dot com bust but nothing that seriously interrupted the long boom that began somewhere in 1988. They had never experienced anything quite like 2008; so they never imagined that such a crisis could actually happen.

Similarly, 2020 was an unprecedented year – in our lives and certainly for the tech industry. The GFC (as the name suggests) was a financial crisis. A lot of people lost their jobs, but after the bailouts things went largely back to normal. COVID-19 is something different altogether – the impact will be felt for years and we don’t yet know the full implications of the crisis.

While we would like to start 2021 with a clean slate and never talk about the pandemic again, the reality is that COVID-19 will shape what we will see this year. In the first place it looks like the disease will still be around for a substantial part of the year. Secondly, all the changes it has brought in 2020 with entire workforces suddenly moving to operating from home will have profound implications for technology and customer experience this year.

As we ease into 2021, I look at some of the organisational and technology trends that are likely to impact customer experience (CX) in 2021.

#1 All Business is Now eBusiness

COVID-19 has ensured that the few businesses which did not have an online presence became acutely aware that they needed one. It created a need for many businesses to quickly initiate eCommerce. Forbes reported a 77% increase in eCommerce infrastructure spending YoY. This represents about 4 years of growth squeezed into the first 6 months of 2020!

From a CX point of view there is going to be far more interaction with brands and products through online channels. This is not just about eCommerce and buying from a portal. It is also about using tools like Instagram, Facebook and other social media platforms more widely. It is about learning to interact with the customer in multiple ways and touching their journeys at multiple points, all virtually using the web – mostly the mobile web.

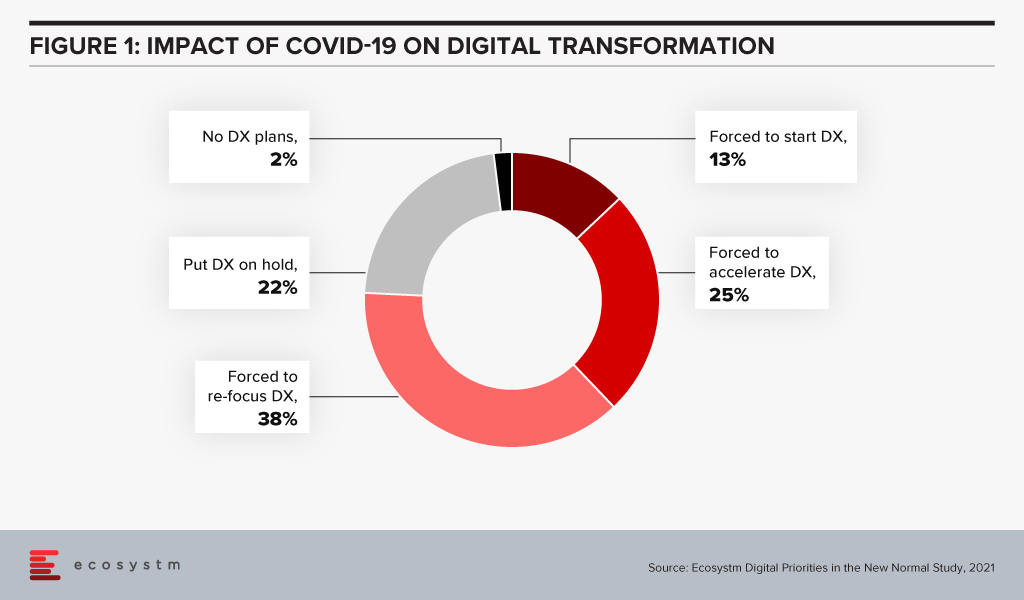

Ecosystm research shows that almost three out of four companies have decided on accelerating or modifying the digitalisation they were undergoing (Figure 1). It is fair to expect that this gives a further boost to moving to the cloud. For the customer it will mean being able to access information in many new ways and connect with products, services, brands at multiple points on the web.

Since interacting with the customer at multiple points is new for most services, I foresee a lot of missed opportunities as companies learn to navigate a completely different landscape. Customers pampered by digitally native organisations often react harshly to even a small mistake. It will become critical for companies to not just become a bigger presence online but also to manage their customers well.

