Last month, Broadcom announced their intentions to acquire VMWare in a deal worth USD 61 billion – one of the biggest acquisitions in the tech world.

Broadcom has been actively looking to diversify away from their core business of chip manufacturing into enterprise software. Their previous acquisitions – CA Technologies for USD 18.9 billion in 2018, followed by Symantec for USD 10.7 billion the next year – have already indicated that. The VMware acquisition is the biggest – and arguably very different from the others.

Ecosystm Analysts, Alan Hesketh, Darian Bird, Niloy Mukherjee and Tim Sheedy comment on the implications for the companies and the market.

Download Ecosystm Snapshot: Broadcom’s Acquisition of VMware as a PDF

Last week, Kyndryl became a Premier Global Alliance Partner for AWS. This follows other recent similar partnerships for Kyndryl with Google and Microsoft. This now gives Kyndryl premier or similar partner status at the big three hyperscalers.

The Partnership

This new partnership was essential for Kyndryl to provide legitimacy to their independent reputation and their global presence. And in many respects, it is a partnership that AWS needs as much as Kyndryl does. As one of the largest global managed services providers, Kyndryl manages a huge amount of infrastructure and thousands of applications. Today, most of these applications sit outside public cloud environments, but at some stage in the future, many of these applications will move to the public cloud. AWS has positioned itself to benefit from this transition – as Kyndryl will be advising clients on which cloud environment best suits their needs, and in many cases Kyndryl will also be running the application migration and managing the application when it resides in the cloud. To that end, the further investment in developing an accelerator for VMware Cloud on AWS will also help to differentiate Kyndryl on AWS. With a high proportion of Kyndryl customers running VMware, this capability will help VMware users to migrate these workloads to the cloud and run core businesses services on AWS.

The Future

Beyond the typical partnership activities, Kyndryl will build out its own internal infrastructure in the cloud, leveraging AWS as its preferred cloud provider. This experience will mean that Kyndryl “drinks its own champagne” – many other managed services providers have not yet taken the majority of their infrastructure to the cloud, so this experience will help to set Kyndryl apart from their competitors, along with providing deep learning and best practices.

By the end of 2022, Kyndryl expects to have trained more than 10,000 professionals on AWS. Assuming the company hits these targets, they will be one of AWS’s largest partners. However, experience trumps training, and their relatively recent entry into the broader cloud ecosystem space (after coming out from under IBM’s wing at the end of 2021) means they have some way to go to have the depth and breadth of experience that other Premier Alliance Partners have today.

Ecosystm Opinion

In my recent interactions with Kyndryl, what sets them apart is the fact that they are completely customer-focused. They start with a client problem and find the best solution for that problem. Yes – some of the “best solutions” will be partner specific (such as SAP on Azure, VMware on AWS), but they aren’t pushing every customer down a specific path. They are not just an AWS partner – where every solution to every problem starts and ends with AWS. The importance of this new partnership is it expands the capabilities of Kyndryl and hence expands the possibilities and opportunities for Kyndryl clients to benefit from the best solutions in the market – regardless of whether they are on-premises or in one of the big three hyperscalers.

Most organisations across various sectors have already adopted a private cloud, or a public cloud environment for their applications. However, not every application belongs to a solely private or public cloud architecture. Shifting to a hybrid cloud model provides a means of straddling both public and private environments.

To define the building blocks for a virtualised infrastructure, VMware hybrid cloud offers a portfolio of services:

- vSphere & vCenter for compute virtualisation and management

- vSAN for storage virtualisation

- NSX for network and security virtualisation

To learn more about Transforming with VMware Cloud, download the free whitepaper below.

(Clicking on this link will take you to a separate page where you can download the free whitepaper)

Since officially separating from IBM in November last year, Kyndryl has been busy cementing some heavyweight partnerships. The alliances with Microsoft, Google, and VMware demonstrate its intention to build hybrid cloud solutions with whoever it needs to, rather than favouring the Big Blue or Red Hat. The SAP tie-up hints at a future of migrating ERP workloads to the cloud and even an eye on moving up the application stack. Last week Kyndryl announced it is working with Nokia to provide private 5G and LTE networks to enable Industry 4.0 solutions. The first customer reference for the partnership is Dow, deploying both real-world and proof-of-concept applications for worker safety and collaboration and asset tracking.

The Partnership

Kyndryl has a competitive networking services unit, particularly in partnership with Cisco. Its focus has been on SD-WAN, campus networks, and network management as part of broader cloud services deals. This 5G partnership with Nokia is its first serious effort to work with one of the major carrier-grade vendors using cellular technology. It creates an opportunity for Kyndryl to position itself as a provider of services that underpin IoT and edge applications, rather than only cloud, which has until now been its main strength.

Prior to the Kyndryl announcement, Nokia was already developing private 5G solutions under the moniker Digital Automation Cloud (DAC). A key customer is Volkswagen, using the network to connect robots and wireless assembly tools. Over-the-air vehicle updates are also tested over the private network. Volkswagen operates in a dedicated 3.7-3.8 GHz band, which was allocated by the Federal Network Agency in Germany. This illustrates a third option for accessing spectrum, which will become an important consideration in private 5G rollouts.

Private 5G Use Cases

Private 5G has several benefits such as low latency, long-range, support for many users per access point, and provision for devices that are mobile due to handover. It is unlikely that it will completely replace other technologies, like wireless LAN, but it is very compelling for certain use cases.

Private 5G is useful on large sites, like mines, ports, farms, and warehouses where connected machines are moving about or some devices – like perimeter security cameras – are just out of reach. Utilities, like power, gas, and water, with infrastructure that needs to be monitored over long distances, will also start looking at it as a part of their predictive maintenance and resiliency systems. Low latency will become increasingly important as we see more and more customer-facing digital services delivered on-site and autonomous robots in the production environment.

Another major benefit of private 5G compared to operating on public service is that data can remain within the organisation’s own network for as long as possible, providing more security and control.

Private 5G Gaining Popularity

There has been a lot of activity over the last year in this space, with the hyperscalers, telecom providers and network equipment vendors developing private 5G offerings.

Last year, the AWS Private 5G was announced, a managed service that includes core network hardware, small-cell radio units, SIM cards, servers, and software. The service operates over a shared spectrum, like the Citizens Broadband Radio Service (CBRS) in the US, where the initial preview will be available. CBRS is considered a lightly licenced band. This builds on AWS’s private multi-access edge compute (MEC) solution, released in conjunction with Verizon to integrate AWS Outposts with private 5G operating in licenced spectrum. A customer reference highlighted was low latency, high throughput analysis of video feeds from manufacturing robots at Corning.

Similarly, Microsoft launched a private MEC offering last year, a cloud and software stack designed for operators, systems integrators, and ISVs to deploy private 5G solutions. The system is built up of components from Azure and its acquisition of Metaswitch. AT&T is an early partner bringing a solution to the market built on Microsoft’s technology and the operator’s licenced spectrum. Microsoft highlighted use cases such as asset tracking in logistics, factory operations in manufacturing, and experiments with AI-infused video analytics to improve worker safety.

The Future

Organisations are likely to begin testing private 5G this year for Industry 4.0 applications, either at single sites in the case of factories or in select geographic areas for Utilities. Early applications will mostly focus on simple connectivity for mobile machines or remote equipment. In the longer term, however, the benefits of private 5G will become more apparent as AI applications, such as video analysis and autonomous machines become more prevalent. This will require the full ecosystem of players, including telecom providers, network vendors, cloud hyperscalers, systems integrators, and IoT providers.

On 4 November Kyndryl completed the spin-off from IBM and began trading as an independent company on the New York Stock Exchange. It is effectively a USD 19 Billion start-up, and the industry will be tracking its journey keenly. Kyndryl has the ability to disrupt markets as it reinvents its business to embrace growth areas and help clients through their tech-led transformations.

Ecosystm Analysts Darian Bird, Peter Carr, Sash Mukherjee, Tim Sheedy, Ullrich Loeffler, and Venu Reddy comment on Kyndryl’s strategy going forward and the associated opportunities.