New solutions such as Customer Data Platforms (CDP), as opposed to CRM will become common. Players who are into Customer Experience management are likely to see huge business growth and new players will rapidly enter this space. They will promise to affordably manage CX across the globe, leveraging the cloud.

#2 Virtual Merges with Real

Virtual and Augmented Reality are not new. They have been around for a while. This will now cross the early adoption stage and is likely to proliferate in terms of use cases and importance.

AR/VR has so far been seen mainly in games where one wears an unwieldy – though ever-improving – headset to transport oneself into a 3D virtual world. Or in certain industrial applications e.g., using a mobile device to look at some machinery; the device captures what the eye can see while providing graphical overlays with information. In 2021 I expect to see almost all industrial applications adopting some form of this technology. This will have an impact on how products are serviced and repaired.

For the mainstream, 2020 was the year of videoconferencing – as iconic as the shift to virtual meetings has been, there is much more to come. Meetings, conferences, events, classrooms have all gone virtual. Video interaction with multiple people and sharing information via shared applications is commonplace. Virtual backgrounds which hide where you are actually speaking from are also widely used and getting more creative by the day.

Imagine then a future where you get on one of these calls wearing a headset and are transported into a room where your colleagues who are joining the call also are. You see them as full 3D people, you see the furniture, and the room decor. You speak and everyone sees your 3D avatar speak, gesture (as you gesture from the comfort of your home office) and move around. It will seem like you are really in the conference room together! If this feels futuristic or unreal try this or look at how the virtual office can look in the very near future.

While the solutions may not look very sophisticated, they will rapidly improve. AR/VR will start to really make its presence felt in the lives of consumers. From being able to virtually “try” on clothes from a boutique to product launches going virtual, these technologies will deeply impact customer experience in 2021 and beyond

In the immortal words of Captain Kirk, we will be going where no man has gone before – enabled by AR / VR.

#3 Digital CX will involve Multiple Technologies

AI, IoT and 5G will continue to support wider CX initiatives.

The advances that I have mentioned will gain impetus from 5G networking, which will enable unprecedented bandwidth availability. To deliver an AR experience over the cloud, riding on a 5G network, will literally be a game changer compared to the capabilities of older networks.

Similarly, IoT will lead to massive changes in terms of product availability, customisation and so on. 5G-enabled IoT will allow a lot more data to be carried a lot faster; and more processing at the edge. IoT will have some initial use cases in Retail, Services and other non-manufacturing sectors – but perhaps not as strongly as some commentators seem to indicate.

AI continues to drive change. While AI may not transform CX in 2021, this is a technology which will be a component of most other CX offerings, and so will impact customer experience in the next few years. In fact, thinking of businesses in 2025 I cannot believe that there will be a single business to customer (B2C) interaction which will not feature some form of AI technology.

I’d be interested to hear your thoughts on the technologies which will impact CX in 2021 – Connect with me on the Ecosystm platform.

Authored by Alea Fairchild and Audrey William

Video conferencing company Zoom hosted its virtual Zoomtopia user conference lasts week. Given the attention the company has received as the de-facto standard video communication service for the many stranded work-from-home folks, Zoom has been using the event to launch a number of new products. This includes bringing into general availability its OnZoom events platform and marketplace, and introducing Zapps which brings apps from other providers into the Zoom experience.

ZaaP!

In this age of work-from-home connectivity, we are all asked to multi-platform depending on customer preference, company standards and choice of scale-out from a licensing perspective. But will video-led unified communications help position Zoom to be the infrastructure platform of choice of the workforce? Will Zoom as a Platform (ZaaP!) become a well-used phrase to discuss unified collaboration infrastructures?

The agenda of Zoomtopia, covering healthcare, government, financial services, sales engagement, blending learning in education, mindfulness, CSR, and a whole gambit of other vertical topics, demonstrates a virtual play to highlight use cases where other platforms have focused on the horizontal aspect of productivity.

If you compare Microsoft’s horizontal approach with Cisco’s networking approach, both come from places of productivity. Zoom, being video-led and UC oriented, comes from a place of communication and collaboration. Is collaboration now the real driver for the future of work?