To download this Vendorsphere as a pdf for offline use, please click here.

In this first edition of Ecosystm RNx we rank the Top 10 Global Cloud Vendors.

Ecosystm RNx is an objective vendor ranking based on in-depth and quantified ratings from technology decision-makers on the Ecosystm platform.

If you are an technology user, this Cloud Vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are a Cloud Vendor, this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

Two weeks ago, Michael Dell made the big announcement that Dell Technologies would spin off their shareholding in VMware, leading to a share price spike for both companies. A lot has already been written about the move – we would like to highlight a market-based view which we feel will be significant for the two companies going forward.

First let us break down the facts around the deal:

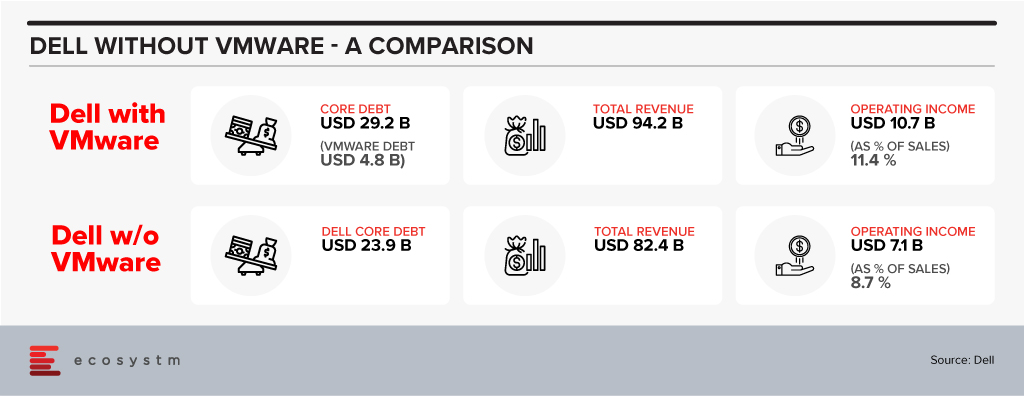

As has been analysed threadbare the deal reduces the total debt Dell is carrying and will even reduce the ratio of Dell debt to EBITDA. As a result, it is highly likely that Dell’s credit rating will move up from their current BB+ level to investment grade – which can have a lot of implications for future capital raising. There is also a buzz in the market that Dell Technologies may also sell off Boomi soon and write down another USD 3 Billion approximately in debt.

It is interesting to note that the company has been willing to let go off VMware even though it will dilute their profitability ratios – VMWare business being obviously more profitable than Dell’s traditional businesses which are heavily based on products.

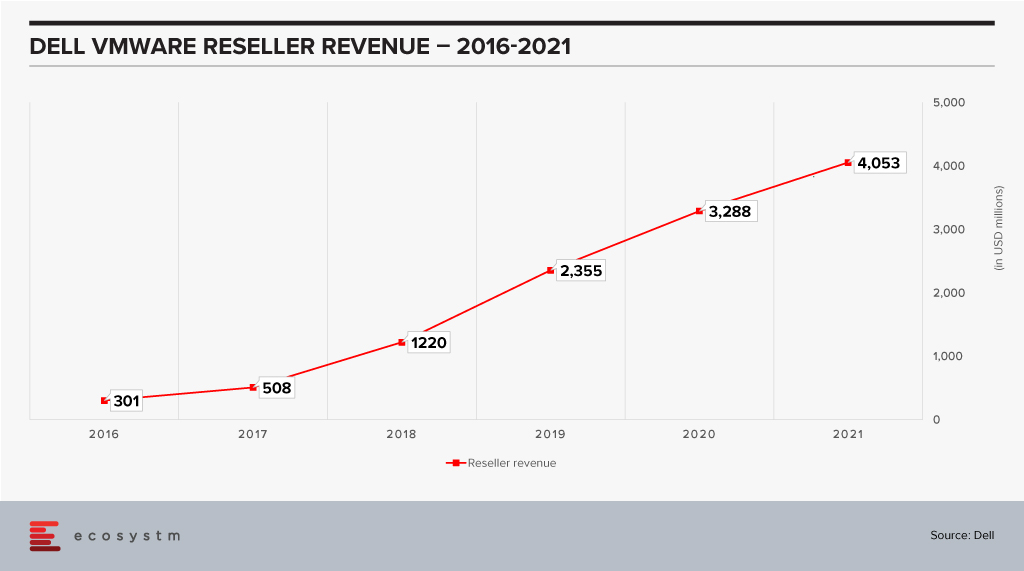

The last few years has seen Dell reselling a fair amount of VMware products. From a number of perspectives Dell has been a key reseller for VMware and now contributes almost 34% of VMware’s revenues.

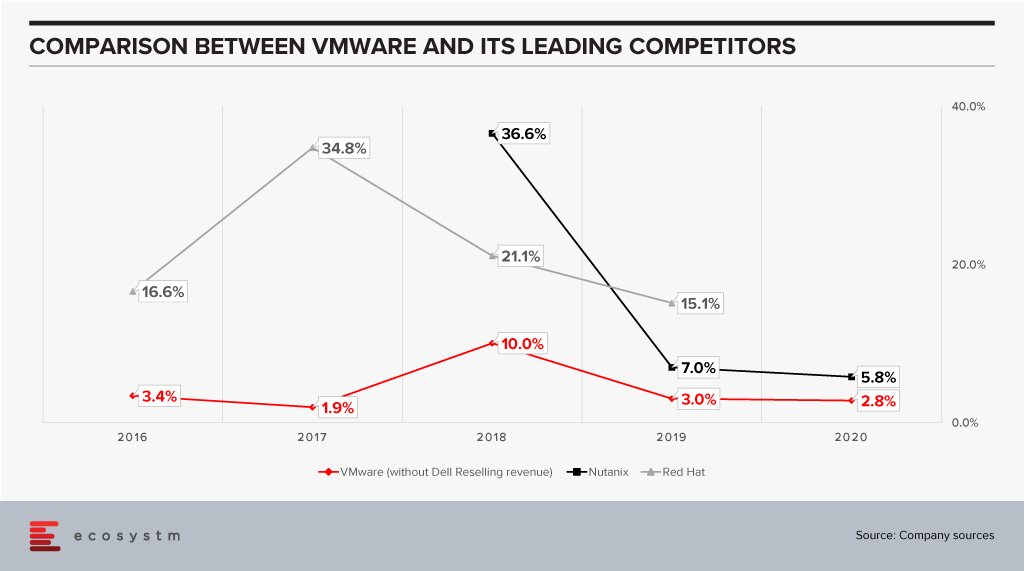

This chart is a testament to the power of execution that is inherent within Dell. This performance was aided by market growth – but even then it is remarkable how Dell has been able to scale up taking VMware to their customers. The two companies have very different sales cycles. A VMware sale typically has a longer cycle with a completely different set of touchpoints from the boxes that Dell is so good at selling – which have shorter cycles. The sales cycle for EMC products is closer to VMware’s which would have helped. The sales of the VXRail hyperconverged appliance have also jumped in recent times and this would have driven an equivalent spike in VMware revenues. It is still a remarkable achievement to be able to bring these three diverse groups together and grow revenue.

Market Impact of the Spin-Off

Does it make sense then for VMware to part with their largest reseller? Would it not be better for VMware to continue to drive this and use Dell’s execution skills to drive more growth? Data suggests that there could be another twist to this story.