Zoom connects the dots with these two product introductions. Zapps is designed to link productivity tools directly into the Zoom experience for user access to multiple applications from the platform. OnZoom allows hosts to run one-time events or event series with up to 100 or 1,000 attendees (depending on their license) and sell tickets for them. Zoom is also integrating the ability to receive donations through events via Pledgeling. Think a combination of EventBrite meeting GoFundMe meeting Facebook Events.

Zooming Ahead

With the wide variety of activities during this social distancing period around the world that have been Zoom-powered, familiarity leads to experimentation and early adoption.

Without using the word ‘portal’ – Zoom as a Platform (ZaaP!) enforces the drive for a main infrastructure for live interaction via video as the main means of communication over written material or pre-recorded media materials. And many of us are video-led, more than ever.

Zoom is scaling rapidly. When it started out many years ago, they were known as a company that offered video sessions for free and everyone was wondering who this new kid on the block was. In a span of a few years, they have become a powerhouse.

The announcement of OnZoom is something that marketeers will take note of. Many marketeers are Zoom users but could be using other platforms for hosting events. The solution will have in-built tools for selling tickets, scheduling, gifting tickets, promotional activities, etc. Zoom is thinking about video and layering that with added functionality to run a large-scale event. You can see them going into using AI to churn out rich analytics on attendees, attendance rates, effectiveness of campaigns and so on. All of a sudden it is about hosting an event with in-built rich features plus analytics so events can be run better. They are reaching a new audience and making it a fully built all-purpose solution for event organisers and marketeers.

Security Front and Centre

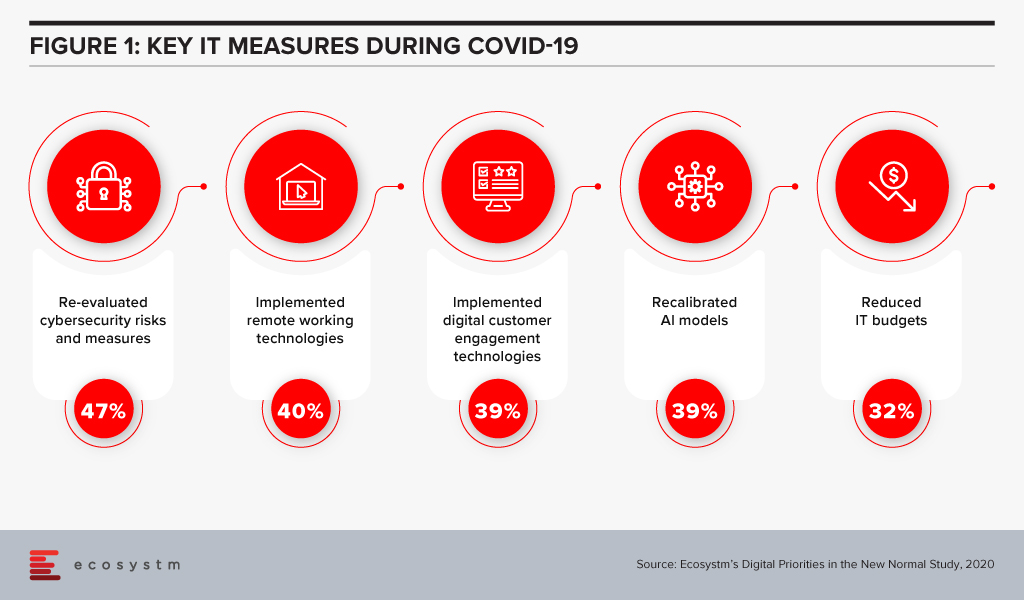

Ecosystm research shows that security has been a key component in organisation’s COVID-19 responses – and rightly so (Figure 1).

While Zoom received some negative publicity this year around security, they were quick to admit the issues and made incremental changes in the subsequent months including an acquisition. With E2EE, no third party including Zoom is provided with access to the meeting’s private keys. Zoom’s E2EE ensures that communication between meeting participants using Zoom applications is encrypted using cryptographic keys known only to the devices of those participants. Zoom is starting to penetrate larger accounts and the security aspect is important as it is the top of the mind discussion for every business leader.