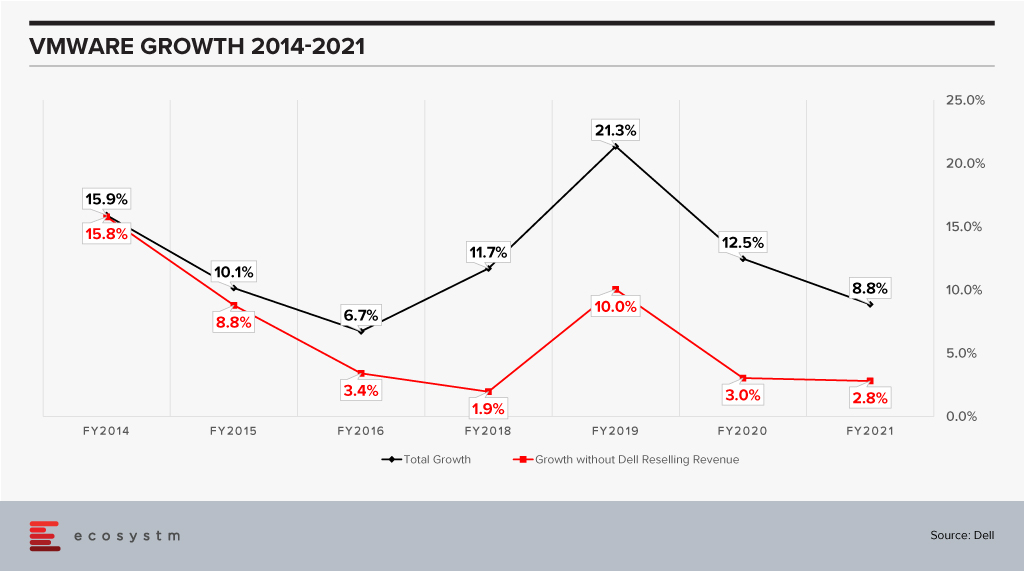

VMware has been growing impressively as a company when one looks at the black line and while the growth has slowed in percentage terms, this is on a much higher revenue base. FY2021 revenue is close to 2x the revenue in FY2014. However, when one considers it without the Dell reselling revenue (the red line) it looks a lot less impressive especially in the last couple of years when it is an anemic 3%. When comparing this growth we also see a slowdown of sorts in recent years for VMware.

Til Dell acquired EMC – and VMware in consequence – they were working closely with other vendors such as Nutanix and driving solid growth for them. As they pivoted to doing more with VMware, did this then mean that other vendors – of either bare metal or cloud – drifted away from VMware?

Anecdotal evidence suggests that vendors such as HPE became more cautious and tried to diversify their business. It is entirely possible that if we looked at VMware as two separate businesses – one with Dell and one independent – the independent business has been losing share in the last few years.

The optical separation from Dell may then help VMware in rebuilding stronger relationships with the other players in the market including the hyperscalers. This may fuel further VMware growth. To do that VMware will have to manage a balancing act:

- On the one hand keep growing their reseller revenue with Dell. They are on a good wicket so far and need to make sure this continues. While the revenue from appliances – which come loaded with VMware – is a sure-fire proposition, other growth needs to be harvested carefully. Dell has a multitude of offerings and taking their eyes of the VMware ball is super easy.

- Build trust and closer ties with the other vendors to keep driving revenue. VMware’s leadership in the market means they already have ties with other industry leaders like HPE, AWS and so on. These will need to become much deeper; VMware will need to build the trust that they will give these vendors equal status even as they are building new appliances with Dell.

The one complicating factor here is that Michael Dell remains the Chairman of the Board of VMware. This may give other vendors pause and they may still want to keep their options open instead of putting all eggs into the VMware basket.

Ecosystm Comments

VMware is at a fairly critical inflection point in their business. The growth of cloud technologies still bodes well for virtual machines which has been their mainstay, but this is also likely to drive growth for more containerisation. They have great products for that part of the business also. However, as container adoption is likely to explode VMware would not want vendors to shift, to say Red Hat, and develop deeper partnerships with them or other competitors. They would like to keep the vendors on VMware – be it a virtual machine or a container. One does feel the future battle for VMware really rests on how well they will be able to grow in the container space. This will have to be done while continuing to innovate to keep the lead in the virtual machine space. Doing it will be quite a feat!!

Finally, what then of Dell? The company seems to have a talent for running businesses which are in long-term secular decline – but running those businesses well. Their PC business is delivering almost 7% operating income and has continued to show growth. The PC market last year was on fire thanks to the pandemic which dramatically increased the demand for devices – growth was double digits for a market which has declined almost every year since 2011. As Dell is fond of saying the PC industry has sold over 5 billion machines since the PC was declared dead!