Ecosystm Comments

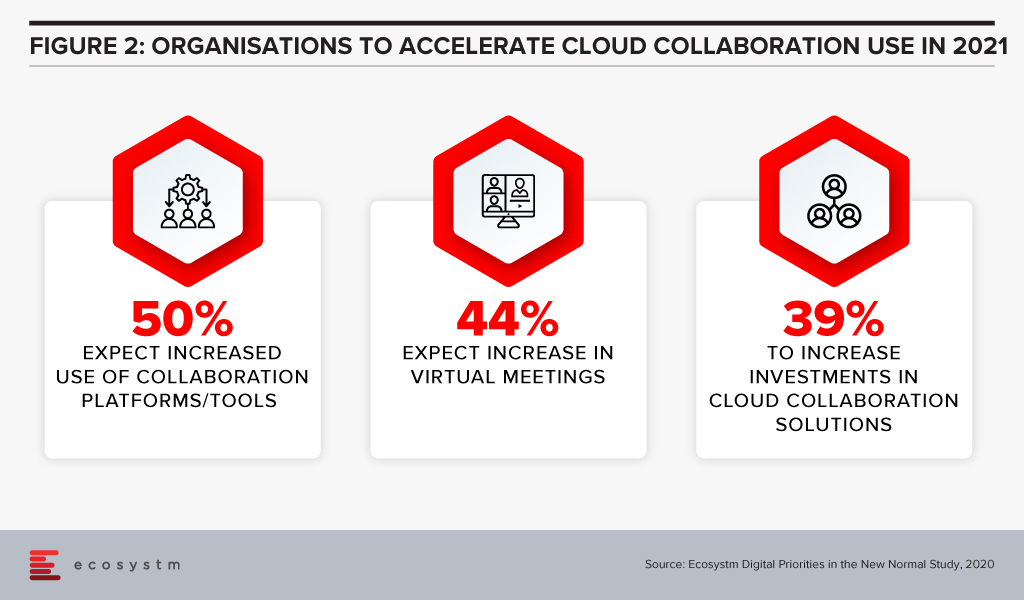

With the hybrid work model evolving between home and work, and work patterns changing, one thing that is going to stay is the use of video and collaboration tools and it is only going to accelerate (Figure 2).

What Zoom is doing well is how they take workflows and APIs seriously, making productivity flow into UC and UX, and not the other way around.

With longer work hours becoming a norm, growing instances of emotional stress and mental fatigue, UX becomes paramount. Knowledge workers want to seamlessly move between workflows and still find the experience simple and not tiring. Zoom is building on that vision as a platform enabler and infrastructure provider.

As organisations aim to maintain operations during the ongoing crisis, there has been an exponential increase in employees working from home and relying on the Workplace of the Future technologies. 41% of organisations in an ongoing Ecosystm study on the Digital Priorities in the New Normal cited making remote working possible as a key organisational measure introduced to combat current workplace challenges.

Ecosystm Principal Advisor, Audrey William says, “During the COVID-19 pandemic, people have become reliant on voice, video and collaboration tools and even when things go back to normal in the coming months, the blended way of work will be the norm. There has been a surge of video and collaboration technologies. The need to have good communication and collaboration tools whether at home or in the office has become a basic expectation especially when working from home. It has become non-negotiable.”

William also notes, “We are living in an ‘Experience Economy’ – if the user experience around voice, video and collaboration is poor, customers will find a platform that gives them the experience they like. To get that equation right is not easy and there is a lot of R&D, partnerships and user experience design involved.”

AWS and Slack Partnership

Amid a rapid increase in remote working requirements, AWS and Slack announced a multi-year partnership to collaborate on solutions to enable the Workplace of the Future. This will give Slack users the ability to manage their AWS resources within Slack, as well as replace Slack’s voice and video call features with AWS’s Amazon Chime. And AWS will be using Slack for their internal communication and collaboration.

Slack already uses AWS cloud infrastructure to support enterprise customers and have committed to spend USD 50 million a year over five years with AWS. However, the extended partnership is promising a new breed of solutions for the future workforce.

Slack and AWS are also planning to tightly integrate key features such as: AWS Key Management Service with Slack Enterprise Key Management (EKM) for better security and encryption; AWS Chatbot to push AWS Virtual machines notifications to Slack users; and AWS AppFlow to secure data flow between Slack, AWS S3 Storage and AWS Redshift data warehouse.