The server market seems to have stagnated over the last couple of years which is a bit of a surprise given the growth in cloud. Dell’s revenue has declined two years in a row pointing to possible issues which need fixing in that part of the business.

As the company focuses on these key challenges in the market it probably makes sense for them to lower their debt and earn more freedom to operate. One never knows – given the number of surprises that Michael Dell has engineered over the last decade such as taking Dell private, acquiring EMC, stabilising it, then going public again, making a windfall in the process – if he has some other rabbits yet to be pulled out of his hat!!!

Access insights on adoption of key Cloud solutions in regions/countries and industries. Insights include drivers and inhibitors of adoption, budget allocation, and preferred implementation partners.

AWS has been busy this year moving beyond its stronghold of public cloud to bring infrastructure closer to the enterprise and ultimately to where the end user needs computing most. The global availability of AWS Outposts, essentially AWS on prem, the launch of AWS Wavelength, edge computing embedded in 5G networks, and the extension of the AWS Snow Family of edge devices, have all combined to create a compelling hybrid cloud story. This evolution in AWS’ strategy has required a maturing of its partner ecosystem, building alliances with telcos, co-location providers, and integrators that are all still trying to cement their roles in the hybrid cloud space.

Outposts: The AWS Vision of Hybrid Could

Outposts launched late last year with availability extended to many mature countries in January 2020, in addition to India, Malaysia, New Zealand, Taiwan, Thailand, Israel, Brazil, and Mexico in June. The plug and play system delivers AWS compute and storage from the organisation’s own data centre with a rack that requires only power and network access. The system is managed with the same tools and APIs used in public AWS regions, providing a single hybrid cloud management console. Outposts is targeted primarily at the enterprise space, with the cheapest development and testing units coming in at $7-8k monthly or around $250-280k upfront, depending on the country. Other higher-end configurations include general purpose, compute optimised, graphics optimised, memory optimised, and storage optimised. Monthly installments attract a 10-15% premium over upfront payments.

The launch of hybrid cloud solutions by the major cloud providers and containerised services that allow workloads to be deployed in public and private environments will ensure enterprises are willing to continue their cloud journeys. Security concerns and data residency regulations have prevented many organisations from shifting sensitive workloads to the cloud. Moreover, as industries launch new customer-facing digital services or transform their manufacturing systems, latency will become a concern for some workloads. Hybrid cloud addresses each of these issues by employing either public or private resources depending on the data, location, or capacity needs.

AWS Outposts has two variants, namely Native AWS and VMware Cloud on AWS. Organisations already heavily invested in the AWS ecosystem will likely choose Native AWS and use Outposts as a means of migrating further workloads that require an on-prem environment over to a hybrid cloud environment. More traditional organisations, such as banks, may select the VMware Cloud on AWS variant as a means of retaining the same operational experience that they are accustomed to in their existing VMware environments today.

AWS will rely heavily on its network of enterprise partners for sales, management, and maintenance services for Outposts. AWS partners like Accenture, HCL, TCS, Deloitte, DXC, NTT Data, and Rackspace have all shifted in recent years to deliver the full stack from infrastructure to application services and now have a ready-made hybrid cloud platform to migrate on to. AWS is also in the process of recruiting co-location partners to serve Outposts from third-party data centres, providing another option that enterprises are familiar with. This will likely come as welcomed news for co-location providers that have been fighting uphill against AWS.

Wavelength: Embedding Cloud in 5G Networks

Another major announcement in AWS’s drive towards hybrid cloud and edge computing was the general availability of Wavelength in August. This service embeds AWS into the data centres of 5G network operators to reduce latency and bandwidth transmission. Data for applications residing in Wavelength Zones is not required to leave the 5G network. AWS is looking to attract mobile operators, who previously might have viewed it as a competitor while the public cloud space was more fragmented and open to telcos. These partnerships are another example of AWS expanding its ecosystem. Current Wavelength partners are Verizon, Vodafone Business, KDDI, and SK Telecom. With their own take on edge services, Microsoft has signed up the likes of Telstra and NTT Communications, while Google has enlisted AT&T and Telefónica. Edge computing in 5G networks will be the next battleground for cloud supremacy.