The Competitive Landscape

The partnership between AWS and Slack has enabled Slack to scale and compete with more tools in its arsenal. The enterprise communication and collaboration market is heating up with announcements such as Zoom ramping up its infrastructure on Oracle Cloud. The other major cloud platform players already have their own collaboration offerings, with Microsoft Teams and Google Meet. The AWS-Slack announcement is another example of industry players looking to improve their offerings through partnership agreements. Slack is already integrated with a number of Microsoft services such as OneDrive, Outlook and SharePoint and there was talk of being integrated with Microsoft Teams earlier this year. Similarly, Slack has also integrated some GSuite tools on its platform.

“There is a battle going on now in the voice, video and collaboration space and there are many players that offer rich enterprise grade capabilities in this space. AWS is already Slack’s “preferred” cloud infrastructure provider, and the two companies have a common rival in Microsoft, competing with its Azure and Teams products, respectively,” says William.

The Single Platform Approach

The competition in the video, voice and collaboration market in becoming increasingly intense and the ability to make it easy for users across all functions on one common platform is the ideal situation. This explains why we have seen vendors in recent months adding greater capabilities to their offerings. For instance, Zoom added Zoom phone functionality to expand its offerings to users. Avaya released Spaces – an integrated cloud meeting and team collaboration solution with chat, voice, video, online meetings, and content sharing capabilities. The market also has Cisco as an established presence, providing video and voice solutions to many large organisations.

Organisations want an all-in-one platform for voice, video and collaboration if possible as it makes it easier for management. Microsoft Teams is a single platform for enterprise communications and collaboration. William says, “Teams has seen steady uptake since its launch and for many IT managers the ability to capture all feedback, issues/logs on one platform is important. Other vendors are pushing the one vendor platform option heavily; for example, 8×8 has been able to secure wins in the market because of the one vendor platform push.”

“As the competition heats up, we can expect more acquisitions and partnerships in the communications and collaboration space, in an effort to provide all functions on a single platform,” says William. “However, irrespective of what IT Teams want, we are still seeing organisations use different platforms from multiple vendors. This is a clear indication that in the end there is only one benefit that organisations seek – quality of experience.”

Organisations across the globe, are facing disruption on a scale never seen before, and are urgently seeking ways of remaining viable. Predictably, cybersecurity is a secondary concern and is often handled reactively. To make matters worse, a chronic cybersecurity skills shortage is being made much more severe by the crisis.

Remote working has reached unprecedented levels as organisations try hard to keep going. This is massively expanding the attack surface for cyber criminals, weakening security and leading to a cybercrime pandemic. Hacking activity and phishing, inspired by the COVID-19 crisis, are growing rapidly. Containing and suppressing this cybercrime pandemic is proving to be almost impossible.

Remote working intensifies known threats posed by phishing and ransomware. More alarming are the distinctive cybersecurity vulnerabilities associated with home working including reliance on home Wi-Fi, increased use of unpatched VPNs and devices, and the exponential growth of network access points. These vulnerabilities increase the likelihood of a breach enormously.

Corporate IT is in a very challenging position. It needs to ensure that organisations can operate in a way that they have never operated before, while ensuring that their assets are secure – a very difficult, if not an impossible task for which there is no precedent.

Some important cybersecurity considerations, during and after the COVID-19 pandemic include:

Re-enforce Basic Cyber Hygiene

As massive numbers of people work from home, basic cyber hygiene becomes more critical than ever before. Organisations must maintain awareness of security threats among employees, ensure security policies are being followed and be certain that corporate software is being updated and patched on time. With a dispersed workforce, these basic practices are more challenging, and training becomes more critical. Phishing attacks are often the primary attack vector for malicious actors, so employees must be able to identify these attacks. They increasingly exploit shortages of goods such as protective equipment and sometimes claim to offer official information relating to COVID-19.

Remote employees often access sensitive business data through home Wi-Fi networks that will not have the same security controls – such as firewalls – that are used in offices. There is more connectivity from remote locations, which requires greater focus on data privacy, and hunting for intrusions from a much larger number of entry points.