On a smaller scale, AWS has released new additions to its Snow Family of edge computing devices. AWS Snowcone is a compact, rugged computing device designed to process data on the network edge where cloud services may be insufficient. The processed data can then be uploaded to the cloud either through a network connection or by physically shipping the device to AWS. The convergence of IT and OT will drive the need for these edge devices in remote locations, such as mines and farms and in mobile environments for the healthcare and transportation industries.

Competitive Strategies

Openness will become a critical difference between how cloud platform providers approach hybrid cloud and edge computing. While AWS is certainly extending its ecosystem to include partners that it previously would have viewed as rivals, as the dominant player, it will be less compelled to open up to its largest competitors. If it can control the full system from ultraportable device, to $1M server rack, to cloud management console, it can potentially deliver a better experience for clients. Conversely, the likes of Microsoft, Google, and IBM, all need to be willing to provide whichever service the client desires, whether that is an end-to-end solution, management of a competitor’s cloud service, or an OEM’s hardware.

Nutanix has emerged as a leading hyper converged infrastructure (HCI) provider and is partnering with public cloud infrastructure providers to bring greater value to its customers. Last week saw the partnership between Microsoft and Nutanix, aimed to evolve the hybrid offerings of both providers. As part of this collaboration, both companies will focus on extending Nutanix hybrid cloud infrastructure to Azure. The collaboration will include the development of Nutanix-ready nodes on Azure to support Nutanix Clusters and services. The benefits expected include improved cost, security, and efficiency. Clients will also be able to deploy Azure instances from Nutanix interface for a consistent experience across their cloud environment. The solution is aimed to eliminate re-tooling, re-architecting processes and other technical challenges of maintaining a hybrid environment.

Ecosystm Principal Advisor, Darian Bird says, “The announcement of Nutanix Clusters on Azure is another piece of the hybrid puzzle that will allow Nutanix clients to extend their private cloud environments into public infrastructure. Organisations want the control associated with a private cloud but with the flexibility to scale up and down in the public cloud. Key to hybrid cloud is an additional layer that enables applications to be shifted from one cloud to another, either to prevent lock-in or to choose the best environment depending on the circumstances.”

The deal will also broaden the sales and support experience for Microsoft and Nutanix. “Nutanix has emphasised licence portability as a key characteristic of its hybrid cloud strategy. Microsoft clients will be able to use Azure credits to pay for Nutanix software, while those already with Nutanix licences will be able to port those over to Clusters on Azure. Simplified cloud procurement will be critical for IT departments looking to optimise cloud expenditure across multiple providers.”

Bird adds, “Organisations will now be able to manage servers, containers, and data services on Nutanix HCI, on prem or in the cloud through a single control pane with Azure Arc. Microsoft has realised that producing a true hybrid cloud system requires it to manage as many types of infrastructure as possible, whether they come from niche partners or major competitors. IT departments want the choice of supplier without adding complexity to their systems.”

Nutanix Strengthening its Partner Ecosystem

“The partnership with Microsoft Azure comes only a month after Nutanix announced the general availability of Clusters on AWS. Considering Nutanix’s close connection to Google, it seems likely that it will also launch on the search giant’s cloud before long,” says Bird.

Last year, Nutanix partnered with HPE for the general availability of HPE’s integrated hybrid cloud as a service offering, HPE GreenLake for Nutanix, and the HPE ProLiant DX solution.

Earlier in the month, Nutanix launched its global partner multi-cloud program – Elevate – to bring Nutanix’s global partner ecosystem under one integrated architecture managed through consistent tools, resources and platforms, to accelerate their clients’ multi-product, multicloud roadmap in their transformation journeys.

“Nutanix has made great strides in its shift from hardware vendor to HCI provider and it’s now focused on delivering tools that enable the shift to cloud. These recent moves will help Nutanix catch up to VMware and become a viable alternative in a hybrid cloud environment,” says Bird.