Place More Focus on Endpoint Security

The unprecedented switch to remote working is radically increasing the number of vulnerable endpoints. Given that endpoints are located at a distance from corporate premises, it is frequently difficult for IT departments to configure endpoint systems and install necessary security software.

It is vital to assess the security posture of all endpoints connecting to the corporate network. This practice enables an organisation to determine whether or not an endpoint requesting to access internal resources meets security policy requirements. It requires the ability to monitor and enforce policy across all devices, while making onboarding and offboarding seamless.

It is essential that endpoint solutions can be rapidly deployed for remote workers, as needed on both personal and corporate devices. Devices used for remote work need much more than the basic antivirus and antispyware protection. Multi-factor authentication (MFA) and on-board endpoint detection and response (EDR) capabilities are crucial.

Be More Selective About How and When Video Conferencing and Collaboration Platforms are Used

Since lockdowns spread around the world, the use of video conferencing and collaboration tools has grown beyond the wildest expectations of suppliers of these tools. The extraordinary growth of Zoom has made it a target for attackers. Many security vulnerabilities have been discovered with Zoom such as, a vulnerability to UNC path injection in the client chat feature, which allows hackers to steal Windows credentials, keeping decryption keys in the cloud which can potentially be accessed by hackers and gives the ability for trolls to ‘Zoombomb’ open and unprotected meetings. Zoom has so far managed to augment its security features in part by its recent acquisition of Keybase, a secure messaging service.

Switching to an alternative video conferencing platform will not necessarily offer greater levels of security as privacy is typically not a strength of any collaboration platform. Collaboration platforms tend to tread a fine line between a great experience and security. Too much security can cause performance and usability to be impacted negatively. Too little security, as we have seen, allows hackers to find vulnerabilities. If data privacy is critical for a meeting, then perhaps collaboration platforms should not be used, or organisations should not share critical information on them.

Protect all Cloud Workloads

In today’s remote working paradigm, cloud computing is being used more than ever. This frequently exposes organisations to risks that are not adequately mitigated.

Organisations typically need to manage a mix of on-premises technology together with multiple clouds, which are often poorly integrated. These complexities are compounded by the increasing risk from cyberattacks associated with cloud migration and hybrid cloud implementations. In cloud environments, the leading cybersecurity risks include insecure interfaces and APIs, data breaches and data loss, unauthorised access, DDoS attacks, and a lack of a unified view of assets.

Protection requirements for securing hybrid multicloud environments are evolving rapidly. In addition to tightening up endpoint security, organisations must also place greater emphasis on cloud workload protection. Cloud security solutions need to offer a unified and consistent view across all physical machines, virtual machines, serverless workloads and containers, used by an organisation.

Amend Incident Response Plans

It is the containment of breaches that often determines the success of security policies and procedures. Basic cyber hygiene as well as changes to IT architecture, such as micro segmentation, play an essential role in breach containment. But incident response plans also need to be made relevant to the current pandemic scenario.

Employees and IT teams are now working in a completely different environment than envisaged by most incident response plans. Existing plans may now be obsolete. At the very least, they will need to be modified. Usually, incident response plans are designed to respond to threats when most employees are operating in a corporate environment. This clearly needs to change. Employees need to be trained in the updated plan and know how to reach support if they believe that a security breach has occurred in their remote location.

Critically, new alert and warning systems need to be established, which can be used by employees to warn of threats as well as to receive information on threats and best practices.

Organisations are struggling to keep the lights on. In this battle to remain operational, cybersecurity has been taking a back seat. This cannot last for long as the deluge of new vulnerabilities is creating easy pickings for attackers. Cyber hygiene, endpoint security, cloud security, security policies and incident response plans must be continually reviewed.

Click here to download the full report ?

The COVID-19 crisis has forced countries to implement work from home policies and lockdowns. Since the crisis hit, uptake of cloud communication and collaboration solutions have seen a dramatic increase. Video conferencing provider, Zoom has emerged as a key player in the market, with a rapid increase in user base from 10 million daily active participants in December 2019 to 200 million in March 2020 – a growth in the number of users of nearly 200%!

Security Concerns around Zoom

The rapid increase in user base and the surge in traffic has required Zoom to re-evaluate its offerings and capacity. The platform was primarily built for enterprises and now is seeing unprecedented usage in conducting team meetings, webinars, virtual conferences, e-learning, and social events.

The one area where they were impacted most is security. In his report, Cybersecurity Considerations in the COVID-19 Era, Ecosystm Principal Advisor Andrew Milroy says, “The extraordinary growth of Zoom has made it a target for attackers. It has had to work remarkably hard to plug the security gaps, identified by numerous breaches. Many security vulnerabilities have been discovered with Zoom such as, a vulnerability to UNC path injection in the client chat feature, which allows hackers to steal Windows credentials, keeping decryption keys in the cloud which can potentially be accessed by hackers and the ability for trolls to ‘Zoombomb’ open and unprotected meetings.”

“Zoom largely responded to these disclosures quickly and transparently, and it has already patched many of the weaknesses highlighted by the security community. But it continues to receive rigorous stress testing by hackers, exposing more vulnerabilities.”

However, Milroy does not think that this issue is unique to Zoom. “Collaboration platforms tend to tread a fine line between performance and security. Too much security can cause performance and usability to be impacted negatively. Too little security, as we have seen, allows hackers to find vulnerabilities. If data privacy is critical for a meeting, then perhaps collaboration platforms should not be used, or organisations should not share critical information on them.”

Zoom to increase Capacity and Scalability

Zoom is aware that it has to increase its service capacity and scalability of its offerings, if it has to successfully leverage its current market presence, beyond the COVID-19 crisis. Last week Zoom announced that that it had selected Oracle as its cloud Infrastructure provider. One of the reasons cited for the choice is Oracle’s “industry-leading security”. It has been reported that Zoom is transferring more than 7 PB of data through Oracle Cloud Infrastructure servers daily.

In addition to growing their data centres, Zoom has been using AWS and Microsoft Azure as its hosting providers. Milroy says, “It makes sense for Zoom to use another supplier rather than putting ‘all its eggs in one or two baskets’. Zoom has not shared the commercial details, but it is likely that Oracle has offered more predictable pricing. Also, the security offered by the Oracle Cloud Infrastructure deal is likely to have impacted the choice and it is likely that Oracle has also priced its security features very competitively.”

“It must also be borne in mind that Google, Microsoft and Amazon are all competing directly with Zoom. They all offer video collaboration platforms and like Zoom, are seeing huge growth in demand. Zoom may not wish to contribute to the growth of its competitors any more than it needs to.”

Milroy sees another benefit to using Oracle. “Oracle is known to have a presence in the government sector – especially in the US. Working with Oracle might make it easier for Zoom to win large government contracts, to consolidate its market presence.”

Gain access to more insights from the Ecosystm Cloud Study

The COVID-19 pandemic has highlighted the importance of the telecommunications industry which has now become the backbone of the new normal, both in a social and business sense. The last few months have seen a number of changes including more video usage, location of traffic and time of traffic. Network usage is on the rise and telecom carriers are prioritising on the resilience of their networks and the quality of services offered to their customers.

What goes up must come down

According to Speedtest, global mobile and broadband speeds have suffered as a result of the increase in traffic with speeds dropping in March 2020 for mobile to 30.47 Mbps (from 31.62 Mbps in February) and fixed broadband to 74.64 Mbps (from 75.41 Mbps in February). In Southeast Asia, only Singapore and Vietnam averaged mobile speeds of 54.37 Mbps and 33.97 Mbps respectively, exceeding the global average speeds. As for fixed broadband, Singapore ranked highest globally achieving 197.26 Mbps while Thailand and Malaysia clocked 149.95 Mbps and 79.86 Mbps respectively, trumping the global average speeds.

Southeast Asian carriers increase network efficiency and quality

Singapore. The country’s ICT regulator, Infocomm Media Development Authority (IMDA), reported an increase in internet usage and its intentions to support telecom carriers in boosting network capacity to ensure essential services run smoothly. Priority will be given to high traffic and residential areas where a larger proportion of the population are working from home. The Ministry of Communications and Information (MCI) reported that Singapore has at least 30 percent buffer in network capacity even during peak periods. Major TV operators Mediacorp, Singtel and Starhub have made more content available for free during this period. This may further impact network speeds as customers are consuming more content over wifi (on mobile apps) or over the fibre networks.

Thailand. Part of the country’s public assistance measures during the pandemic, include offering about 30 million mobile subscribers 10GB free data. The National Broadcasting and Telecommunications Commission (NBTC) will also upgrade the speeds of fixed broadband to at least 100 Mbps which is expected to benefit 1.2 million household subscribers. Leading operator Advanced Info Service (AIS) recently announced that it has deployed 5G networks at hospitals to boost network capacity and speeds, and is deploying robots for telemedicine to empower the healthcare system to fight COVID-19.

Malaysia. Maxis and Telekom Malaysia (TM) reported a surge in traffic since the movement control order (MCO) was implemented by the Government on the 18th March 2020. The MCO is expected to run at least until 28th April 2020. TM cited a 30 percent increase in usage attributed to the increase in traffic for streaming, online games and teleconferencing. Leading operators Maxis, Digi, Celcom and U Mobile have offered 1GB free data during the MCO period as part of the Government’s stimulus package. Maxis, TM, Digi and Celcom have also committed significant manpower to ensure that the networks are operating efficiently and to ensure customer support. Leading TV operator Astro has made all movie, news and cartoon networks available to all its customers until the 28th April 2020.

Social distancing fillip for video conferencing

The rise of social distancing has made us all seek new ways to connect, mainly through video chat. Video conferencing traffic is on the rise as it is the next best thing to face-to-face meetings. Microsoft Teams and Zoom have been big benefactors. The American Economic Institute (AEI) notes that Zoom hit some 200 million users daily from a daily average 10 million. Microsoft Teams added some 12 million registrations to a total of 44 million.

Many predict that the home working trend will continue in the recovery stage and beyond, due to improvements in the telecommunications infrastructure and impending rollout of 5G. It is also predicted that the commercial property sector is likely to suffer due to this trend. This period also highlights the critical importance of cybersecurity with increasing occurrences of hacking and fraud. Zoom is being forced to reinforce their privacy and security measures, as an example.

COVID-19 has changed the way we web

On the social front, many are also using video conferencing to communicate with friends and family. Operators relaxing and offering additional data has undoubtedly contributed to the increase in this usage too. Now that many are homebound, network traffic in residential areas are higher than ever. In the past, peak hours of traffic at homes were at night – this has changed with adults and children homebound. Adults are using video conferencing and more voice calls; while children are using elearning, playing games or streaming videos. The European Commission had asked Netflix and other streaming platforms to reduce streaming quality to standard definition (SD). Netflix has assured that it has the capability to manage levels of streaming quality in accordance with the networks quality requirement of individual countries.

Online gaming and video streaming have emerged as winners and have seen an increase in consumption in these times as they provide for entertainment for millions stuck at home. There is tremendous opportunity for both telecom operators and content providers to increase their number of services in this area. Netflix, YouTube, Microsoft Xbox and PlayStation are among the winners in this sector. YouTube provides for a primary news source and commentary on the epidemic for many. Netflix’s stocks are near an all-time high at present.

eCommerce boost for essentials goods and services

The eCommerce sector should see a major improvement in Southeast Asia as physical channels to market have reduced. Emerging economies such as Malaysia and Thailand should see an improvement in services and embrace eCommerce like their mature counterparts. Statista reports that the average Malaysian eCommerce shopper spent just US$159 and Thailand just US$100 on online consumer goods purchases in 2018, considerably lower than the global average of US$634. There is huge opportunity to provide for basic necessities such as online grocery, food and delivery of goods. As a consequence, contactless payment and the transport and logistics sector will be forced to adapt their business operations to ride this wave successfully. As eCommerce transactions diversify and increase in emerging markets, it will give telecom providers an opportunity to keep engaging with platform players.

Telecom carriers are likely to suffer financial losses due to the scale of the disruption COVID-19 has brought about. However, there are some positives takeaways from this period. The increase of network traffic and the changing patterns have driven carriers to better understand network traffic management. The sharp consumer and business onboarding as far as applications and digital services are concerned, has given the digital economy and 5G use cases a shot in the arm. This is likely to spur innovation in services including communications, eCommerce, payments, logistics and healthcare among others.